Présentation de l'entreprise

| CCB Futures Résumé de l'examen | |

| Fondé | 2013 |

| Pays/Région Enregistré | Chine |

| Régulation | CFFE (Réglementé) |

| Instrument de Marché | Futures |

| Compte de Démo | ✅ |

| Plateforme de Trading | Logiciel de Trading Cloud Wenhua Winshun Version HD (wh6), Terminal de Trading Rapide, Infinite Easy (Édition Professionnelle Pro), Version PC Flush Futures, Boyi Master, Édition Futures Jianxin Polestar 9.5, Édition Futures Jianxin Polestar 9.3, etc. |

| Support Client | Chat en direct |

| Tél : 400-90-95533 | |

| Email : ptg@ccbfutures.com | |

Informations sur CCB Futures

CCB Futures est un courtier réglementé, offrant des transactions sur contrats à terme sur différentes plateformes de trading.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Diverses plateformes de trading | Types limités de produits de trading |

| Bien réglementé | |

| Comptes de démo disponibles | |

| Support par chat en direct |

CCB Futures est-il légitime ?

Oui. CCB Futures est autorisé par la CFFEX à fournir des services.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Bourse des contrats à terme financiers de Chine (CFFEX) | Réglementé | CCB Futures有限责任公司 | Licence Futures | 0103 |

Sur quoi puis-je trader sur CCB Futures ?

CCB Futures propose le trading sur les contrats à terme.

| Instruments négociables | Pris en charge |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Type de compte

CCB Futures n'a pas clairement indiqué les types de compte qu'il propose, mais il propose des comptes de démonstration pour les clients.

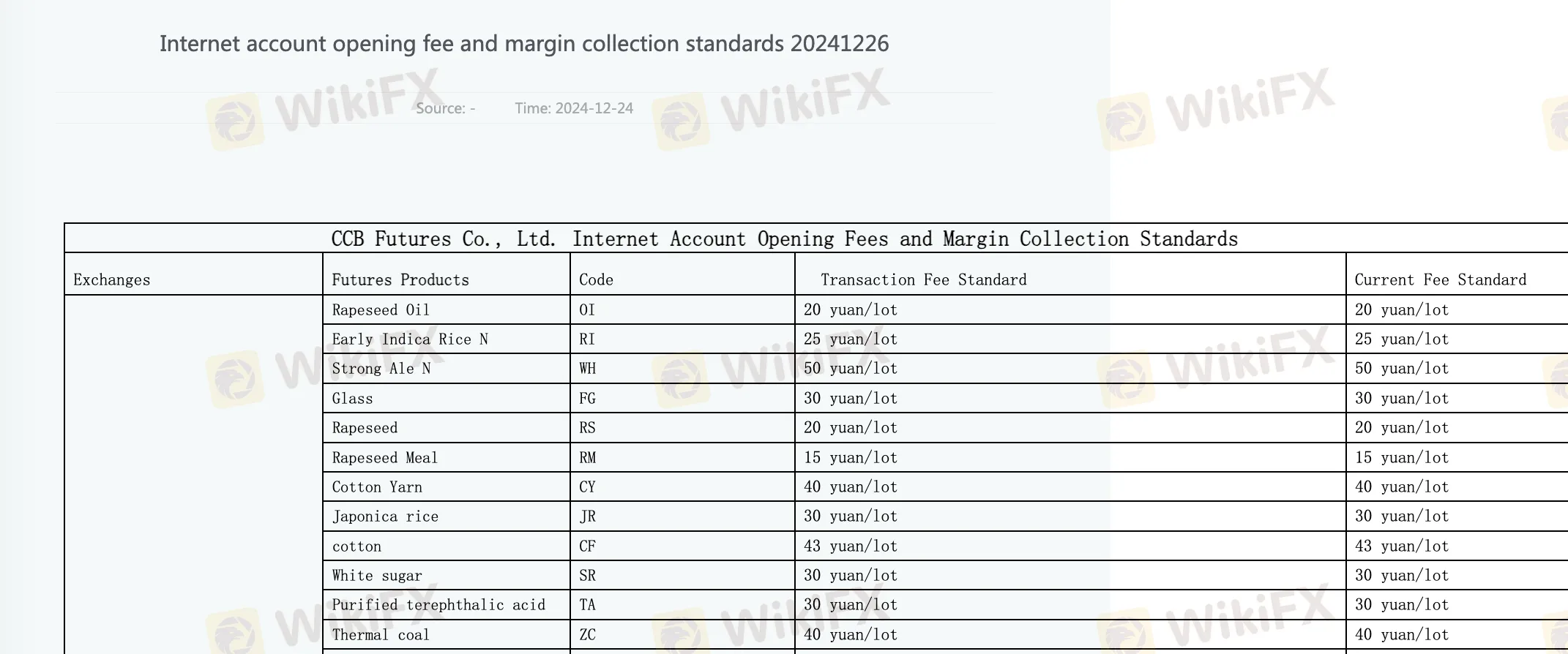

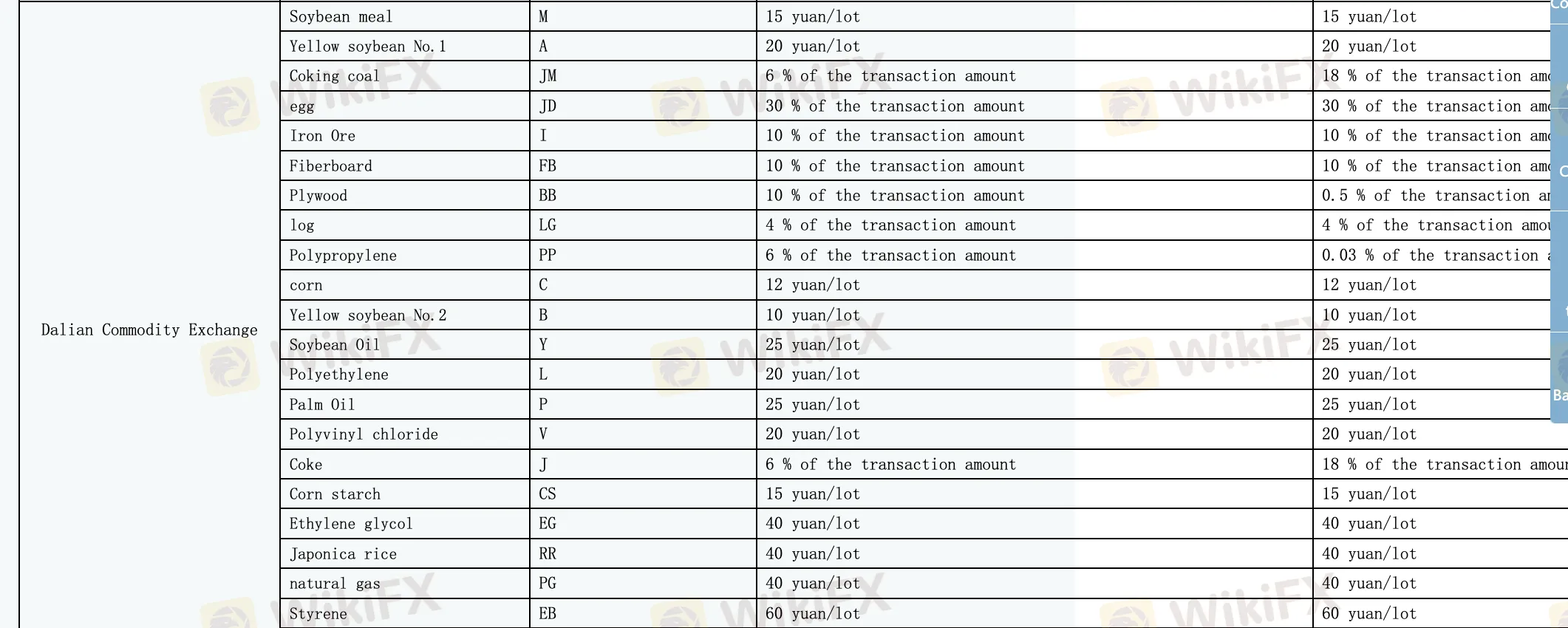

Frais de CCB Futures

CCB Futures exige des frais d'ouverture de compte sur internet, des frais actuels et des normes de collecte de marge.

| Produits à terme | Norme de frais actuelle |

| Huile de colza | 20 yuans/lot |

| Coton | 43 yuans/lot |

| Huile de palme | 25 yuans/lot |

Plateforme de trading

Le courtier propose diverses plateformes de trading, y compris Wenhua Winshun Cloud Market Trading Software HD Version (wh6), terminal de trading rapide, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, Kuaiqi V3 Trading Terminal, Trading Pioneer, Pyramid Decision Trading System, terminal de trading rapide version secrète nationale, application Jianxin Futures et logiciel de trading mobile Yisheng Yixing.

Dispositifs disponibles : ordinateur de bureau et mobile.

Dépôt et retrait

Pendant les heures de trading continues, les clients ne peuvent que déposer des fonds mais pas les retirer. Aucun montant minimum de dépôt ou de retrait défini et aucun frais spécifié.