公司简介

| QNB FINANSINVEST 评论摘要 | |

| 成立时间 | 2016年 |

| 注册国家/地区 | 土耳其 |

| 监管 | 未受监管 |

| 产品与服务 | 投资产品、股票交易、外汇、海外投资交易、VIOP、债券工具、权证、场外衍生品、共同基金交易、交易所交易基金和投资咨询 |

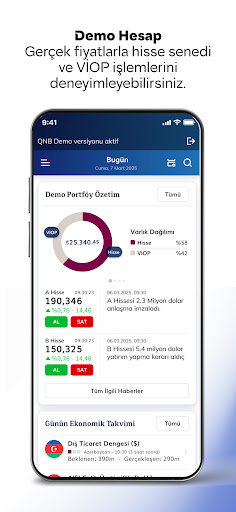

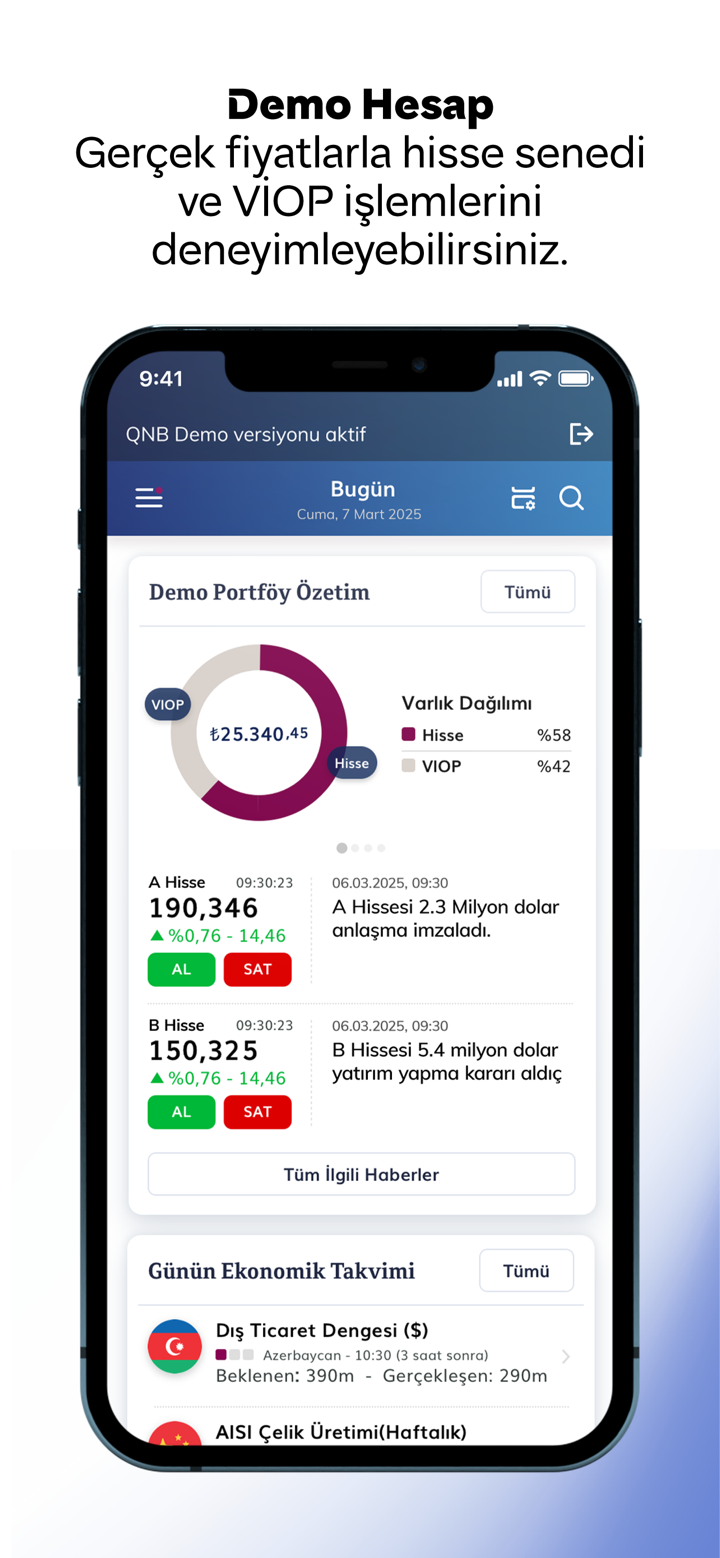

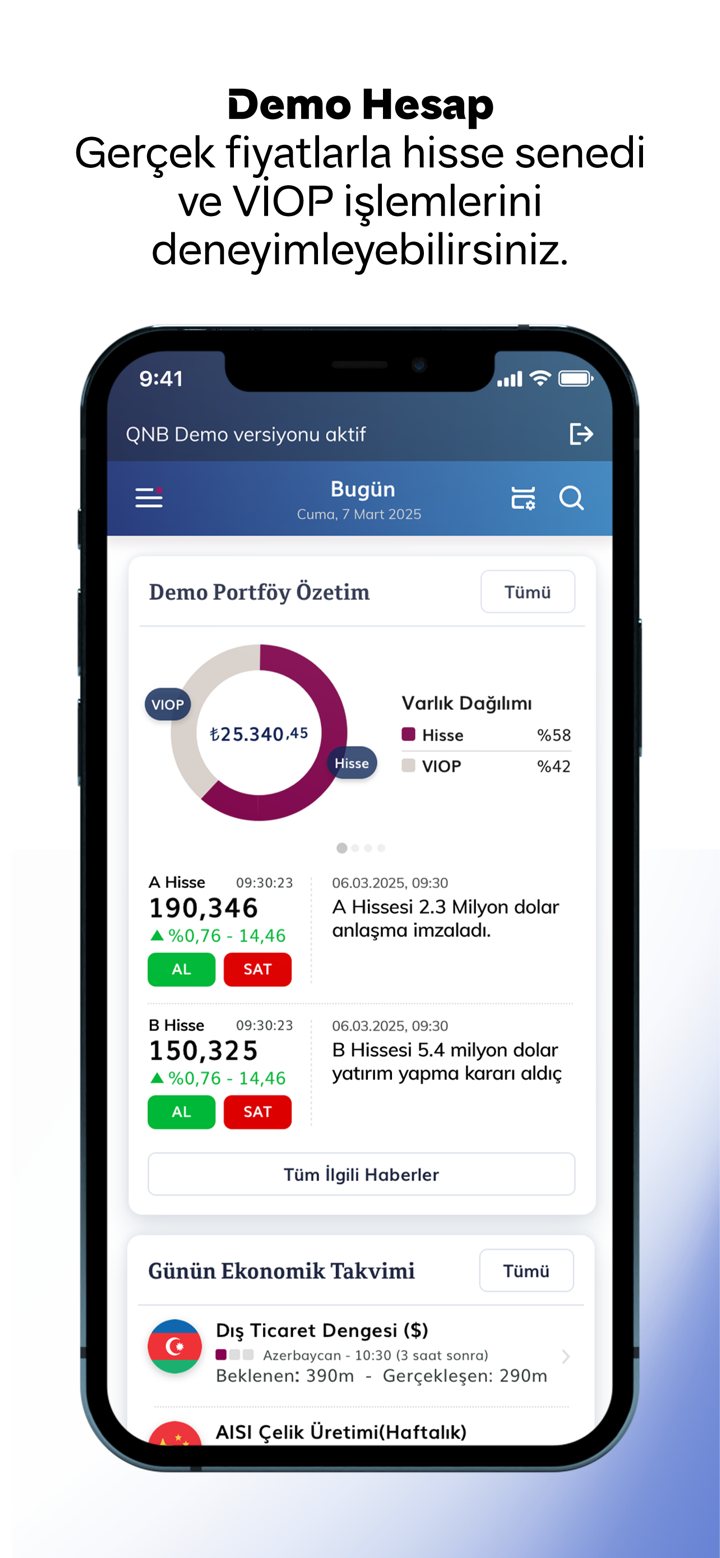

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | QNB Invest |

| 最低存款 | / |

| 客户支持 | 在线聊天 |

| 电话:+90 212 336 7373 | |

| 电子邮件:webinfo@qnbfi.com | |

| Twitter、Facebook、Instagram、YouTube和Linkedin | |

| Esentepe Mah. Büyükdere Cad. Kristal Kule Binası No: 215 Kat: 6-7 34394 Şişli / İstanbul | |

QNB Finansinvest成立于2016年,总部位于土耳其,是一家为客户提供多样化服务和产品的金融机构。作为QNB集团的子公司,QNB Finansinvest受益于其母公司在中东和非洲地区拥有超过1500亿美元资产的实力和稳定性。

QNB Finansinvest专注于投资组合管理、投资咨询、财富管理、投资银行、固定收益、证券和共同基金,为个人和企业客户提供服务。自1996年成立以来,该公司在资本市场活动方面已积累了超过25年的经验。

优点和缺点

| 优点 | 缺点 |

| 各种产品和服务 | 无法访问的网站 |

| 在线聊天支持 | 未受监管 |

| 无模拟账户 | |

| 交易条件信息有限 | |

| 不支持MT4/5 |

QNB FINANSINVEST是否合法?

QNB Finansinvest声称提供安全措施。他们强调他们的128位加密安全程序优于电子商务市场上其他参与者使用的标准SSL-40位加密,突出了该加密技术被土耳其主要券商广泛采用。这种加密技术被吹捧为行业标准,为其平台上的敏感信息提供了增强的保护。

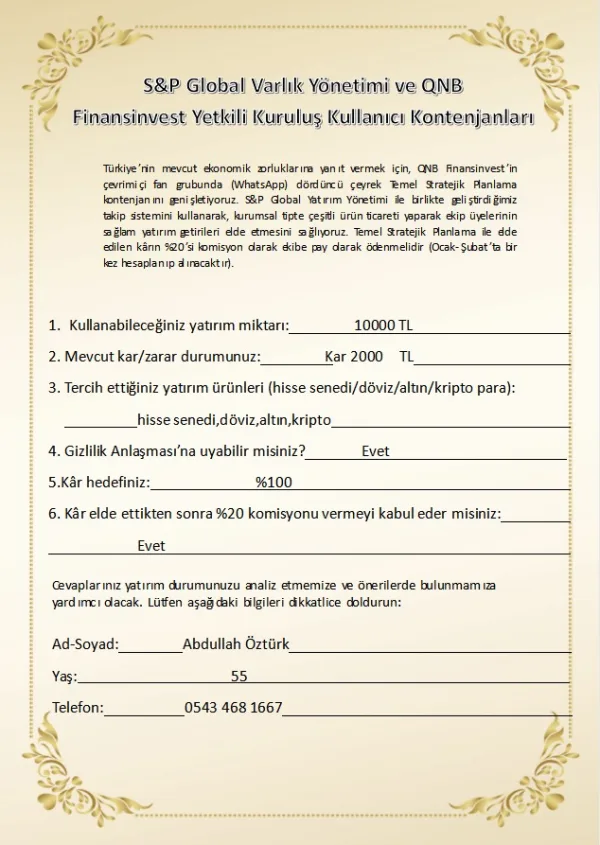

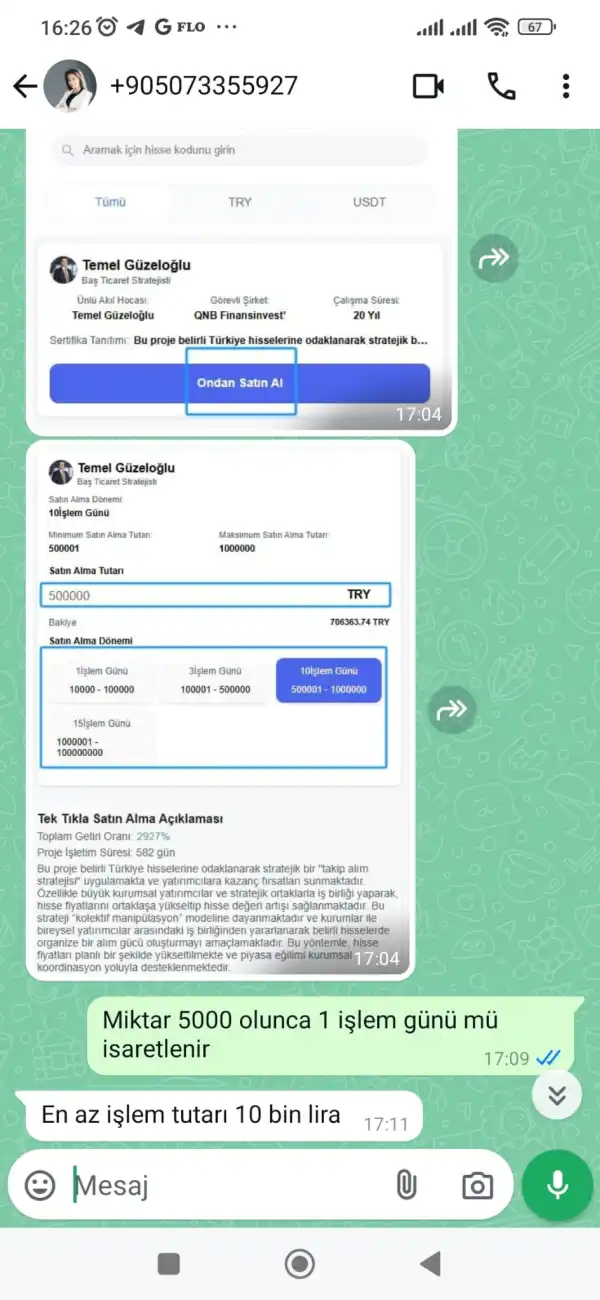

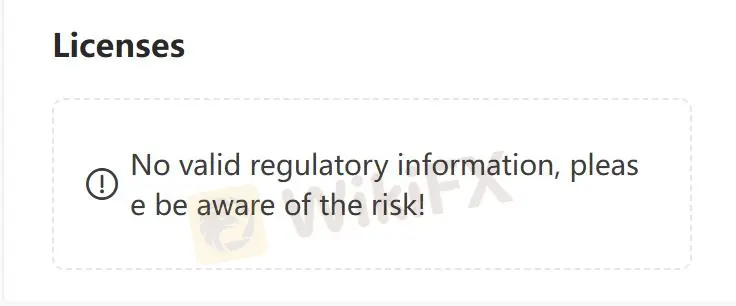

然而,一个显著的问题是缺乏对QNB Finansinvest运营的有效监管。没有政府或金融机构的监督,投资者面临固有的风险。缺乏监管监督意味着没有外部机构确保符合行业标准、最佳实践和法律要求。因此,投资者面临潜在的剥削风险,因为缺乏监管留下了滥用和欺诈行为的空间。

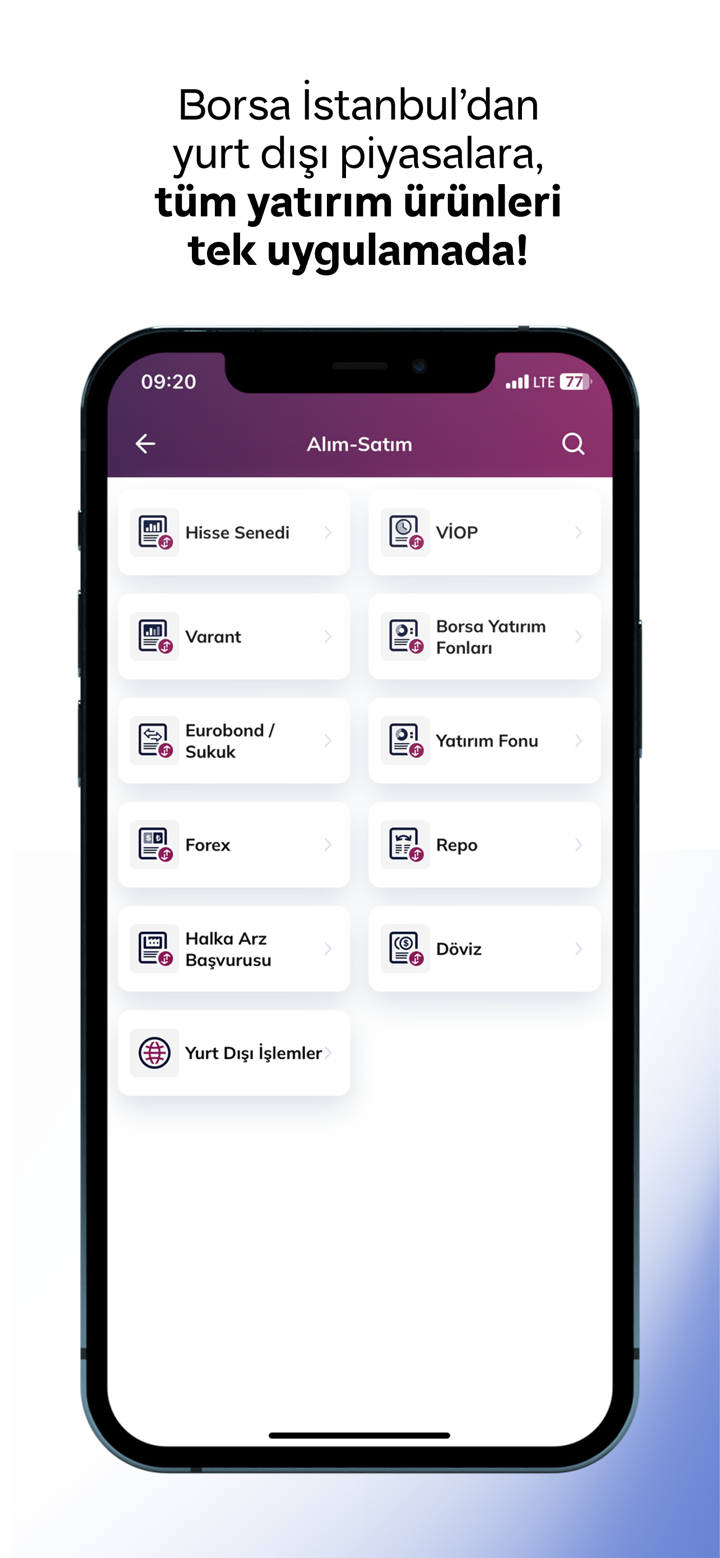

产品和服务

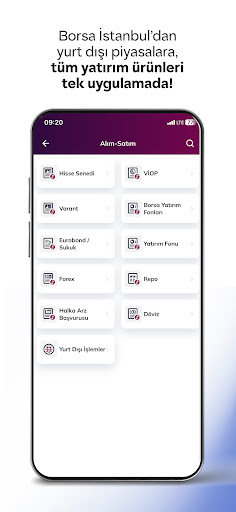

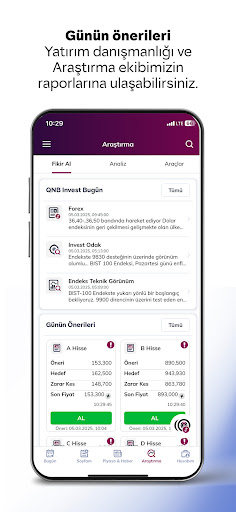

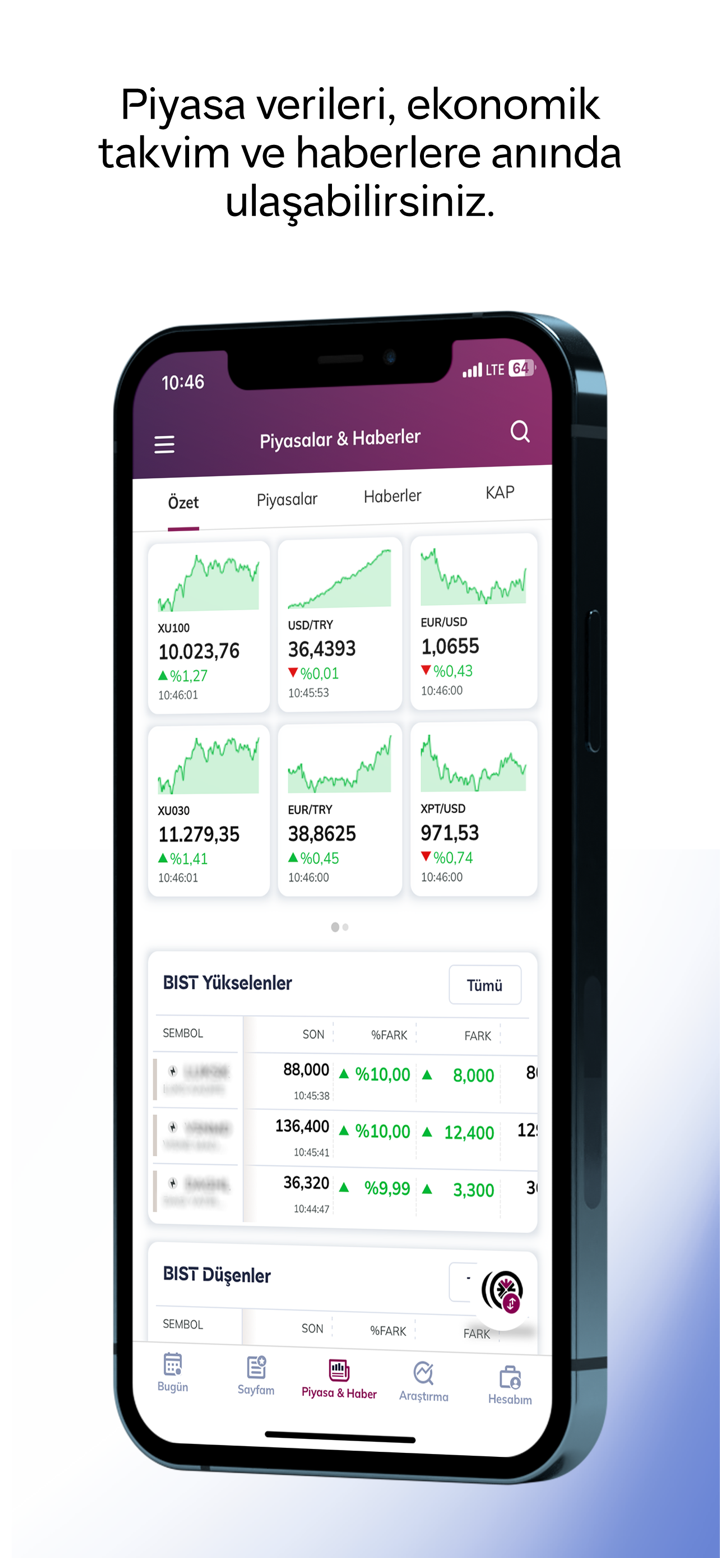

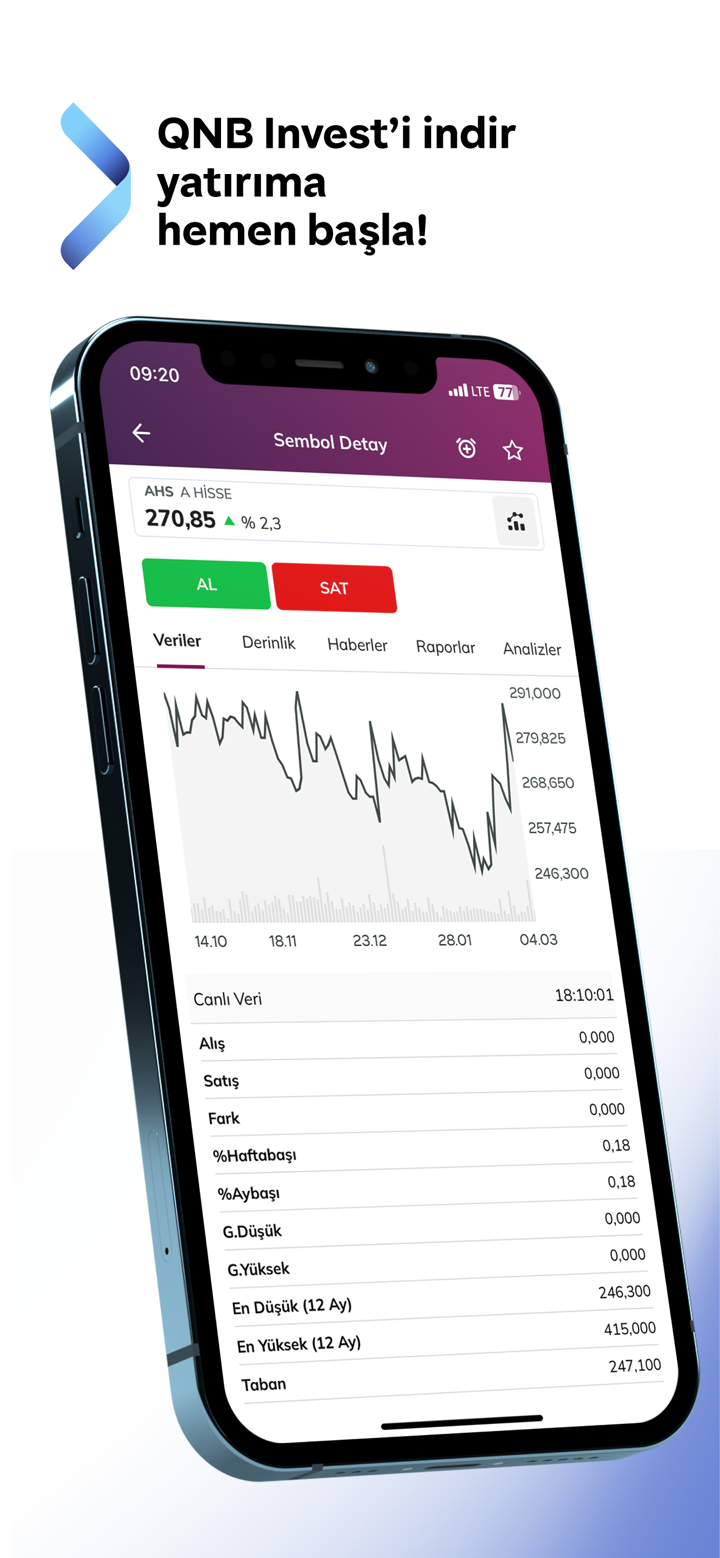

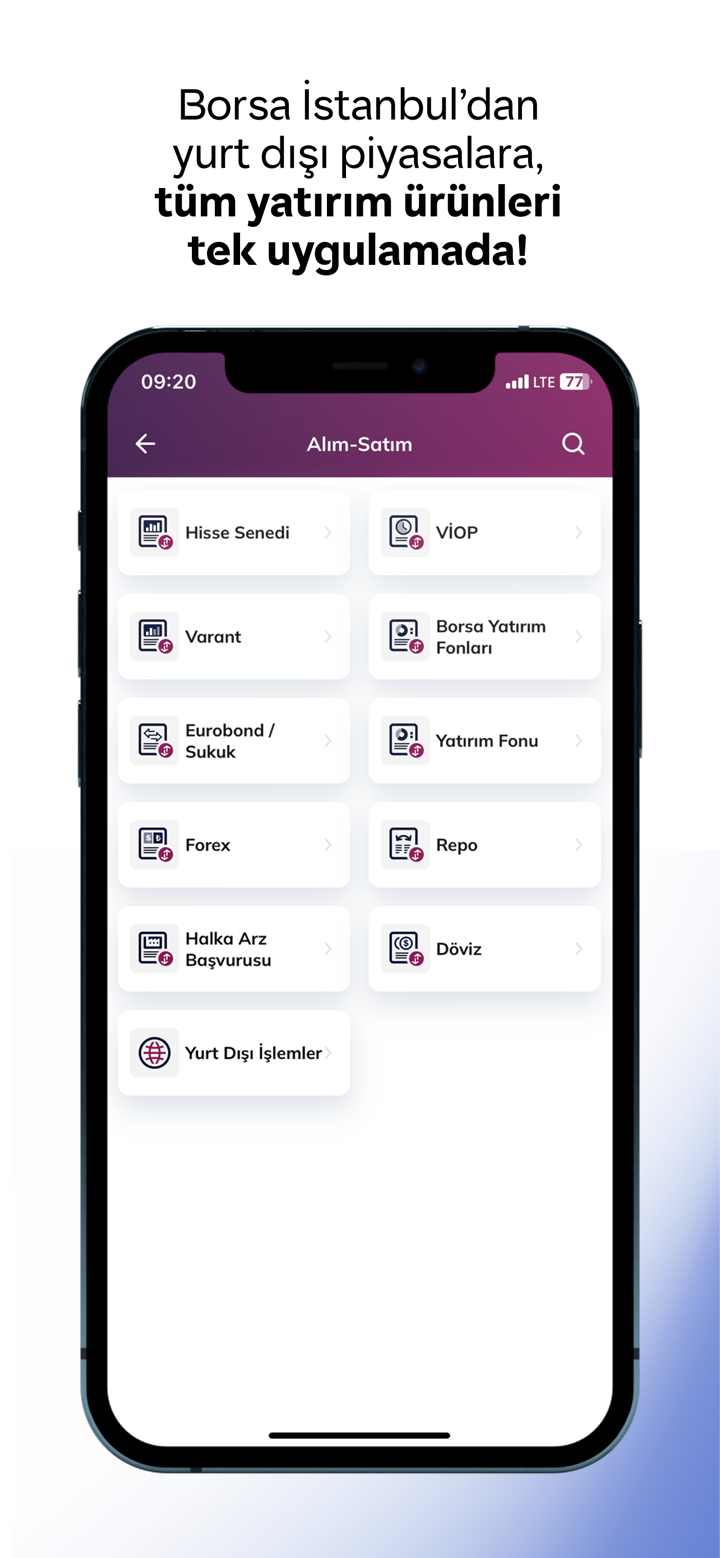

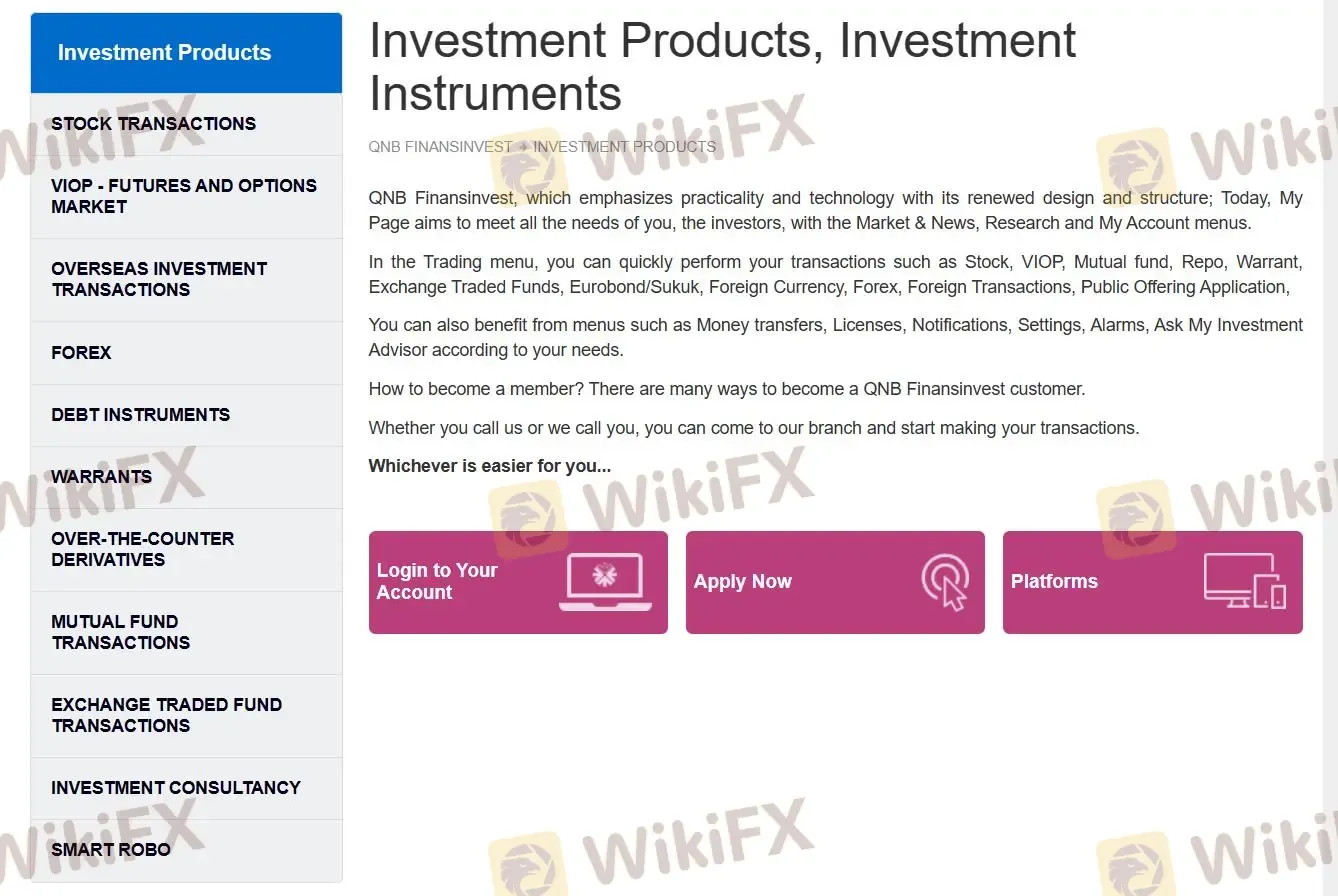

QNB FINANSINVEST提供各种投资产品和服务,包括投资产品、股票交易、外汇、海外投资交易、VIOP、债券工具、权证、场外衍生品、共同基金交易、交易基金交易和投资咨询。

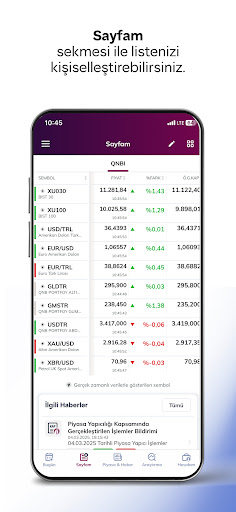

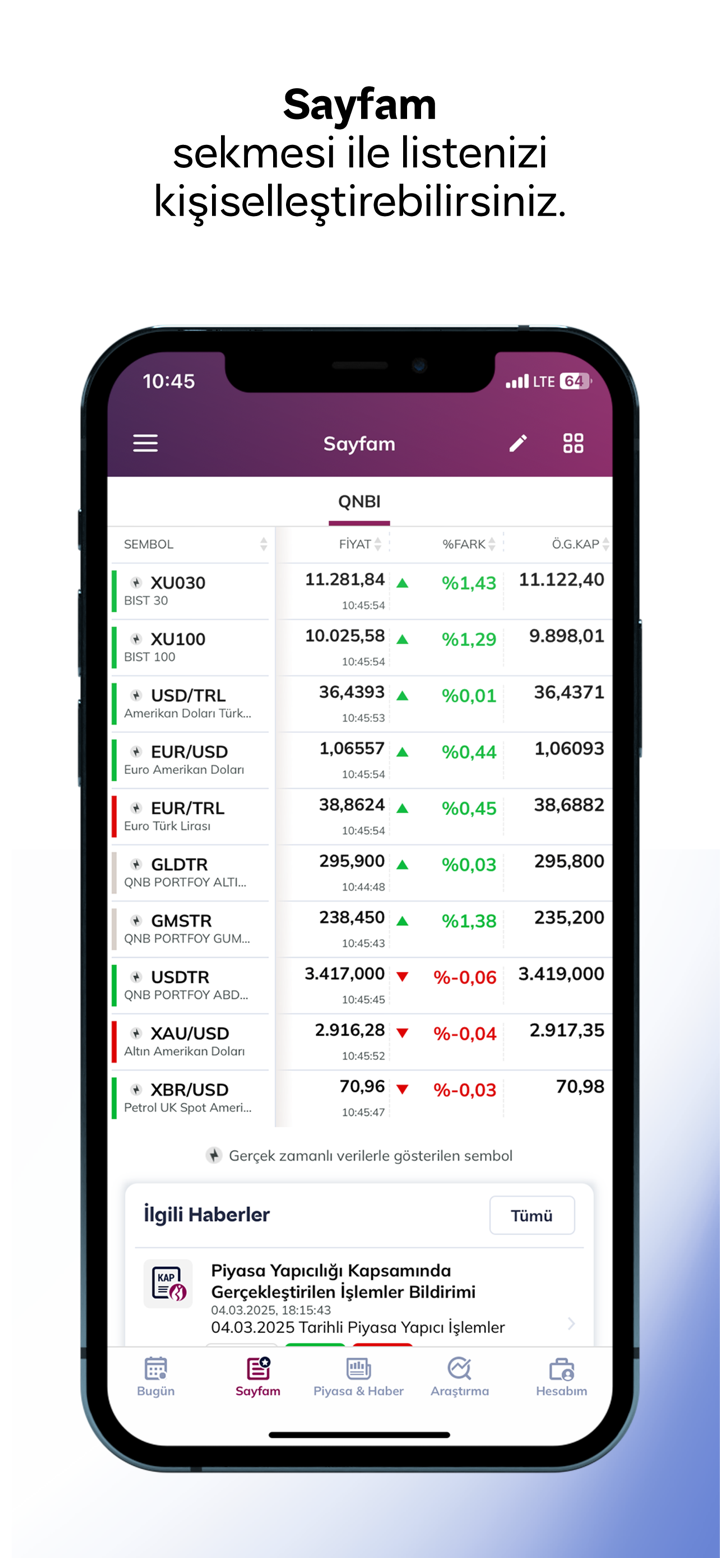

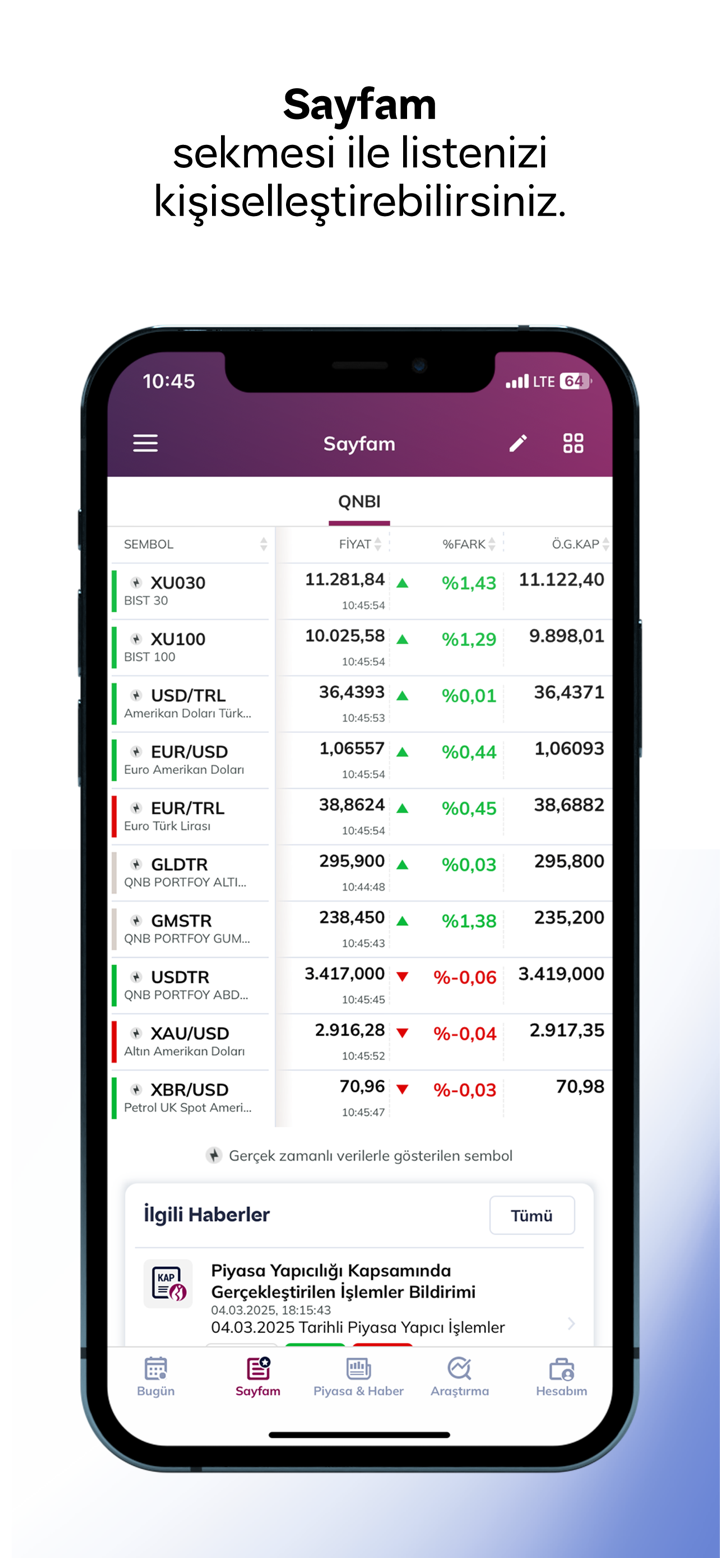

外汇:货币对、商品、指数和外汇。

投资产品:股票、VIOP、共同基金、回购、权证、交易所交易基金、欧元债券/伊斯兰债券、外币、外汇、外汇交易、公开发行申请。

VIOP:购买和销售股票、股票指数(BIST-30)、交易所汇率(TL/美元、TL/欧元、欧元/美元)、黄金、商品和电力的合同,以一定的抵押品/保证金进行对冲、投资和套利,符合预期。

海外投资交易:外国股票、交易所交易基金、欧元债券和伊斯兰债券产品。

债券工具:回购、国库券、政府债券、欧元债券和私营部门债券等固定收益产品。

场外衍生品:远期合约、掉期、期货、期权和结构化产品。

共同基金交易:货币市场基金、私营部门债券证券基金、短期债券证券基金、债券证券基金、欧元债券证券基金、第一对冲基金、QNB组合第一变量基金和ONB组合主要股权基金。

交易所交易基金交易:GOLDIST、USDTR、QOUR和GMSTR。

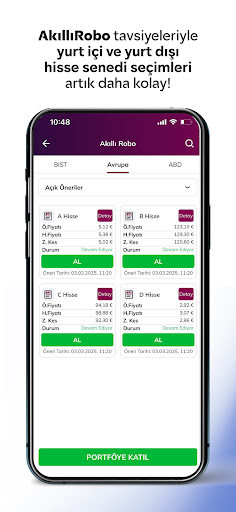

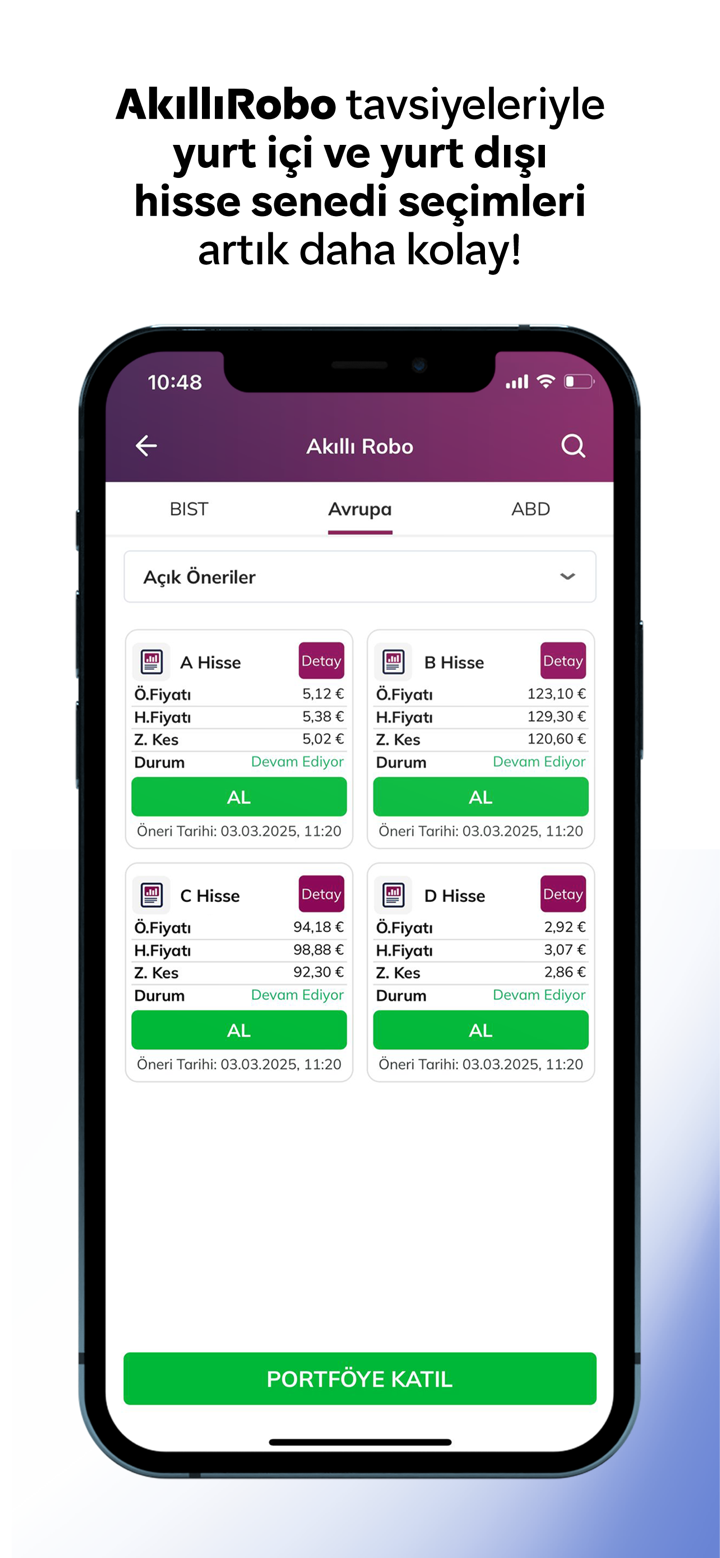

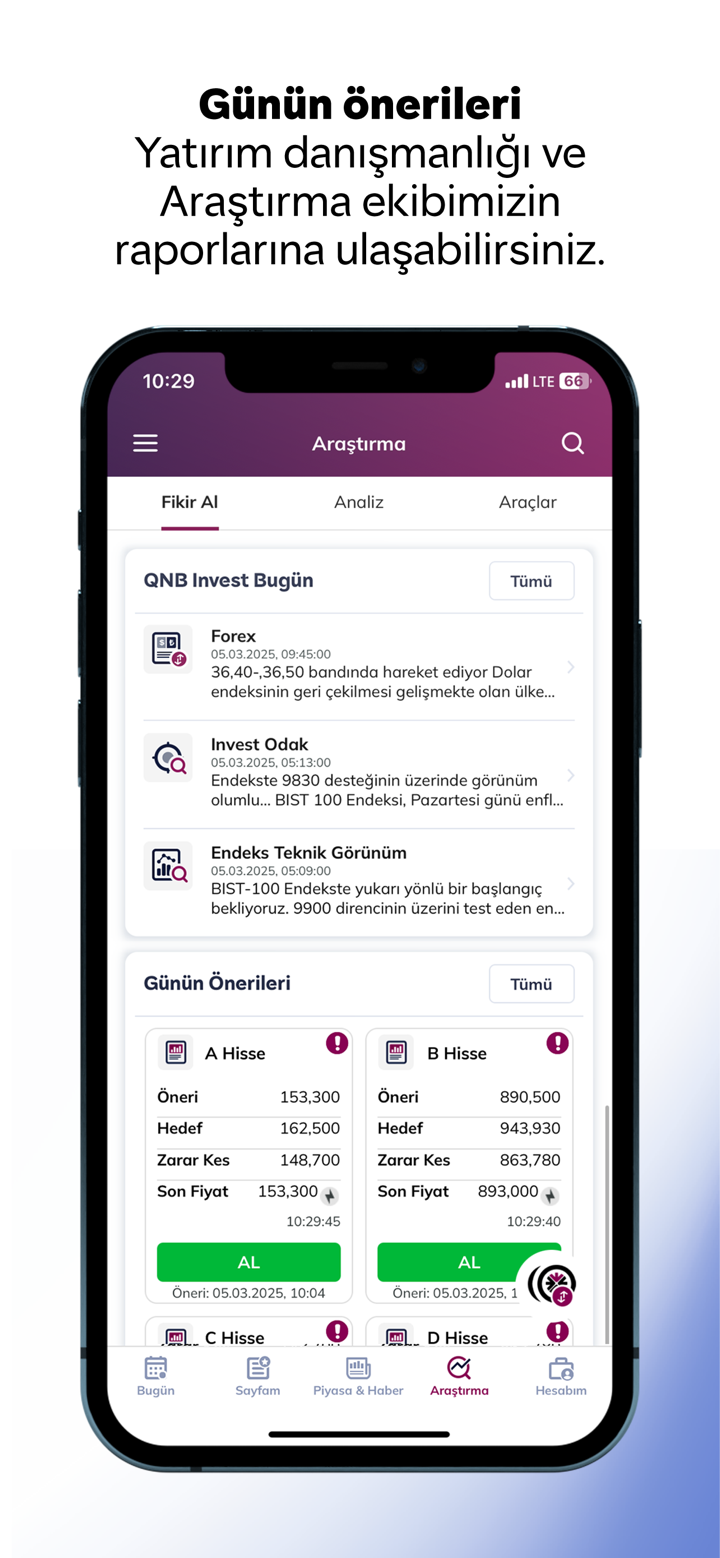

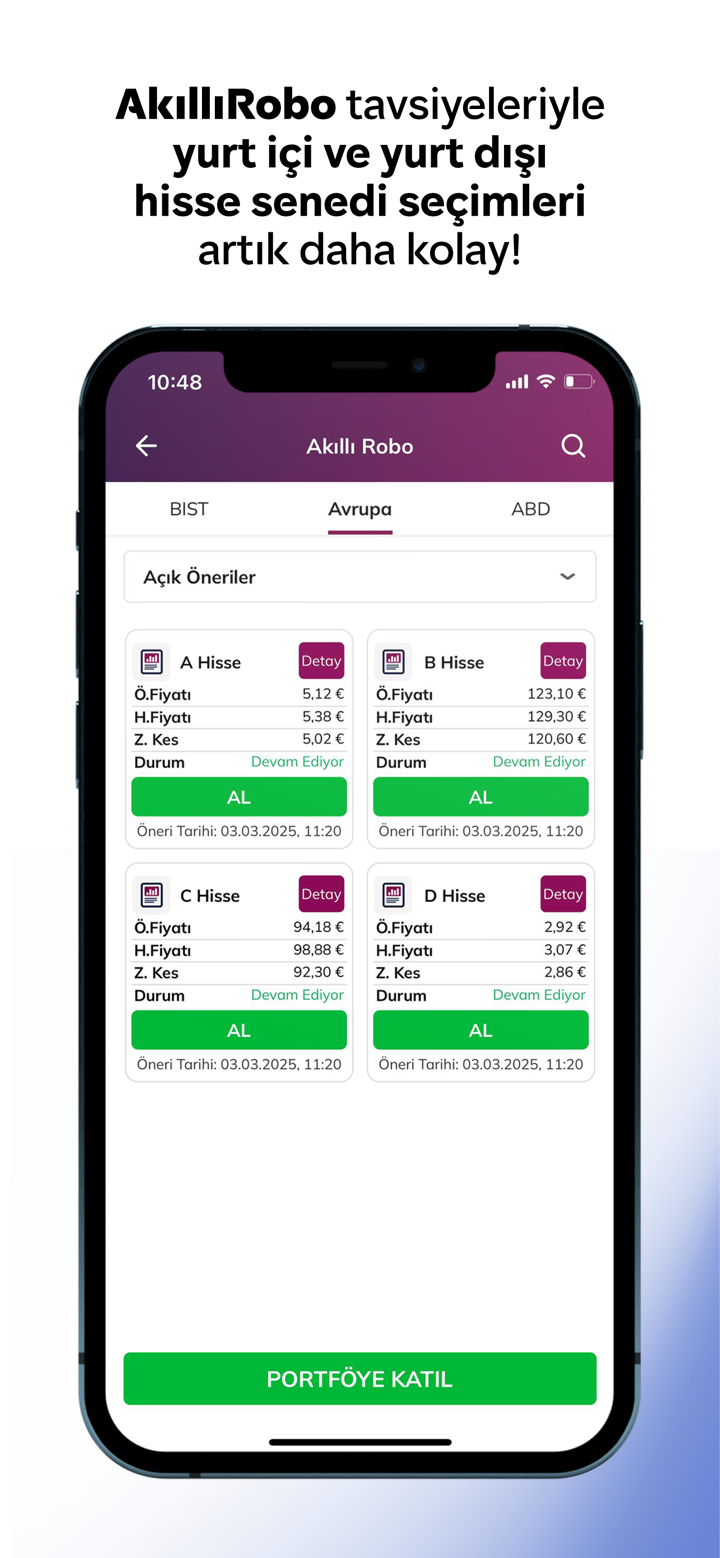

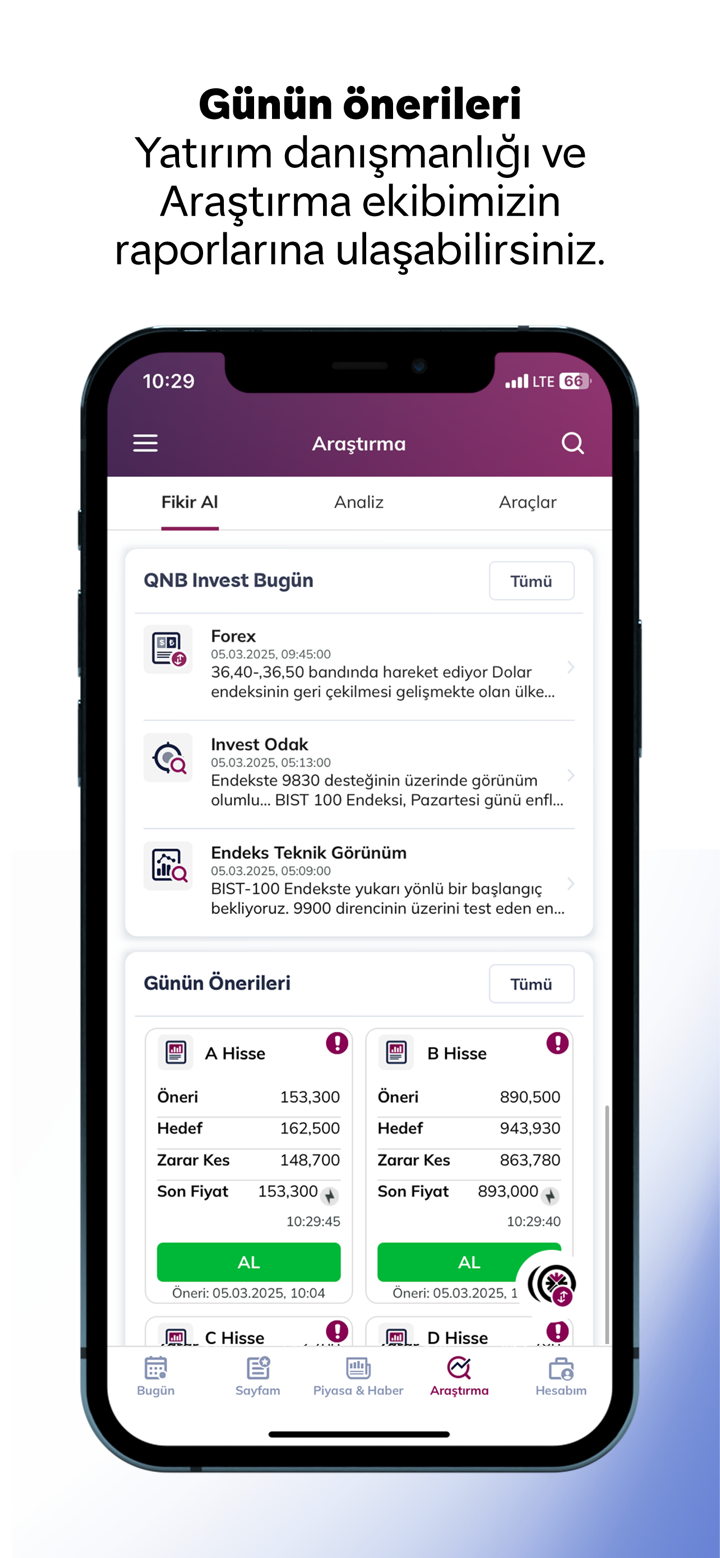

投资咨询:股票交易建议、投资顾问、模型投资组合和股票支撑阻力。

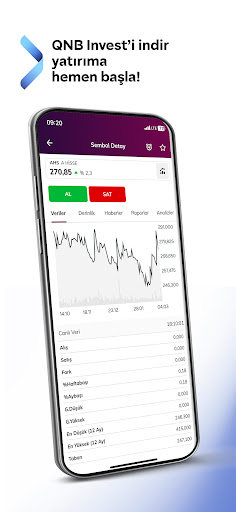

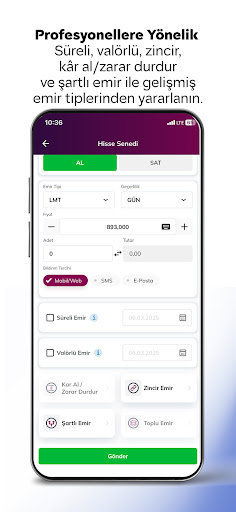

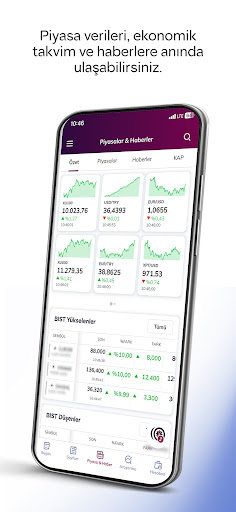

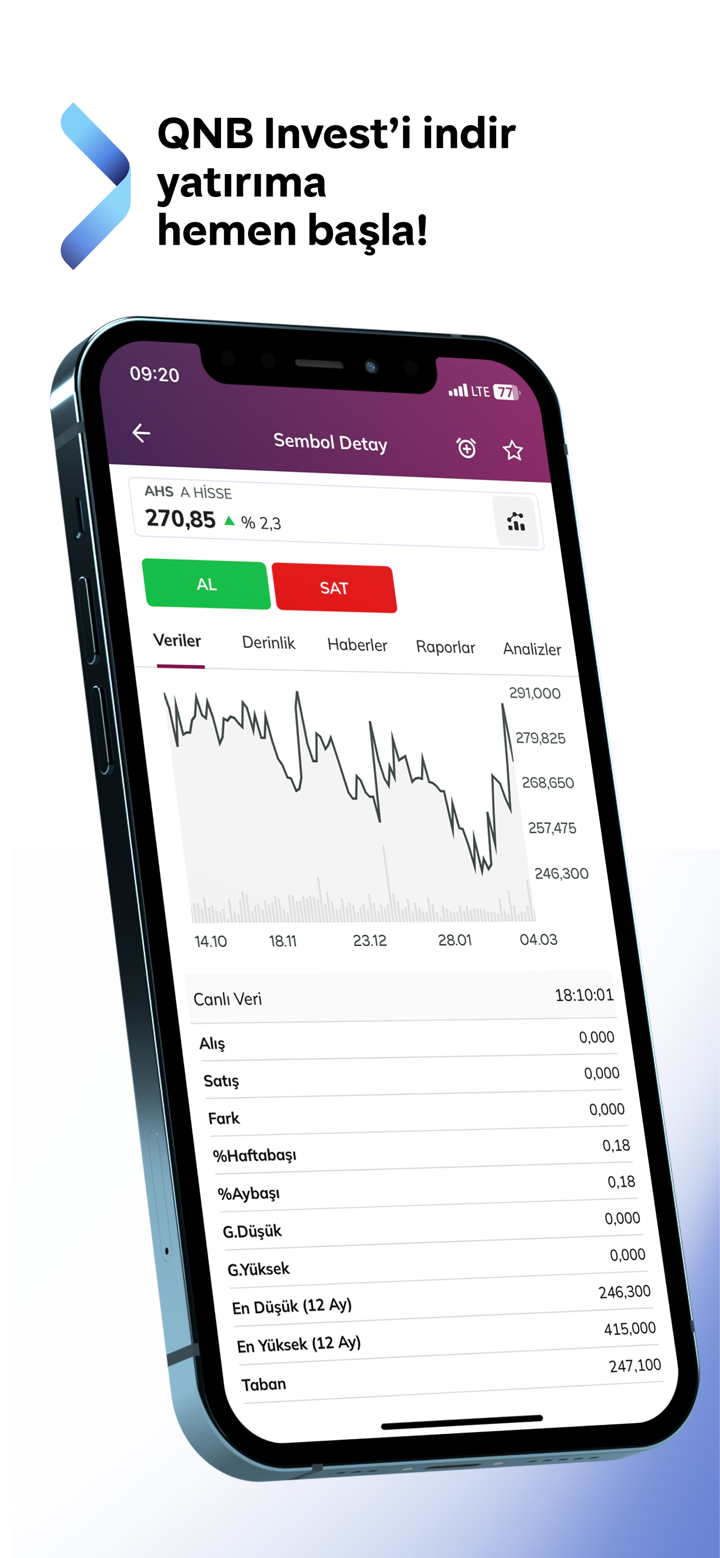

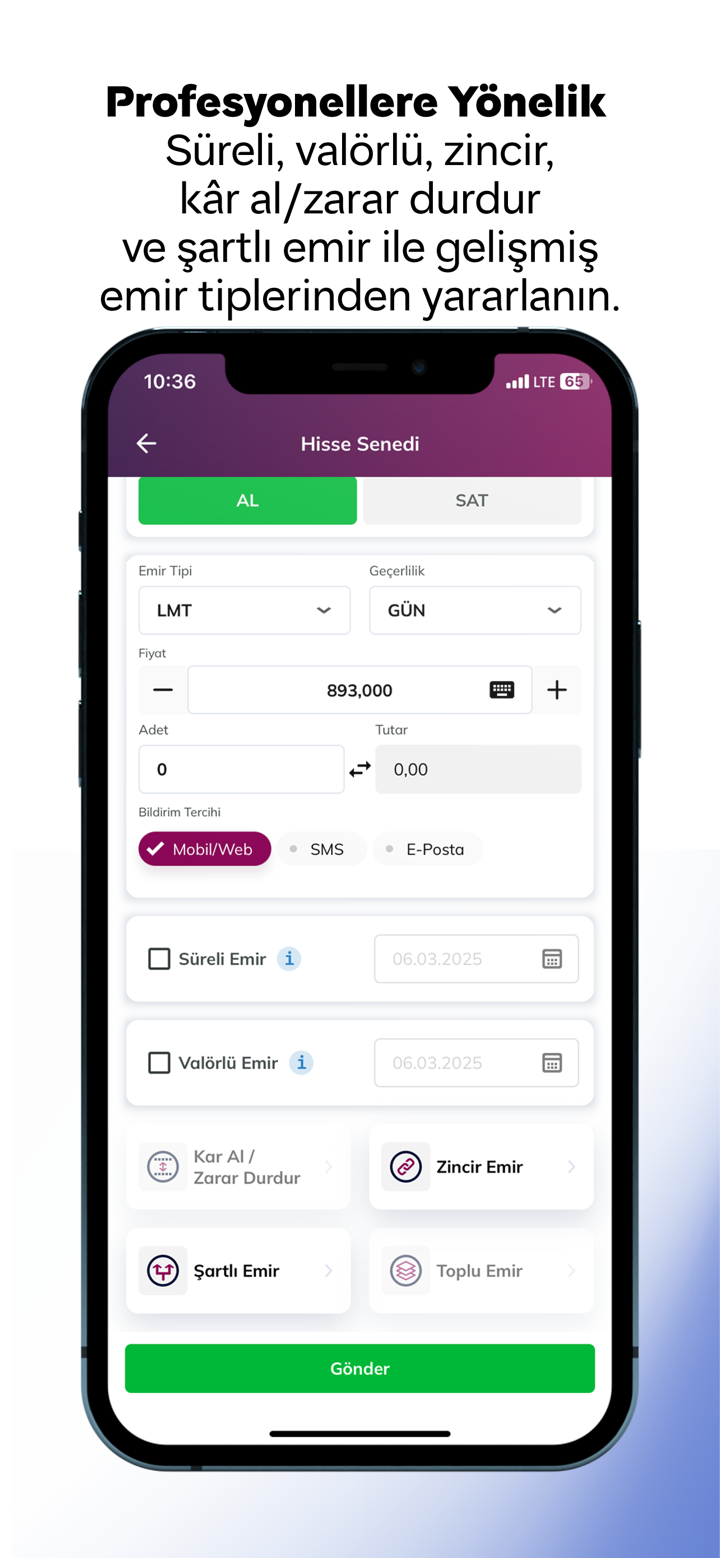

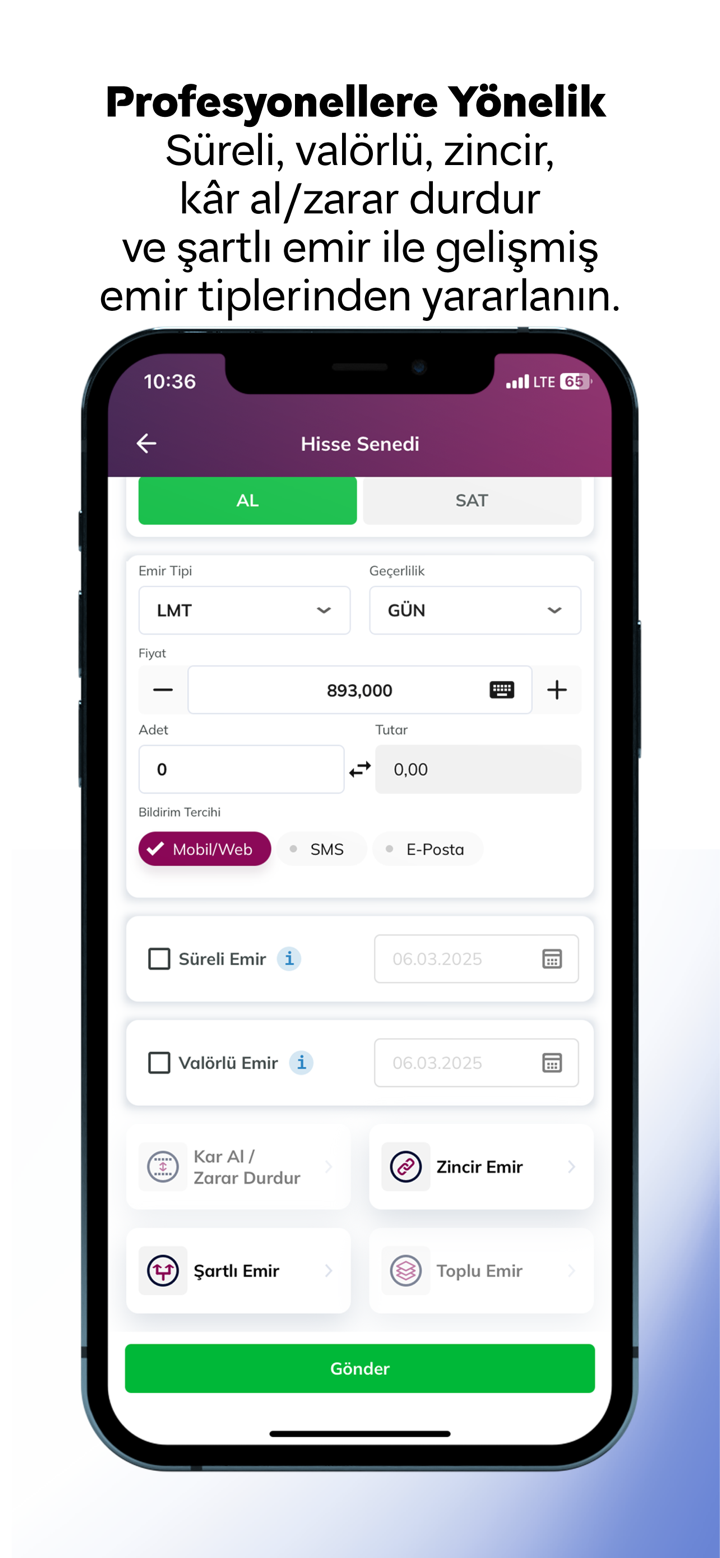

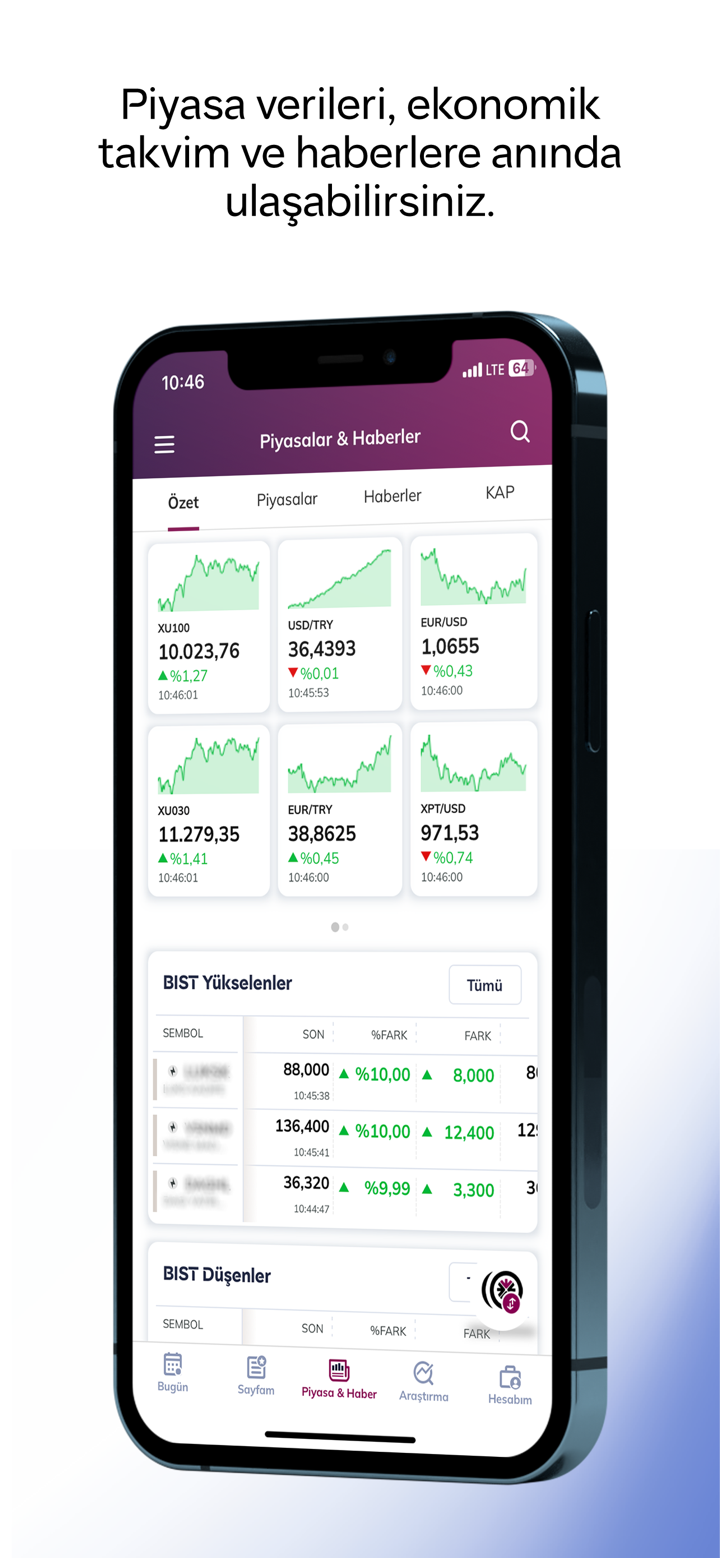

交易平台

| 交易平台 | 支持的 | 可用设备 | 适用于 |

| QNB Invest | ✔ | Web、桌面、平板电脑、Android、iOS | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |