Tom Nalichowski

1-2年

How much leverage does LINE FX allow on major currency pairs, and does this limit vary for different types of assets?

Based on my experience trading with LINE FX and reviewing the detailed background I found, the maximum leverage allowed on major currency pairs is up to 1:25. I found this leverage set consistently across the 23 currency pairs offered, with no mention of higher or tiered leverage for other asset types. For me, a leverage cap of 1:25 reflects the strict Japanese regulatory environment, specifically under FSA oversight, which generally sets tighter limits compared to offshore or unregulated brokers. This leverage policy is important because it directly impacts both risk and potential reward—higher leverage can amplify both profits and losses, but in my view, the 1:25 ratio represents a more measured and safer approach, especially for retail traders. I always remind myself that while some brokers advertise much higher leverage, regulatory constraints like those at LINE FX are implemented for trader protection. As far as I can see, there isn’t a distinction in leverage limits for different assets—LINE FX, being a FX-specialized platform in Japan, doesn’t appear to offer CFDs or riskier instruments with varied leverage. Overall, I found LINE FX’s leverage offering to be straightforward and consistent, in line with its regulated, retail-focused business model.

Broker Issues

Instruments

Account

Leverage

Platform

Allan777

1-2年

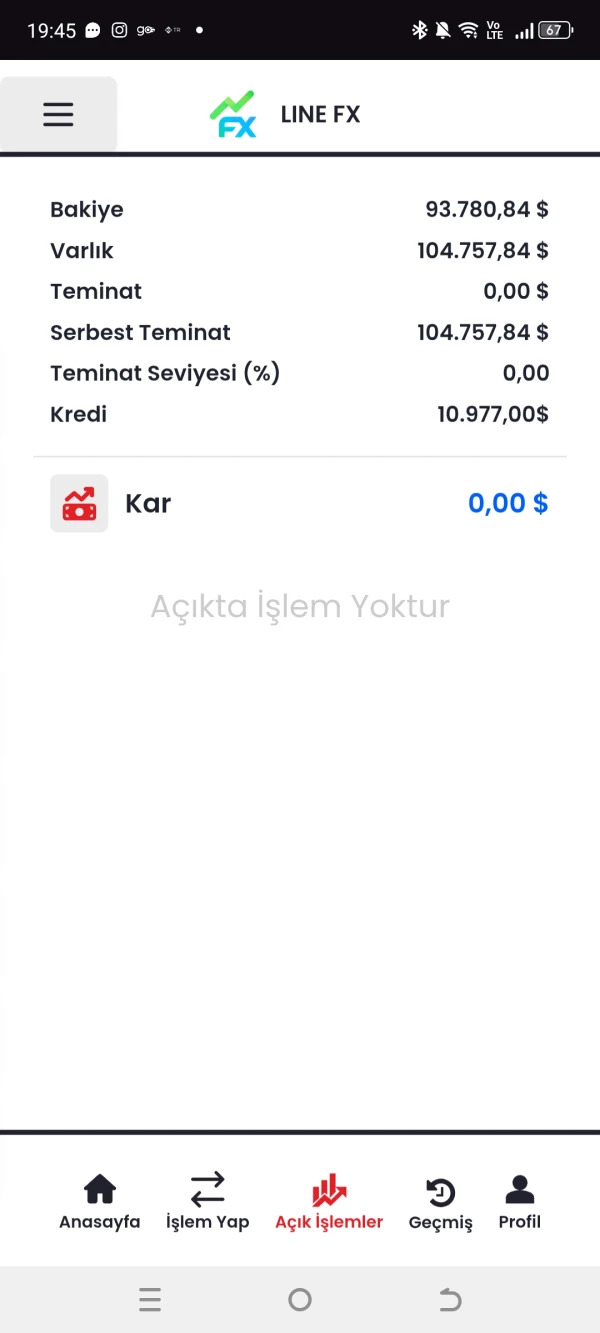

Is it possible to add funds to my LINE FX account with cryptocurrencies such as Bitcoin or USDT?

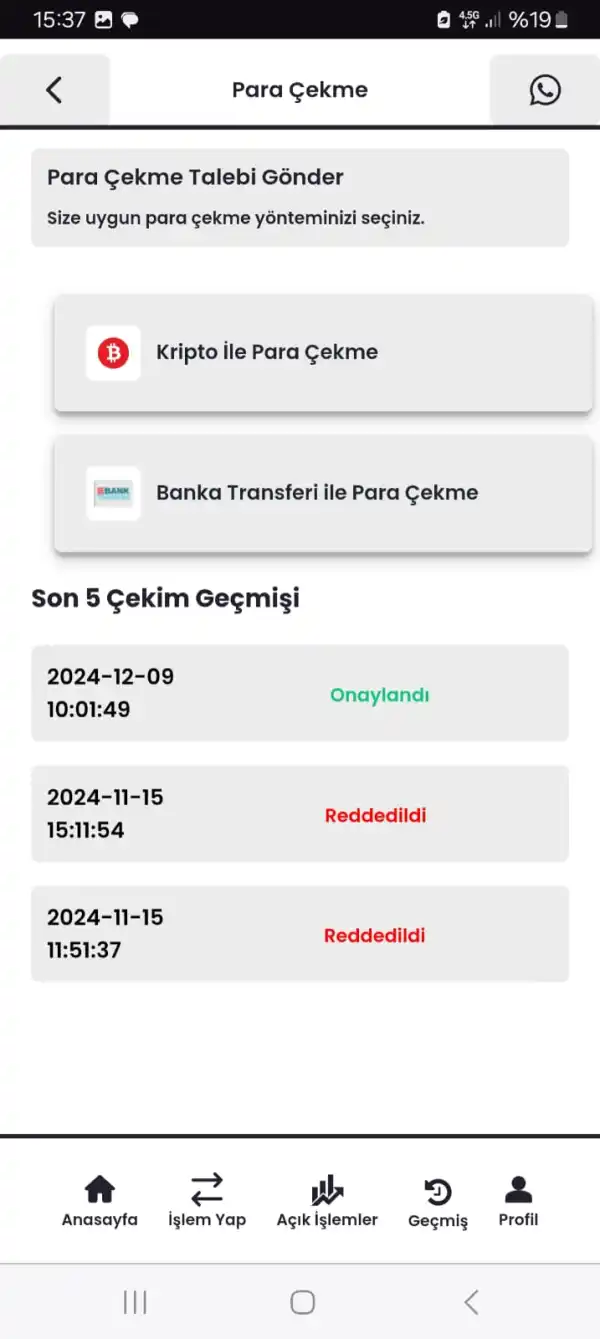

In my own experience researching and trading with various platforms, I’ve found that payment options are often a crucial part of a broker’s trustworthiness and transparency. With LINE FX, I paid special attention to their deposit and withdrawal procedures before considering them for any trading activity. From what I have seen, LINE FX is registered in Japan and currently only accepts bank transfers and a system called QuickCash for deposit payments. For withdrawals, only bank transfers are permitted. There is no information indicating that they support cryptocurrency deposits such as Bitcoin or USDT.

This limitation is not unusual for brokers licensed and regulated by the Japanese Financial Services Agency, as their regulations typically require strict identity verification and traceable payments. While this approach does limit flexibility for traders seeking to use crypto, it also minimizes certain risks associated with anonymous or non-traceable funding. For me, knowing that all deposits and withdrawals on LINE FX go through established Japanese banks or recognized payment systems helps confirm that their operations are in line with regional regulatory expectations.

While this may not suit everyone’s preferences, especially those wanting to use digital assets, I personally view the restriction as an indicator of their commitment to operating within Japanese financial compliance standards, rather than a drawback.

Broker Issues

Withdrawal

Deposit

JV1s24K_g0ld

1-2年

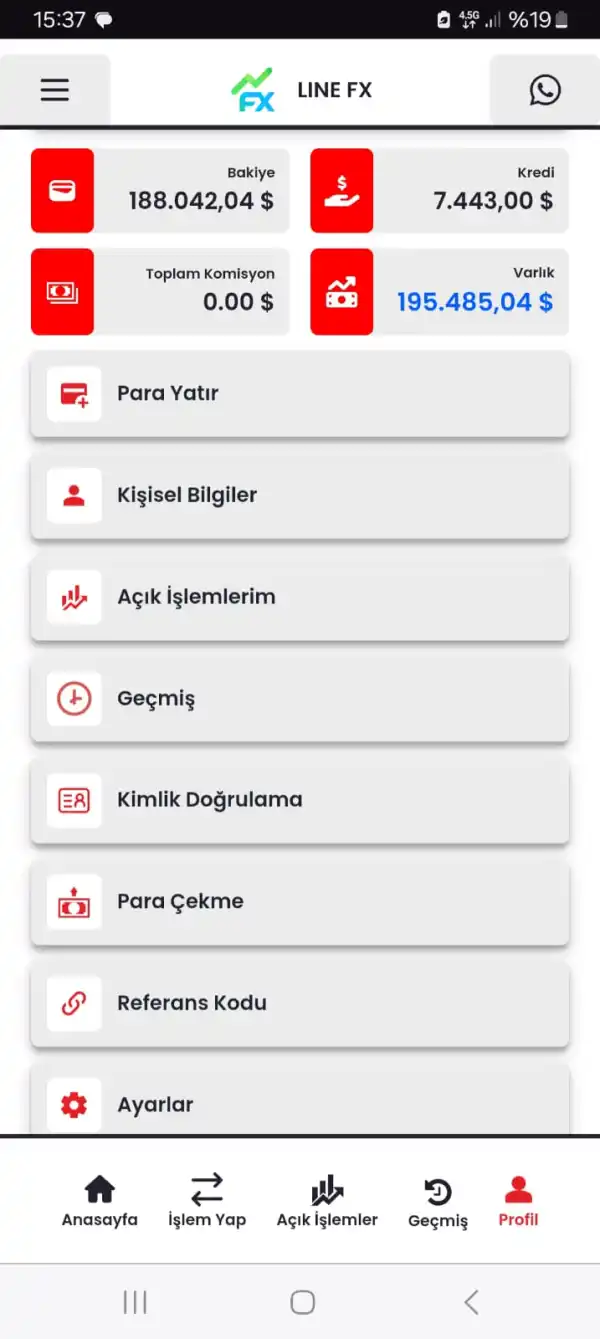

Is it possible to use Expert Advisors (EAs) for automated trading on the LINE FX platform?

Based on my detailed review and experience with LINE FX, one important consideration for me as a trader is whether the platform supports Expert Advisors (EAs) for automated trading. From what I understand about LINE FX, trading is primarily facilitated through their proprietary platforms: LINE FX for smartphones, LINE FX Pro for PC, and integration with TradingView for charting features. While TradingView offers solid analytical tools, it does not natively allow execution of automated trading strategies, such as Expert Advisors, in the same direct way that platforms like MetaTrader 4 or 5 do.

For traders accustomed to setting up EAs, this is a significant limitation. Personally, the inability to directly implement automated trading scripts or strategies within LINE FX's platform environment means I cannot run custom bots or algorithmic solutions as I might elsewhere. The focus here is on a streamlined, user-friendly trading interface, but not on advanced automation or coding integration. Since adopting any new broker always involves risk assessment, I prefer platforms that offer native EA compatibility when automation is part of my strategy.

Given this, for those heavily reliant on EAs, LINE FX may not be the most suitable choice. I advise caution and careful consideration of your trading needs. For manual or semi-automated trading, the tools available are adequate—but the lack of built-in EA support is an important point to acknowledge before opening an account.

Broker Issues

Leverage

Platform

Account

Instruments

Ibgentle

1-2年

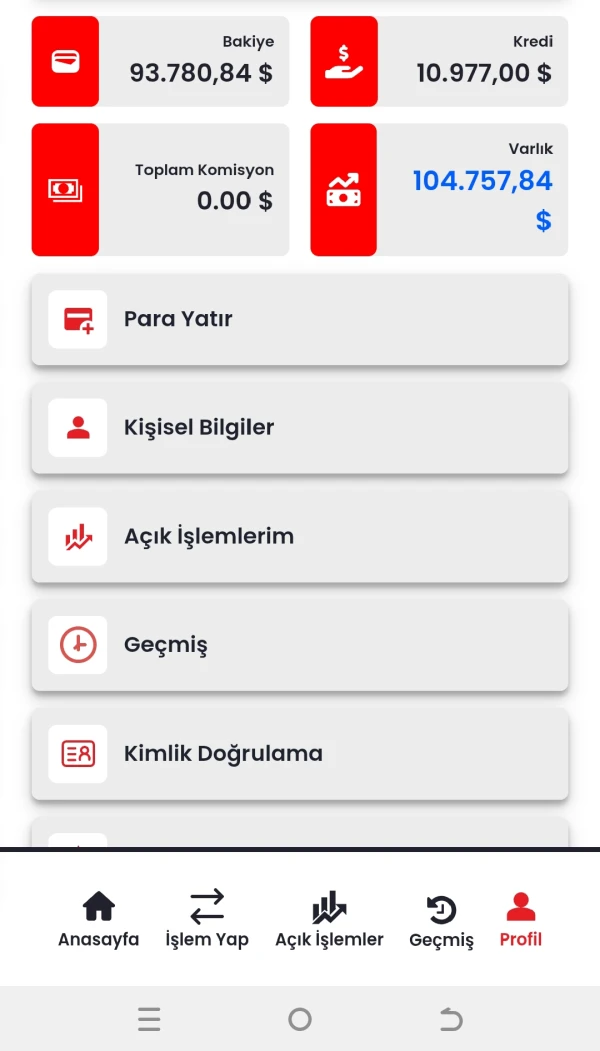

Which types of trading instruments does LINE FX offer access to, such as forex, stocks, indices, cryptocurrencies, or commodities?

From my close reading of the available details, my experience with LINE FX has shown that their focus is squarely on forex trading. Specifically, the platform offers access to 23 currency pairs. This means that, for me, LINE FX is dedicated strictly to foreign exchange trading, and there are no indications that it provides trading instruments outside of forex—such as stocks, indices, cryptocurrencies, or commodities.

This singular concentration on forex can be beneficial for someone who values a streamlined and specialized platform, particularly when reliability and regulation are priorities. The fact that LINE FX operates under a Retail Forex License regulated by the Japanese Financial Services Agency adds a layer of security that I personally consider very important, especially in a market filled with lesser-known or unregulated brokers.

However, it’s equally important for me, as a trader, to weigh the absence of other popular instruments. For traders seeking a diversified asset class exposure—such as equities, crypto, or commodities—LINE FX may not be suitable. In summary, in my experience, LINE FX is strictly a forex broker and does not currently cater to wider instrument trading needs.

Broker Issues

Instruments

Account

Platform

Leverage