公司简介

| R首次代币发行 评论摘要 | |

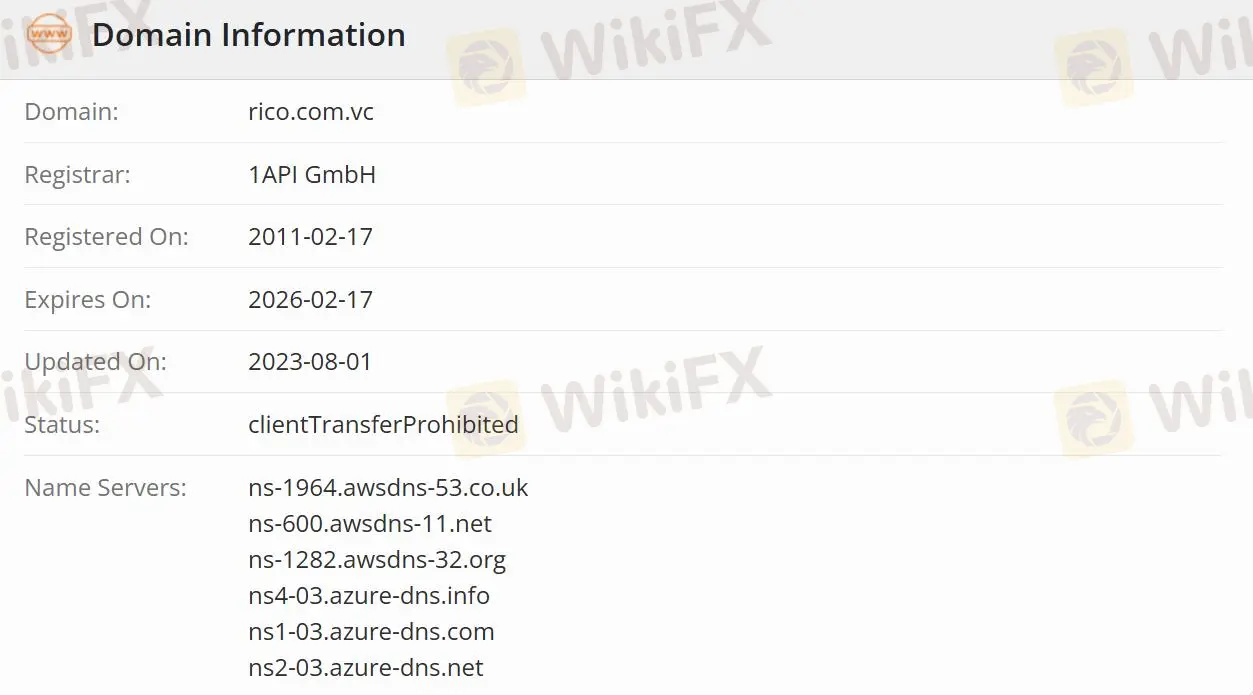

| 成立日期 | 2011-02-17 |

| 注册国家/地区 | 巴西 |

| 监管 | 未受监管 |

| 产品 | 所有投资/直接国库/固定收益/其他投资/股票市场和BM&F |

| 模拟账户 | ✅ |

| 交易平台 | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| 客户支持 | 电话:+55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp:+55 11 4935-2740 | |

| YouTube、Instagram、Facebook、Twitter | |

R首次代币发行 信息

R首次代币发行 成立于2011年,是一家在巴西注册的未受监管的投资公司。该公司提供各种产品,包括所有投资和模拟器,并提供5个不同费用的主要平台,如Profit Rico Trader、MetaTrader 5、TraderEvolution、Tradezone、Tryd Pro和Profit。R首次代币发行提供投资账户以进行投资和数字账户以处理日常交易。

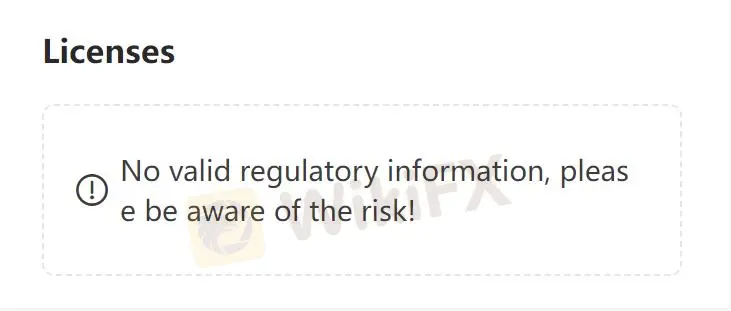

R首次代币发行 是否合法?

R首次代币发行 未受监管,相比受监管的公司,安全性较低。

R首次代币发行 提供哪些产品?

该公司提供各种产品,包括所有投资、直接国库、固定收益、CBD、LC、LCA、LCI和债券。R首次代币发行还提供其他投资,如投资基金、房地产基金、COE、CRI、CRA和公开发行-IPO。此外,还涉及股票市场和BM&F的股票租赁、期权、期货合约、迷你合约、股票期货和流动性提供商-RLP。

账户类型

Rico提供两种账户,具有不同的余额。通过投资账户,用户可以投资固定收益和浮动收益应用,并使用数字账户处理日常交易,如支付账单、发送和接收PIX和TED,以及接收工资。

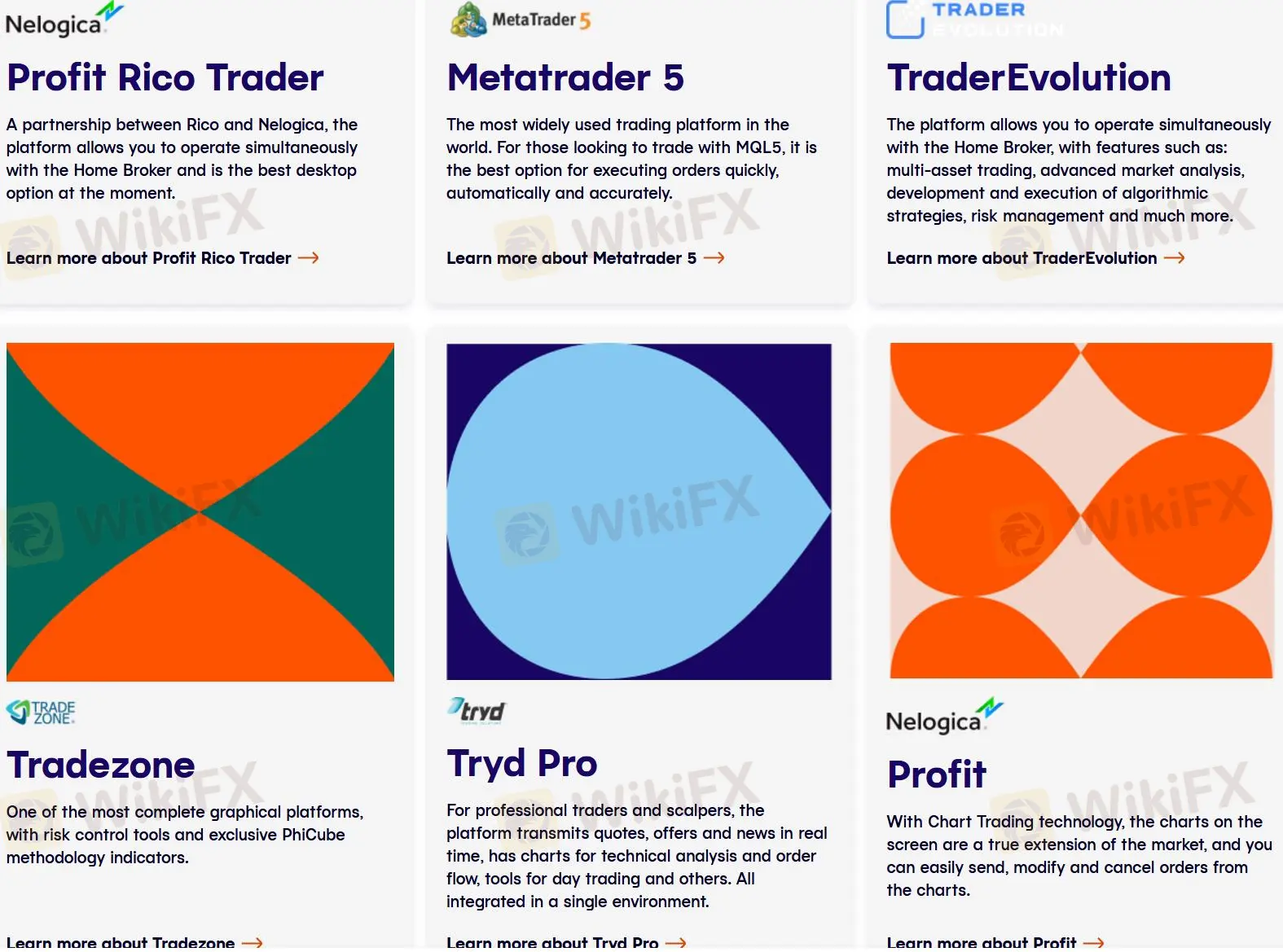

交易平台

在R首次代币发行中,用户可以自由选择任何平台,包括Profit Rico Trader、MetaTrader 5、TraderEvolution、Tradezone、Tryd Pro和Profit。除了MetaTrader 5(真实和模拟账户)、Tradezone Web(Webchart)和TraderEvolution Web平台免费外,每个平台收取的手续费也不同:

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus;

R$ 139.90 – ProfitPro。

然而,对于付费平台,还有一个ISS费用,相当于充值金额的10.68%。

| 交易平台 | 支持 | 可用设备 |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

客户支持选项

交易者可以关注R首次代币发行的YouTube、Instagram、Facebook和Twitter,并通过WhatsApp和电话与公司保持联系。

| 联系方式 | 详细信息 |

| 电话 | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| 社交媒体 | YouTube、Instagram、Facebook、Twitter |

| 支持语言 | 葡萄牙语 |

| 网站语言 | 葡萄牙语 |

| 实际地址 | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |