Razzie87

1-2年

Which types of trading instruments does TIANFU FUTURES offer, such as forex, stocks, indices, cryptocurrencies, or commodities?

In my experience as a trader, I have found that TIANFU FUTURES is quite focused and specialized in its range of tradable instruments. When I examined their offerings, it became evident that TIANFU FUTURES only allows trading in commodity futures. They do not provide access to forex, individual stocks, indices, cryptocurrencies, bonds, options, or ETFs. I see this narrow product selection as both an advantage for traders who are focused solely on the commodity futures sector and a limitation for those who, like me, often look for diversification across multiple asset classes.

The company is properly licensed for commodity futures activities in China, which, in my view, speaks to a level of regulatory oversight for this specific market segment. However, I believe it is important for potential clients to be aware that if their interest lies in trading instruments outside commodity futures—such as forex pairs, global indices, or digital assets—they will need to look elsewhere. For me, this clear limitation impacts the broker’s suitability and makes it most appropriate for traders who are exclusively dedicated to commodities. This specialized approach means I would exercise particular diligence to ensure my trading goals align with their available instruments before opening an account.

Broker Issues

Instruments

Leverage

Account

Platform

Allan777

1-2年

How do TIANFU FUTURES' swap fees or overnight financing charges stack up against those offered by other brokers?

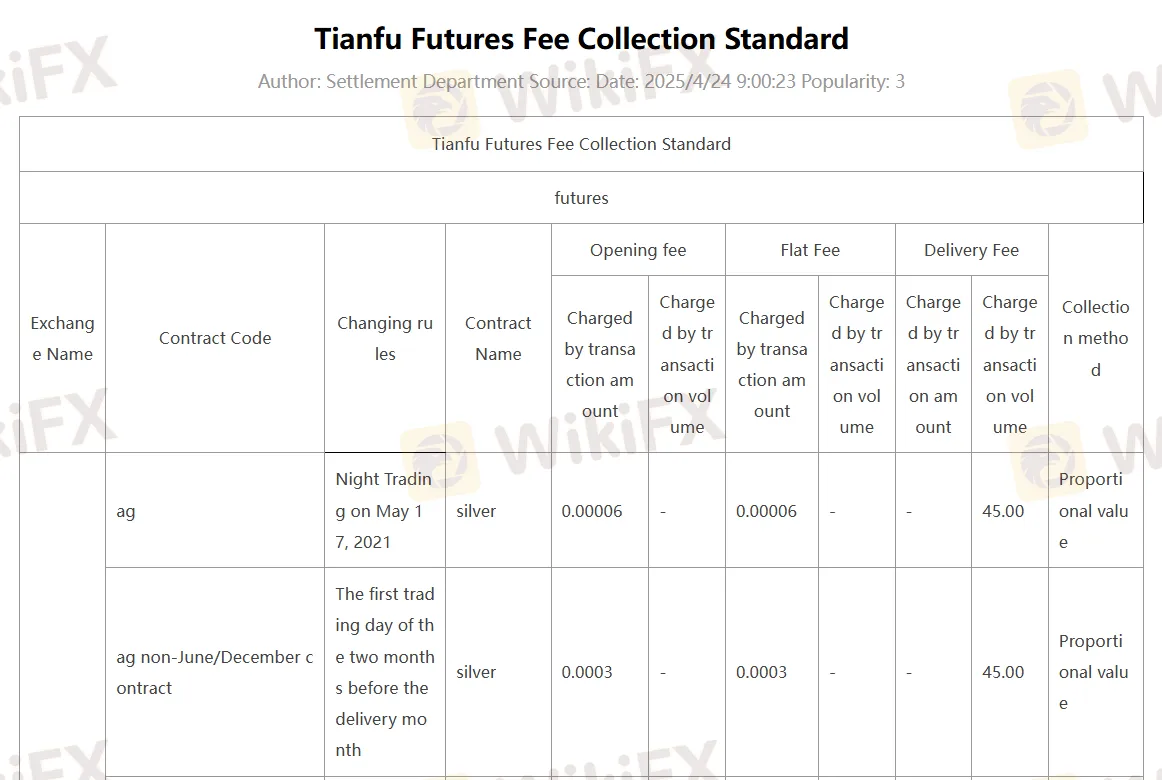

As someone who takes a cautious and methodical approach to broker selection, I have to be clear that TIANFU FUTURES primarily offers commodity futures trading rather than forex or CFD products, and their fee structure reflects this focus. In my own due diligence, I've found that typical "swap fees" or overnight financing charges apply mainly to leveraged forex and CFD positions—products that TIANFU FUTURES does not provide. Instead, they charge a combination of opening fees, flat fees, and delivery fees for futures contracts. This is fairly standard for the futures industry in regulated Chinese markets.

Because TIANFU FUTURES deals in regulated commodity futures (and not rolling spot forex or CFDs), the traditional swap fee comparison with other multi-asset brokers doesn’t quite apply. Most global brokers offering forex or CFDs calculate overnight financing costs based on interbank rates, adding or subtracting a margin. In contrast, futures contracts at exchanges like those TIANFU FUTURES accesses are generally cash-settled or require margin adjustments, without daily swap fees.

For me, it’s critical to note that futures positions might still incur costs due to margin requirements and contract rollover, but not the direct overnight charges typical in other asset classes. Anyone evaluating TIANFU FUTURES against broader brokers should be conscious of these structural differences. My experience suggests carefully reviewing the specific fee schedule on their website or through direct inquiry before making any commitment, as fee transparency in Chinese futures can sometimes be less granular than with international CFD brokers.

Broker Issues

Fees and Spreads

Ibgentle

1-2年

How much do you need to deposit at a minimum to start a live trading account with TIANFU FUTURES?

Based on my examination of TIANFU FUTURES, I noticed that their public resources—including the broker's website details and regulatory disclosures—do not clearly specify a minimum deposit requirement to open a live account. As someone accustomed to reviewing brokers, this lack of clarity is concerning. In my experience, transparency around account funding is a core aspect of trustworthiness. Many reputable providers make these terms explicit, helping traders plan their capital allocation and avoid unwelcome surprises when onboarding.

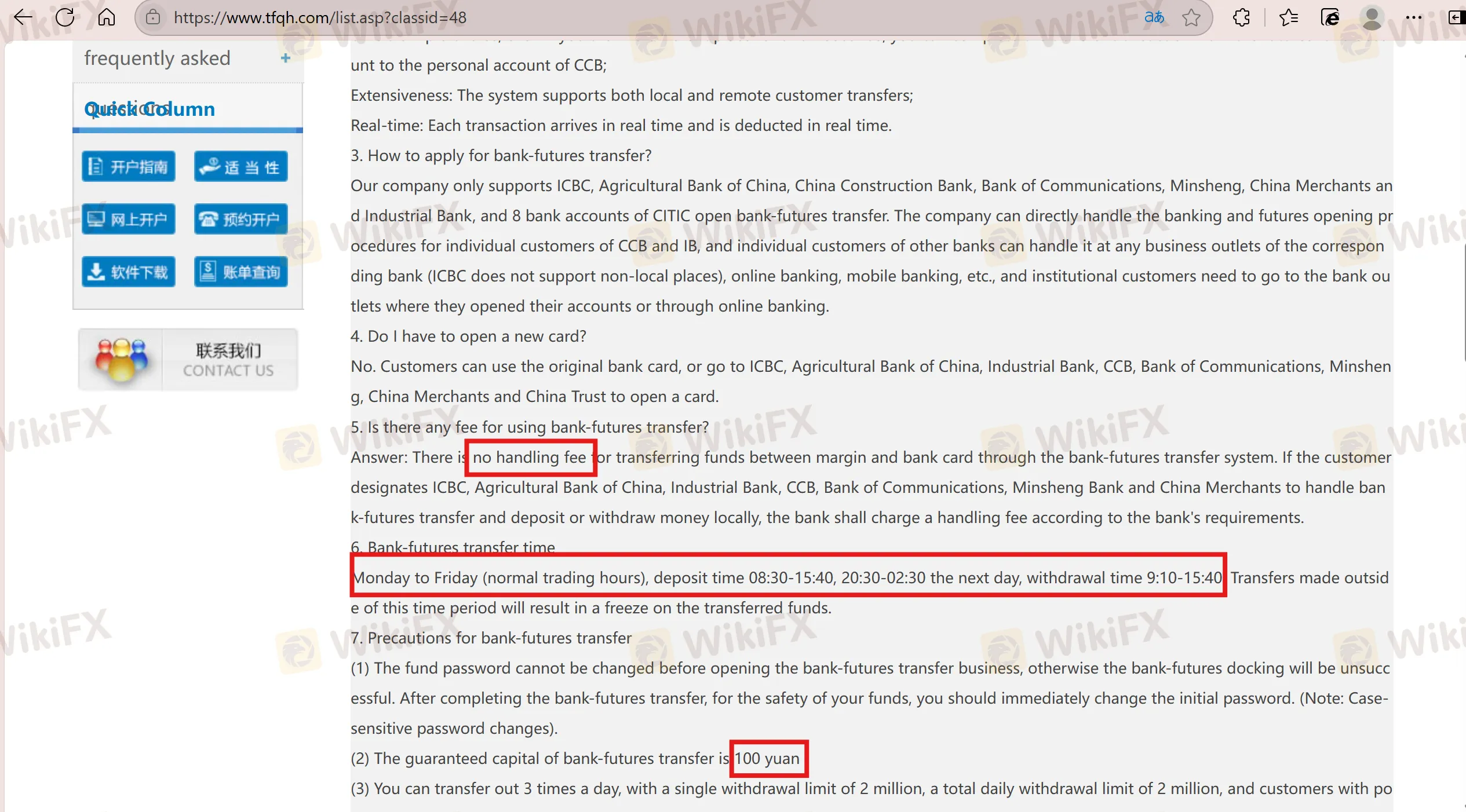

For TIANFU FUTURES, what I can confirm is that all deposits and withdrawals are conducted via a bank-futures transfer system with select Chinese banks, and that transaction windows are strictly limited to business hours. There are no internal handling fees for broker-side fund transfers, but the partnered banks may charge fees according to their own policy. From a risk management perspective, the absence of demo accounts and the exclusivity to commodity futures—not forex or other instruments—means potential clients like me are unable to test the platform or practice strategy before making a financial commitment.

Given these points, if I were seriously considering trading with them, I would reach out directly to their customer service for precise funding requirements and contract specifications. This cautious approach is, in my opinion, necessary when minimums and key terms are not directly published.

Broker Issues

Deposit

Withdrawal

Jezreel2

1-2年

Have you encountered any drawbacks with TIANFU FUTURES in terms of customer support or the reliability of their trading platform?

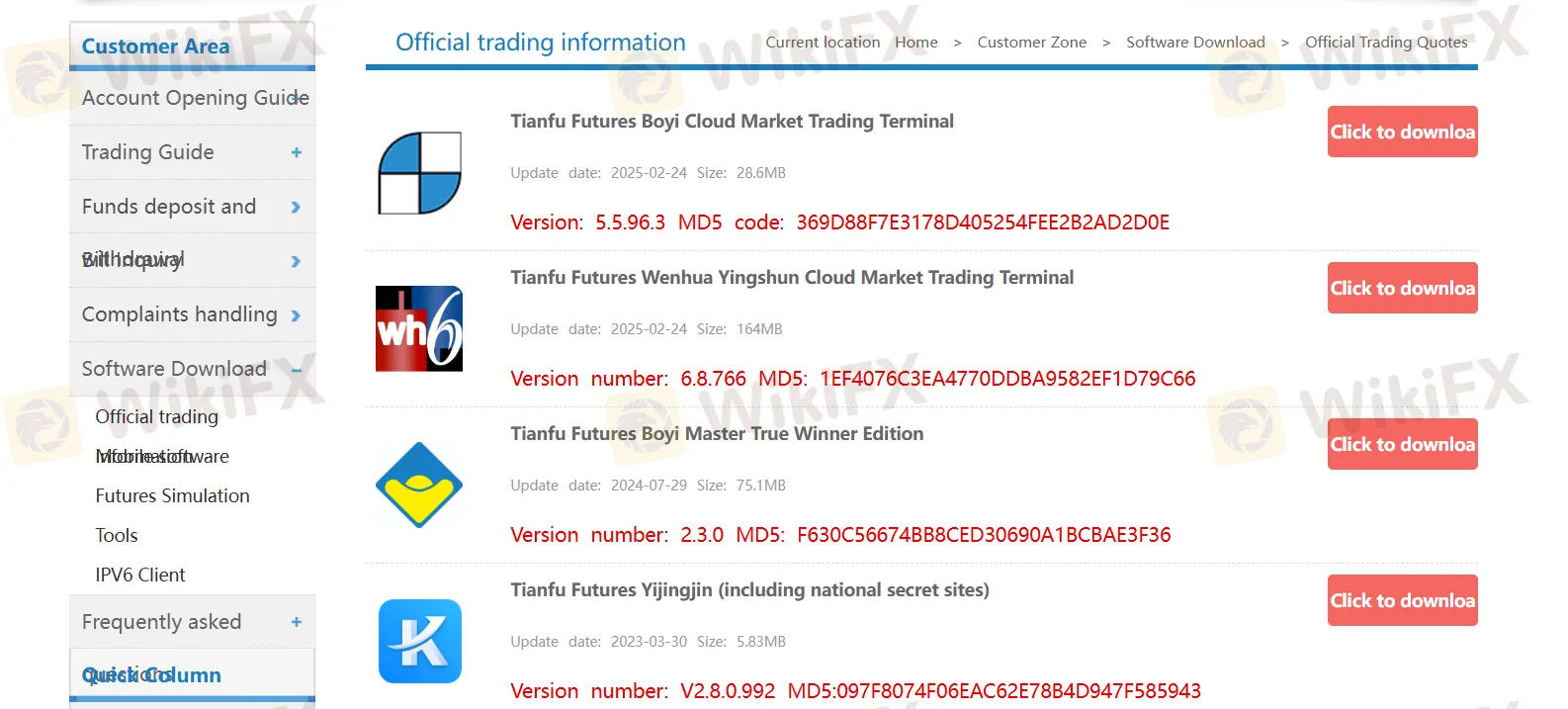

In my experience with TIANFU FUTURES, there are a few areas where I’ve noticed limitations, particularly regarding customer support responsiveness and overall platform transparency. While the broker has been operating for 5-10 years and is properly regulated by the China Financial Futures Exchange, which certainly gave me some peace of mind regarding its legitimacy, I found that getting clear assistance through their customer service lines could be inconsistent, especially during peak trading hours. Email support is available, but I sometimes felt responses lacked detail, making it challenging to resolve more technical queries promptly.

As for platform reliability, TIANFU FUTURES does offer multiple in-house trading terminals tailored for commodity futures. While these platforms functioned steadily for basic tasks on my PC and tablet, they did not provide the smooth, intuitive interface or speed I’ve come to expect from global trading software. Moreover, the absence of a demo account made it difficult for me to thoroughly test out these platforms beforehand or familiarize myself with their features without committing real funds. In combination with limited product offerings and a degree of opacity in fee structures, this cautious approach to both customer engagement and transparency leaves me measured in recommending TIANFU FUTURES, particularly if smooth support and platform testing are important factors in your trading process.