公司簡介

公司簡介

企業簡介

基本信息&監管機構

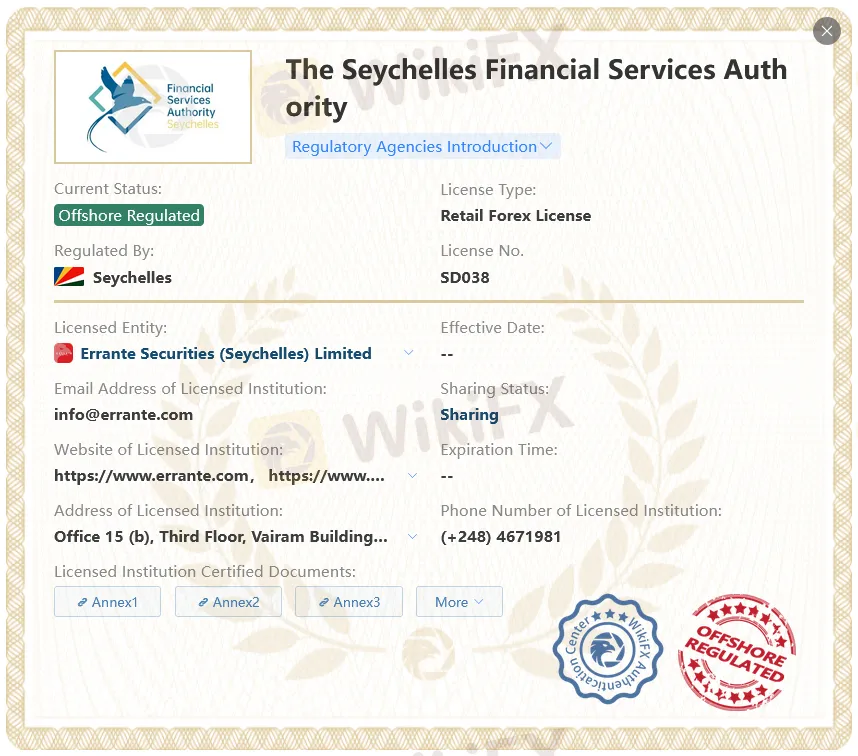

Errante是壹家在線交易經紀商,成立於1999年,至今已擁有30年的行業經驗。Errante目前受塞舌爾金融服務管理局的離岸監管(監管號:DS038)。

安全性分析

Errante目前沒有受到任何主流監管機構的監管,只持有塞舌爾FSA的零售外匯牌照,安全保障相對沒有那麽高。此外,Errante設置的交易杠桿相對較高,因此投資者在選擇該平臺的時候要應謹慎考慮。

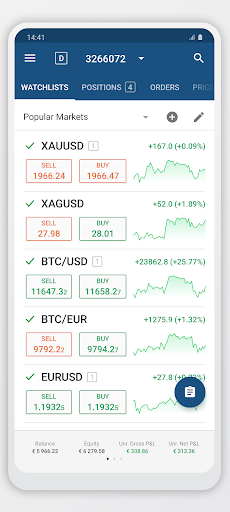

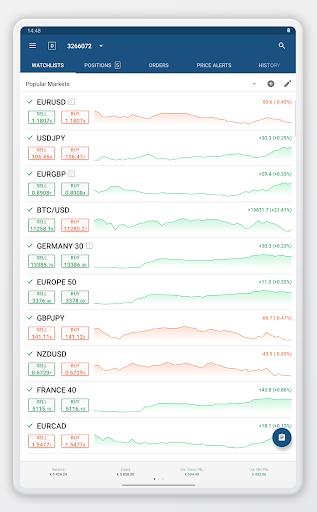

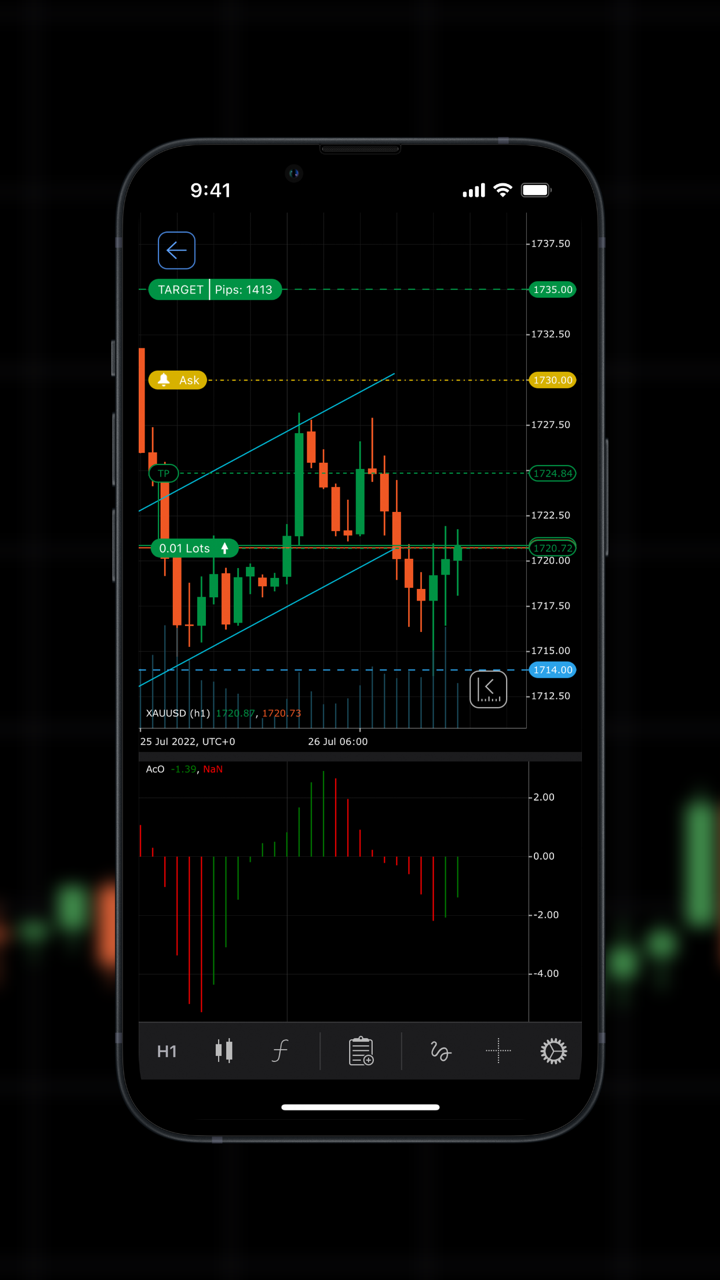

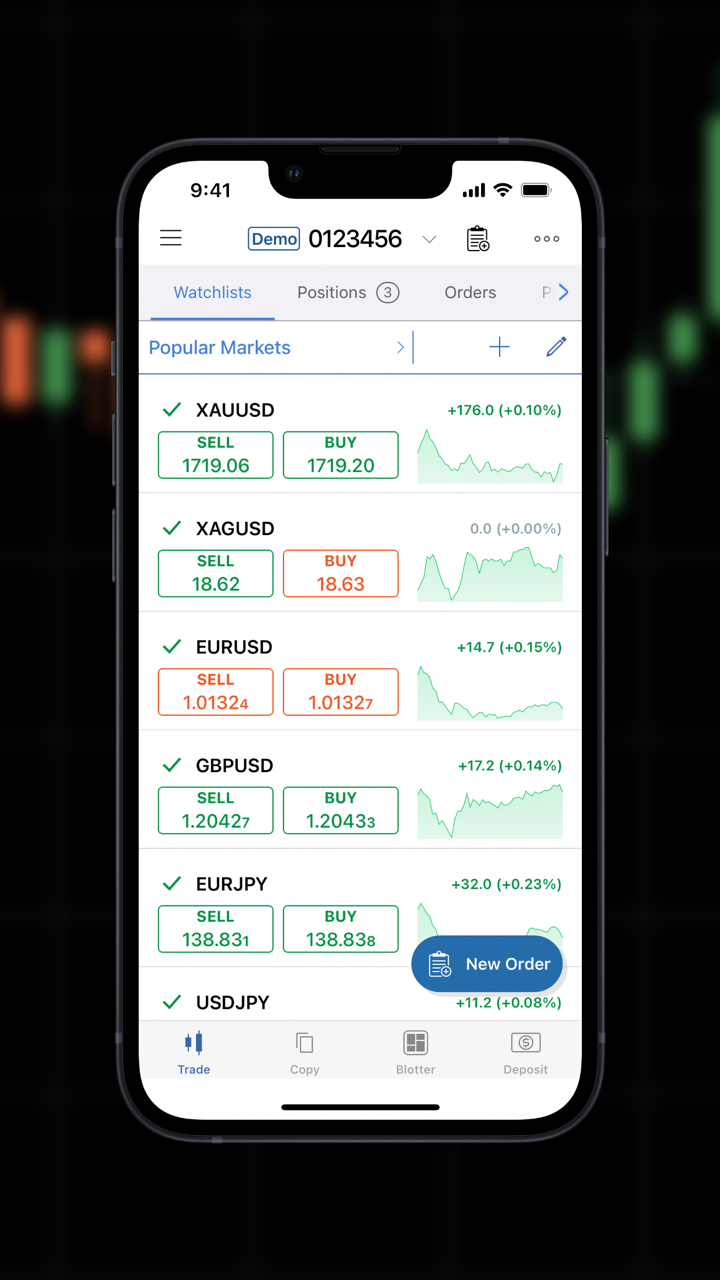

主營業務

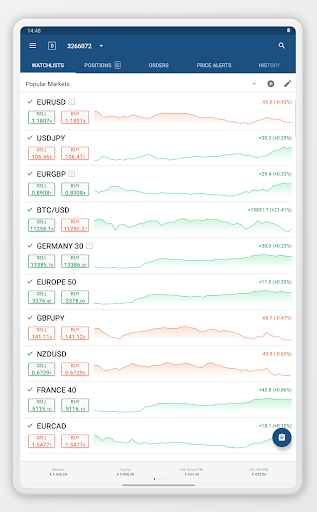

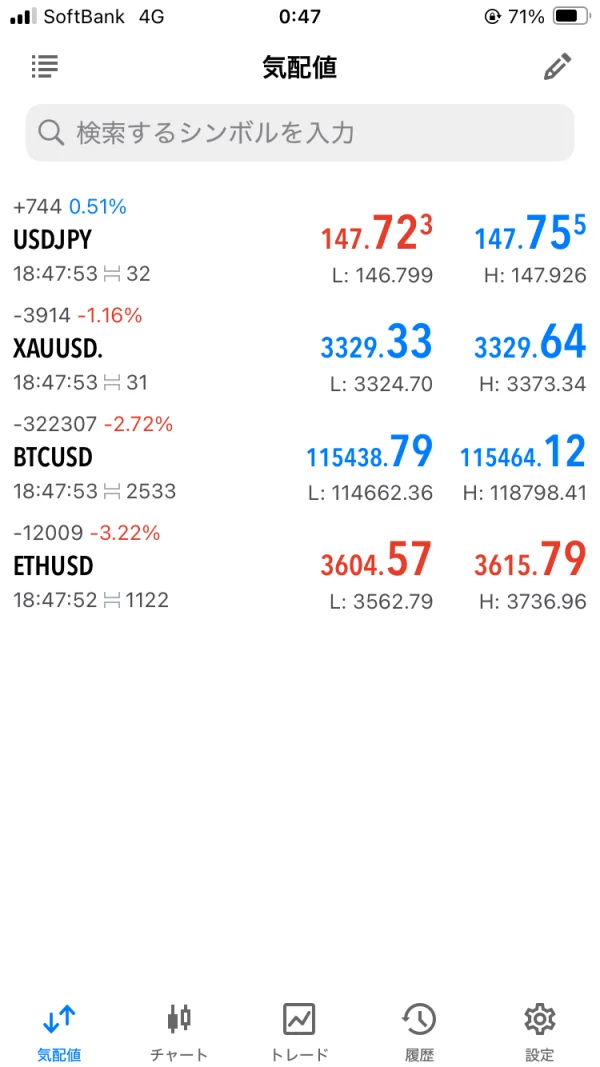

Errante給投資者提供了全球金融市場傷主流及熱門的交易工具,主要是外匯(可交易50多個貨幣對),股票,指數,金屬,能源,加密貨幣。

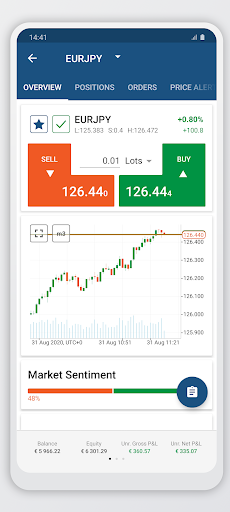

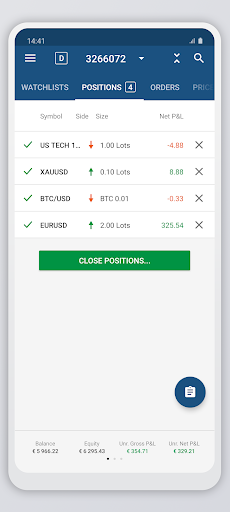

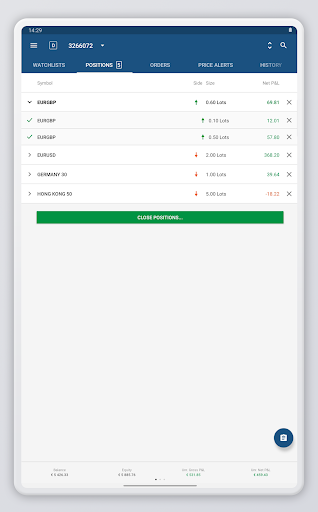

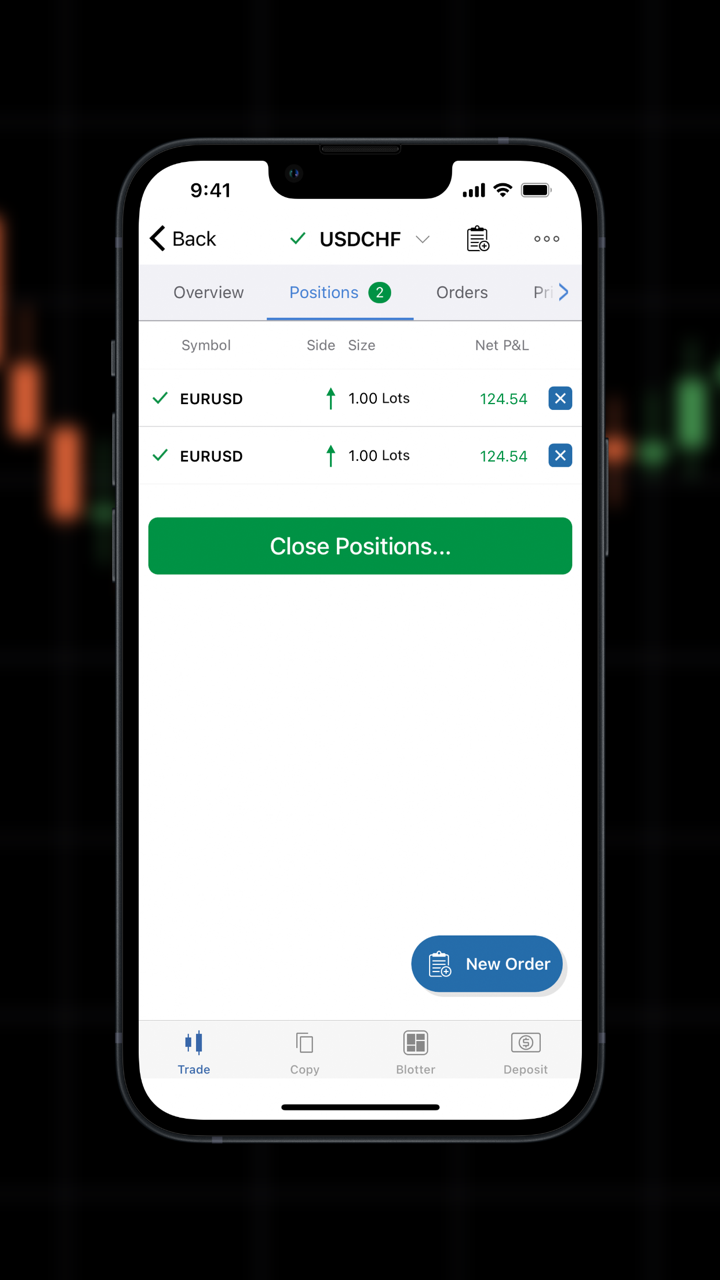

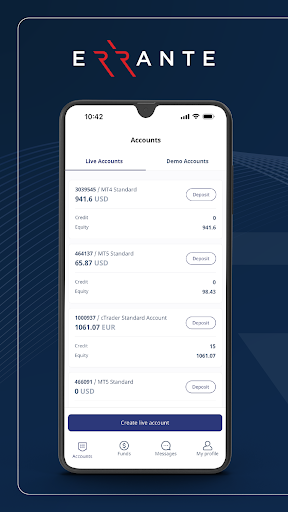

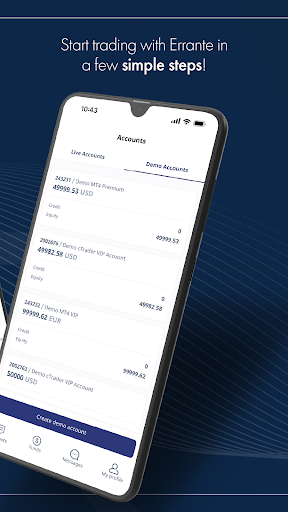

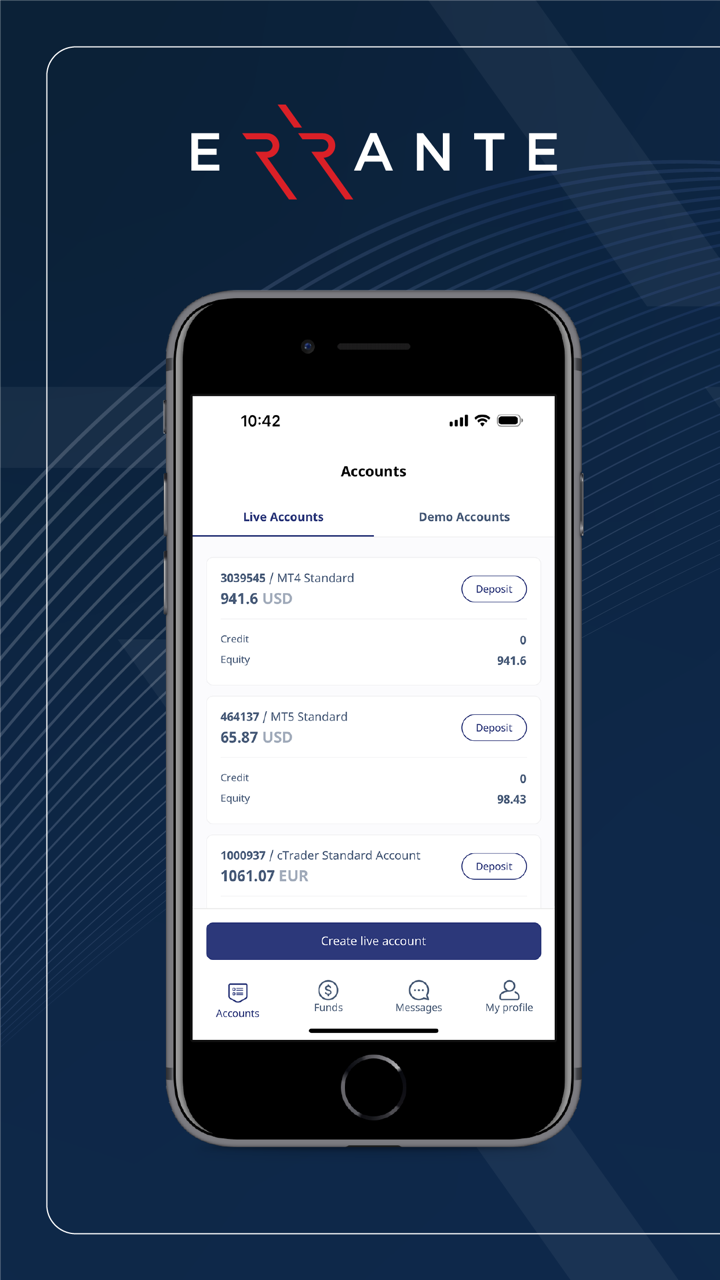

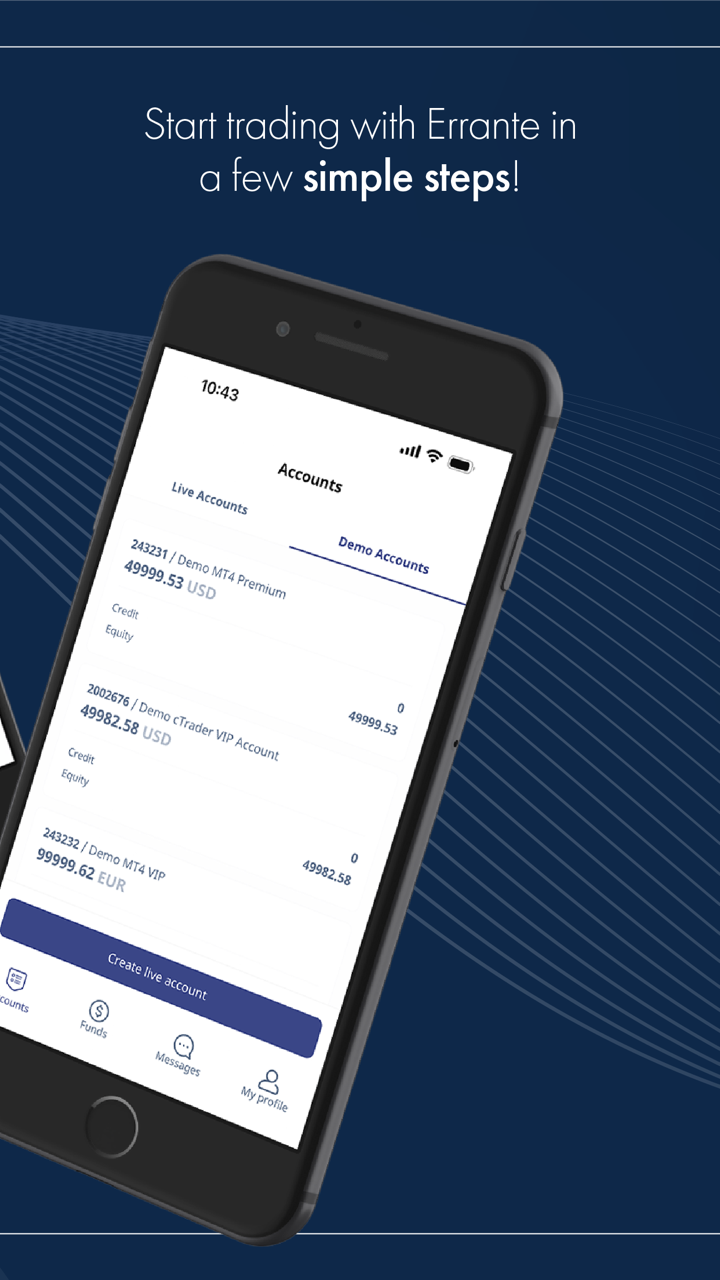

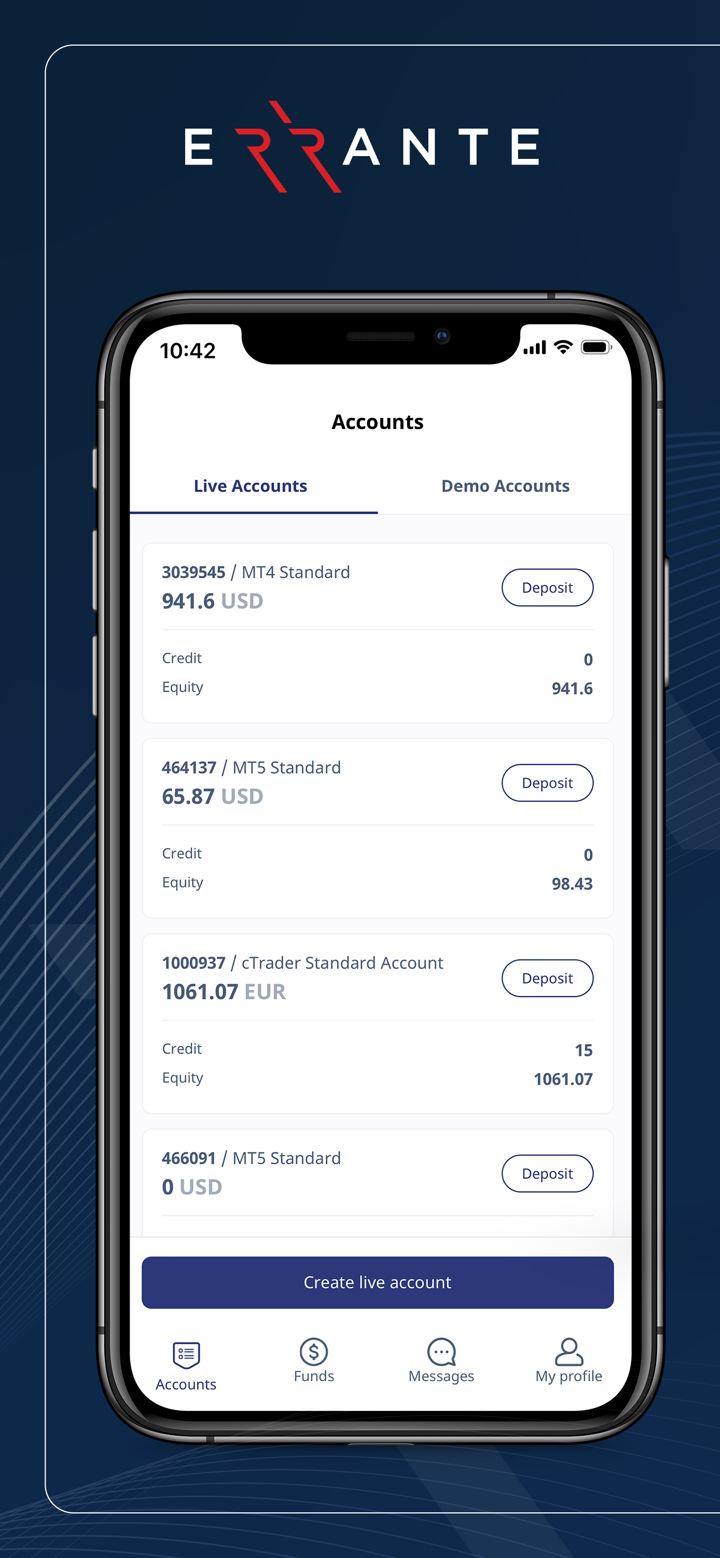

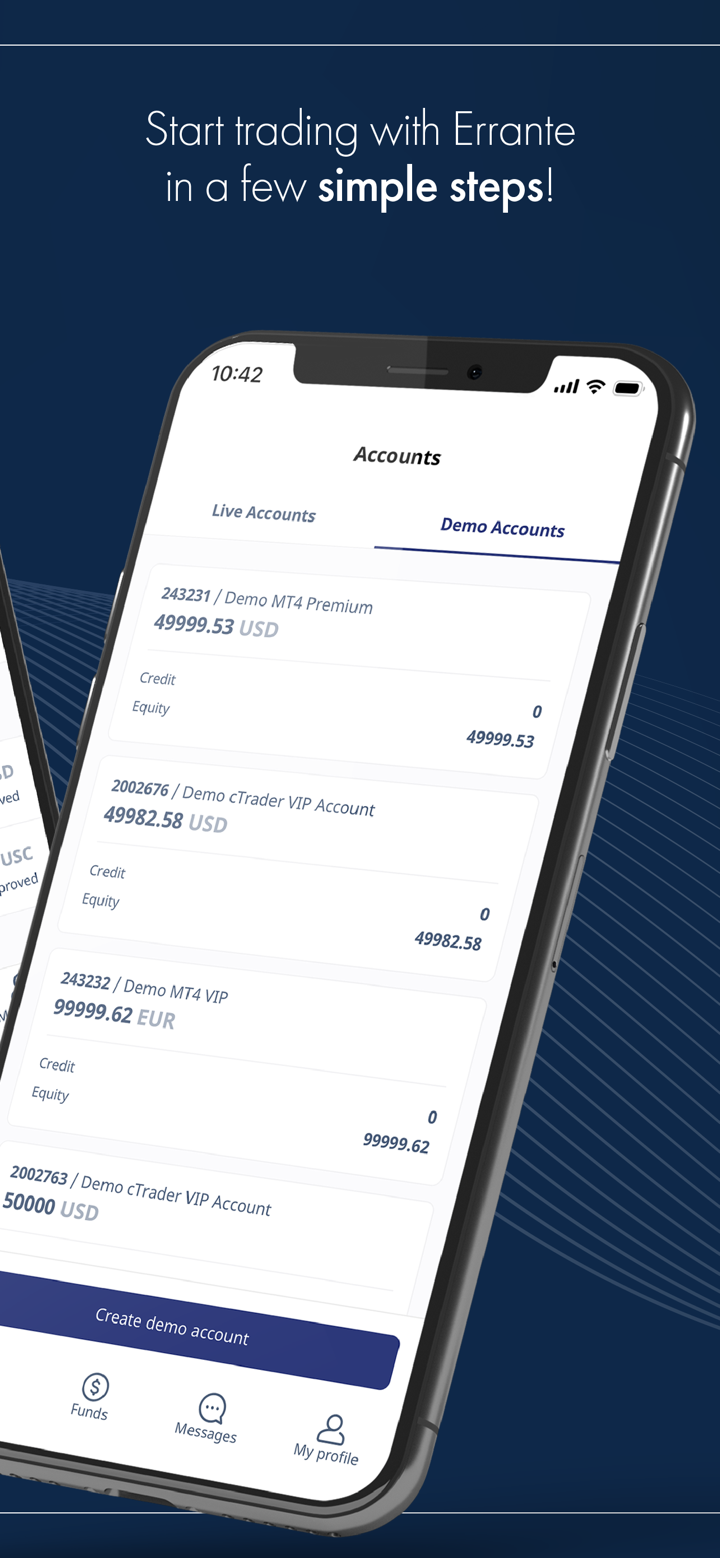

杠桿&賬戶

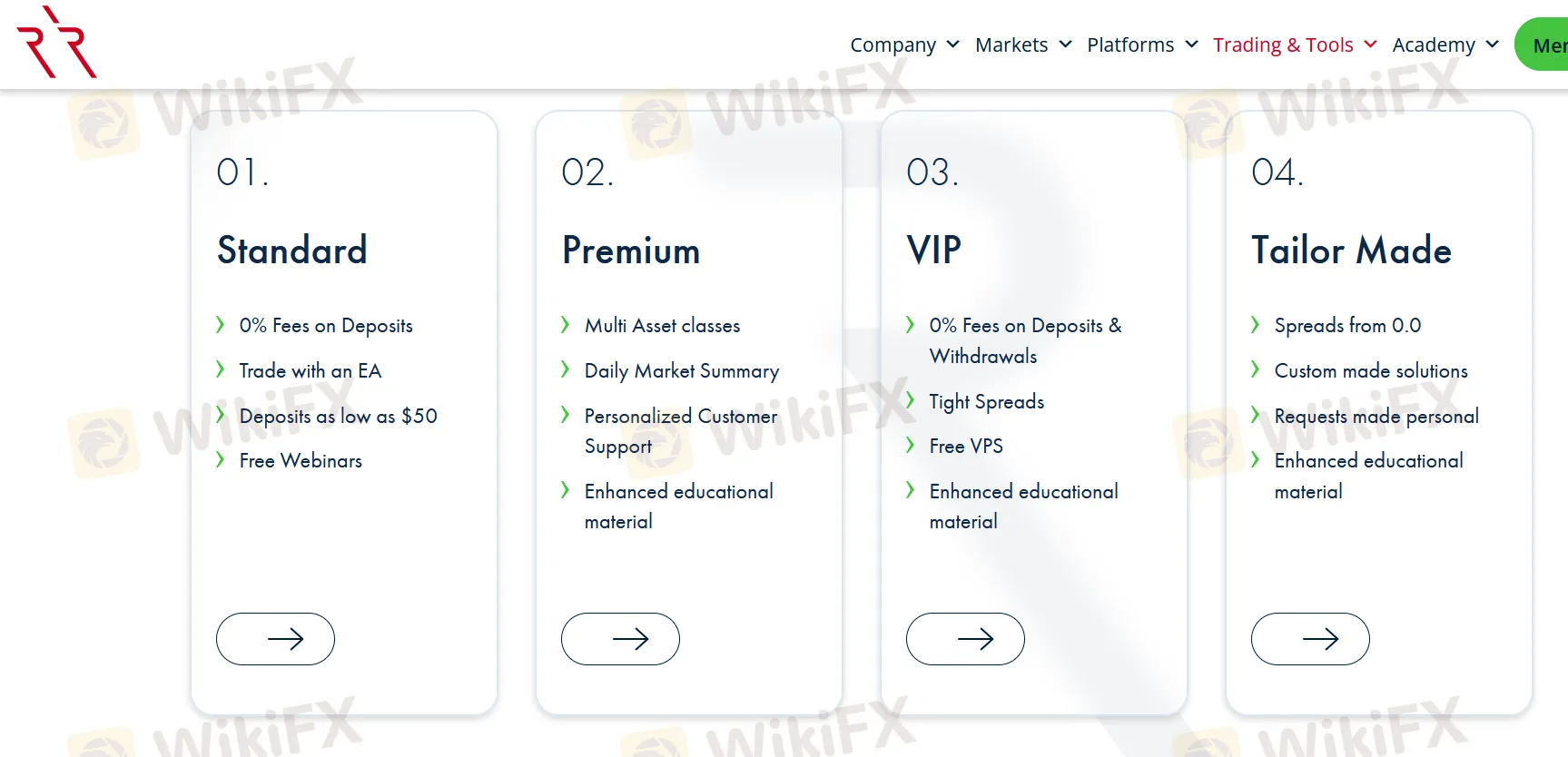

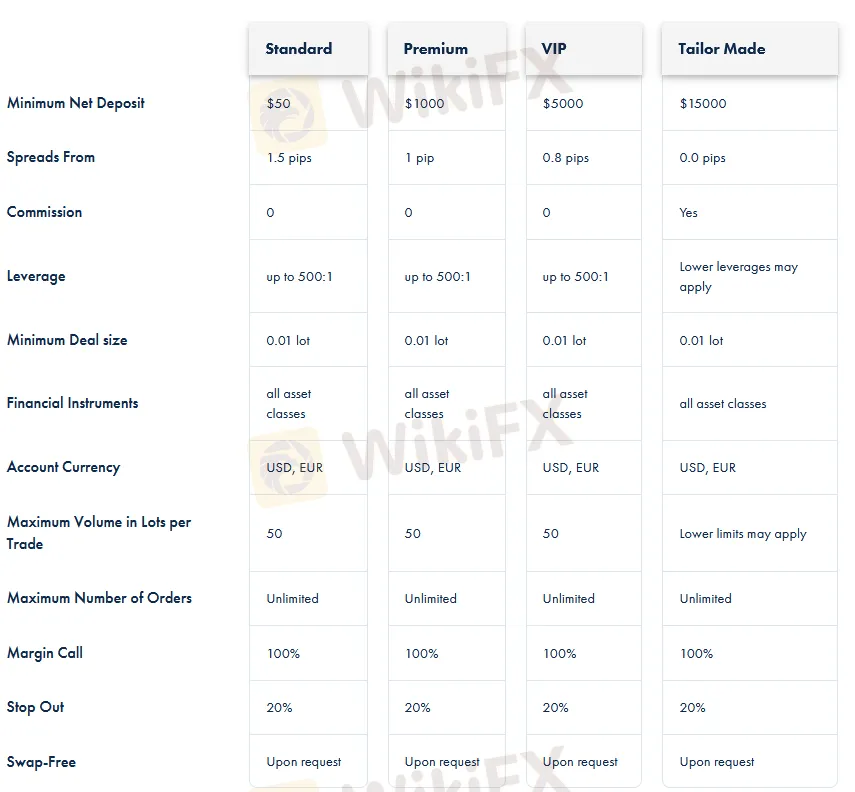

主要貨幣對的最大交易杠桿為1:500,次要貨幣對的最大杠桿為1:200,貴金屬(黃金,白銀的)的交易杠桿為1:100,股票的交易杠桿為1:20,指數產品的交易杠桿高達1:100,原油交易杠桿為1:100,天然氣杠桿為1:20,加密貨幣的杠桿為1:10。為滿足不同投資者的投資需求和交易體驗,Errante設置了四種不同類型的賬戶,即標準賬戶(最低入金50美元),高級賬戶(最低入金1000美元),VIP賬戶(最低入金5000美元),專屬定制賬戶(最低入金15,000美元)。

點差&傭金費用

標準賬戶的平均點差為1.5點,高價賬戶的平均點差為1.0點,VIP賬戶的平均點差為0.2點,專屬定制賬戶的平均點差為0.0點。四種賬戶的外匯交易均不收取傭金。

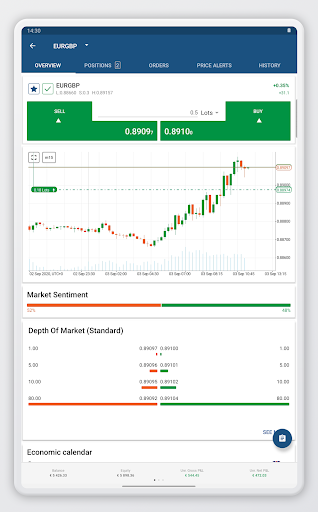

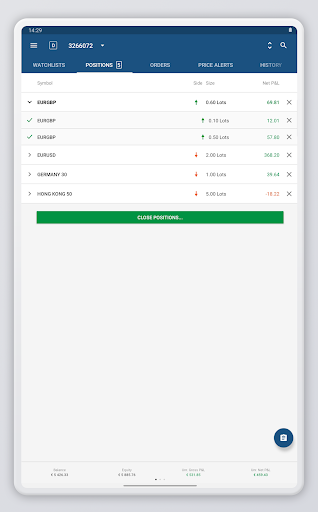

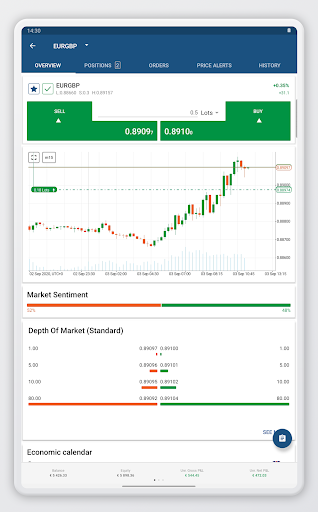

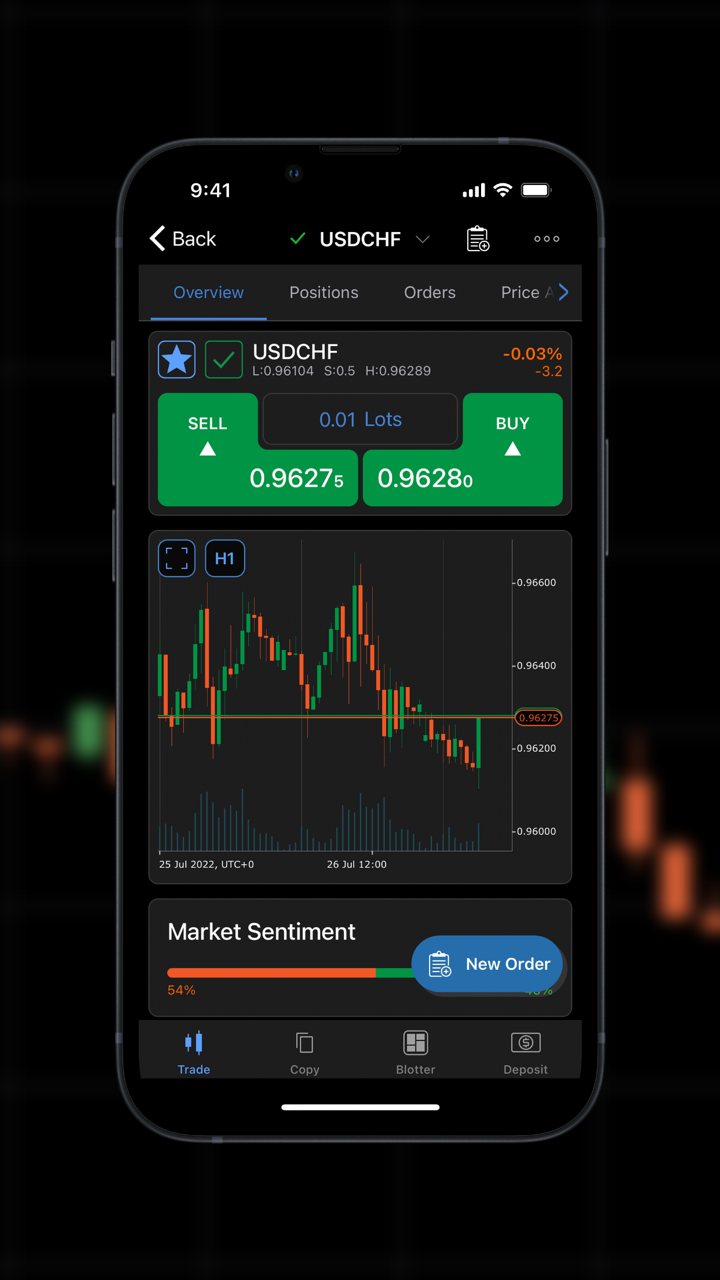

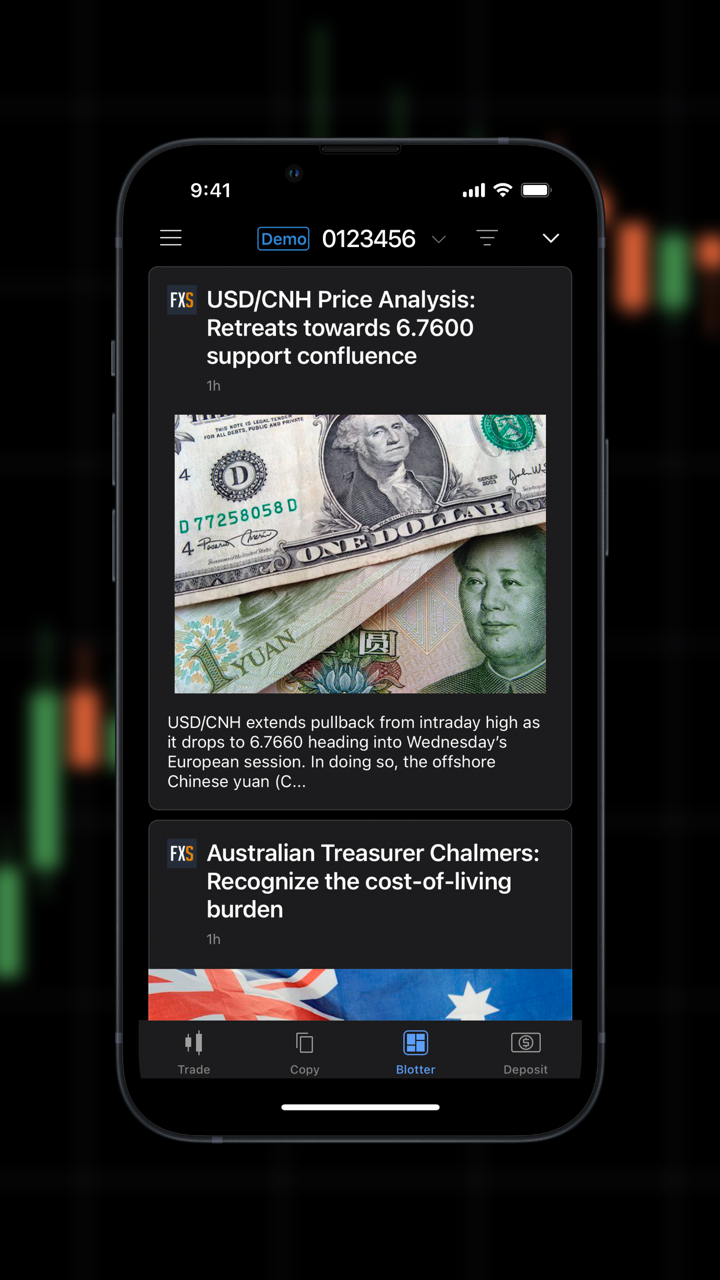

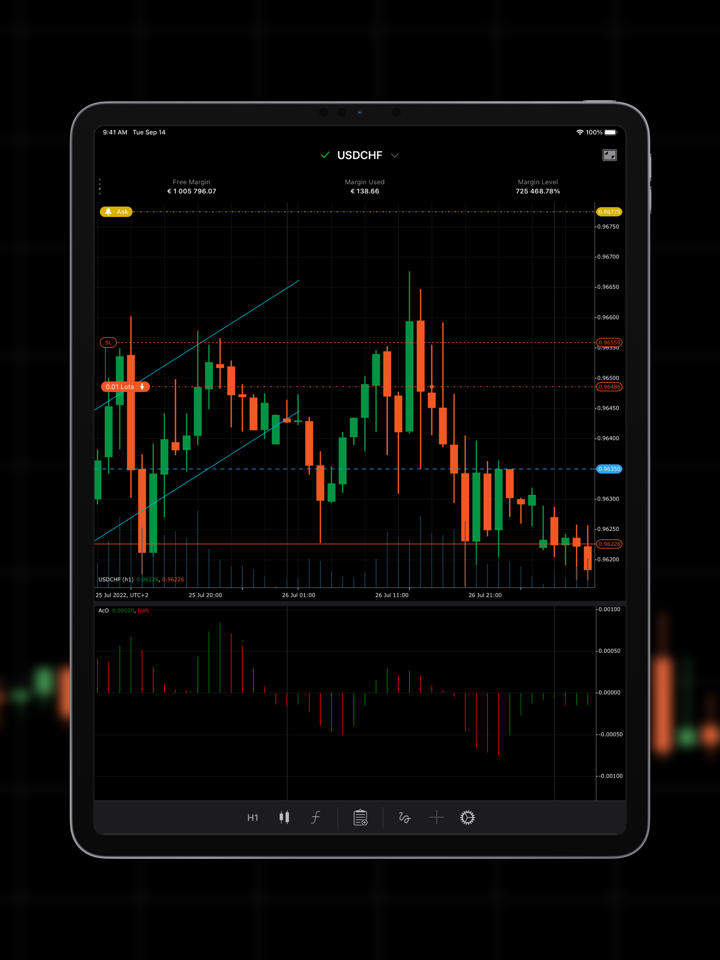

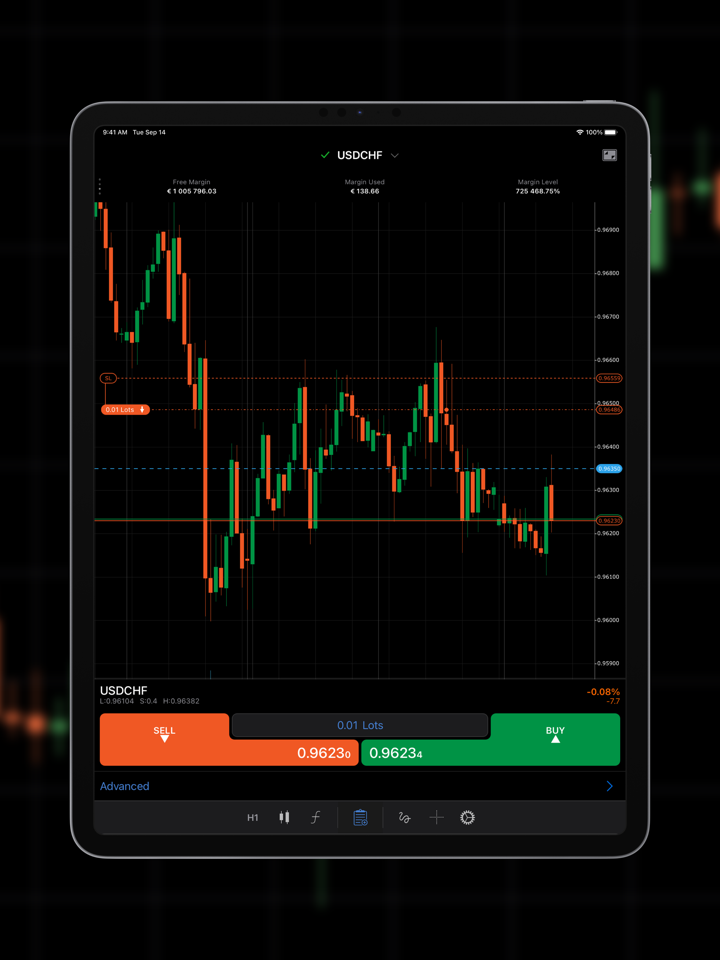

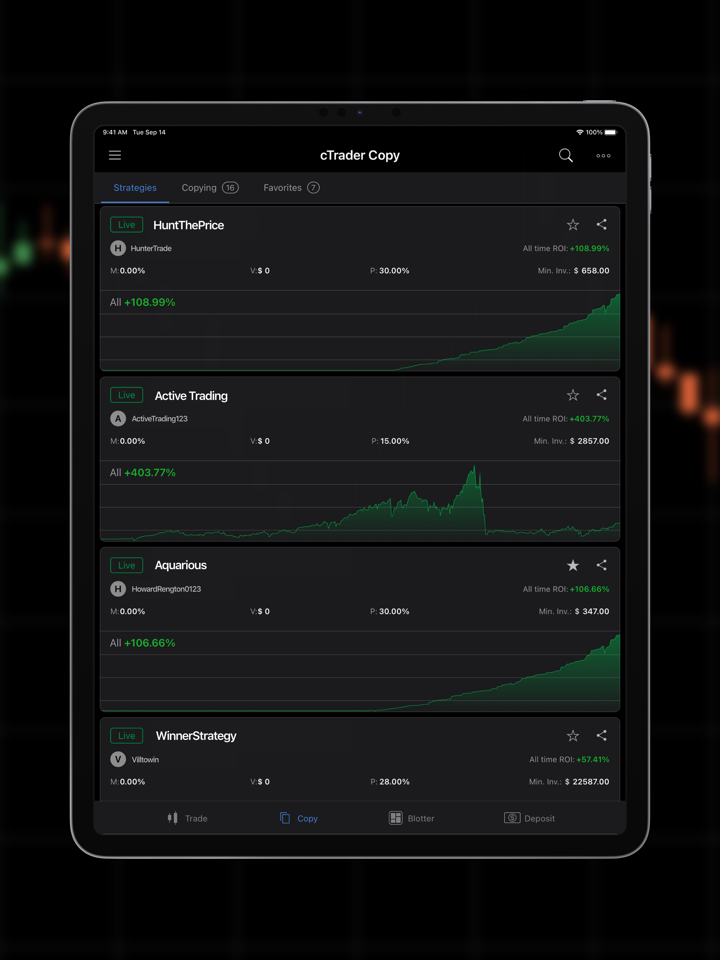

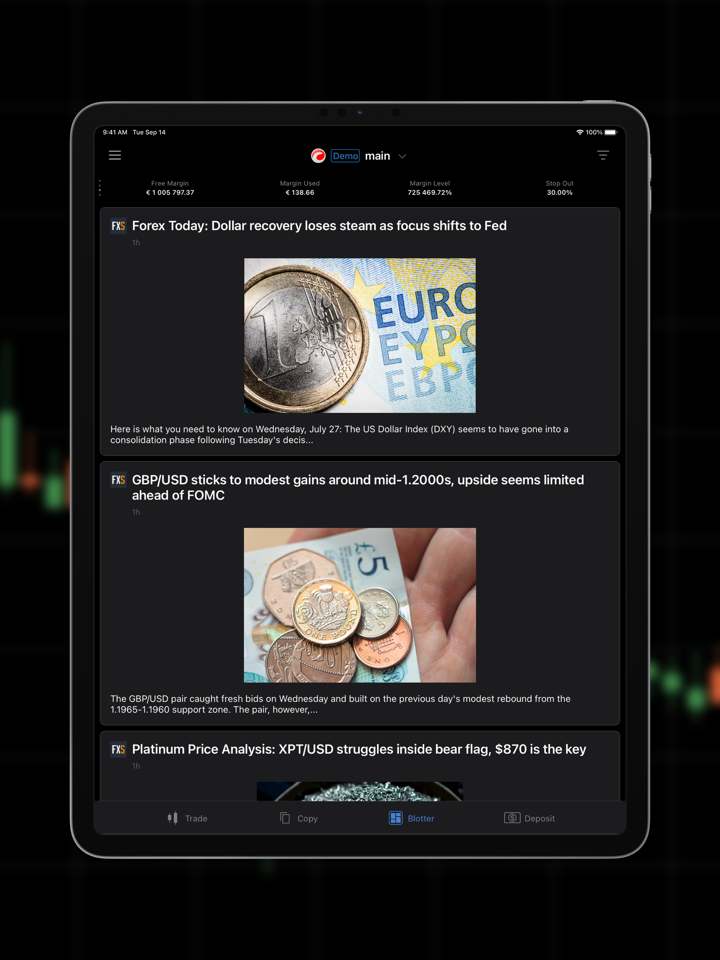

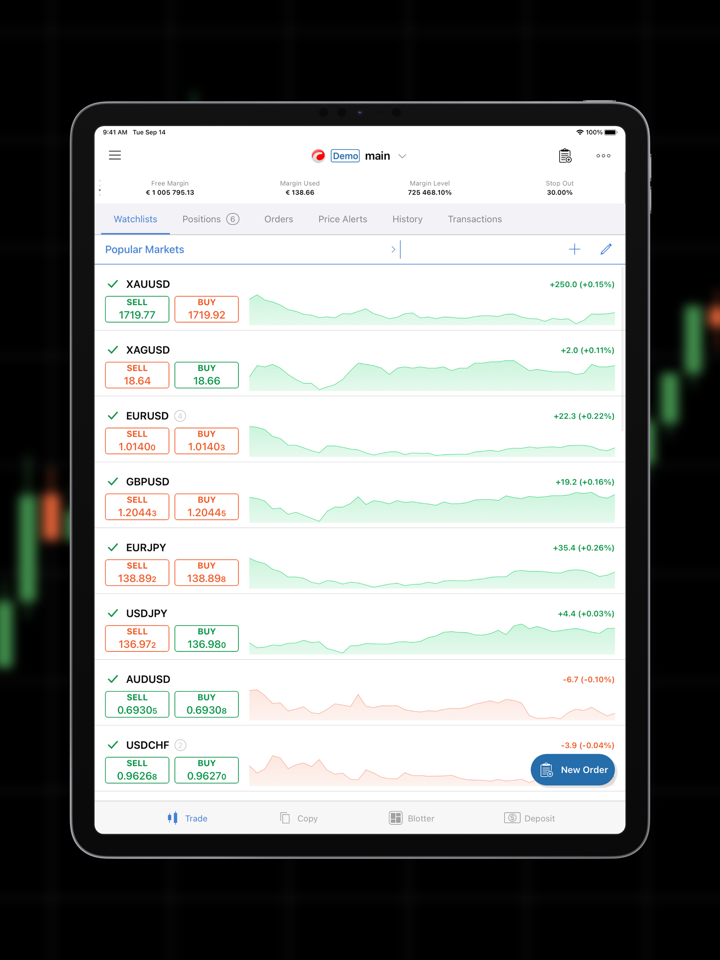

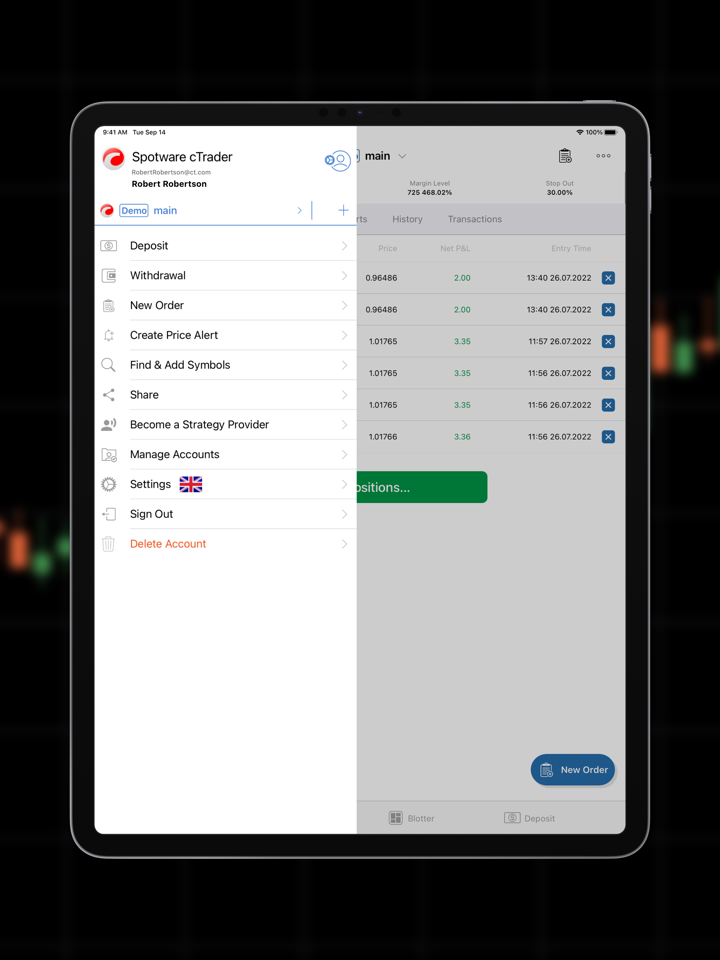

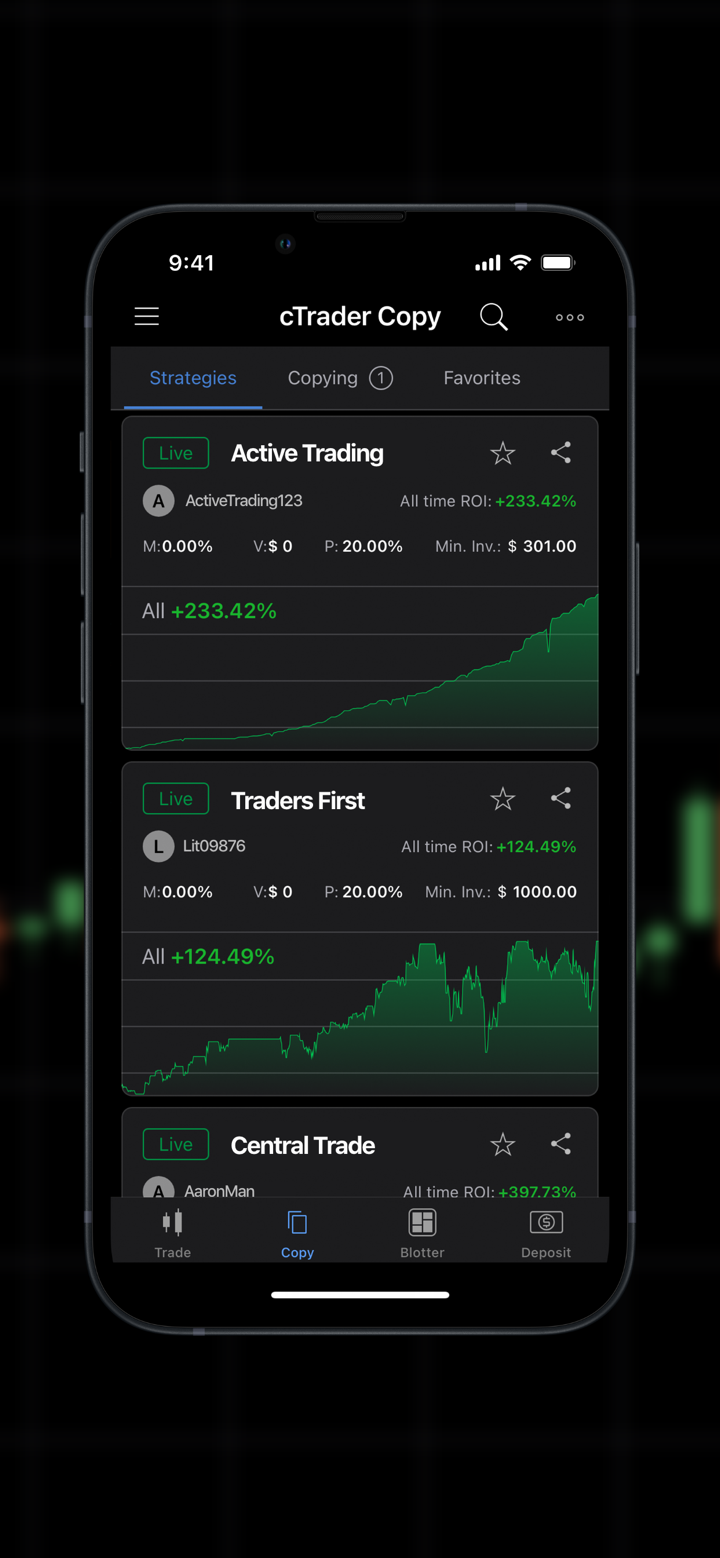

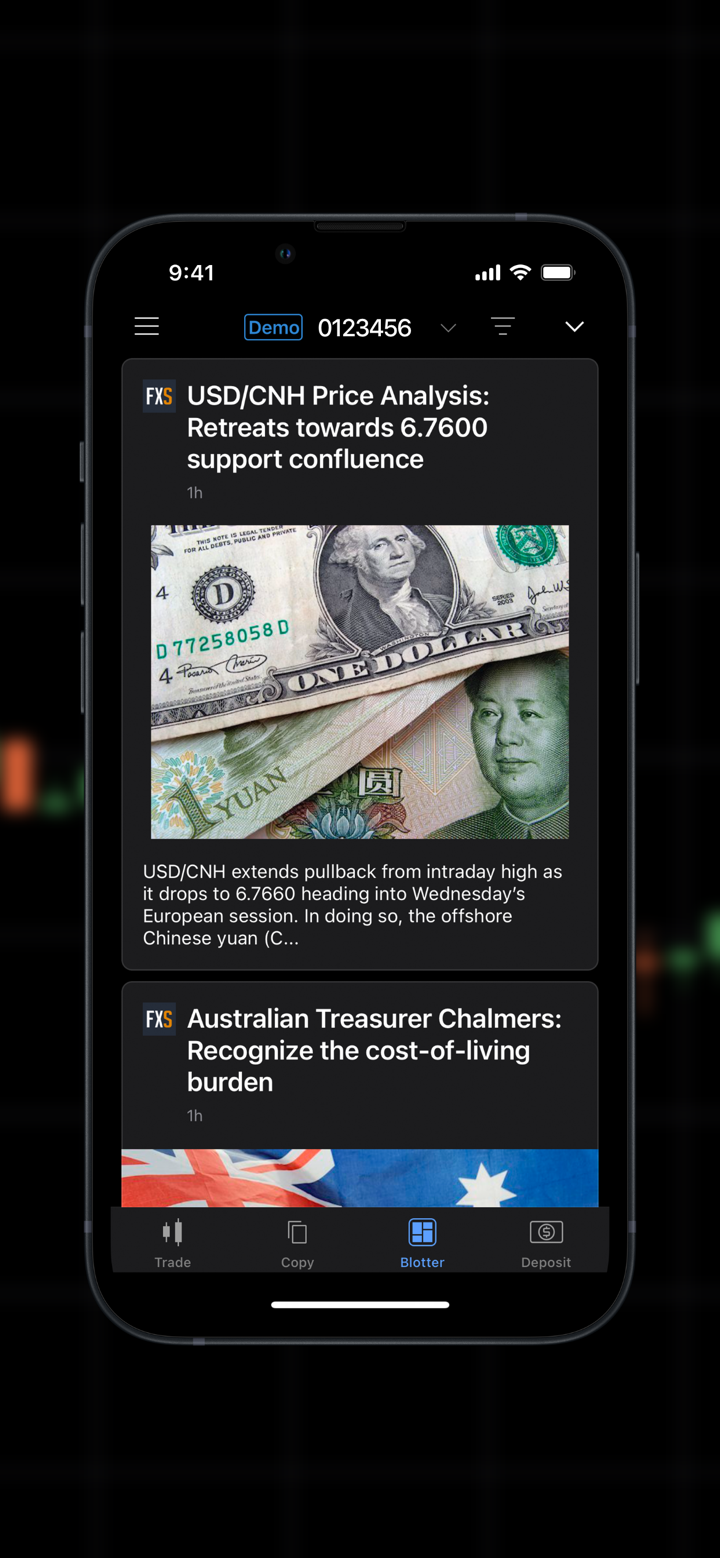

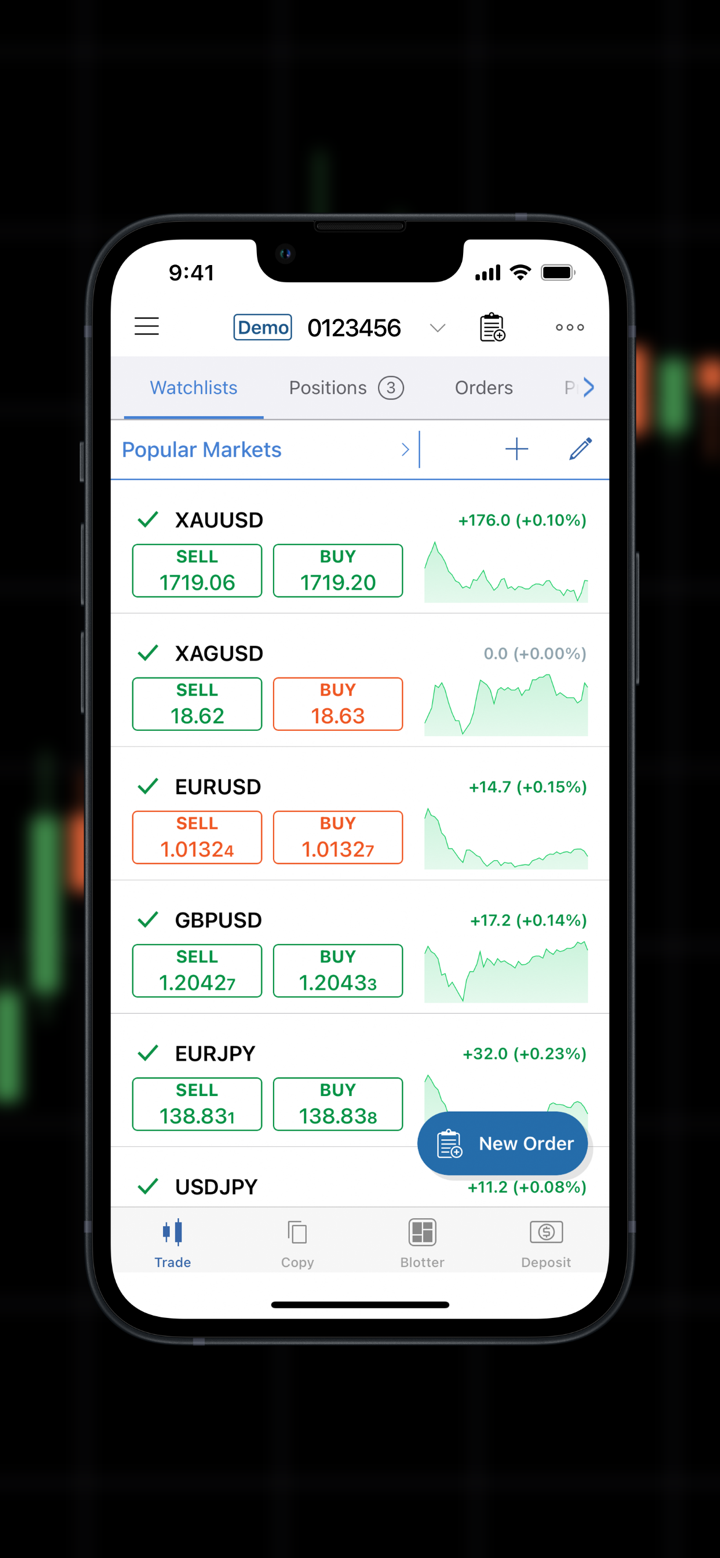

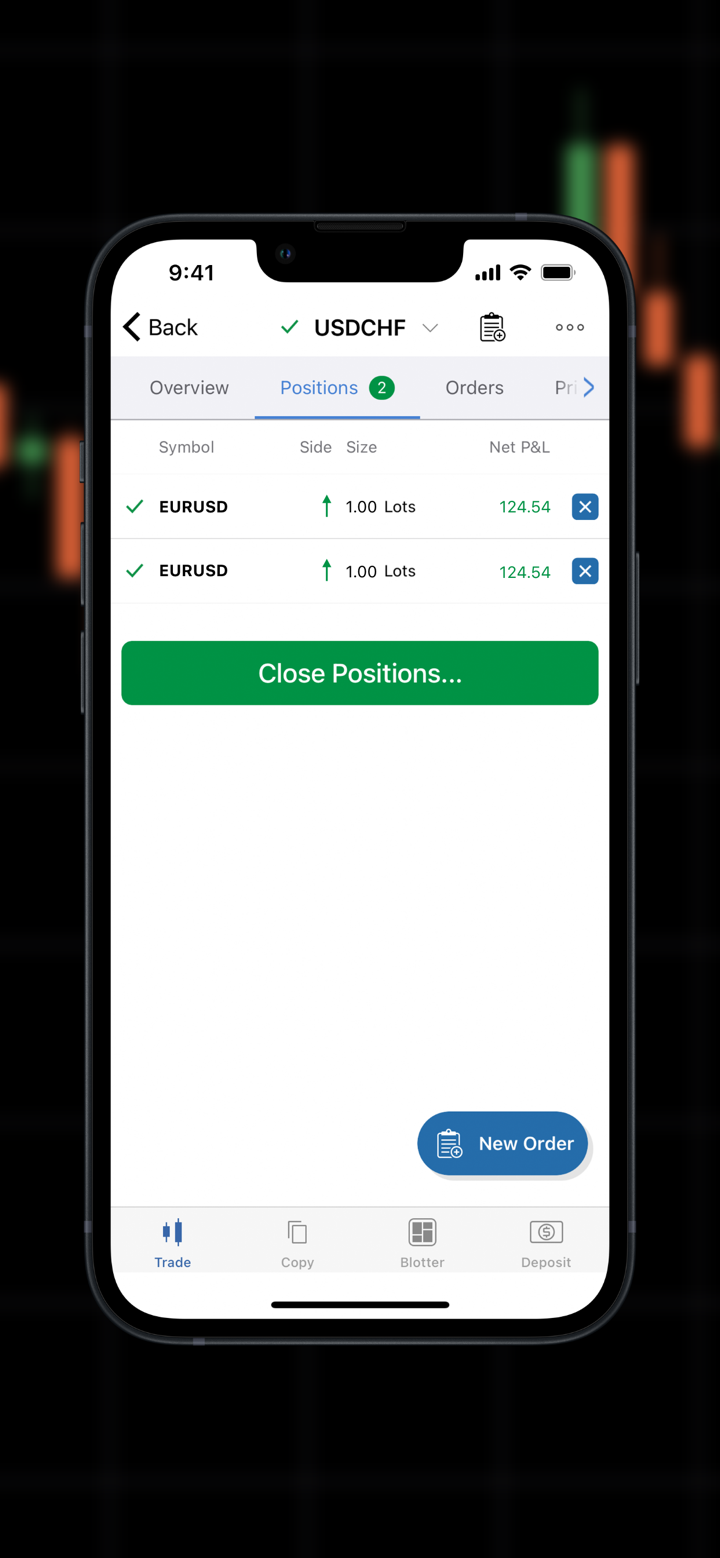

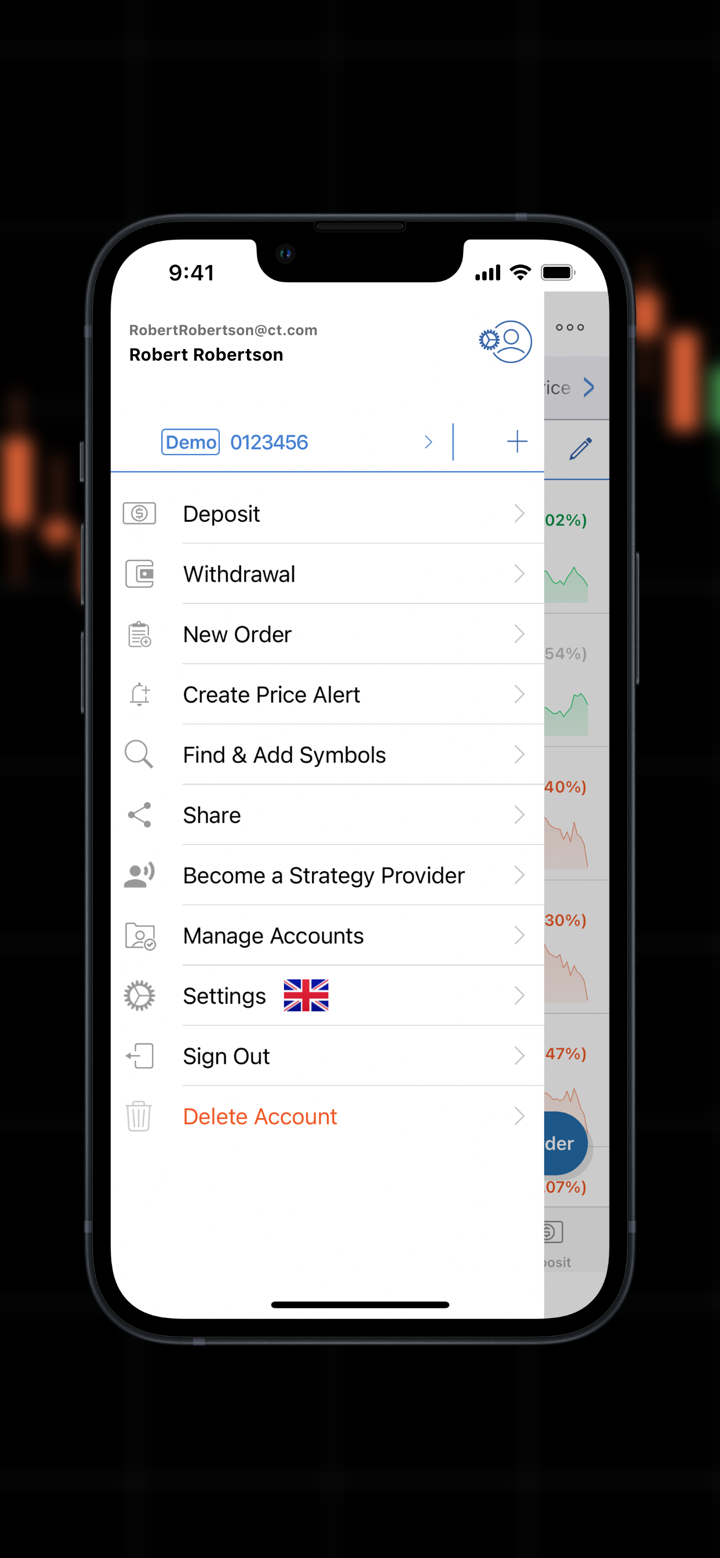

交易平臺

Errante為交易者提供了MT4和MT5交易平臺,MT4是全球金融市場上最受歡迎,最強大的交易軟件之壹,MT5是MT4的最新版,交易者可以根據自己的需求靈活選擇適合自己的交易軟件。

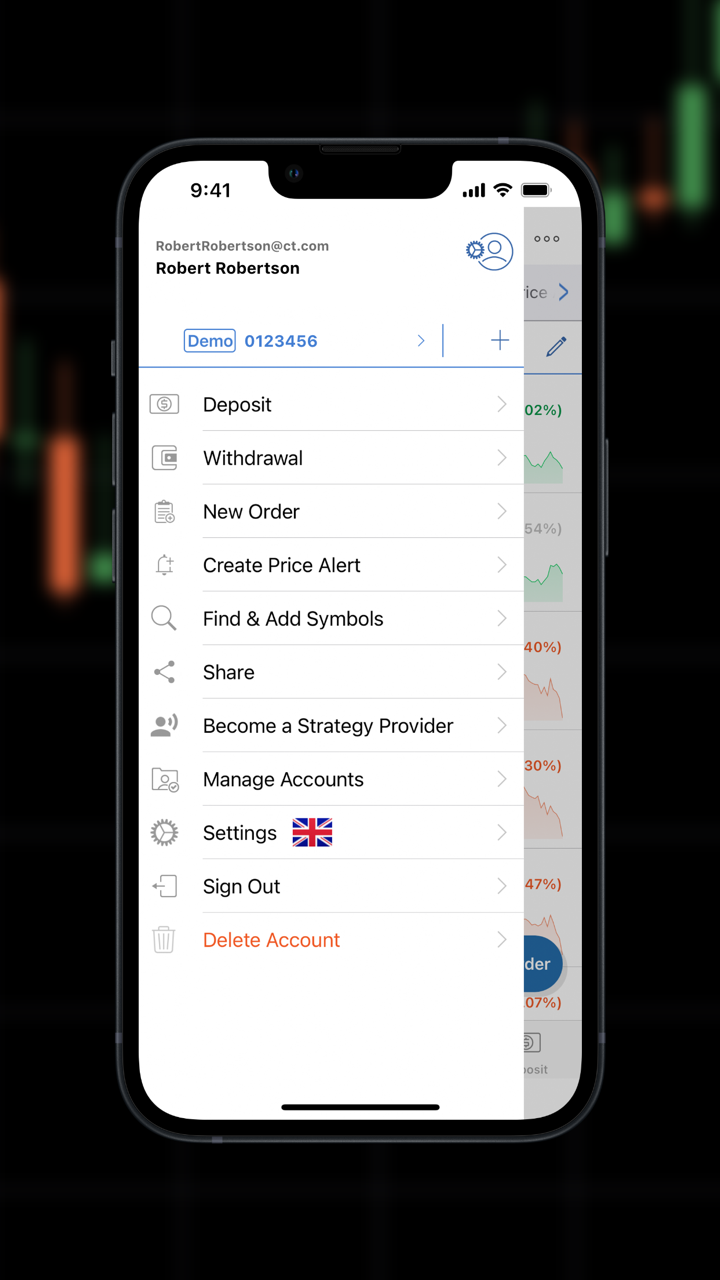

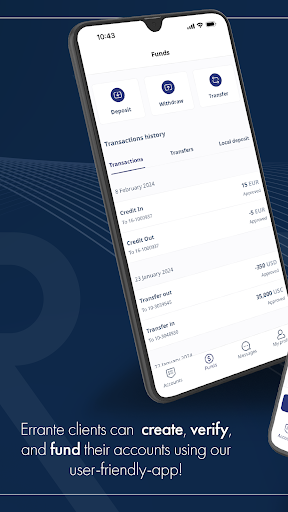

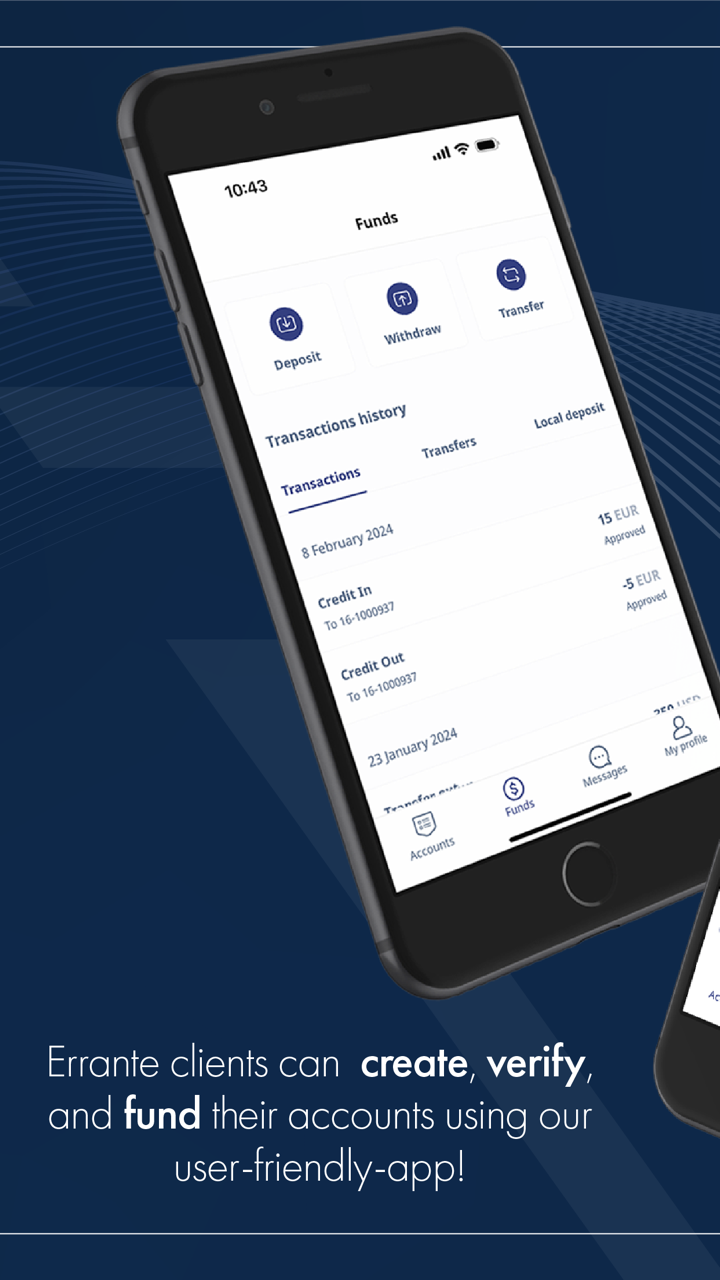

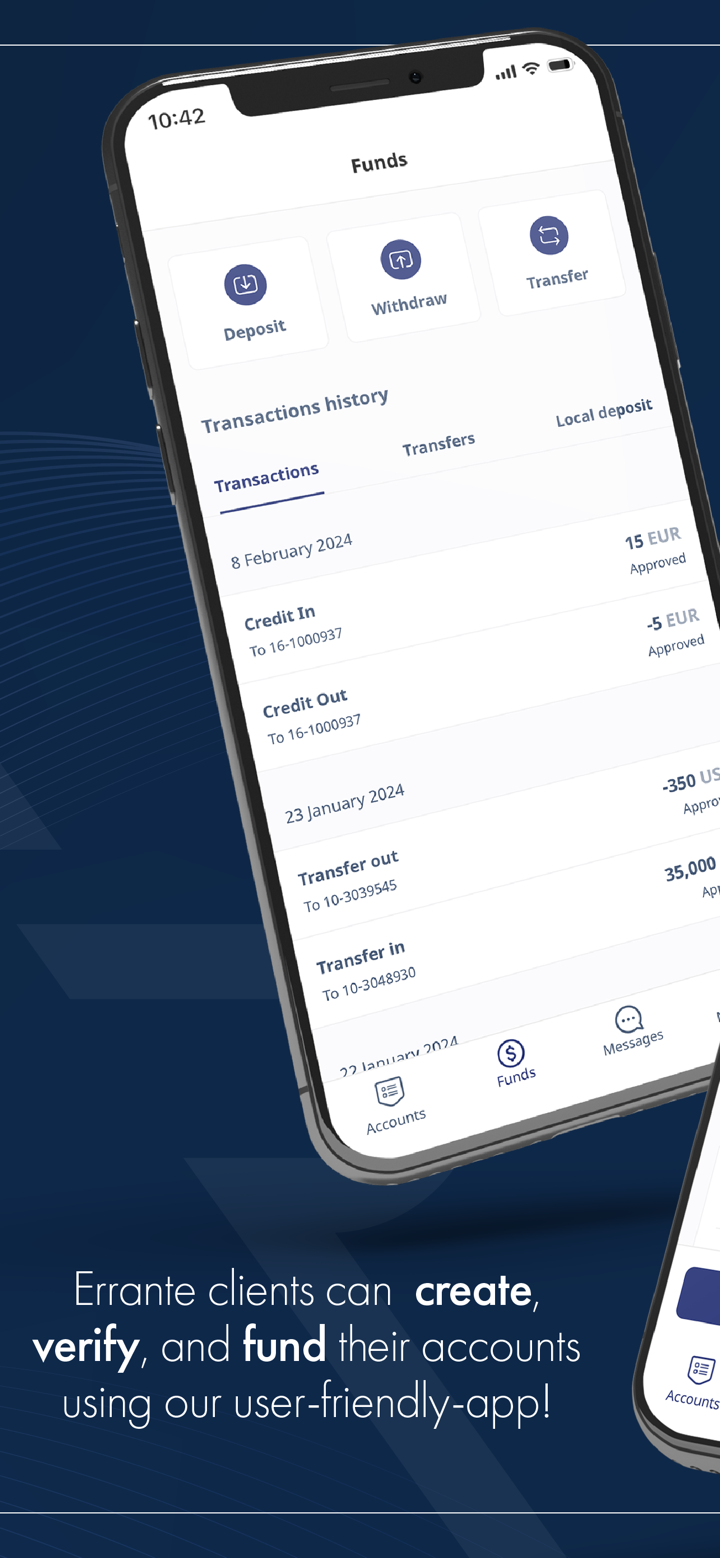

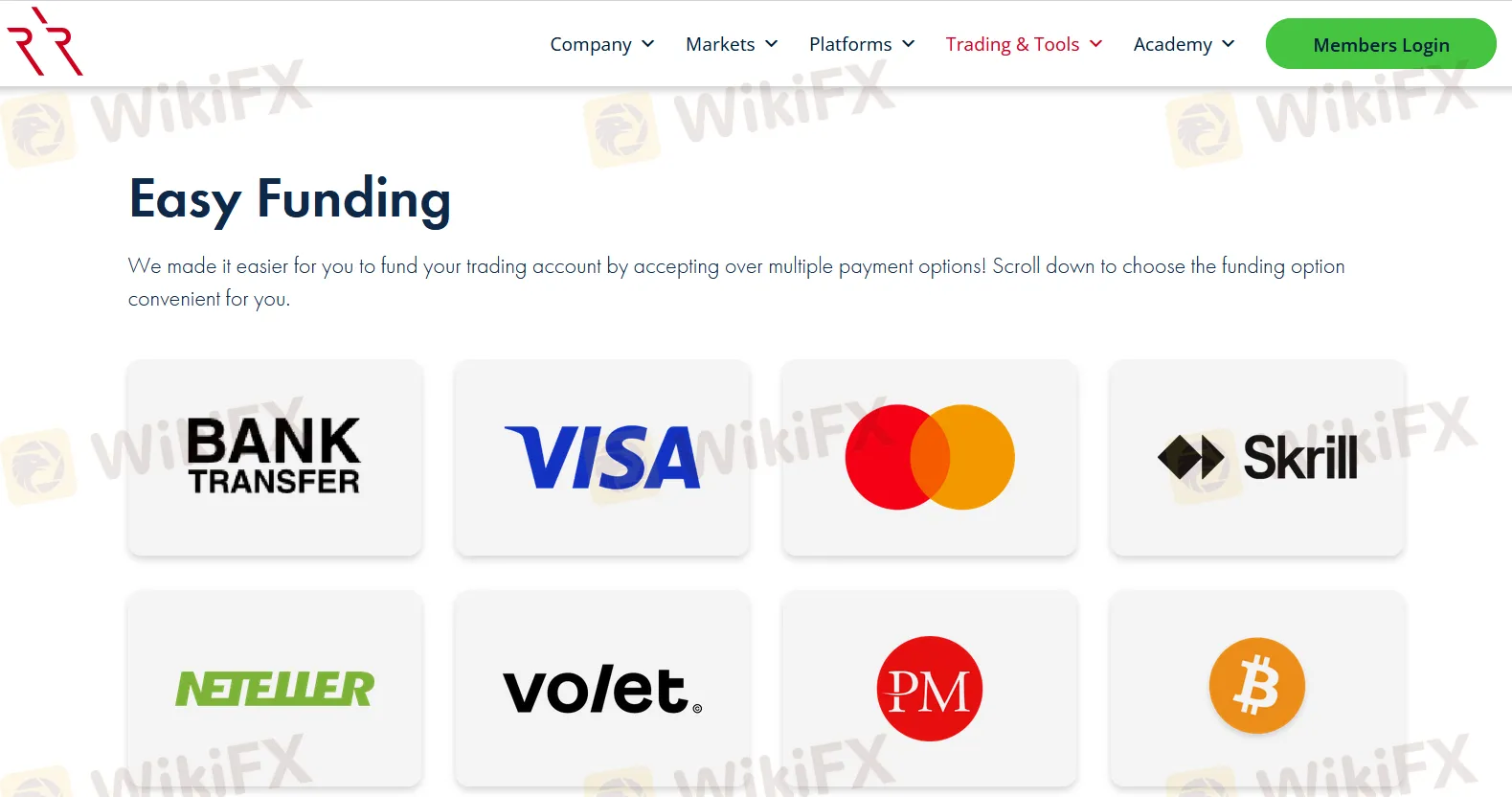

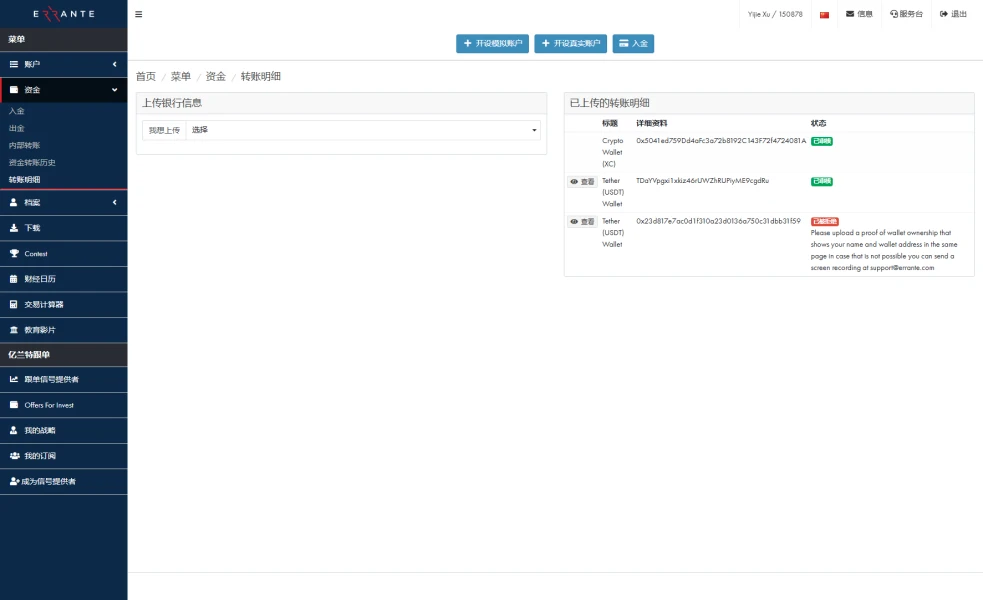

出入金

Errante為投資者提供多種便捷安全的出入金方式,主要有電匯(支持歐元,美元,最低入金50美元/歐元,最低出金100歐元/美元,出入金無手續費),VISA, MasterCard借記卡/信用卡(支持歐元,美元,最低入金50美元/歐元,最低出金20美元/歐元,無手續費),NETELLER,STICPAY, Skrill, Perfect Money, CASHU(這些電子支付方式支持歐元,美元,最低入金50美元/歐元,最低出金20美元/歐元,出金需需支付1%的手續費),加密貨幣支付如比特幣,萊特幣,以太坊等(最低入金50歐元/美元,最低出金20歐元/美元,出入金無手續費)。

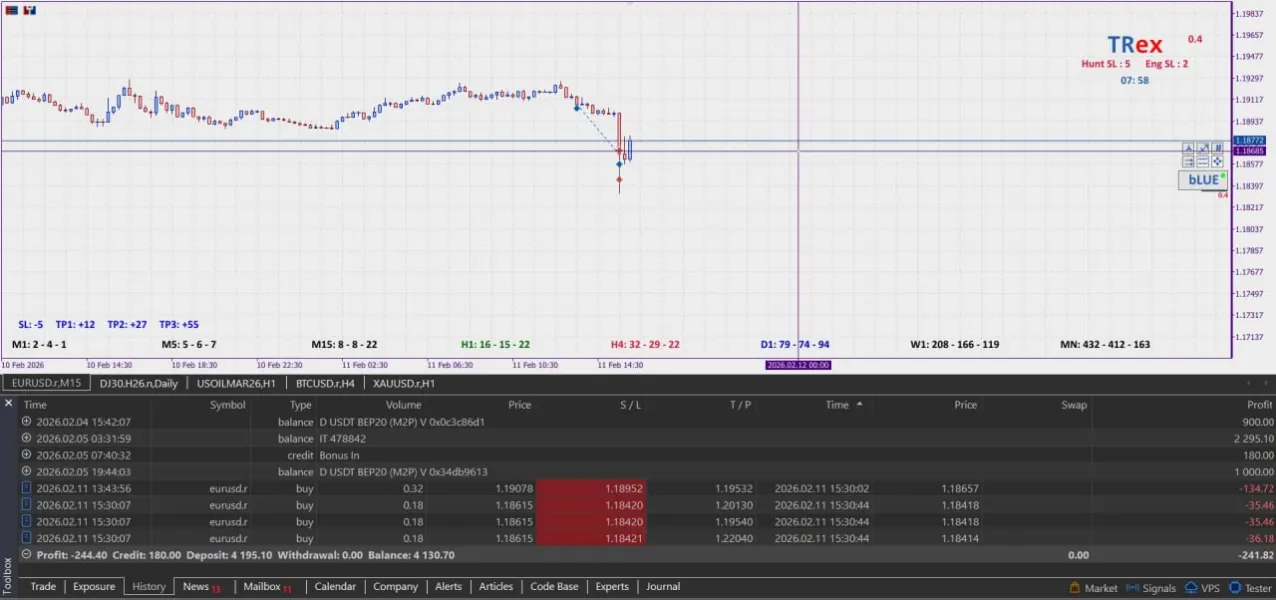

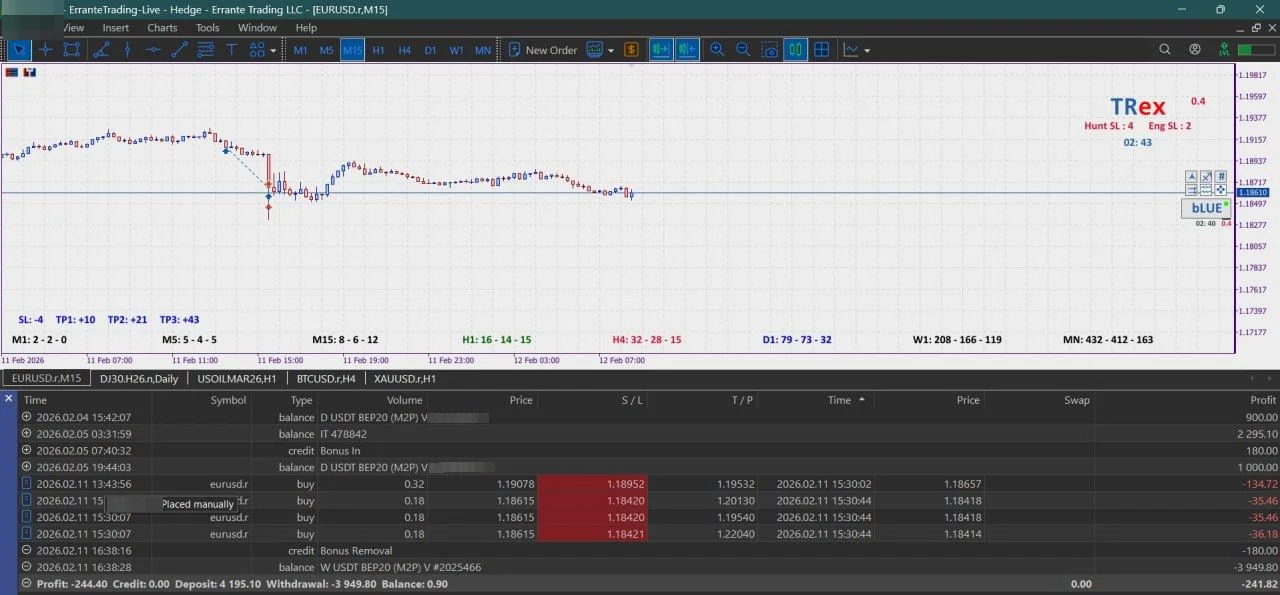

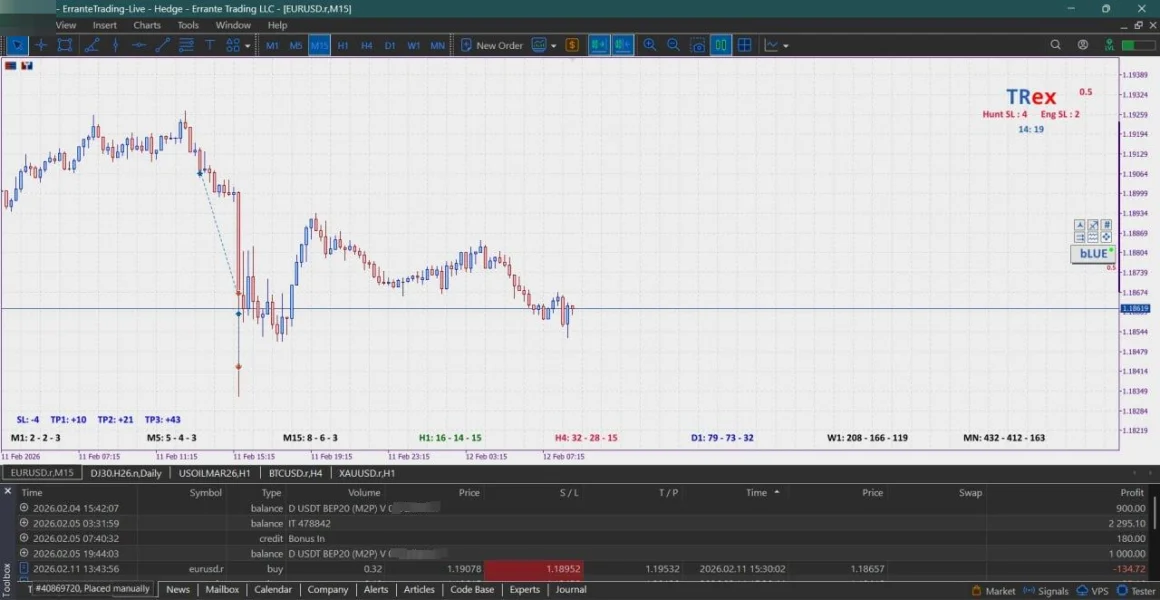

rasool2757

美國

嗨 昨天他們操縱了我VIP帳戶中歐元兌美元持倉的止損,然後我 被止損了40點,客服說是因為滑點!!! 請離開這個詐騙的經紀商 🚫🚫🚫⛔️⛔️❌️❌️🆘️🆘️

爆料

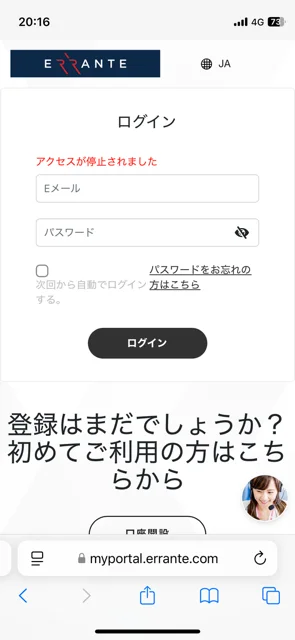

FX2788163487

日本

當我試圖提取我的利潤時,我收到了以下的電子郵件。 ------------ 我們在負責部門檢查了您的使用環境,發現同一個IP地址被多個帳戶使用(這些帳戶似乎屬於不同的客戶)。這種情況可能違反我們的服務條款,我們遺憾地撤銷了相關交易的利潤。此外,我們採取了凍結您的帳戶的措施。我們感謝您的理解。 ------------ 我的家人不交易外匯,所以我不知道這是從哪裡來的。這是一種不公平的對待。

爆料

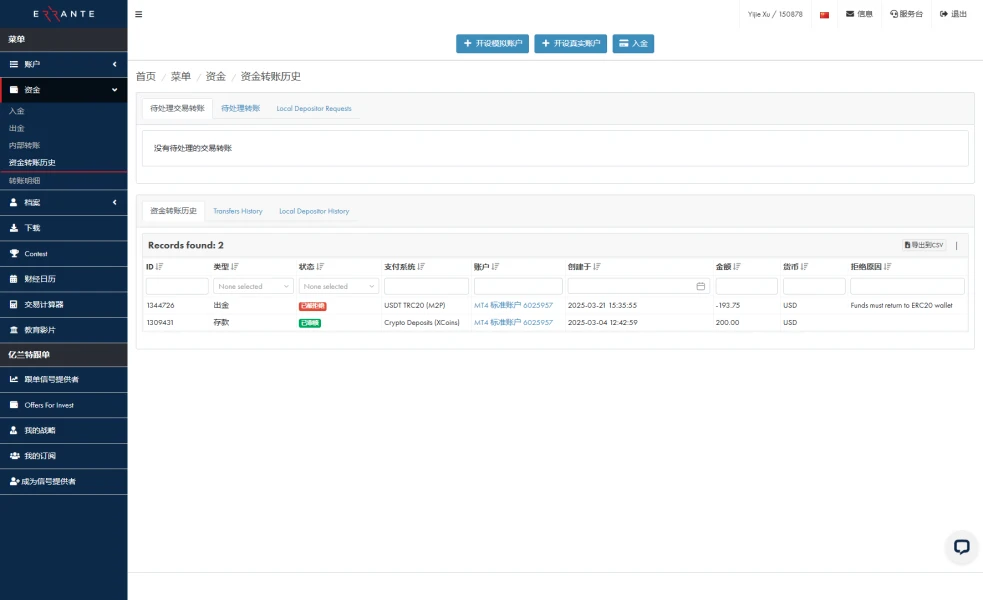

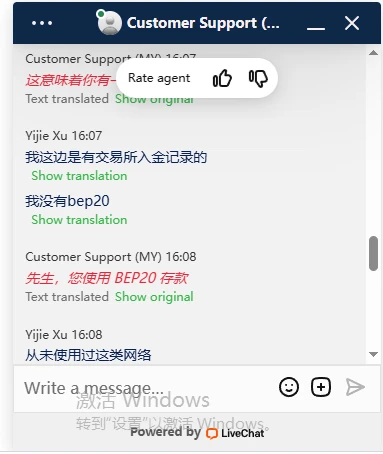

gh5479

香港

黑平台,只能进不能出,我出金选用trc20出金,平台给我拒绝,理由是资金返回需使用erc20,随后我又绑定了erc20,平台又拒绝出金理由需要上传交易所姓名以及钱包地址,询问平台客服之后,平台客服居然说我入金的网络是bep20,我入金使用的是欧易交易所,笑死交易所都没这网络,客服随便又说,我必须绑定bep20钱包地址才可以出金,纯纯黑平台,只进不出

爆料

R Y

日本

由於我拙劣的交易導致全損,所以立即停止使用了,但覺得約定等方面都沒有特別問題,是一家好公司。

中評

FX2563990896

日本

我覺得同其他人比,個差價都算普通啦。 滑點之類嘅問題都冇特別出現。 最令人擔心嘅係,佢哋採用咗動態槓桿制度,即係根據交易量嚟調整槓桿比例。

中評

FX1825073414

日本

為咗開戶獎金而登記,但感覺都係一般般…冇特別好亦冇特別差。忠誠計劃又唔算特別出色,點差又唔算窄…要講值唔值得做主力用,我就有啲懷疑。另外聽講有啲人話出唔到錢,考慮埋呢點就更加…係咁上下啦。

中評

ナカみどり

日本

入金好順利。出金都冇問題,可以放心。

好評

FX8823628920

日本

開戶獎金5000日元到手!出金條件相對寬鬆,應該冇問題。

好評

Wingwing Ng

白俄羅斯

ERRANTE的最低存款與行業中的其他平台相當。他們的存款和提款過程簡單可靠,但沒有太多與其他經紀商有所不同的地方。

中評

Larance Chris

澳大利亞

外匯、商品和指數在這裡表現不錯。點差還可以,交易條件似乎整體上都不錯。ERRANTE很棒,我仍然在這裡交易外匯和指數。免費VPS也加快了交易執行速度,當我開設專業帳戶時,我可以使用它。正常的交易執行也非常好。

好評

Lilybrown

美國

ERRANTE,我的貿易船。受監管且多樣化的服務使其成為穩定的旅程。多個帳戶和可靠的平台增添了旅程。留意有限的監管範圍和潛在的槓桿風險。客製化帳戶的佣金費用令人驚訝,但總體而言,18 個月後感到滿意

中評

daniel1530

馬來西亞

我想再次曝光errante 我想调解不是要吵架但是客服都不能够理解 我相信如果交易商的老板知道这件事情他一定会帮忙我解决这个案例 我们哪里知道几时系统出错 系统问题也不是我们照成的 我只想协调拿回我应该拿的钱 不是小数目USD24000 亏了我们自己亏 赚了又是自己亏

爆料

amir9354

英國

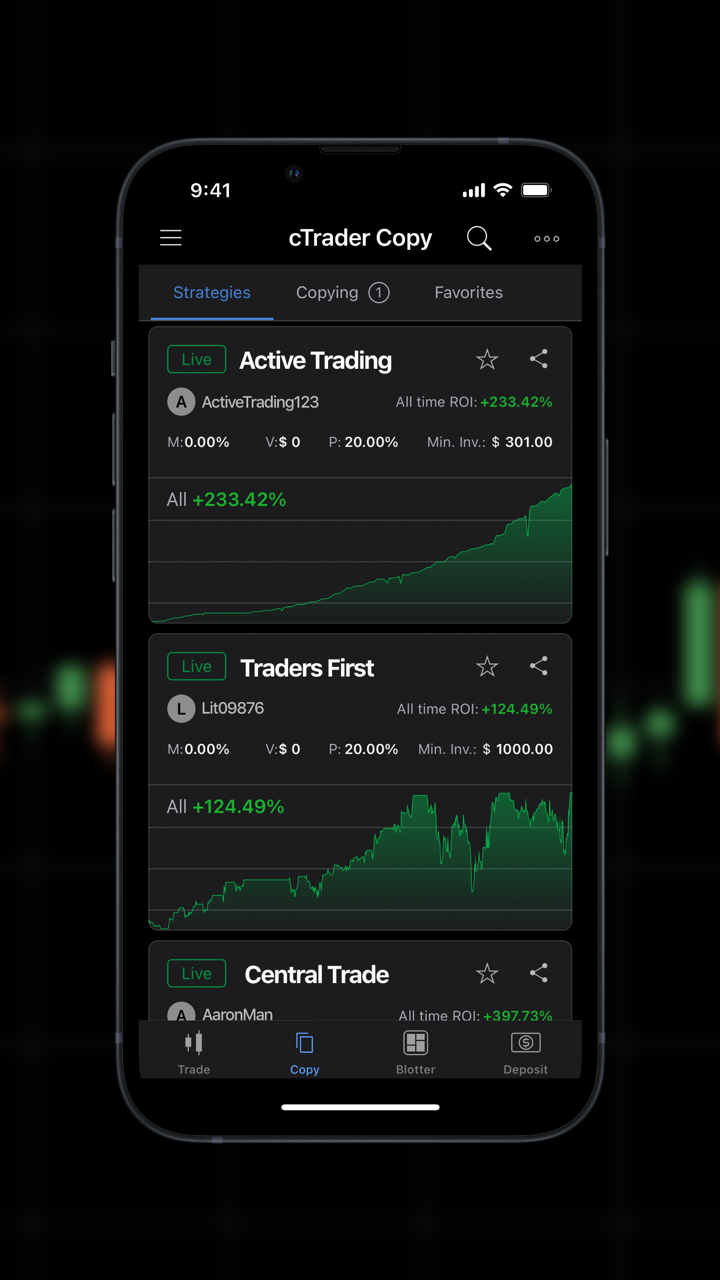

非常好的經紀人,出色的支持,提款很快就受到 cysec 監管。 Metatrader 4-5 和流行的 Ctrader 程序的完整許可證。公平的點差。僅在翻轉期間才會感覺到滑移。

好評

daniel1530

馬來西亞

我在Errante平台交易盈利了将近有24000USD,平台商说系统出错就把我所有账户封锁了,连我本金都不归还,不让我登录进去截图证据,客服&Facebook&Instagram也把我拉黑了,这是正规平台的操作吗?这么对待用户, 这间公司还强行关闭我的账号因为还有浮亏限定我20小时关单 这间公司系统不是出问题一次了 我跟了两年遇到到三次但是都是没有要承担后果 如果今天我的事件没有得到解决又会有下个交易员遇到同样问题 希望第三方人员能够处理好这件事情 现在我也遇到户口封锁所以证据还不止这些

爆料

daniel1530

馬來西亞

我盈利了但是公司自动扣除说系统问题报价出错 但是还是连续两天都开放给顾客交易理由是因为假日没有技术人员维修 但是有技术人员扣除顾客的盈利 我其他证据都要之前户口里 公司把我封锁到连户口都开不到 我两天盈利USD24000 希望这个平台可以帮忙我追究 我也担心自己说错话被告所以要求你们帮忙我解决

爆料

随缘化

美國

這真的很令人驚訝,但我以 1000 美元開始了一項投資,他們提供最好的服務,並且將客戶的最大利益放在心上。你可以親眼看看,你會著迷的。

中評

FX2409997059

巴西

我曾經合作過的最好的經紀人....出色的支持並滿足我們的所有要求......

好評

。94447

英國

該平台確實有良好的交易條件,但經常出現高滑點,高達 5 倍的點差。好吧,這似乎不是一個理想的交易平台......

中評

金鑫23788

哥倫比亞

大家好,我是wikifx用戶,最近看到這裡出現了一個版塊:評論。所以我來這裡是為了填補空白!好吧,我是一個流浪的顧客。這是一個很好的經紀人,因為它是安全的!您知道這些外匯經紀商每天犯下多少騙局嗎?好吧,流浪不是那樣的。這些條件,雖然不可能滿足每個人的需要,但對我來說是公平和有吸引力的。

好評

FX5179656533

香港

之前加了10美金的点差 想着刷返佣 结果今天发现账户返佣全部以佣金更正为由变成0了 交易账户的钱也被扣干净了 请问这种行为是什么样的一家平台才能干出来的事儿呢 请大家远离这种无良平台 mt4 3013708

爆料

Gustavo@Fring

馬來西亞

交易商Errante用客戶投資的錢付給銷售人員,還故意拖延時間,讓客戶賠錢。

爆料

Gustavo@Fring

馬來西亞

交易商Errante不允許用戶出金資金并限制他們訪問賬戶。Errante目前已收到5個用戶投訴。投訴基本涉及無法取款、異常交易、故意制造滑點、拿客戶錢給員工發工資等問題,6月份只解決了1個投訴,其余投訴Errante都沒有回應。

爆料

勉为其难

香港

直接封掉后台,佣金不给出,本金也不给出。金额3000美金。黑平台给黑吃黑了

爆料