Perfil de la compañía

| Concord Securities Group Resumen de la revisión | |

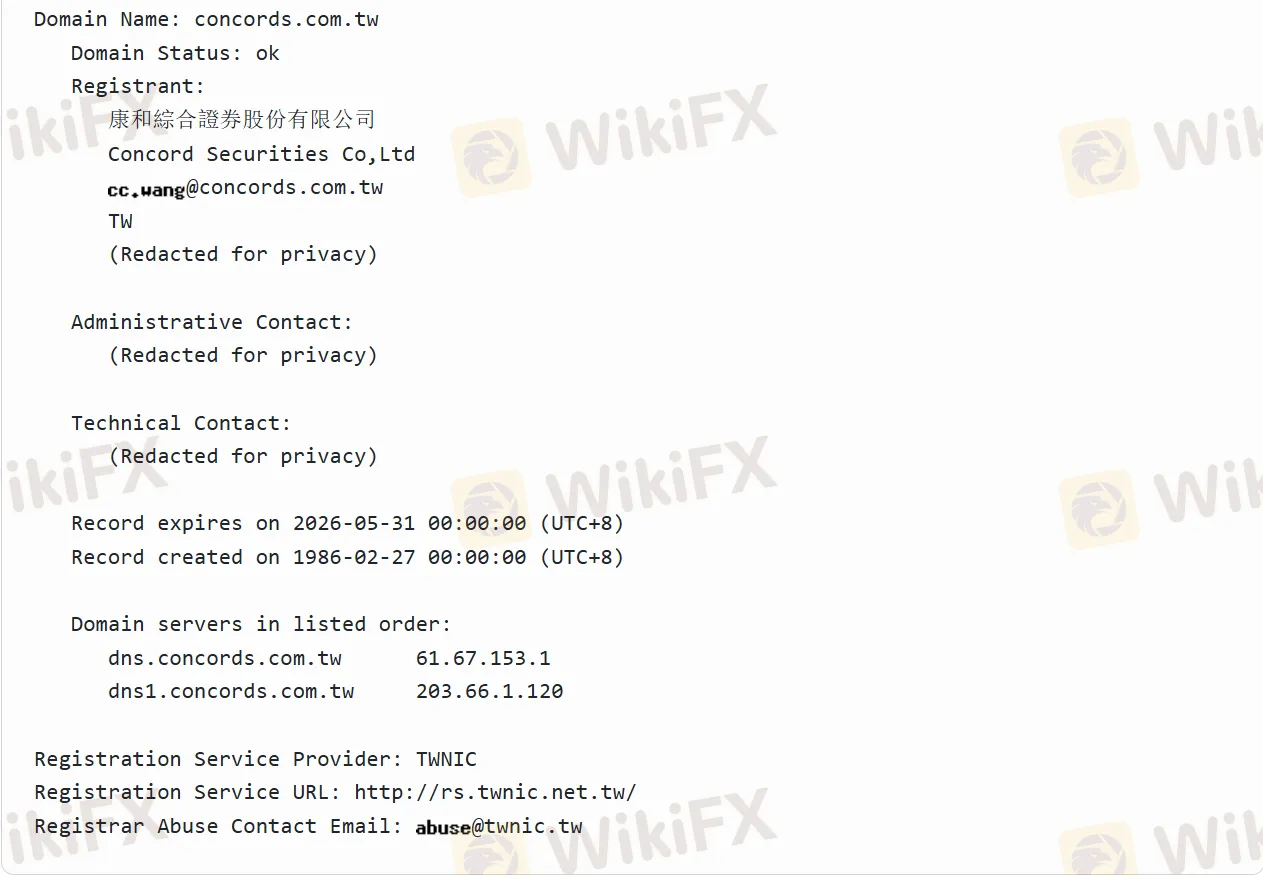

| Fecha de fundación | 1986-02-27 |

| País/Región registrado | China, Taiwán |

| Regulación | Regulado |

| Instrumentos de mercado | Productos de renta fija, bonos, acciones, derivados, warrants y ETFs |

| Plataforma de negociación | Servicio en línea de 77 Securities (computadoras, tabletas y teléfonos inteligentes) |

| Soporte al cliente | (886-2) 8787-1888 |

| service@6016.com | |

Información de Concord Securities Group

Concord Securities Group es un proveedor de servicios financieros bien establecido. Está compuesto por una empresa matriz y varias subsidiarias especializadas, incluidas Concord Securities, Concord Futures, Concord Capital Management, Concord Insurance Agent y Concord Asset Management Services. Desde su establecimiento en 1990 con un capital pagado de NT$1.356 mil millones, ha crecido de manera constante, cotizando en el mercado de venta libre en 1996.

El grupo se compromete a proporcionar servicios de inversión y financieros integrales, con una filosofía empresarial centrada en maximizar la competencia corporativa, aumentar los beneficios y mejorar el bienestar de los empleados. Su cultura corporativa enfatiza la integridad, la estabilidad, el servicio y la continuidad.

Pros y contras

| Pros | Contras |

| Regulado | Estructura corporativa compleja |

| Una amplia gama de servicios financieros | Alta dependencia del mercado |

| Más de treinta años de operación |

¿Es Concord Securities Group legítimo?

Sí, Concord Securities Group es un proveedor legítimo de servicios financieros y está regulado por la Bolsa de Taipéi. Su número de licencia no se ha publicado. El hecho de que esté listado en el mercado de venta libre (OTC) indica que cumple con ciertos requisitos regulatorios.

¿Qué puedo negociar en Concord Securities Group?

Los inversores pueden negociar varios instrumentos financieros en Concord Securities Group. Estos incluyen acciones, ya que el grupo ofrece servicios de corretaje, transacciones de financiamiento de acciones y servicios de negociación de acciones extranjeras. Además, hay operaciones de futuros, bonos y productos de renta fija. Además, el grupo también ofrece servicios relacionados con derivados, warrants y productos vinculados a índices como ETFs.

| Instrumentos negociables | Soportados |

| Productos de renta fija | ✔ |

| Bonos | ✔ |

| Acciones | ✔ |

| Derivados | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |