Company Summary

| Manulife Review Summary | |

| Founded | 1897 |

| Registered Country/Region | China Hong Kong |

| Regulation | SFC |

| Market Instruments | Life protection, savings and retirement plans, health protection, MPF & ORSO, ManulifeMOVE, investment products, tax-deductible products, general insurance |

| Customer Support | 2108 1110, 2510 3941 |

Manulife Information

Manulife, established in 1897 and regulated by the SFC in Hong Kong, offers a comprehensive suite of financial solutions including life and health protection, savings and retirement plans, MPF & ORSO, investment products like mutual funds and ILAS, and tax-deductible options. They also provide the ManulifeMOVE wellness program and various payment methods for diverse client needs.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Manulife Legit?

Manulife has a “Dealing in futures contracts” license regulated by the Securities and Futures Commission (SFC) in China, Hong Kong, with a license number of ACP555.

Products and Services

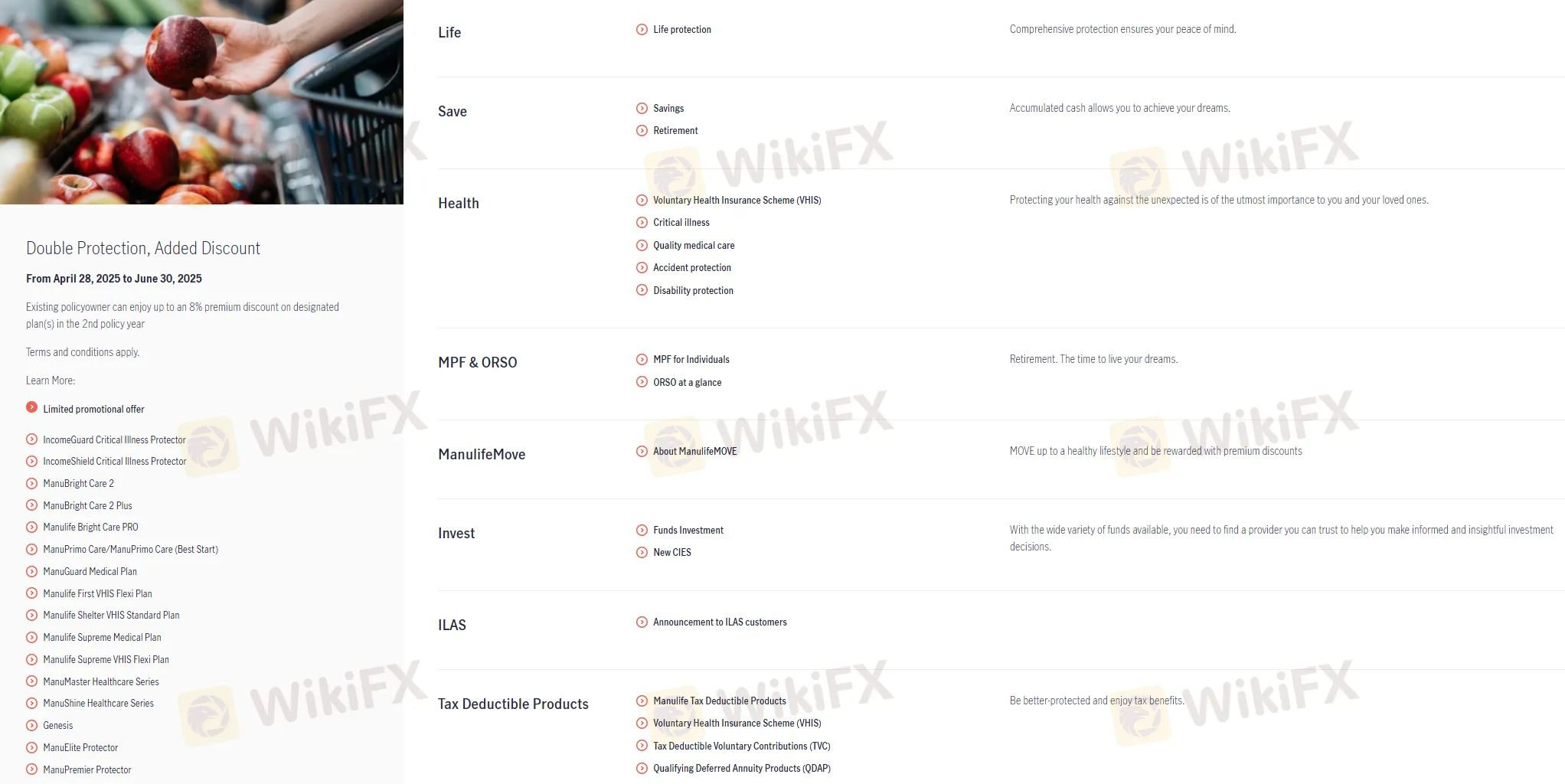

Manulife offers a comprehensive range of financial products and services:

- Life Protection: Manulife provides life insurance products that offer comprehensive protection, ensuring peace of mind for you and your loved ones.

- Savings and Retirement: Their savings and retirement plans help you accumulate cash over time, allowing you to achieve your dreams and enjoy a comfortable retirement.

- Health Protection: Manulife offers voluntary health insurance schemes (VHIS) and critical illness coverage. Their insurance plans include accident and disability protection, ensuring financial security in case of unexpected events.

- MPF & ORSO: Manulife offers Mandatory Provident Fund (MPF) services for individuals, as well as Occupational Retirement Schemes Ordinance (ORSO) options, helping you prepare for retirement and live your dreams.

- ManulifeMOVE: This program promotes a healthy lifestyle through physical activity tracking and rewards participants with premium discounts.

- Investment Products: Manulife offers mutual funds and Investment-linked Assurance Schemes (ILAS), providing opportunities for investment growth and financial freedom.

- Tax-Deductible Products: They offer various tax-deductible products, including VHIS, Tax-Deductible Voluntary Contributions (TVC), and Qualifying Deferred Annuity Products (QDAP), offering both protection and tax benefits.

- Other Services: Manulife also provides services like credit cards and general insurance, offering additional financial solutions to meet various needs, such as travel insurance and more.

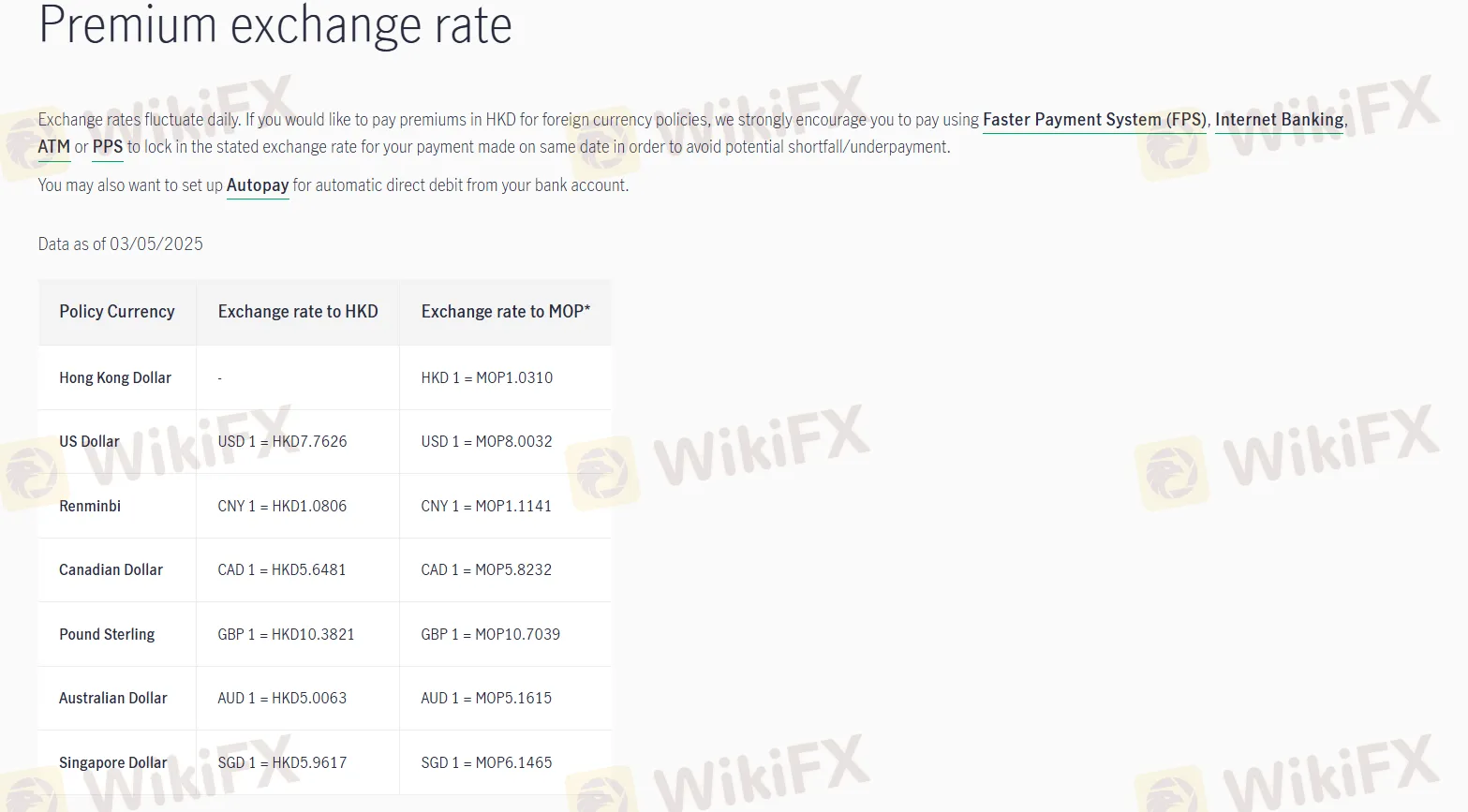

Exchange Rate

Manulife encourages using FPS, internet banking, ATM, or PPS for HKD premium payments on foreign currency policies to lock in the daily exchange rate and avoid potential underpayment. They also recommend setting up Autopay for automatic deductions. This data is current as of May 3, 2025.

| Policy Currency | Exchange rate to HKD | Exchange rate to MOP* |

| Hong Kong Dollar | - | HKD 1 = MOP 1.0310 |

| US Dollar | USD 1 = HKD 7.7626 | USD 1 = MOP 8.0032 |

| Renminbi | CNY 1 = HKD 1.0806 | CNY 1 = MOP 1.1141 |

| Canadian Dollar | CAD 1 = HKD 5.6481 | CAD 1 = MOP 5.8232 |

| Pound Sterling | GBP 1 = HKD 10.3821 | GBP 1 = MOP 10.7039 |

| Australian Dollar | AUD 1 = HKD 5.0063 | AUD 1 = MOP 5.1615 |

| Singapore Dollar | SGD 1 = HKD 5.9617 | SGD 1 = MOP 6.1465 |

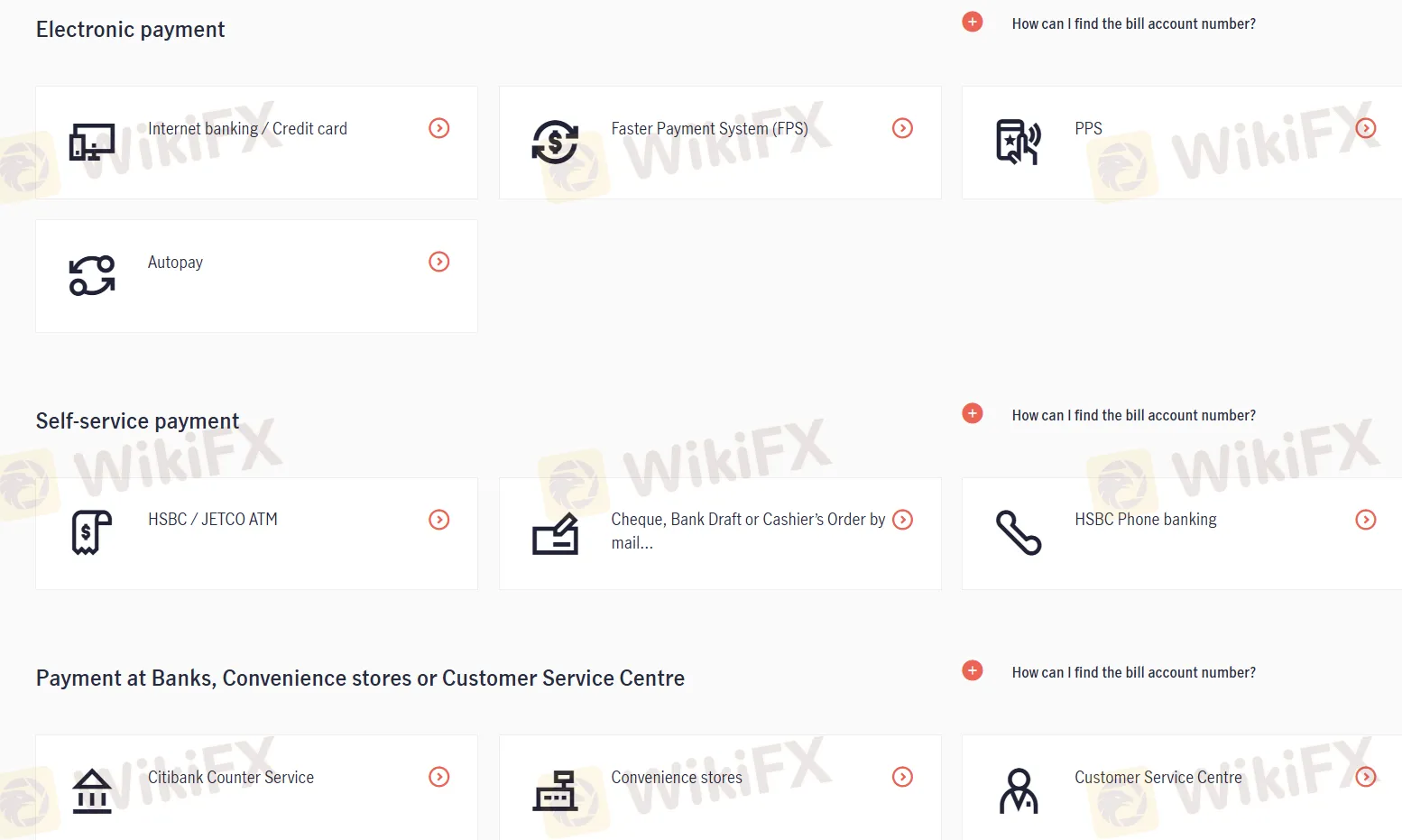

Payment Options

Manulife offers various payment methods: Electronic payment via internet banking/credit card, FPS, PPS, and Autopay; Self-service payment through HSBC/JETCO ATMs, mail-in cheques/bank drafts, and HSBC phone banking; and Payment at Banks, Convenience stores, or Customer Service Centres, including Citibank counters.