Buod ng kumpanya

| Concord Securities Group Buod ng Pagsusuri | |

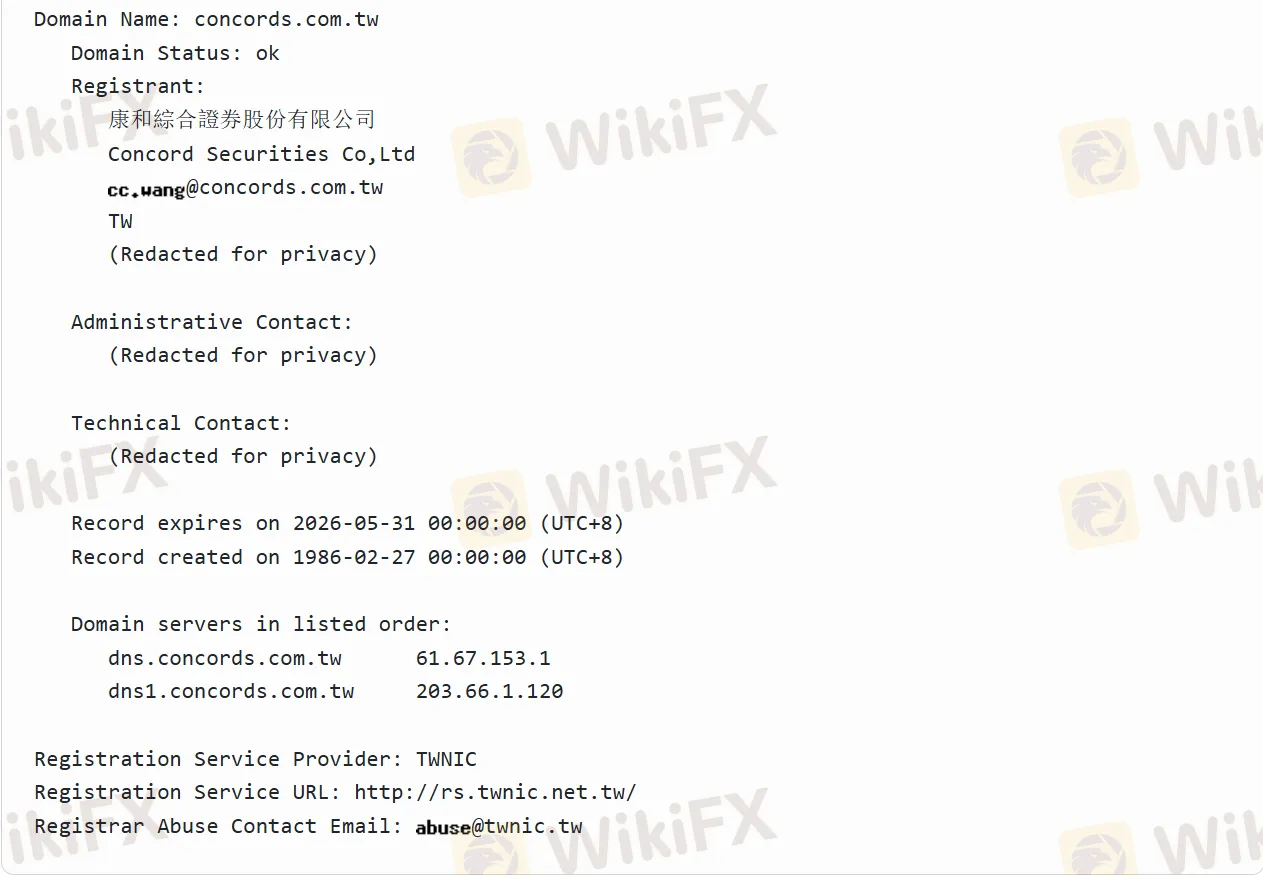

| Itinatag | 1986-02-27 |

| Rehistradong Bansa/Rehiyon | China, Taiwan |

| Regulasyon | Regulated |

| Mga Kasangkapan sa Merkado | Mga produkto ng fixed-income, bonds, stocks, derivatives, warrants, at ETFs |

| Platform ng Paggagalaw | 77 Securities Online Service (computers, tablets, at smartphones) |

| Suporta sa Customer | (886-2) 8787-1888 |

| service@6016.com | |

Impormasyon Tungkol sa Concord Securities Group

Ang Concord Securities Group ay isang kilalang tagapagbigay ng mga serbisyong pinansyal. Binubuo ito ng isang pangunahing kumpanya at ilang espesyalisadong sangay, kabilang ang Concord Securities, Concord Futures, Concord Capital Management, Concord Insurance Agent, at Concord Asset Management Services. Mula nang itatag ito noong 1990 na may bayad na kapital na NT$1.356 bilyon, patuloy itong lumalago, at naglista sa OTC noong 1996.

Ang grupo ay nangangako na magbigay ng kumpletong mga serbisyo sa pamumuhunan at pinansya, na may pilosopiyang pangnegosyo na nakatuon sa pagpapalakas ng kakayahan ng kumpanya, pagtaas ng kita, at pagpapabuti sa kapakanan ng mga empleyado. Ang kanilang kultura ng kumpanya ay nagbibigay-diin sa integridad, katatagan, serbisyo, at patuloy na pag-unlad.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulated | Komplikadong istraktura ng kumpanya |

| Malawak na hanay ng mga serbisyong pinansyal | Matataas na dependensya sa merkado |

| Mahigit sa tatlong dekada ng operasyon |

Tunay ba ang Concord Securities Group?

Oo, ang Concord Securities Group ay isang lehitimong tagapagbigay ng mga serbisyong pinansyal, at ito ay nireregula ng Taipei Exchange. Hindi pa nailalabas ang numero ng lisensya nito. Ang katotohanan na ito ay naka-lista sa over-the-counter (OTC) market ay nangangahulugan na ito ay sumusunod sa ilang regulasyon.

Ano ang Maaari Kong I-trade sa Concord Securities Group?

Maaaring mag-trade ang mga mamumuhunan ng iba't ibang mga instrumento sa pinansya sa Concord Securities Group. Kasama dito ang mga stocks, dahil nag-aalok ang grupo ng mga serbisyong brokerage, mga transaksyon sa stock financing, at mga serbisyong pang-ibang bansa sa pag-trade ng stocks. Bukod dito, mayroong futures trading, bonds, at mga produkto ng fixed-income. Bukod dito, nagbibigay din ang grupo ng mga serbisyo kaugnay ng derivatives, warrants, at mga produkto na may kaugnayan sa index tulad ng ETFs.

| Mga Tradable na Instrumento | Supported |

| Mga produkto ng fixed-income | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

| Derivatives | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |