基础信息

香港

香港 天眼评分

香港 | 20年以上 |

香港 | 20年以上 |https://www.swhyhk.com/sc/

官方网址

评分指数

影响力

C

影响力指数 NO.1

美国2.78

美国2.78单核

1G

40G

1M*ADSL

香港

香港  swhyhk.com

swhyhk.com  香港

香港

| 申万宏源评论摘要 | |

| 成立时间 | 2015 |

| 注册国家/地区 | 中国 |

| 监管 | SFC期货合同交易牌照(受监管),SFC证券交易牌照(已超出) |

| 市场工具 | 股票、期货 |

| 交易平台 | 电子服务 |

| 客户支持 | 联系表单 |

| 电话:(852) 2509-8395 | |

| 电子邮件:ir@swhyhk.com | |

| 微信 | |

申万宏源(香港)有限公司是总部位于香港的金融服务提供商,是中国证券公司申万宏源集团有限公司的子公司。该公司提供包括股票和期货交易、资产管理、企业金融和机构证券在内的全面服务。

| 优点 | 缺点 |

| 受监管,持有期货合同交易牌照 | 证券交易牌照已超出 |

| 多种联系渠道 | 可交易产品有限 |

| 透明的费用结构 |

申万宏源受香港证监会监管,持有期货合同交易牌照(编号AAF420)。同时,其证券交易牌照(编号AAC927)已超出,这意味着与证券相关的活动可能存在风险。

| 受监管机构 | 监管机构 | 监管状态 | 受监管实体 | 牌照类型 | 牌照编号 |

| 香港证券及期货事务监察委员会(SFC) | 受监管 | 申万宏源期货(香港)有限公司 | 期货合同交易 | AAF420 |

| 香港证券及期货事务监察委员会(SFC) | 已超出 | 申万宏源证券(香港)有限公司 | 证券交易 | AAC927 |

交易者可以在该平台上交易股票和期货。

| 交易资产 | 可用 |

| 股票 | ✔ |

| 期货 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 基金 | ❌ |

| 交易所交易基金 | ❌ |

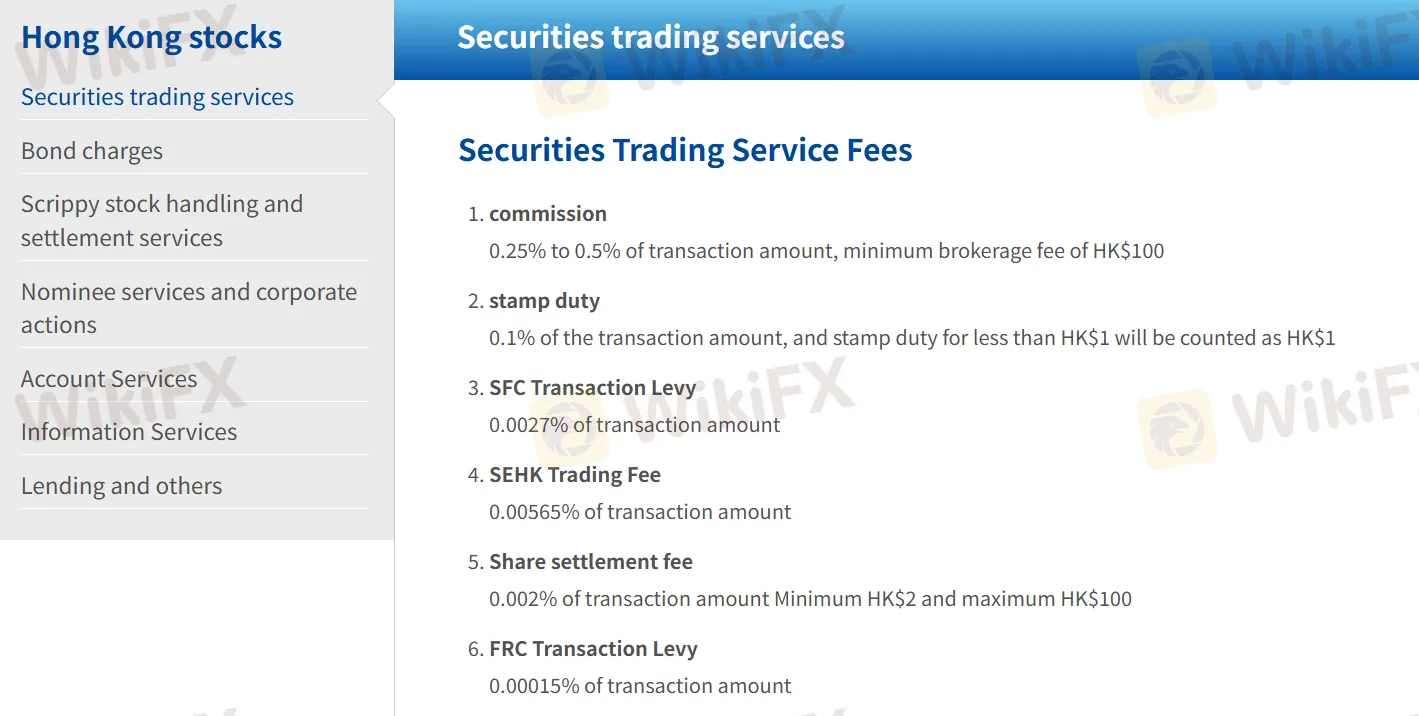

申万宏源在其网站上清晰地介绍了费用结构。

以下是各种证券交易服务手续费,包括其计算方法以及任何适用的最低或最高金额。

有关该平台的费用和收费的更多信息,请访问 https://www.swhyhk.com/tc/wealth-management_hong-kong-equities/#trading-methods

| 证券交易服务 | 费用 |

| 佣金 | 交易金额的0.25%至0.5%,最低佣金费为100港元 |

| 印花税 | 交易金额的0.1%; 交易金额低于1港元的印花税将计为1港元 |

| SFC交易征费 | 交易金额的0.0027% |

| SEHK交易费 | 交易金额的0.00565% |

| 股份结算费 | 交易金额的0.002%,最低2港元,最高100港元 |

| FRC交易征费 | 交易金额的0.00015% |

| 交易平台 | 支持 | 可用设备 |

| 电子服务 | ✔ | 桌面,移动,网络 |

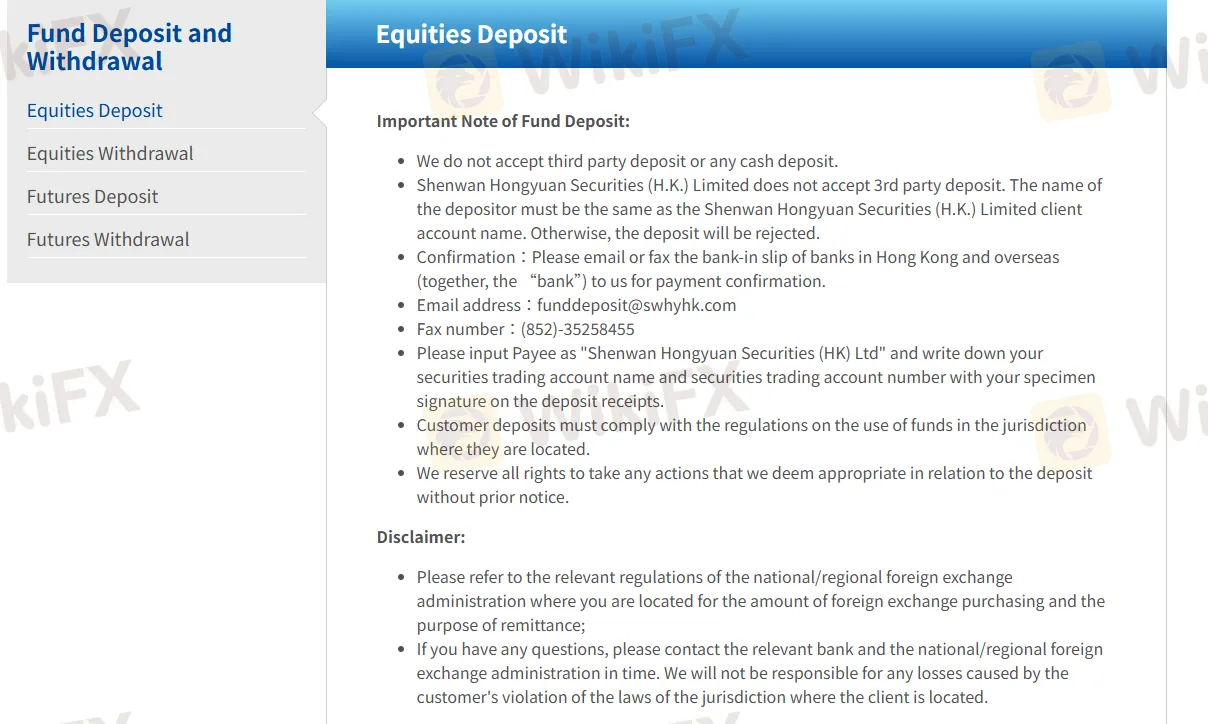

存款程序

取款 程序对股票和期货都相同。

注意:存款人的姓名必须与客户的账户名称相符。不接受第三方存款和现金存款。存款必须符合当地法规。

深度 | 制造通胀:日央行如何逃逸“流动性陷阱”?

欧央行降息了,美联储还远吗?

见微知著:美国制造业复苏前景如何?

——原创SWS-Economics申万宏源证券研究所 | 宏观研究部发表于上海收录于合集#宏观深度专题报告24个密云不雨2024年海外经济展望王茂宇 宏观分析师王胜 博士 宏观研究部负责人申万宏源宏观主要内容总结:202

原创SWS-Economics申万宏源证券研究所 | 宏观研究部发表于上海#货币政策与汇率10个#世界经济11个静观其变美联储11月FOMC会议点评王茂宇 宏观分析师王胜博士宏观研究部负责人申万宏源宏观主要内容当地时间1

原创SWS-Economics申万宏源证券研究所 | 宏观研究部发表于上海收录于合集#宏观深度专题报告30个片面看空地产需求的五个“误区”地产需求框架革新及展望专题屠强FRM 高级宏观分析师王胜博士 宏观研究部负责人申万

From my experience and research as a long-time trader reviewing Shenwan Hongyuan, their withdrawal process is fairly standard but has some important specifics to consider. According to the official information, once a withdrawal request has been properly submitted and the required forms have been sent (typically via fax), instructions received before 12:00 PM are processed on the same business day. In practical terms, this means that if you submit your withdrawal request in the morning and the company receives all the necessary documentation—especially the completed withdrawal form—your withdrawal should be processed by the end of that working day. It’s important to understand, however, that actual receipt of funds in your bank account depends on interbank transfer times and could take an additional day or more depending on your bank’s processing. For telegraphic transfers, service fees and possible international transit times might further extend the total time before funds fully clear in your account. The broker does not mention supporting e-wallet withdrawals; the accepted methods are primarily traditional banking channels, including bank transfer, cheque, and similar means. I always recommend that traders use their own bank accounts (as third-party deposits and cash are not accepted) and ensure the account name matches for compliance. In my view, while Shenwan Hongyuan appears transparent about their process, I remain cautious, especially in light of some user reports citing problems with withdrawals. Therefore, I would never assume instant processing or guaranteed timeframes—instead, I plan for at least 1–3 business days, and always confirm details with their customer service if speed is critical for my trading or funding needs.

Speaking from my own experience evaluating brokers, fee transparency is essential for both budget planning and risk management. With Shenwan Hongyuan, I spent time reviewing their official disclosures on funding procedures. For deposits, I did not come across any direct deposit fees imposed by Shenwan Hongyuan itself, whether via bank transfer, cheque, or cashier’s order—though, as with any brokerage, your bank might charge its own standard transfer fees. What's particularly important for me is that third-party and cash deposits aren’t accepted, reinforcing their compliance with local regulations. When it comes to withdrawals, the process seems straightforward, but there is a cost consideration for telegraphic transfers; Shenwan Hongyuan specifically notes that service fees apply for these. The exact fees may vary depending on your bank and the method chosen, so I find it prudent to confirm these costs before executing larger or international withdrawals. In my view, the absence of hidden or excessive in-house funding fees appears to be a positive, but as always, I remain cautious and double-check fee schedules directly on their platform to avoid surprises. For me, a clear understanding of every cost involved is central before trusting any broker with my capital.

From my own experience and based on my research into Shenwan Hongyuan, it’s important to note that this broker is fundamentally different from typical forex providers offering ECN or raw spread accounts. Shenwan Hongyuan mainly facilitates equities and futures trading, not forex, and their published fee structure is tied directly to transactions in these markets rather than per-lot calculations found with ECN forex accounts. Their commission is charged as a percentage of the transaction amount—most notably, for equities the commission ranges from 0.25% to 0.5% with a minimum HK$100 brokerage fee per trade. There is no mention of per-lot commissions, which makes sense given that they don’t advertise standard forex accounts or platforms like MT4/MT5 with ECN or raw spread models. This fee approach is standard for Hong Kong-based securities brokers and reflects the structure of the equities and futures markets rather than spot forex. For me, the absence of true ECN or “raw spread” account types means traders expecting a per-lot commission structure, as is common in forex trading, won’t find that here. Instead, all commissions are based on transaction values. I would urge anyone, especially those transitioning from forex to securities or futures, to carefully review their fee schedule and make sure it aligns with your trading expectations and style. Being regulated by the SFC for futures does provide some assurance, but the exceeded securities license is a red flag requiring extra caution before depositing substantial funds.

Based on my direct review of Shenwan Hongyuan, I find that the broker relies on its own proprietary e-service trading platform, which is available for desktop, mobile, and web. From my experience as a trader, the compatibility with popular automated trading solutions—like MetaTrader’s Expert Advisors (EAs)—is a critical factor in evaluating a broker, especially for those who rely on algorithmic strategies. Shenwan Hongyuan does not offer the MetaTrader 4 or 5 platforms nor mention support for third-party automated trading tools or EAs on its proprietary system. Why does this matter? Automated trading typically requires either built-in scripting capabilities or external bridge solutions. MetaTrader, for example, has a well-established infrastructure and global community supporting EAs; without such support, integrating automated systems with proprietary platforms can be complex, unreliable, or outright impossible. As a risk-conscious trader, I would exercise caution here—unless the broker specifically provides full documentation or support for algorithmic/automated trading, I do not assume compatibility. For me, the absence of clear EA support means I would not consider Shenwan Hongyuan suitable for automated trading via EAs. This limitation might be a deal-breaker for traders like myself who depend on automation for consistency and scale. For manual futures or equities trading, the regulated status and long operating history offer some confidence, but in terms of automation, I require more transparency and compatibility before committing any capital.

请输入...