EMAR MARKETS Scam Alert: Withdrawal Frozen!

EMAR MARKETS (FSCA 53070, exceeded) lures with $1 deposits & MT5 but traps funds in "data verification" scams & fake fees—avoid! Report & recover losses.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When you look up information about a financial broker, you have one main worry: Is my capital safe? For NEWTON GLOBAL, the facts point to a clear answer. After looking at its regulatory status, user feedback and how transparent it is, NEWTON GLOBAL presents a very high risk to all traders. This conclusion isn't based on opinion, but on real data collected by platforms designed to protect investors. The main problems—no valid regulation and a pattern of serious user complaints—show major warning signs that can't be ignored. A broker's reputation depends on two things: regulatory oversight and positive user experiences. As we will show, NEWTON GLOBAL fails badly on both. We encourage traders to always check information on independent platforms. You can see the full data we are analyzing on the official WikiFX page for NEWTON GLOBAL. This article will break down its regulatory standing, look at real user complaints, and give you a clear verdict to help you make an informed decision.

When you look up information about a financial broker, you have one main worry: Is my capital safe? For NEWTON GLOBAL, the facts point to a clear answer. After looking at its regulatory status, user feedback and how transparent it is, NEWTON GLOBAL presents a very high risk to all traders. This conclusion isn't based on opinion, but on real data collected by platforms designed to protect investors. The main problems—no valid regulation and a pattern of serious user complaints—show major warning signs that can't be ignored. A broker's reputation depends on two things: regulatory oversight and positive user experiences. As we will show, NEWTON GLOBAL fails badly on both. We encourage traders to always check information on independent platforms. You can see the full data we are analyzing on the official WikiFX page for NEWTON GLOBAL. This article will break down its regulatory standing, look at real user complaints, and give you a clear verdict to help you make an informed decision.

The most important factor in a broker's trustworthiness is regulation. It is the foundation of financial safety, making sure that a company follows strict standards of conduct, fund security, and fairness. In this basic area, NEWTON GLOBAL's profile is very concerning.

The most worrying thing about NEWTON GLOBAL is its complete lack of valid regulation. According to verification platform WikiFX, the broker is registered in Mauritius but has “No valid forex regulation.” For a trader, an unregulated environment means you are operating without protection. The consequences are serious:

· *No Client Fund Protection:* Regulated brokers must keep client funds in separate accounts, away from the company's operational funds. Without regulation, your funds can be mixed with the company's capital, putting it at extreme risk if the firm faces financial trouble or decides to misuse them.

· *No Dispute Resolution Process:* If you have a problem, such as a withdrawal refusal or a trade dispute, there is no independent governing body to appeal to. You are left at the mercy of the broker, with little to no way to recover your funds.

· *Lack of Oversight:* The broker operates without any authority watching its financial conduct, marketing claims, or operational integrity. This creates an environment where unethical practices can happen without consequences.

The lack of regulation shows up directly in the broker's trust score. On a scale of 1 to 10, where top brokers score above 9.0, the rating for NEWTON GLOBAL is a shocking 1.41 out of 10. This number isn't random; it's a data-driven assessment of the broker's license, business practices, risk management, software, and regulatory index. Such a low score is a clear warning.

This rating comes with several clear warnings that should be taken seriously by any potential investor:

· Warning: Low score, please stay away!

· Status: Suspicious Regulatory License

· Risk: High potential risk

The “Suspicious Regulatory License” tag is especially telling. It suggests that even if the broker claims to be registered or licensed, that license is either not from a reputable financial authority, is not valid for the services being offered (like forex trading), or is simply fake. In the world of finance, this is a critical failure of legitimacy.

Beyond regulatory data, the most powerful evidence of a broker's character comes from the real experiences of its users. For NEWTON GLOBAL, the available user complaints paint a troubling picture that directly supports the risks suggested by its unregulated status. Instead of just listing these issues, we will analyze them to show a clear pattern of behavior.

The most common and serious complaint against high-risk brokers relates to the inability to withdraw funds. This is where theory becomes a painful reality for traders. The feedback for NEWTON GLOBAL shows this exact pattern.

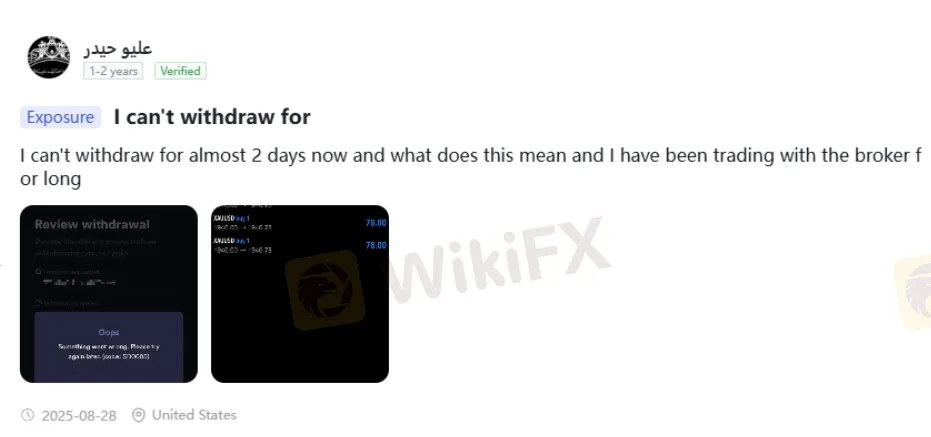

Consider the complaint from user عليو حيدر, posted on August 28, 2025: “I can't withdraw for almost 2 days now...”

While a two-day delay might sometimes happen with any service, in the context of an unregulated entity with an extremely low trust score, it is a major warning sign. It often represents the beginning of a more serious problem.

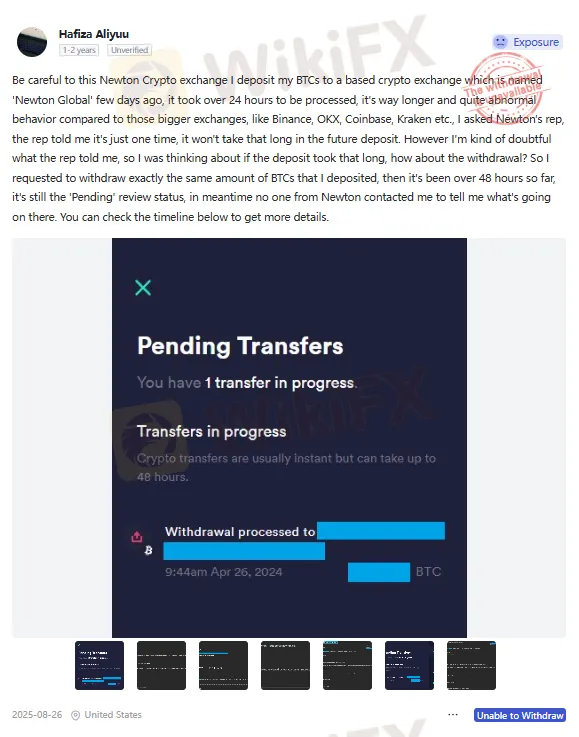

A more detailed and severe account comes from user Hafiza Aliyuu on August 26, 2025. This user's experience highlights multiple operational failures:

· *Slow Deposit:* The user reported that a BTC deposit took over 24 hours to be processed. In the fast-paced world of digital assets, this is highly unusual and indicates potential technical or operational problems.

· *Failed Withdrawal:* After becoming suspicious, the user tried to withdraw funds. After more than 48 hours, the withdrawal request was still “Pending” with absolutely no communication from the broker's support team.

. *The Result:* The user's funds are effectively frozen. They are left in the dark, unable to access their capital and without any reliable way to get help.

When multiple, independent users report problems with the most basic function of a brokerage—giving you back your funds—it is the strongest possible sign of a fraudulent or failing operation.

In the interest of a balanced view, we must also consider the single positive review available. A user named fxhjjj posted on June 27, 2024: “Joining their program was the best decision I made this year!!!”

A critical analysis of this statement is necessary. The language is enthusiastic but completely lacks specifics. The phrase “joining their program” is unclear. It could refer to an actual trading experience, but it is just as likely, if not more so, to be referring to an affiliate or Introducing Broker (IB) program where the user earns commissions for referring others. Such reviews are often used to create a false appearance of legitimacy.

When we compare this vague, generic praise with the specific, detailed and verifiable complaints about core functions, such as deposits and withdrawals, the weight of the evidence is overwhelmingly negative. The specific problems reported by users directly match the risks expected from an unregulated broker.

To provide a complete picture, it is important to look at what NEWTON GLOBAL claims to offer. However, these features must be viewed through the lens of the extreme risk we have already established. Attractive trading conditions are meaningless if your funds are not safe.

NEWTON GLOBAL uses a tiered account structure, a common practice in the industry. The goal is often to attract new traders with a low barrier to entry while selling larger clients to accounts with better conditions.

| Account Type | Minimum Deposit | Spreads From |

| Silver | $500 | 1.5 pips |

| Gold | $2,000 | 0.8 pips |

| Platinum | $10,000 | 0.5 pips |

A further look into their operational details reveals more points of concern.

· *Trading Platforms:* The broker offers the MetaTrader 5 (MT5) platform. While MT5 is a legitimate and powerful platform, there is a notable absence of the industry-standard MetaTrader 4 (MT4). This may limit its appeal to a large segment of traders used to MT4's ecosystem.

· *Leverage:* NEWTON GLOBAL offers leverage up to 1:500. This is extremely high and is a feature often banned or restricted by top-tier regulators because it dramatically increases the risk of loss, especially for inexperienced traders. Offering such high leverage is another common characteristic of unregulated brokers seeking to attract risk-takers.

· *Payment Methods:* The available payment methods include Korapay, B2B in PAY, Bank Transfer, and STICPAY. Noticeably absent are widely trusted and globally recognized methods such as PayPal, Skrill, Neteller, or direct processing with major credit card companies such as Visa and Mastercard. These established payment processors often have more robust dispute resolution and buyer protection policies, which is likely why many high-risk operations avoid them.

This collection of features might look standard at first glance, but they mean nothing without the foundation of regulatory security. A comprehensive breakdown of every feature, warning, and user review is available for cross-verification on the NEWTON GLOBAL page on WikiFX.

When conducting research, traders often encounter conflicting information. Learning to navigate this is a crucial skill. The NEWTON GLOBAL profile on WikiFX presents a perfect case study: a rock-bottom score and severe user complaints exist alongside a Q&A section with surprisingly positive “WikiFX” replies.

This contradiction can be confusing. For example, in response to a question about withdrawal times, a “WikiFX Reply” dated August 6, 2025, states: “Newton Global processes withdrawals quickly, with methods like... B2B in PAY, are processed within 1 hour.”

Let's place this claim directly against the documented user experience:

· *Q&A Claim:* Withdrawals are fast, some within 1 hour.

· *User Reality (Hafiza Aliyuu):* A withdrawal request was left pending for over 48 hours with no communication.

On any review or information platform, it is critical to distinguish between different types of content and weigh them accordingly:

1. *Verified Data:* This includes the regulatory status and the calculated broker score. This information is based on objective, verifiable facts and should be given the most weight. For NEWTON GLOBAL, this data is overwhelmingly negative.

2. *Real User Reviews/Complaints:* These are first-hand experiences from other traders. When a pattern emerges, as with the withdrawal failures at NEWTON GLOBAL, this becomes highly valuable evidence.

3. *Curated or Promotional Content:* This can include sections such as a broker-answered Q&A, sponsored articles, or overly generic positive reviews. This type of content should always be treated with the most skepticism, as it may be outdated, misleading or part of a marketing effort.

When there is a direct conflict between these content types, you must always trust the verified data and the pattern of user experiences over promotional-sounding text. The evidence clearly shows that the positive claims in the Q&A do not reflect the reality faced by users.

After a thorough examination of the available evidence, we can now deliver a final, clear conclusion to the question, “Is NEWTON GLOBAL safe or a scam?”

Based on the total lack of valid regulation from any reputable authority, the extremely low trust score of 1.41 out of 10 and the credible, specific user complaints detailing failures to process withdrawals, we conclude that NEWTON GLOBAL is not a safe broker for your funds. The characteristics it displays—unregulated status, high leverage and withdrawal problems—are consistent with those of scam operations. The risk of losing your entire investment is exceptionally high. The appeal of low deposit requirements or competitive spreads is a facade that hides a fundamentally unsafe operational structure.

We strongly advise readers to never deposit funds with an unregulated broker, regardless of how attractive its marketing or promises may seem. The protection offered by strong financial regulation is not a luxury; it is a necessity for anyone trading online.

Before opening an account with any broker, make it a non-negotiable first step to check its profile on a trusted regulatory database and independent review platform. You can and should do this for every broker on platforms, such as WikiFX, to see their regulatory status, license details, and real user feedback. To see a real-world example of this essential research, you can review all the data points for this broker on the NEWTON GLOBAL page on WikiFX. Prioritizing safety and thorough verification is the single most important investment you can make in your trading journey.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

EMAR MARKETS (FSCA 53070, exceeded) lures with $1 deposits & MT5 but traps funds in "data verification" scams & fake fees—avoid! Report & recover losses.

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!