Resumo da empresa

| CCB Futures Resumo da Revisão | |

| Fundação | 2013 |

| País/Região Registrada | China |

| Regulação | CFFE (Regulado) |

| Instrumento de Mercado | Futuros |

| Conta Demo | ✅ |

| Plataforma de Negociação | Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Terminal de negociação rápida, Infinite Easy (Edição Profissional Pro), Versão PC Flush Futures, Boyi Master, Polestar 9.5 Edição de Futuros Jianxin, Polestar 9.3 Edição de Futuros Jianxin, etc. |

| Suporte ao Cliente | Chat ao vivo |

| Tel: 400-90-95533 | |

| Email: ptg@ccbfutures.com | |

Informações sobre CCB Futures

CCB Futures é um corretor regulamentado, oferecendo negociação de futuros em várias plataformas de negociação.

Prós e Contras

| Prós | Contras |

| Várias plataformas de negociação | Tipos limitados de produtos de negociação |

| Bem regulamentado | |

| Contas demo disponíveis | |

| Suporte de chat ao vivo |

CCB Futures é Legítimo?

Sim. CCB Futures é licenciado pela CFFEX para oferecer serviços.

| País Regulamentado | Regulador | Status Atual | Entidade Regulamentada | Tipo de Licença | Número de Licença |

| Bolsa de Futuros Financeiros da China (CFFEX) | Regulado | CCB Futures有限责任公司 | Licença de Futuros | 0103 |

O Que Posso Negociar na CCB Futures?

CCB Futures oferece negociação de futuros.

| Instrumentos Negociáveis | Suportado |

| Futuros | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

Tipo de Conta

CCB Futures não forneceu claramente os tipos de conta que oferece, mas oferece contas demo para os clientes.

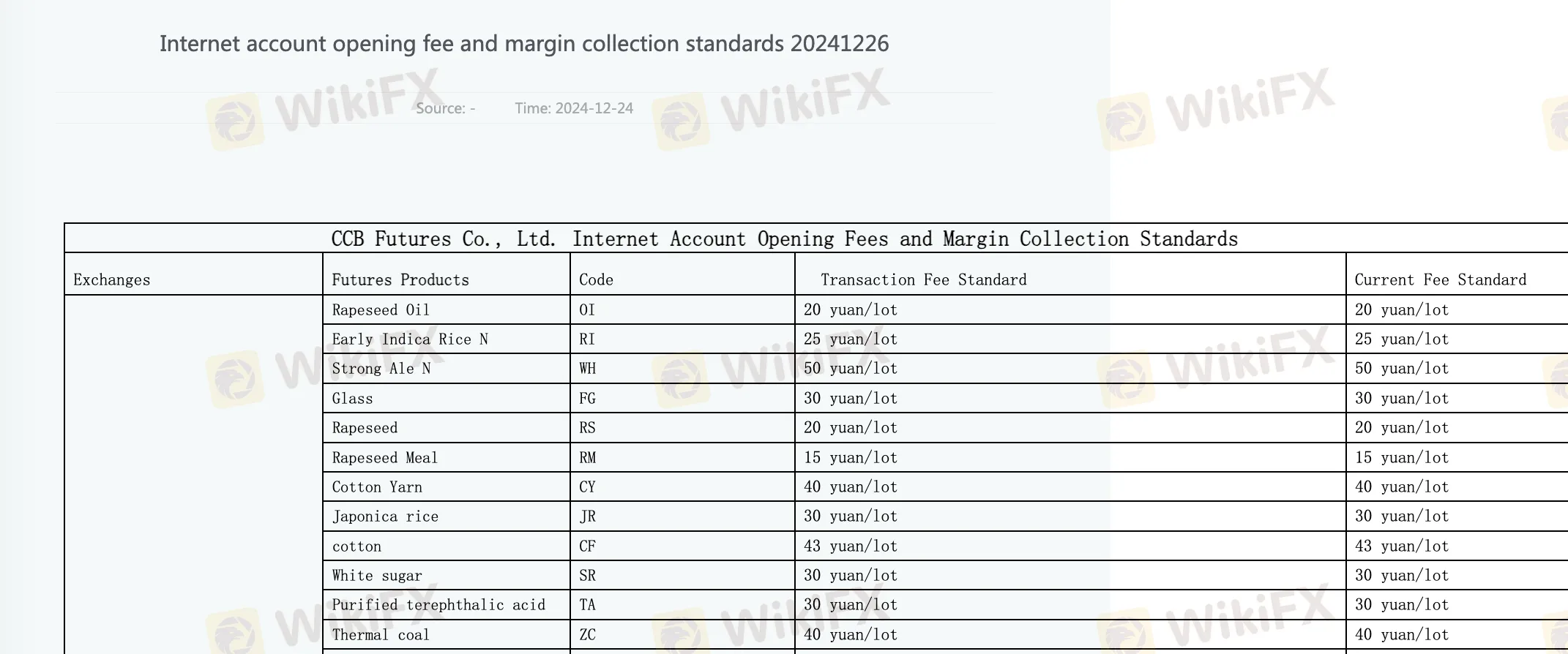

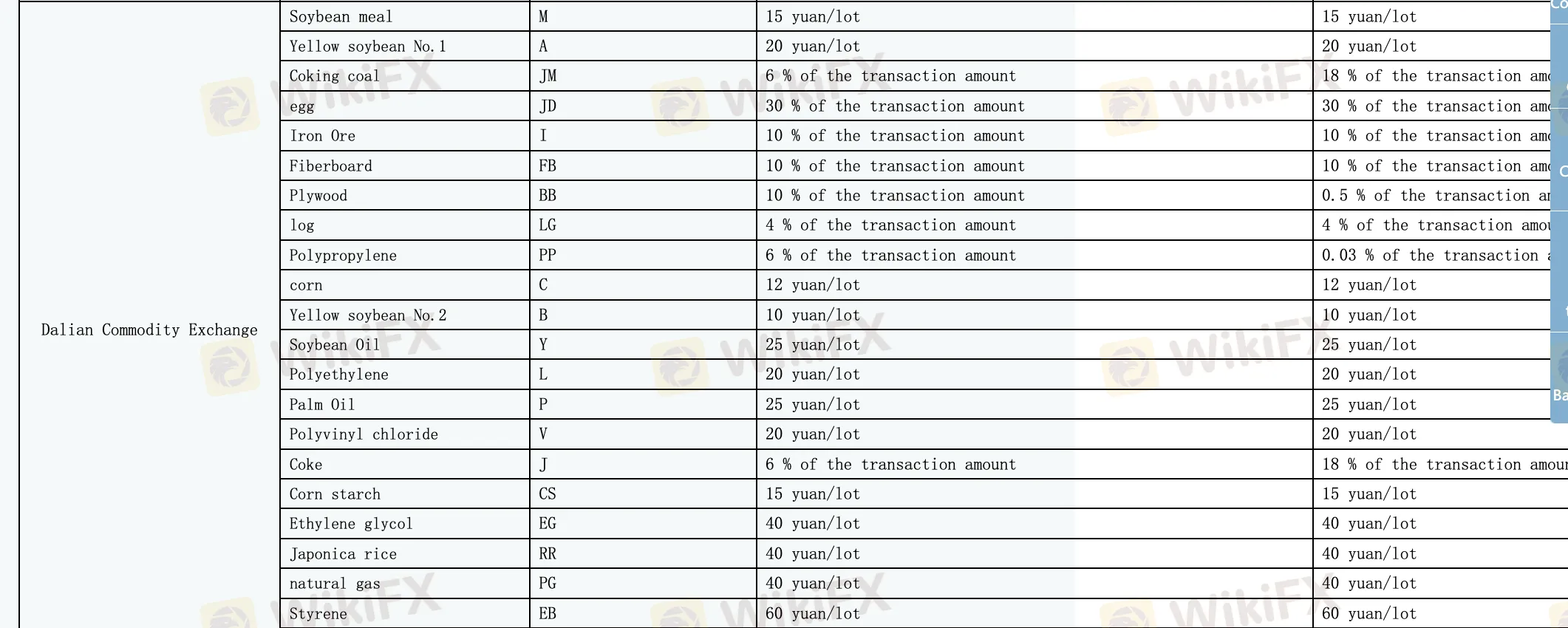

Taxas CCB Futures

CCB Futures requer taxa de abertura de conta pela internet, taxa atual e possui padrões de margem.

| Produtos Futuros | Padrão de Taxa Atual |

| Óleo de colza | 20 yuan/contrato |

| Algodão | 43 yuan/contrato |

| Óleo de palma | 25 yuan/contrato |

Plataforma de Negociação

A corretora oferece várias plataformas de negociação, incluindo Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Terminal de negociação rápida, Infinite Easy (Edição Profissional Pro), Flush Futures PC Version, Boyi Master, Polestar 9.5 Edição Jianxin Futures, Polestar 9.3 Edição Jianxin Futures, Terminal de Negociação Kuaiqi V3, Trading Pioneer, Sistema de Negociação de Decisão da Pirâmide, Terminal de negociação rápida versão nacional secreta, Aplicativo Jianxin Futures e Software de Negociação Móvel Yisheng Yixing.

Dispositivos disponíveis: desktop e móvel.

Depósito e Retirada

Durante o horário de negociação contínua, os clientes só podem depositar fundos, mas não retirar fundos. Não há valor mínimo definido para depósito ou retirada e não há taxas ou encargos especificados.