Profil perusahaan

| GMCU Ringkasan Ulasan | |

| Didirikan | 1985 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC (Melebihi) |

| Layanan | Pinjaman, rekening perbankan, deposito berjangka, asuransi |

| Akun Demo | ❌ |

| Platform Perdagangan | Aplikasi Perbankan Seluler |

| Dukungan Pelanggan | Telepon: 1800 694 628 |

| Email: info@gmcu.com.au | |

| Alamat Surat: PO Box 860, Shepparton, VIC 3632 | |

Informasi GMCU

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) didirikan pada tahun 1985 dan diatur di bawah ASIC dengan nomor lisensi 241364, meskipun statusnya terdaftar sebagai "Melebihi." Institusi ini menyediakan layanan keuangan standar seperti pinjaman rumah, rekening perbankan pribadi, dan produk asuransi, tetapi tidak menawarkan layanan perdagangan lainnya atau akun demo.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai saluran kontak | Melebihi lisensi ASIC |

| Beragam layanan perbankan tradisional | |

| Berbagai pilihan akun | |

| Waktu operasi yang panjang |

Apakah GMCU Legal?

Ya, Goulburn Murray Credit Union Co-Operative Ltd (GMCU) diatur. Perusahaan ini memegang Lisensi Penasihat Investasi yang dikeluarkan oleh Australia Securities & Investments Commission (ASIC) dengan nomor lisensi 241364. Namun, status regulasinya ditandai sebagai Melebihi, yang mungkin menunjukkan bahwa lisensinya tidak lagi valid atau telah melampaui cakupan yang dimaksud.

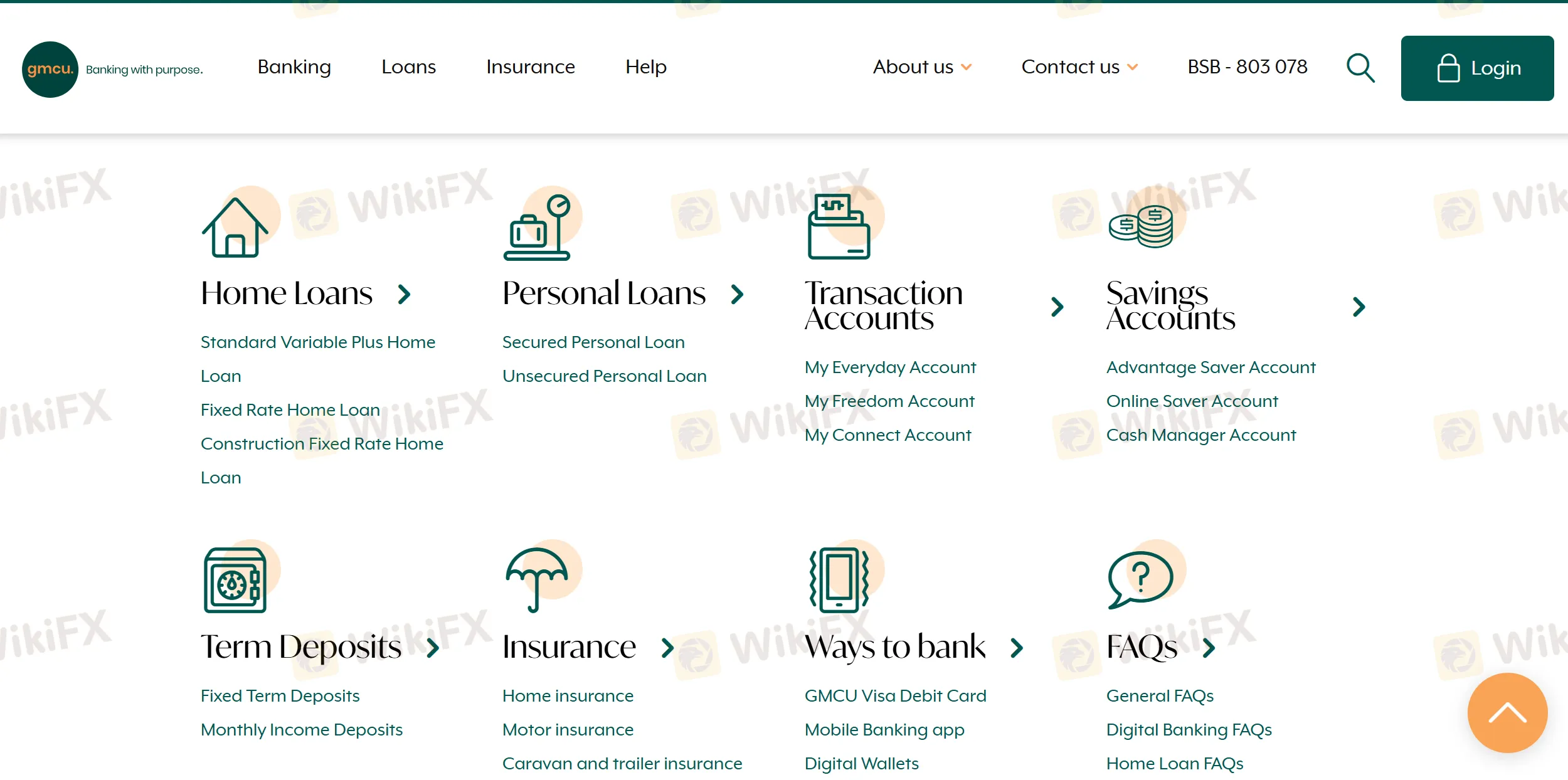

Layanan GMCU

GMCU menawarkan berbagai layanan perbankan ritel termasuk pinjaman rumah dan pribadi, berbagai jenis akun, deposito berjangka, dan opsi asuransi.

| Kategori | Layanan |

| Pinjaman Rumah | Standar Variabel Plus, Tingkat Tetap, Konstruksi Tingkat Tetap |

| Pinjaman Pribadi | Pinjaman Pribadi Tersedia, Pinjaman Pribadi Tidak Tersedia |

| Akun Transaksi | Akun Sehari-hari Saya, Akun Kebebasan Saya, Akun Sambungan Saya |

| Akun Tabungan | Tabungan Unggulan, Tabungan Online, Akun Manajer Tunai |

| Deposito Berjangka | Deposito Berjangka Tetap, Deposito Pendapatan Bulanan |

| Asuransi | Rumah, Motor, Karavan & Trailer, Asuransi Pemilik Rumah |

Jenis Akun

GMCU menawarkan beberapa jenis akun riil (live) yang disesuaikan dengan kebutuhan perbankan sehari-hari, termasuk akun transaksi pribadi dan tabungan.

| Jenis Akun | Cocok untuk |

| Akun Sehari-hari Saya | Individu yang memerlukan akun transaksi umum |

| Akun Kebebasan Saya | Siswa atau pemegang kartu konsesi yang mencari pembebasan biaya |

| Akun Sambunganku | Orang yang lebih suka perbankan digital tanpa akses cabang |

| Akun Penghemat Keuntungan | Penghemat reguler yang menginginkan bunga bonus |

| Akun Penghemat Online | Penghemat berbasis online |

| Akun Manajer Kas | Anggota yang mengelola aliran kas yang lebih besar |

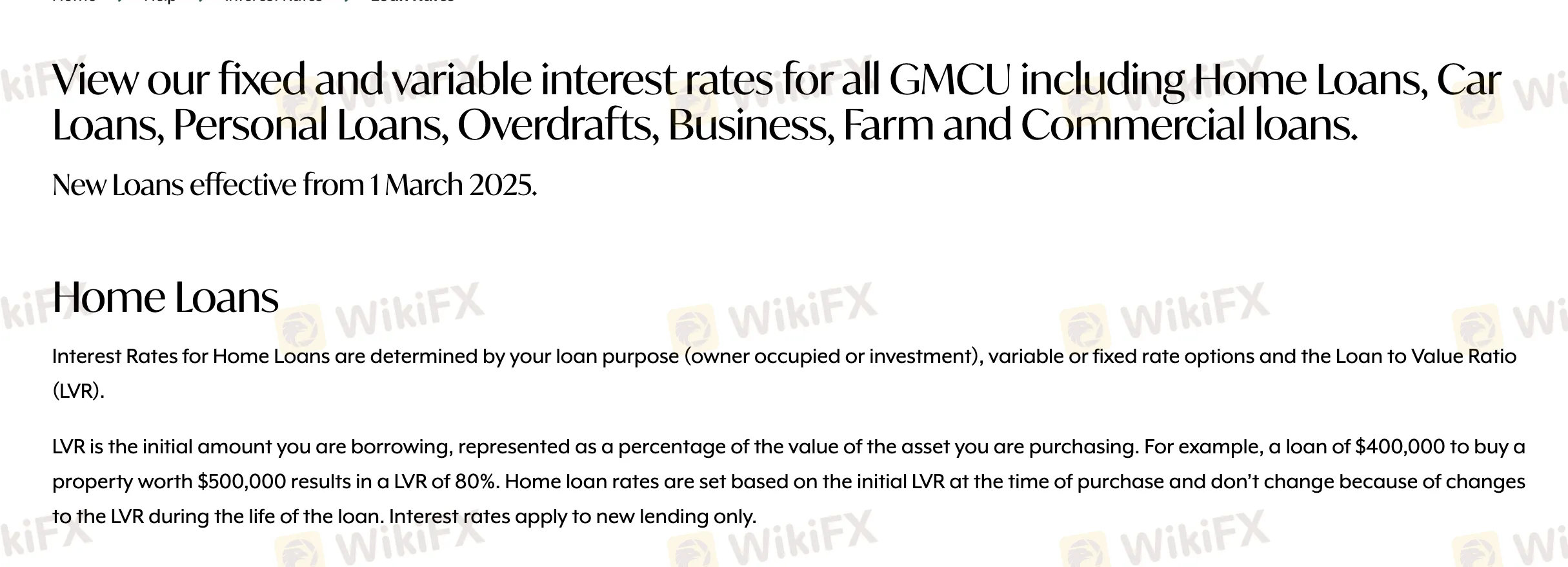

Biaya GMCU

Biaya GMCU cenderung sedang hingga tinggi dibandingkan standar industri, terutama untuk produk pinjaman tanpa agunan seperti pinjaman pribadi dan overdraft.

| Jenis Pinjaman | Tingkat Bunga (per tahun) |

| KPR (Pemilik Hunian, LVR <80%) | 5,94% - 5,79% |

| KPR (Pemilik Hunian, LVR >80%-95%) | 6,34% - 5,79% |

| KPR (Investasi, LVR <80%) | 6,14% - 6,09% |

| KPR (Investasi, LVR >80%-95%) | 6,54% - 6,09% |

| Pinjaman Pribadi (Tersedia Agunan) | 7,79% |

| Pinjaman Pribadi (Tanpa Agunan) | 14,95% |

| Overdraft (Tersedia Agunan) | 9,99% - 10,60% |

| Overdraft (Tanpa Agunan) | 17,69% |

| Pinjaman Bisnis/Pertanian (Tersedia Agunan) | 10,54% - 12,00% |

| Pinjaman Bisnis/Pertanian (Tanpa Agunan) | 18,75% |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Aplikasi Perbankan Seluler | ✔ | iOS, Android |

Deposit dan Penarikan

GMCU tidak secara eksplisit menyebutkan biaya untuk deposit atau penarikan.

| Metode Pembayaran | Biaya | Waktu Pemrosesan |

| Kredit Entri Langsung | / | Biasanya dalam sehari |

| Debit Entri Langsung | Biaya penolakan mungkin berlaku jika dana tidak mencukupi | Berdasarkan jadwal pemasok |

| Pembayaran Periodik | / | Sesuai jadwal |

| Perbankan Internet/Seluler | / | Instan atau dalam sehari |

| Deposit di Cabang | / | Instan atau pada akhir hari |