Company Summary

| CCB Futures Review Summary | |

| Founded | 2013 |

| Registered Country/Region | China |

| Regulation | CFFE (Regulated) |

| Market Instrument | Futures |

| Demo Account | ✅ |

| Trading Platform | Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Fast trading terminal, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, etc. |

| Customer Support | Live chat |

| Tel: 400-90-95533 | |

| Email: ptg@ccbfutures.com | |

CCB Futures Information

CCB Futures is a regulated broker, offering trading on futures on various trading platforms.

Pros and Cons

| Pros | Cons |

| Various trading platforms | Limited types of trading products |

| Regulated well | |

| Demo accountsavailable | |

| Live chat support |

Is CCB Futures Legit?

Yes. CCB Futures is licensed by CFFEX to offer services.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange (CFFEX) | Regulated | 建信期货有限责任公司 | Futures License | 0103 |

What Can I Trade on CCB Futures?

CCB Futures offers trading on futures.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

CCB Futures has not clearly provided the account types it offers, but it offers demo accounts for clients.

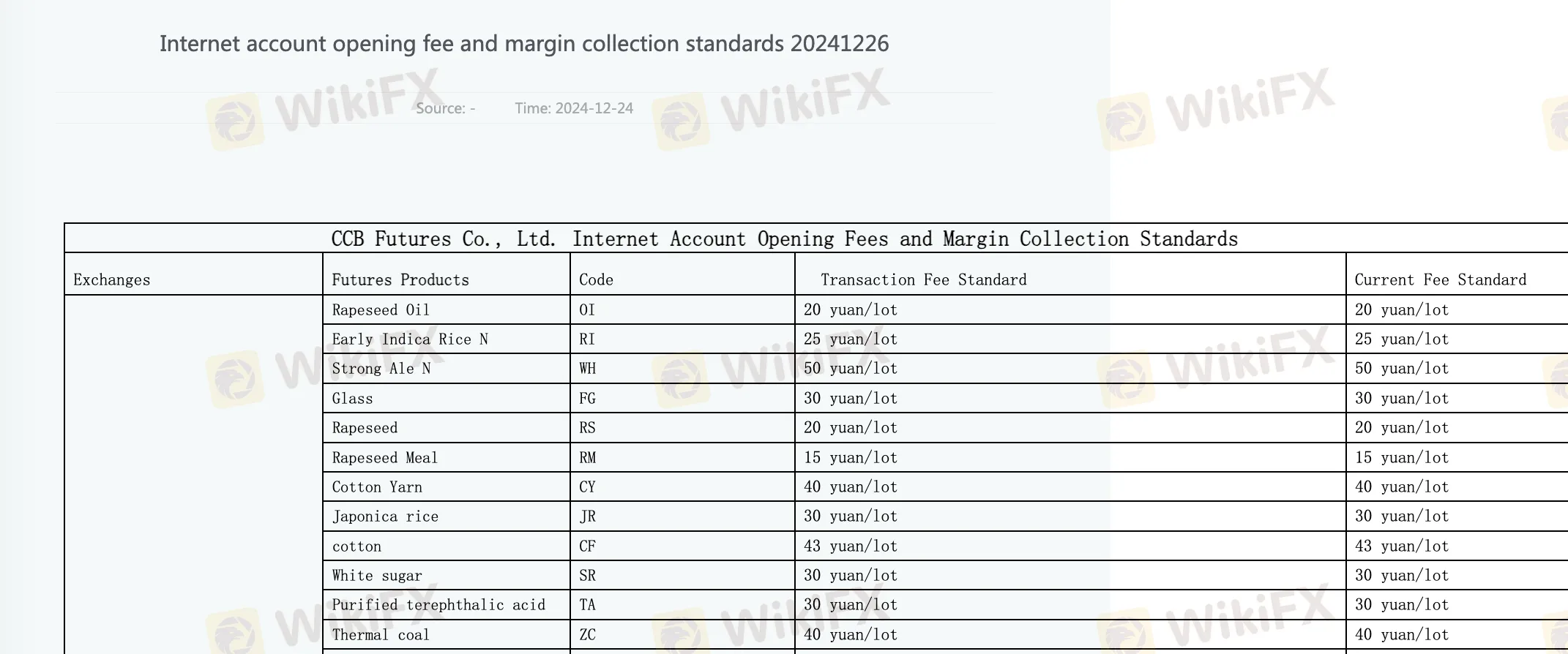

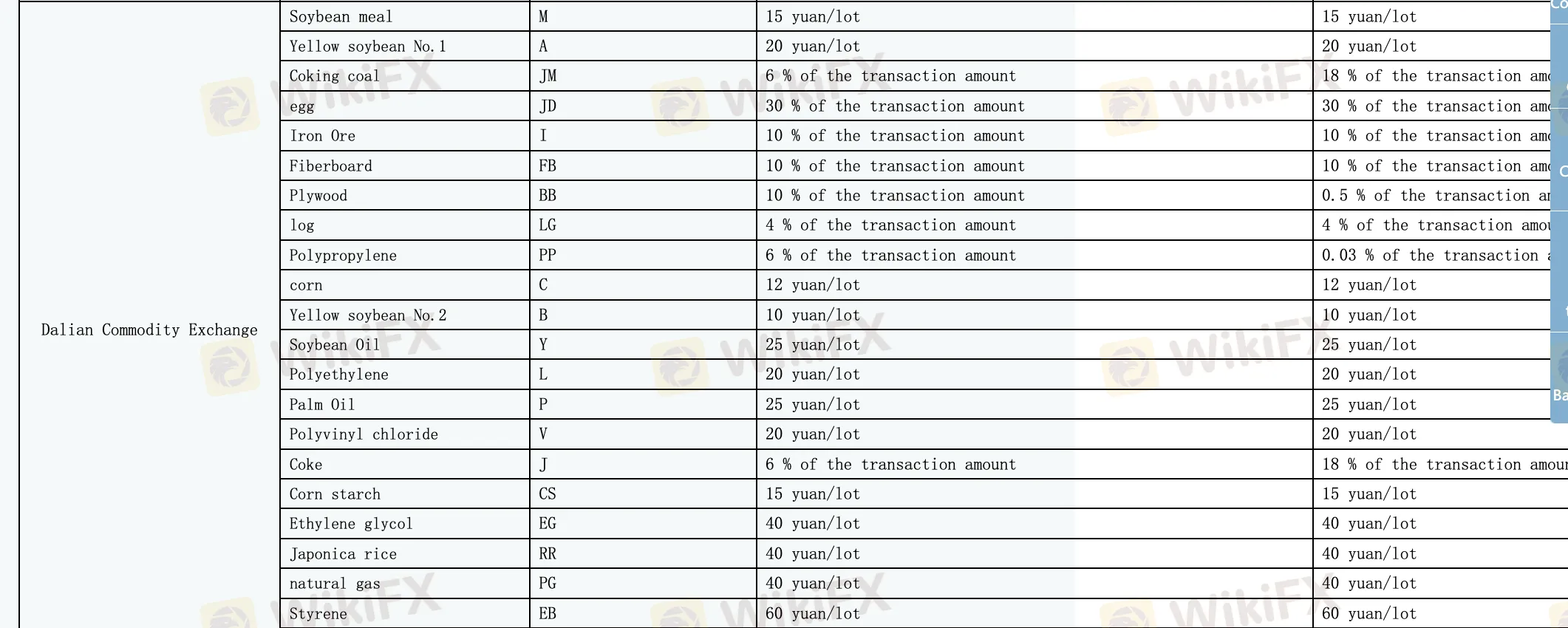

CCB Futures Fees

CCB Futures requires internet account opening fee, current fee and has margin collection standards.

| Futures Products | Current Fee Standard |

| Rapeseed oil | 20 yuan/lot |

| Cotton | 43 yuan/lot |

| Palm oil | 25 yuan/lot |

Trading Platform

The broker provides various trading platforms, including Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Fast trading terminal, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, Kuaiqi V3 Trading Terminal, Trading Pioneer, Pyramid Decision Trading System, Fast trading terminal-national secret version, Jianxin Futures App and Yisheng Yixing Mobile Trading Software.

Available devices: desktop and mobile.

Deposit and Withdrawal

During continuous trading time, clients can only deposit funds but not withdraw funds. No minimum deposit or withdrawal amount defined and no fees or charges specified.