公司简介

| 盈立集团 评论摘要 | |

| 成立时间 | 2021 |

| 注册国家/地区 | 香港 |

| 监管 | MAS |

| 市场工具 | 股票、股份、期权、ETF、REIT和ADRs、期货和外汇 |

| 模拟账户 | ❌ |

| 杠杆 | 1:3 |

| 点差 | / |

| 交易平台 | uSMART App |

| 最低存款 | 0 |

| 客户支持 | 24/5支持 |

| 电话:+65 6303 0663;+65 3135 1599(新加坡)/ +852 9520 4758(香港) | |

| 电子邮件:support@usmart.sg(新加坡)/cs@usmarthk.com(香港) | |

| 地址:新加坡048693,菲利普街3号,皇家集团大厦,12-04室 | |

| 地址:香港上环德辅道中308号富衍金融中心26楼2606-07室 | |

盈立集团,正式注册为uSmart Holding Ltd.,自2021年起作为一家总部位于香港的受监管经纪商运营。盈立集团提供包括美国、新加坡和香港股票、分股、各种美国期权、外汇和网格交易在内的广泛交易选择。该经纪商使用其专有的uSmart平台,兼容iOS、Android、Mac、Windows和Open应用程序接口。目前受MAS良好监管。

优点和缺点

| 优点 | 缺点 |

| 受MAS监管 | 无模拟账户账户 |

| 提供安全措施 | 复杂的费用结构 |

| 简单的开户流程 | 无MT4/5 |

| 无最低存款要求 | 缺乏流行的支付方式 |

盈立集团是否合法?

盈立集团通过获得新加坡金融管理局(MAS)的监管,确立了其合法性和可信度。MAS是一家以其全面严格的金融监管而著称的监管机构。该经纪商持有零售外汇牌照。

| 监管状态 | 受监管 |

| 监管机构 | 新加坡金融管理局(MAS) |

| 许可机构 | USMART SECURITIES (SINGAPORE) PTE. LTD. |

| 许可类型 | 零售外汇牌照 |

| 许可号码 | CMS101161 |

此外,它还提供了进一步的保护。为了确保客户资产的安全,资金和证券存放在独立的托管机构账户中,防止其与其他账户混合。

我可以在盈立集团上交易什么?

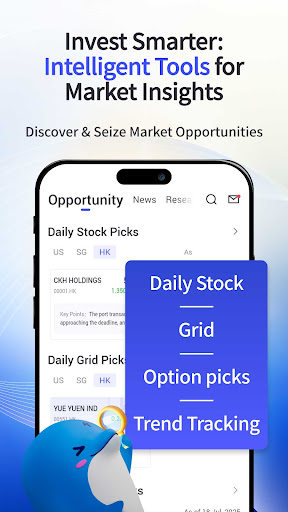

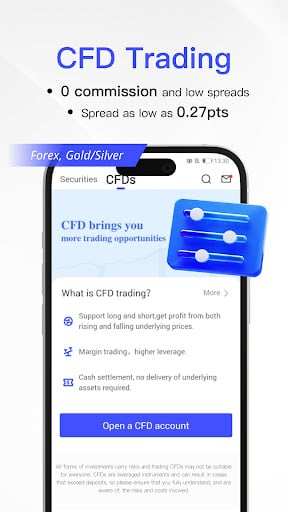

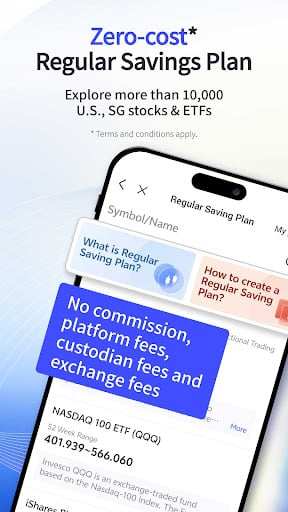

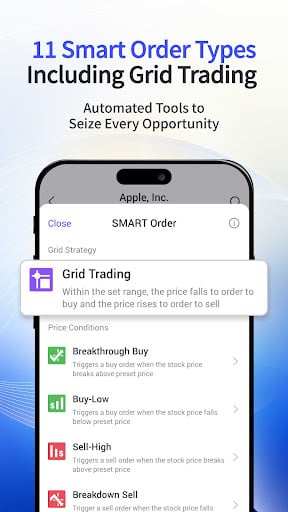

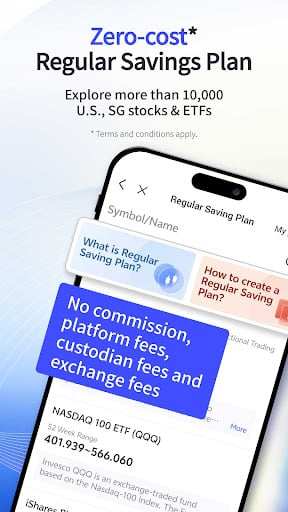

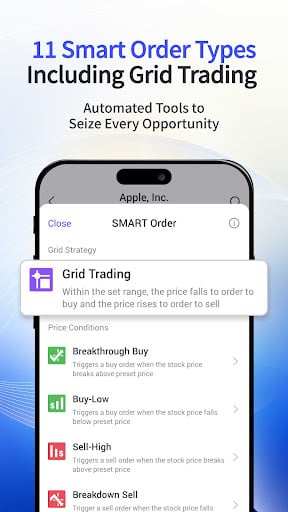

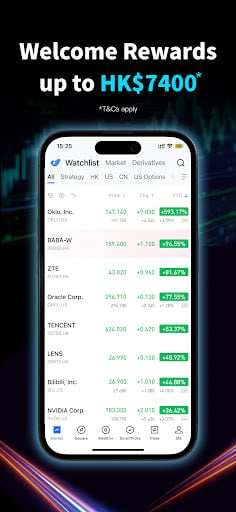

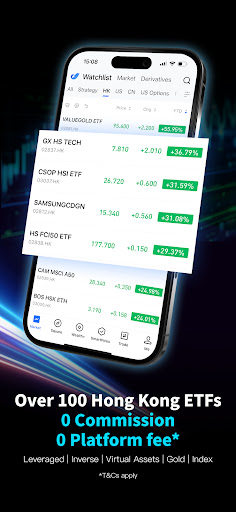

盈立集团在美国、新加坡和香港市场提供股票交易,以及分股、美国期权交易,涵盖多种期权策略、卖空和网格交易订单、ETF、REIT和ADR,以及各种期货和外汇产品。

| 可交易工具 | 支持 |

| 股票/股份 | ✔ |

| 期权 | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| ADR | ✔ |

| 期货 | ✔ |

| 外汇 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

账户类型

盈立集团提供两种账户:现金账户和保证金账户账户。他们声称不需要最低存款。

| 账户类型 | 特点 | 可用交易产品 |

| 现金账户 | 使用现金进行交易的基本账户。购买力通过现金存款获得。 | 股权、分股 |

| 保证金账户 | 具有杠杆(最高3倍)的灵活账户。购买力通过现金或股票作为抵押品获得。 | 股权、分股、期权、卖空 |

要开设盈立集团的账户,您可以点击“注册/登录”,填写您的手机号码或电子邮件,设置密码,然后点击“注册”。该过程简单易行。

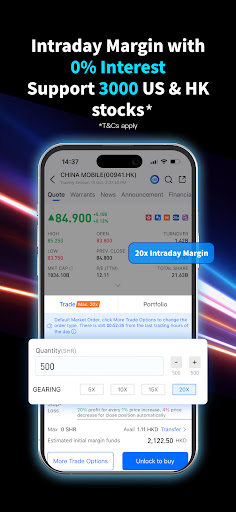

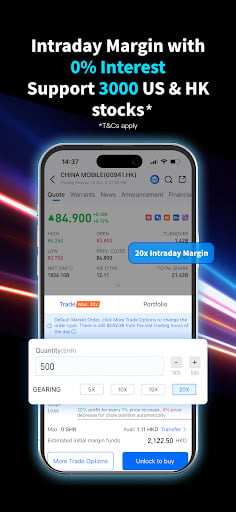

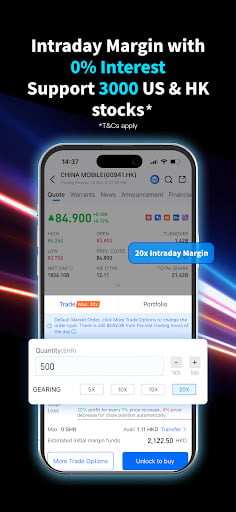

杠杆

盈立集团提供最高1:3的杠杆。请记住,杠杆越大,损失已存资本的风险就越大。杠杆的使用既可能对您有利,也可能对您不利。

盈立集团费用

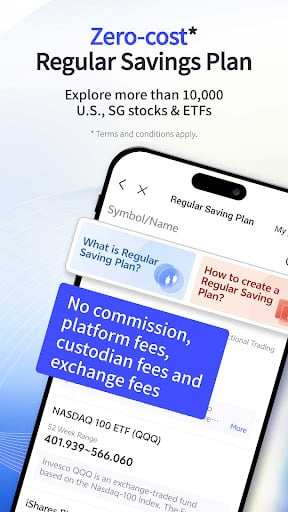

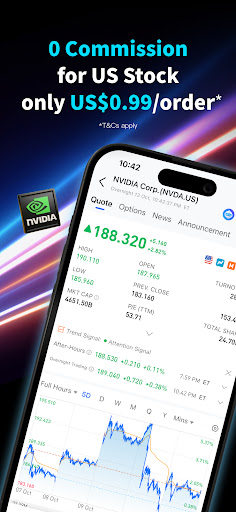

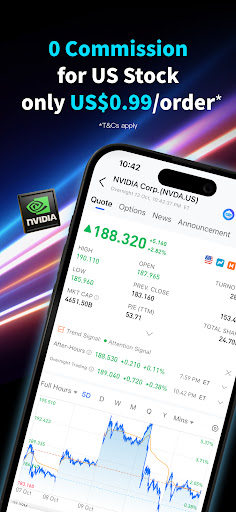

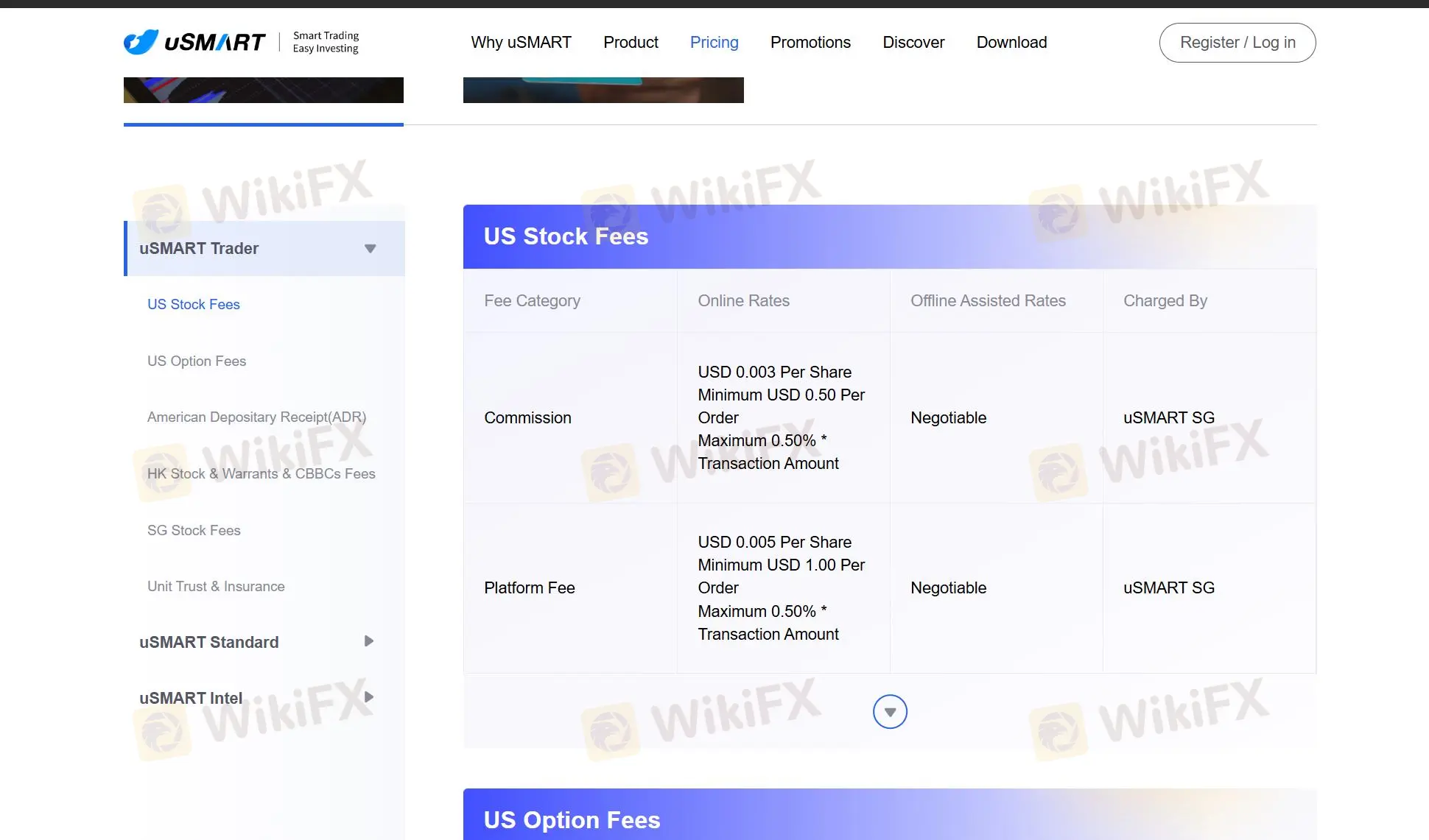

盈立集团 根据不同的产品和服务收取费用手续费。对于uSMART交易者,他们收取美股、美国期权、ADR、港股和认股权证、新加坡股票手续费以及单位信托和保险费用。

| 产品类型 | 费用类型 | 费率/金额 | 最低 | 最高 | 适用的消费税(9%) |

| 美股 | 佣金 | 每股$0.003 | 每笔订单$0.50 | 交易金额的0.50% | ✔ |

| 平台费 | 每股$0.005 | 每笔订单$1.00 | ✔ | ||

| 零股交易 | 佣金 | 每股$0.00(小于1股) | / | / | ❌ |

| 平台费 | 每笔订单$1.00 | / | / | ❌ | |

| 场外交易股交易 | 佣金 | ❌ | / | / | ❌ |

| 平台费 | 每股$0.019 | 每笔交易$6 | 交易金额的2% | ✔ |

更多详细信息请点击:https://www.usmartglobal.com/pricing

交易平台

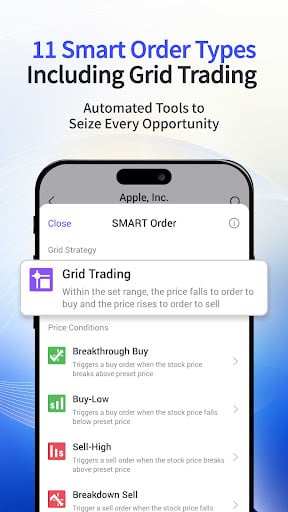

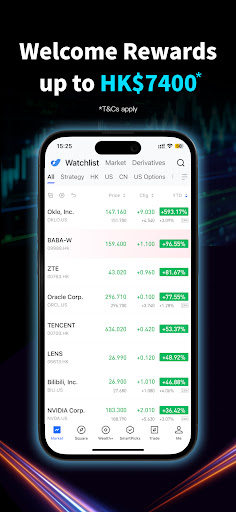

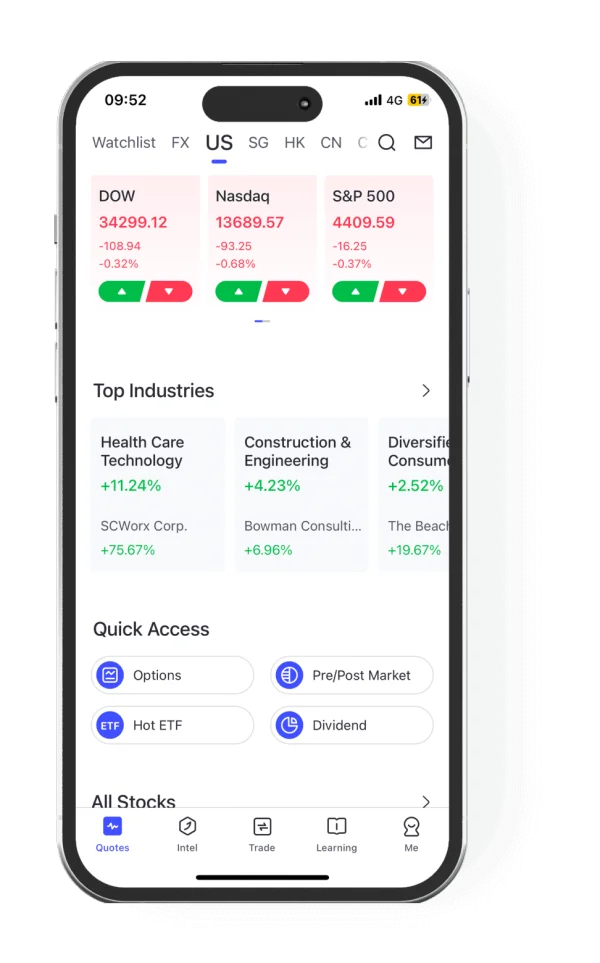

盈立集团 提供了uSMART App。该应用支持iOS、Android、Mac、Windows和Open应用程序接口的交易。TWAP、VWAP订单适用于专业交易者。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| uSMART App | ✔ | iOS、Android、Windows、Mac | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | Windows、Android、WebTrader、iOS | 经验丰富的交易者 |

存款和取款

对于新加坡元(SGD),盈立集团 接受eGIRO、Paynow、FAST、电汇和BigPay进行存款。

对于外币(美元和港币),他们提供电汇和BigPay。

此外,他们支持资金提取,但需要最低提款金额:

| 最低提款 | |

| 港币转至其他国家/地区的银行 | 400 |

| 港币转至香港银行 | 10 |

| 美元 | 50 |