公司简介

| 三丰证券评论摘要 | |

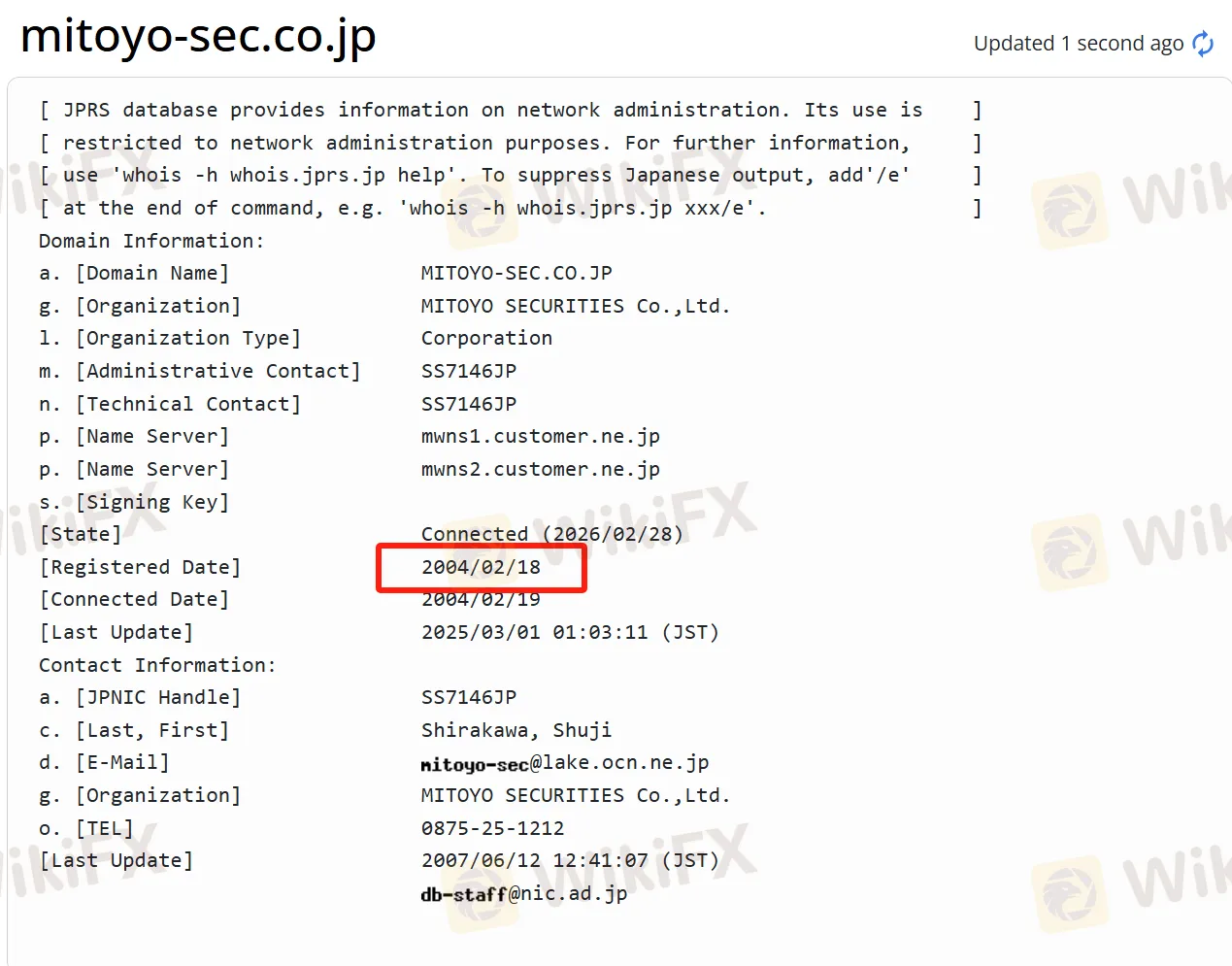

| 成立时间 | 2004 |

| 注册国家/地区 | 日本 |

| 监管 | FSA(受监管) |

| 市场工具 | 投资信托、债券和股票 |

| 交易平台 | / |

| 客户支持 | 电话:0875-25-1212 |

| 传真:0875-25-1221 | |

三丰证券信息

三丰证券证券是一家历史悠久的日本证券公司。自成立以来,公司深深扎根于当地,并以三丰证券地区为其据点开展业务。公司提供多样化的金融产品,涵盖多个国内上市的股票、各种投资信托和不同类型的债券。同时,它提供个性化的金融解决方案和多种交易工具,可以满足不同投资者的需求。该公司拥有良好的福利和福利制度,高度重视当地发展,并积极参与当地振兴。

优缺点

| 优点 | 缺点 |

| 受监管 | 国际业务有限 |

| 多种交易工具 | |

| 良好的福利和福利制度 | |

| 重视当地发展 | |

| 长时间运营 |

三丰证券是否合法?

三丰证券是一家合法合规的证券公司。《金融厅(FSA)》监管三丰证券证券,其许可证号为四国首席财务官(金融商人)第7号。

WikiFX现场调查

WikiFX现场调查团队访问了三丰证券在日本的地址,我们确认其在现场设有实体办公室。

我可以在三丰证券上交易什么?

三丰证券提供在多个交易所上市的国内股票,包括东京证券交易所、名古屋证券交易所、札幌证券交易所和福冈证券交易所。

各种投资信托类型多样,包括股权投资信托、公共债券型投资信托(MRF、公共债券投资信托)、ETF、J-REITs等。投资者可以通过投资信托实现多样化投资。

投资者还可以选择各种债券产品,例如面向个人的政府债券(包括三种类型:10年浮动、5年固定和3年固定),新窗口销售的政府债券,CB(具有新股认购权的国内可转换债券型公司债券),外币计价债券等。

| 可交易工具 | 支持 |

| 投资信托 | ✔ |

| 债券 | ✔ |

| 股票 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

| ETF | ❌ |