WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Is Jetvix a Forex scam? The unregulated status of SVGFSA and the lack of specific forex regulation cast doubt on its trustworthiness. Are traders at risk?

When it comes to the world of Forex trading, picking the right broker is crucial. A question that often comes up among traders is: Is Jetvix a dependable choice? This review delves deep into Jetvix's operations, focusing on its regulatory status and legitimacy, especially in the context of Saint Vincent and the Grenadines' laws on regulating Forex brokers.

Jetvix operates under Jet Corp LLC, headquartered in Ginger Village, Belmont, Kingstown, St. Vincent and the Grenadines. It boasts over 140 trading assets, aiming to cater to a wide range of traders. But, the big question is about its reliability.

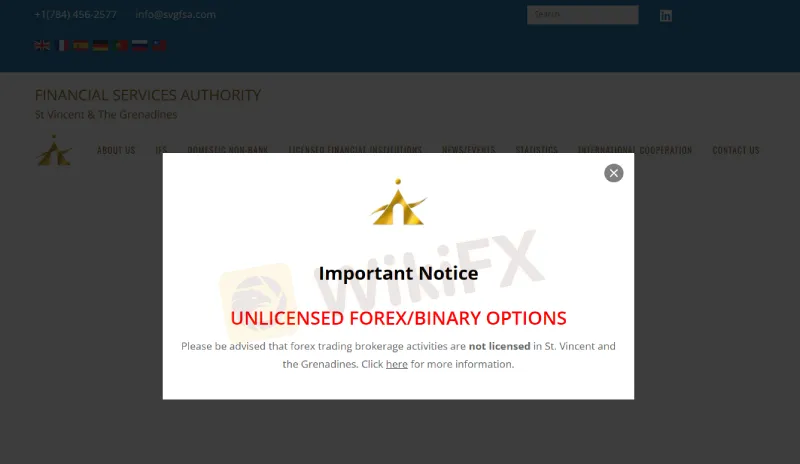

Understanding the regulatory environment is key. In Saint Vincent and the Grenadines, Forex brokers fall under a unique regulatory framework. Although Jetvix, as part of Jet Corp LLC, is a registered entity in the SVGFSA, this doesn't automatically translate to being a regulated Forex broker. According to a 2021 announcement, Saint Vincent and the Grenadines do not specifically regulate financial trading businesses, including Forex, binary options, and cryptocurrency trading.

In Saint Vincent and the Grenadines, LLCs like Jet Corp LLC can be set up quickly (within 24 hours) and are allowed to conduct legal business activities. They need to have a Registered Agent in SVG and declare the nature of their intended business. However, being an LLC doesn't grant them the license to operate a regulated Forex trading business.

The big dilemma: can Jetvix be trusted? The answer isn't straightforward. While it's a legally registered company, its unregulated status in the realm of Forex trading raises questions. This means that while they can conduct other financial businesses, they aren't authorized for Forex trading under SVGFSA law. This gap in regulation may concern traders looking for a secure and regulated trading environment.

Choosing a Forex broker is a significant decision. While Jetvix operates legally as an LLC, its lack of specific regulation in Forex trading under SVG law is a crucial factor to consider. Traders should weigh the importance of regulatory oversight in their decision-making process and consider the potential risks associated with trading with an unregulated broker. Always remember, being informed is your first defense against potential scams in the complex world of Forex trading.

To know more about Jetvix and make an informed decision, click the following CTA: https://www.wikifx.com/en/dealer/3143950073.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.