公司简介

| 宏利 评论摘要 | |

| 成立时间 | 1897年 |

| 注册国家/地区 | 中国香港 |

| 监管机构 | SFC |

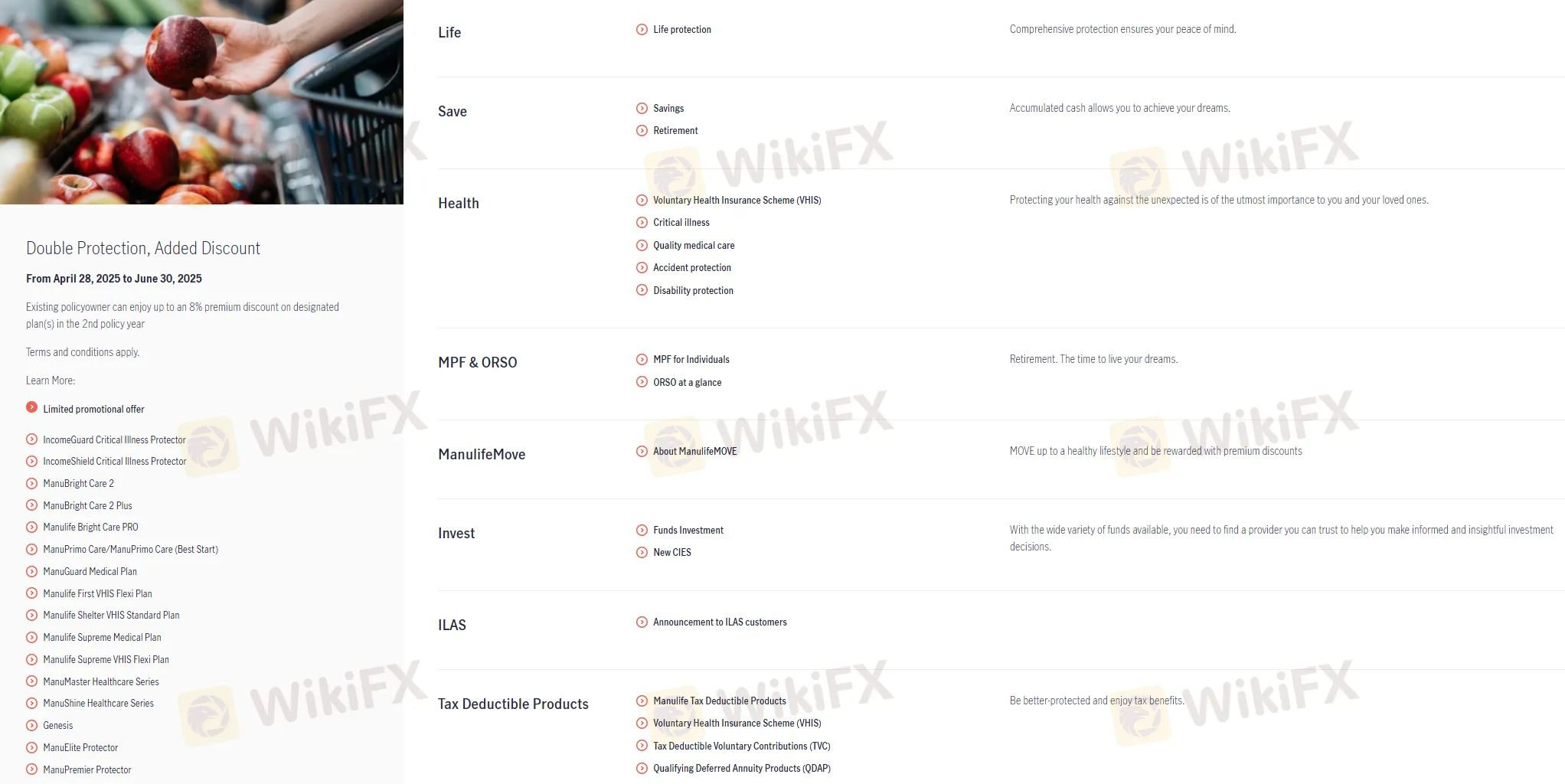

| 市场工具 | 寿险保障、储蓄和退休计划、健康保障、强制性公积金(MPF)和职业退休计划(ORSO)、宏利MOVE、投资产品、可抵税产品、综合保险 |

| 客户支持 | 2108 1110,2510 3941 |

宏利 信息

宏利成立于1897年,由香港SFC监管,提供包括寿险和健康保障、储蓄和退休计划、MPF和ORSO、类似共同基金和ILAS的投资产品以及可抵税选择在内的全面金融解决方案。他们还为不同客户需求提供宏利MOVE健康计划和各种支付方式。

优缺点

| 优点 | 缺点 |

|

|

|

|

宏利 是否合法?

宏利在中国香港由证监会(SFC)颁发“交易期货合同”许可证,许可证号为ACP555。

产品与服务

宏利提供全面的金融产品和服务:

- 寿险保障:宏利提供全面保障的寿险产品,确保您和您的亲人安心。

- 储蓄和退休:他们的储蓄和退休计划帮助您随着时间积累现金,让您实现梦想,享受舒适的退休生活。

- 健康保障:宏利提供自愿健康保险计划(VHIS)和重大疾病保障。他们的保险计划包括意外和伤残保障,确保在意外事件发生时有财务支持。

- MPF和ORSO:宏利为个人提供强制性公积金(MPF)服务,以及职业退休计划(ORSO)选项,帮助您为退休做准备,实现梦想。

- 宏利MOVE:该计划通过跟踪身体活动促进健康生活方式,并奖励参与者享受保费折扣。

- 投资产品:宏利提供共同基金和投资连结保险计划(ILAS),为投资增长和财务自由提供机会。

- 可抵税产品:他们提供各种可抵税产品,包括VHIS、可抵税自愿供款(TVC)和合格延期年金产品(QDAP),既提供保障又享受税收优惠。

- 其他服务:宏利还提供信用卡和综合保险等服务,为满足各种需求提供额外的金融解决方案,如旅行保险等。

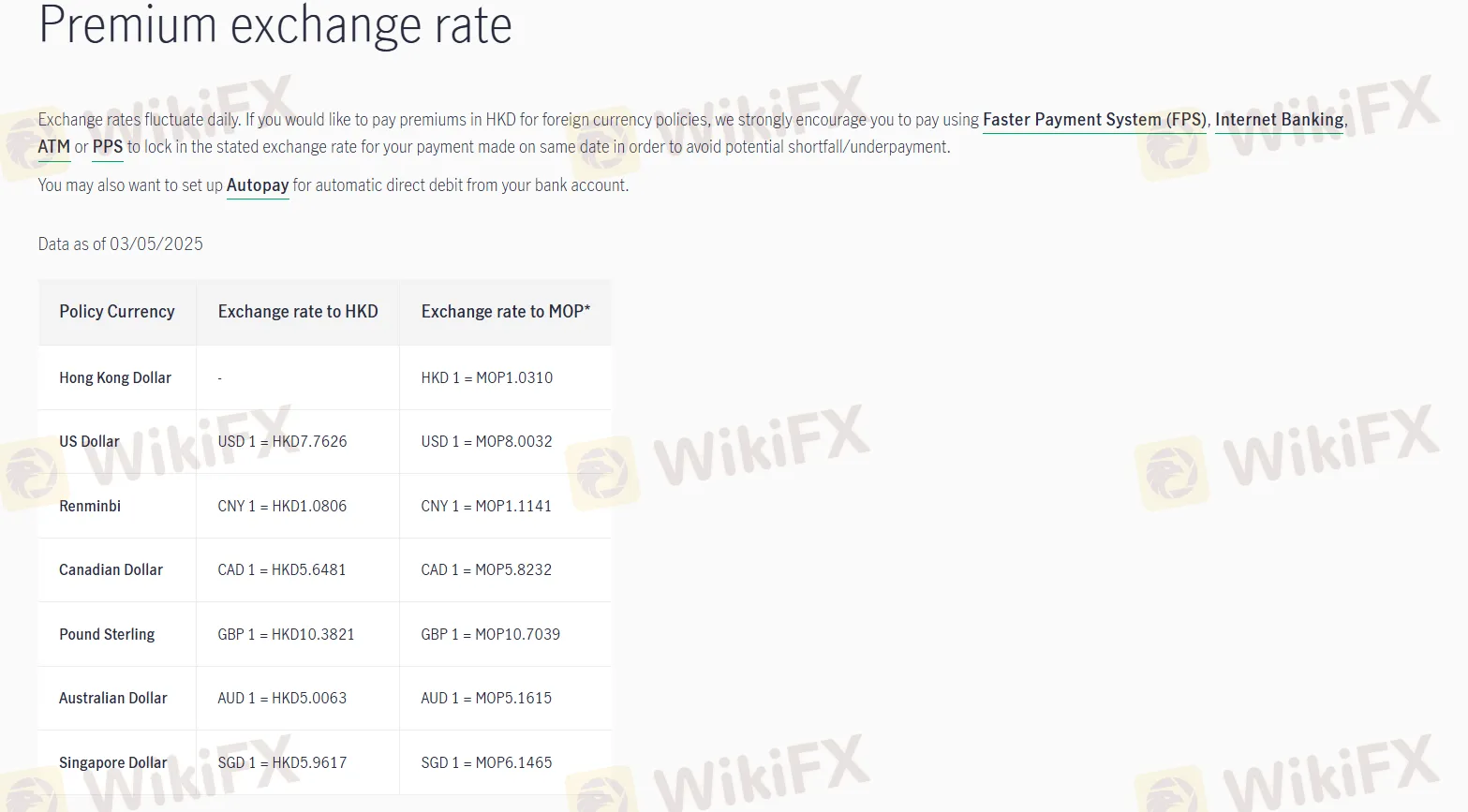

汇率

宏利 鼓励使用FPS、网上银行、ATM或PPS进行外币保单的港币保费支付,以锁定每日汇率并避免潜在的支付不足。他们还建议设置自动付款以进行自动扣款。此数据截至2025年5月3日。

| 保单货币 | 兑换至港币汇率 | 兑换至澳门币汇率* |

| 港币 | - | HKD 1 = MOP 1.0310 |

| 美元 | USD 1 = HKD 7.7626 | USD 1 = MOP 8.0032 |

| 人民币 | CNY 1 = HKD 1.0806 | CNY 1 = MOP 1.1141 |

| 加拿大元 | CAD 1 = HKD 5.6481 | CAD 1 = MOP 5.8232 |

| 英镑 | GBP 1 = HKD 10.3821 | GBP 1 = MOP 10.7039 |

| 澳大利亚元 | AUD 1 = HKD 5.0063 | AUD 1 = MOP 5.1615 |

| 新加坡元 | SGD 1 = HKD 5.9617 | SGD 1 = MOP 6.1465 |

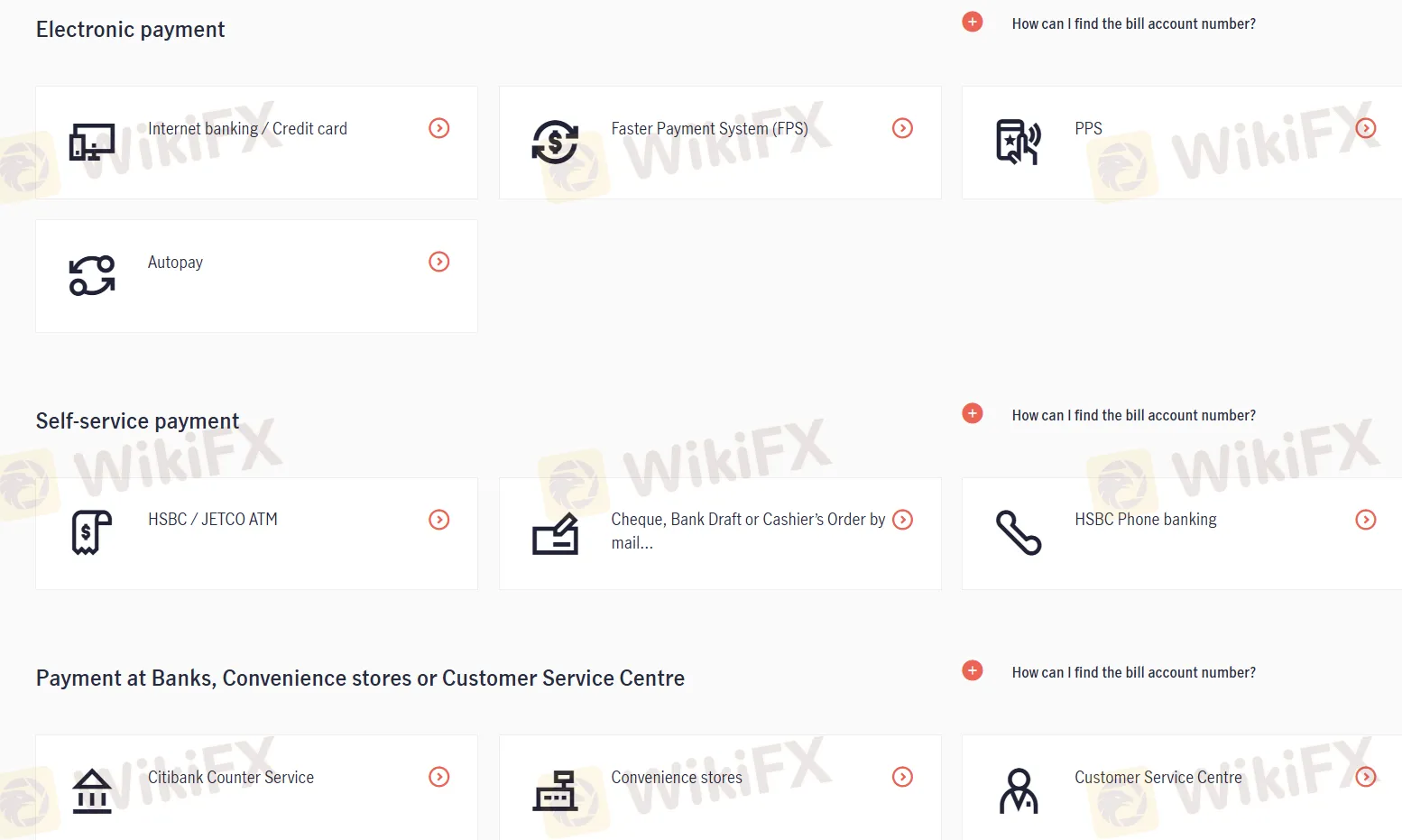

支付选项

宏利 提供各种支付方式:电子支付,包括网上银行/信用卡、FPS、PPS和Autopay;自助支付,通过汇丰银行/JETCO自动柜员机、邮寄支票/银行汇票和汇丰电话银行;以及在银行、便利店或客户服务中心支付,包括花旗银行柜台。