gnsrael

1-2年

How do M&H's swap fees (overnight financing rates) stack up against those offered by other brokers?

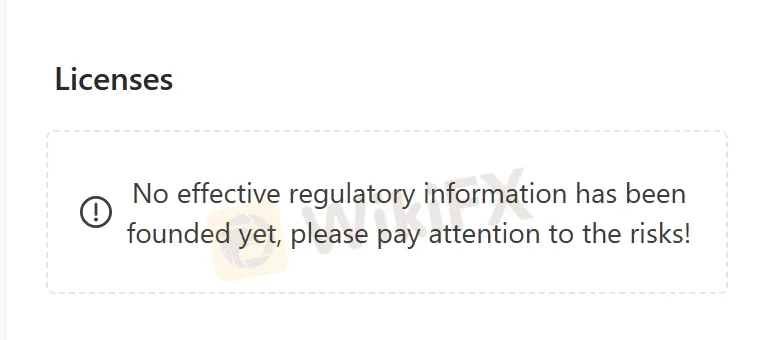

As an independent forex trader, I always look closely at a broker’s transparency and regulatory status before even considering their cost structure, especially when it comes to something as critical as swap fees or overnight financing rates. With M&H, the first major hurdle is the lack of clear, accessible information. Their website is currently inaccessible, and according to the available information, M&H operates without any valid regulatory oversight. For me, this represents a significant risk, as swap fees should be both transparent and subject to oversight to protect clients from unfair or opaque practices.

Unlike well-established, regulated brokers who usually publish their overnight swap rates right on their platforms or in dedicated fee schedules, M&H provides no visible structure or documentation about their swap fees. In my experience, this lack of disclosure is a red flag and makes it impossible to reliably compare their rates to those offered by the more reputable, regulated brokers I have used. Established brokers often have competitive—and closely monitored—swap fees, and even offer calculators so traders can estimate costs in advance. Without M&H sharing similar information, I can’t justify opening an account or risking capital with them, regardless of any potential cost savings. For traders concerned with trust and long-term viability, transparency and regulation should always outweigh the appeal of possible lower fees.

Broker Issues

Fees and Spreads

Mansuber007

1-2年

What particular advantages does M&H offer in terms of its range of trading instruments and its fee structure?

In my experience as a forex trader, I approach brokers like M&H with significant caution, particularly due to their status as an unregulated entity and the overall lack of transparency. That being said, I do see that M&H attempts to present itself as offering a relatively diverse set of investment products, spanning shares, bonds, and various other financial instruments. For me, the appeal of a broad range can be attractive since it theoretically allows for portfolio diversification and potentially more tailored hedging or risk management strategies. Additionally, M&H claims to provide specialized advisory services, touching on areas like hedging, risk analysis, and tax considerations, which may be valuable for traders with complex needs.

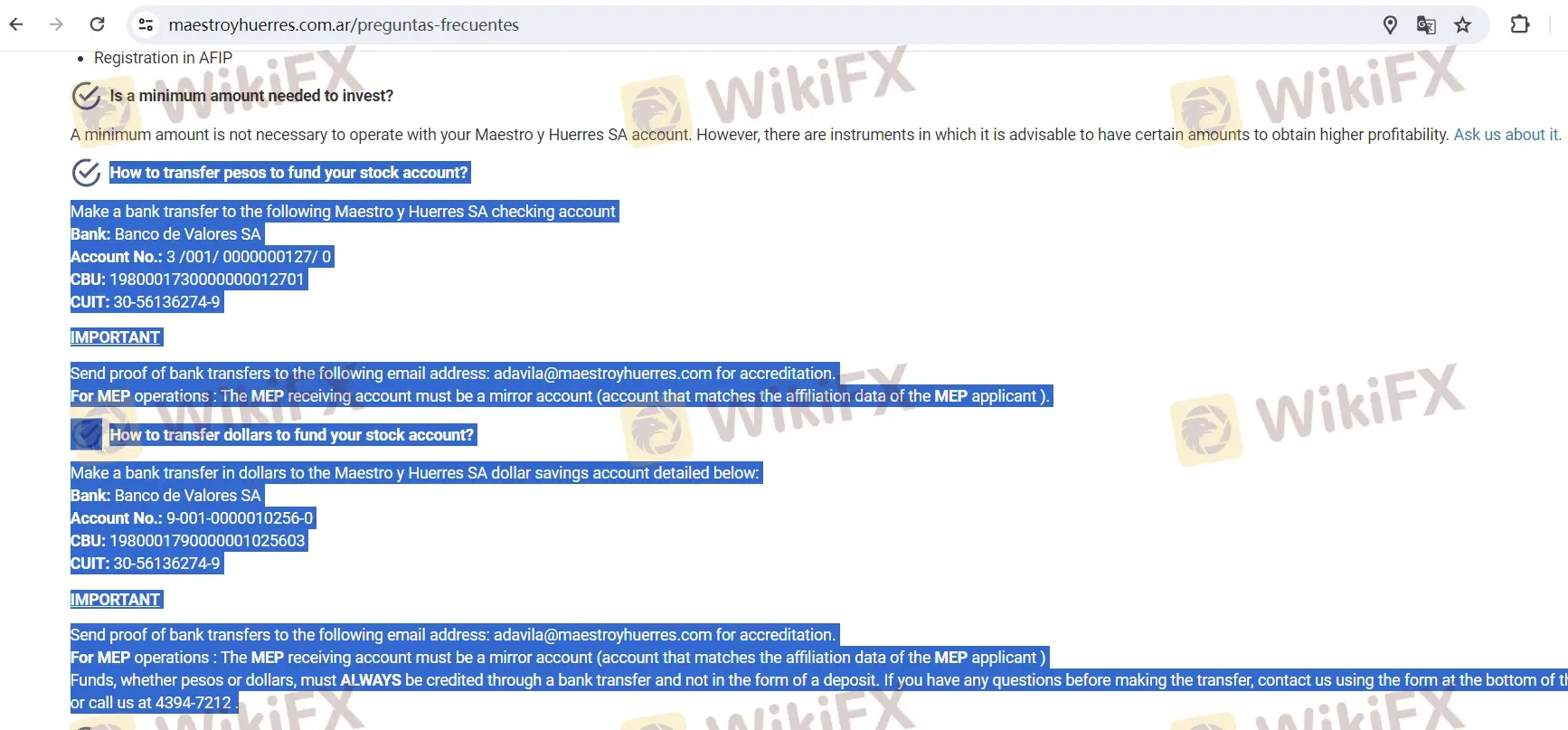

However, the disadvantages far outweigh these theoretical advantages when I consider actual trading practice. The broker’s website is currently inaccessible, and there is a clear absence of information on fee structure, spreads, or commissions. This lack of transparency is a serious red flag since fee clarity is essential for managing costs and making informed decisions. Furthermore, with just bank transfers allowed for funding and no regulated oversight, there is an elevated level of risk—both operational and financial.

In summary, while M&H purports to offer variety in trading instruments and advisory services, the absence of clear information regarding fees combined with regulatory and access concerns means I would not consider any potential advantages meaningful or reliable in my own trading decisions.

Vahid

1-2年

How much is the minimum amount needed to open a live trading account with M&H?

As a seasoned forex trader, I always prioritize transparency and regulatory oversight when considering a new broker. With M&H, I could not find any publicly available or clearly stated information regarding the exact minimum deposit required to open a live trading account. My review process relied on broker communication and accessible details, but I encountered substantial barriers—most notably, M&H’s official website was inaccessible, and there is a clear lack of transparency surrounding crucial account opening terms, including their minimum deposit.

Additionally, M&H operates without any regulatory license, which magnifies the risk for any potential client. Their funding process appears to solely involve direct bank transfers to specific accounts, which I found to be highly unusual and lacking the security and client protections I expect. Requests to send payment verification to an email address rather than through a secure client portal further raised my concerns. Without a clearly published minimum deposit or an accessible, trustworthy channel to verify such essential information, I cannot responsibly recommend depositing any amount or opening a live trading account with M&H. For me, these red flags outweigh any potential benefits, and I would urge any trader to exercise extreme caution.

Broker Issues

Deposit

Withdrawal

Ashraf Shahhat

1-2年

Can I trust M&H as a reliable and secure broker for my trading activities?

As an experienced trader, I have always prioritized two factors above all when considering a broker: robust regulation and operational transparency. Based on my review of M&H, I have significant reservations on both these counts. M&H is openly unregulated, and my understanding is that there are currently no valid regulatory safeguards in place to protect client funds or ensure fair business practices for traders like myself. This absence of oversight introduces a considerable degree of risk, especially when compared to brokers operating under the supervision of reputable authorities.

Another issue that immediately raised concern for me was the inaccessibility of M&H’s official website. In my experience, being unable to reliably access a broker’s site is a red flag, as it complicates the verification of important details such as account terms, fee structures, and even the legitimacy of contact channels. The limited funding methods, specifically only accepting bank transfers, also lack the variety and reversal protections I expect for additional peace of mind, further amplifying my doubts.

While M&H does advertise a broad mix of investment services and claims an operational history of several years, these factors alone cannot outweigh the fundamental risk posed by the lack of regulation and transparency. For me, the security of my capital and the ability to resolve disputes via recognized regulatory channels are non-negotiable. In good conscience, I cannot view M&H as a trustworthy or secure option for trading activities, given these vulnerabilities. I would personally avoid engaging with them until these critical concerns are addressed.