公司简介

| Morrison评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | ASIC监管 |

| 市场工具 | 现金股票、股票期权、权证、ETF、XTB、LIC、LIT和Tracers |

| 模拟账户 | ❌ |

| 交易平台 | Iress、TradeCentre、TradeFloor、Refintiv、Bloomberg Terminal |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:1300 130 545 | |

| 电子邮件:contactus@morrisonsecurities.com | |

| 地址:Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison证券有限公司是一家多元化的金融服务提供商。自2002年以来,凭借澳大利亚监管机构的许可,它提供了许多交易平台,提供各种交易界面,包括专有和第三方解决方案。

这是该经纪商官方网站的首页:

优点和缺点

| 优点 | 缺点 |

| ASIC监管 | 费用结构不清晰 |

| 多个交易平台 | |

| 多种联系方式 | |

| 提供的金融服务 |

Morrison是否合法?

Morrison受澳大利亚证券和投资委员会(ASIC)监管,具有直通处理(STP)编号241737。

| 监管状态 | 已监管 |

| 监管机构 | 澳大利亚 |

| 许可机构 | Morrison证券有限公司 |

| 许可类型 | 直通处理(STP) |

| 许可编号 | 241737 |

我可以在Morrison上交易什么?

Morrison 连接到澳大利亚的主要交易所,以实现无缝执行。他们是ASX、Cboe Australia、NSX和SSE交易所的成员。他们提供现金股票、股票期权(单支股票和指数在一级和二级)、认股权证、ETFs(交易所交易基金)、XTBs(交易所交易债券)、LICs(上市投资公司)、LITs(上市投资信托)和跟踪者(Cboe Australia美国股票 - 可转让托管收据)。

| 交易工具 | 支持 |

| 现金股票 | ✔ |

| 股票期权 | ✔ |

| 认股权证 | ✔ |

| ETFs | ✔ |

| 债券 | ✔ |

| 投资信托 | ✔ |

| 股票 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

金融服务

Morrison 还提供金融服务,包括财务顾问、财富管理者、活跃交易者、基金经理和金融技术平台,为定制金融技术应用程序的集成和开发提供应用程序接口。

账户

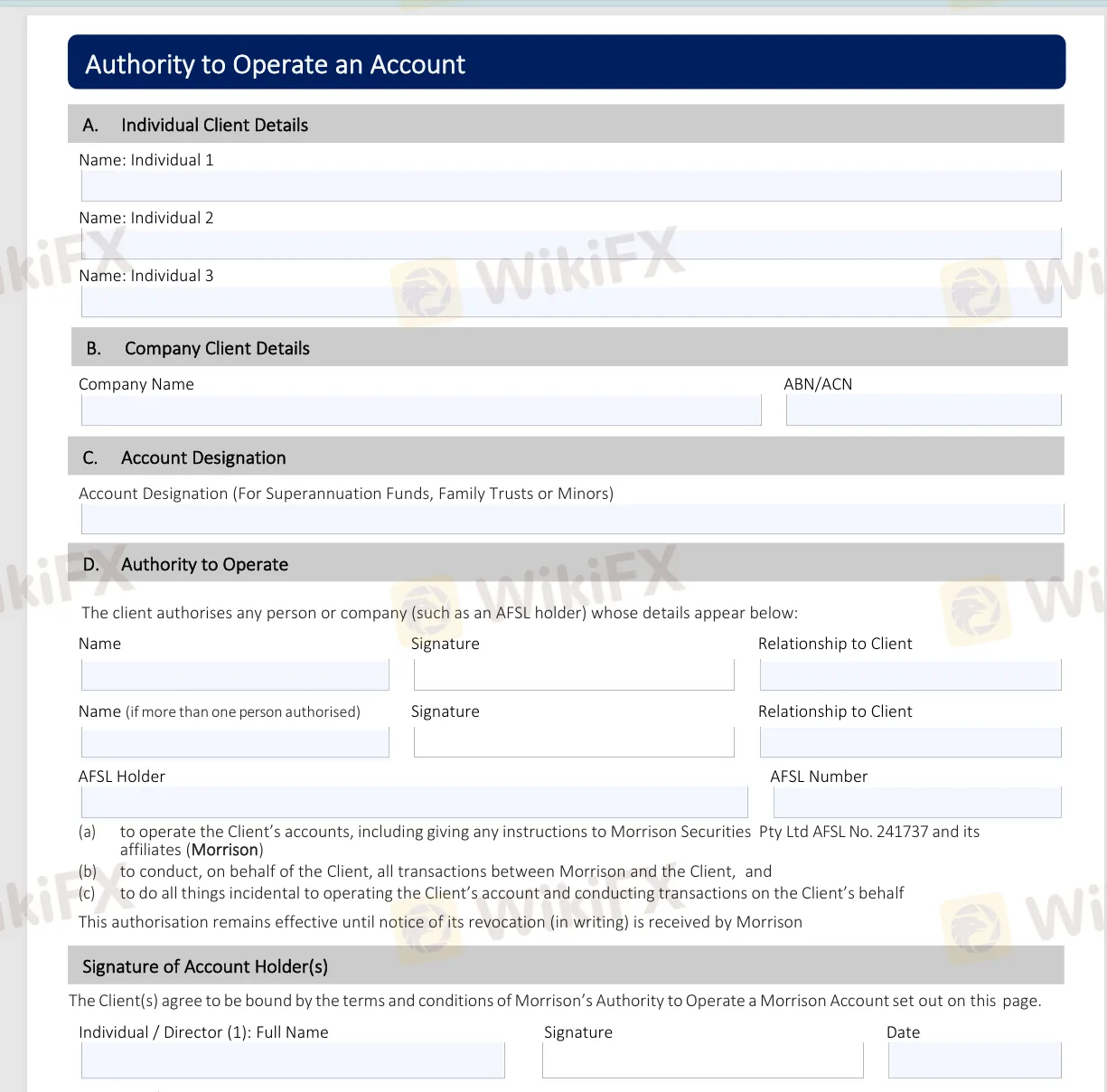

要在Morrison开设账户,请填写他们网站上提供的必要账户维护表格。这些表格包括账户名称修改表格、操作账户的授权、联系方式更改、收入指示、直接借记请求和100点身份证明清单。填写完这些表格后,请发送至账户@morrisonsecurities.com。

交易平台

Morrison 提供各种交易平台,包括用于下单、创建监视列表、查看客户投资组合和高级图表包的软件。他们支持:

| 交易平台 | 支持的组件 |

| Iress | Viewpoint、Web、Pro版本 |

| TradeCentre | Bourse Analyser、TC Web、TC Wealth |

| TradeFloor | 期权交易和风险管理 |

| Refintiv | Eikon平台 |

| Bloomberg Terminal | EMSX |

此外,如果您有自己偏好的平台,他们通过FIX、Webservices和应用程序接口提供兼容性。