简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

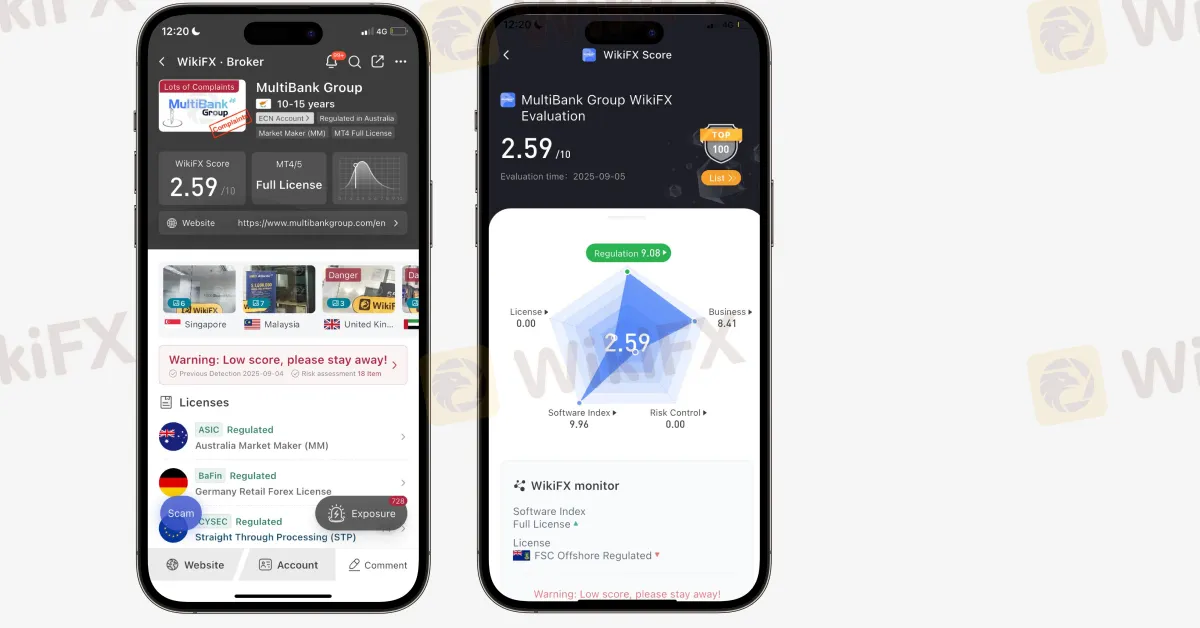

MultiBank Group: Accumulates 728 Scam Complaints

Abstract:MultiBank Group presents itself as a global powerhouse in derivatives, CFDs, and Forex, with a presence in several countries, thousands of instruments, and "up to 16 regulatory licenses." The showcase is impeccable: polished websites, social media campaigns, influencers, and promotional prizes. But the experience of those who have actually traded with the group tells a different story. The document analyzed gathers hundreds of complaints from customers in different countries, culminating in 728 complaints—most involving withdrawal issues, account blocking, bonuses that block withdrawals, and regulatory opacity. These elements, combined, pose a high risk for Forex investors seeking a reliable broker. Throughout this article, we expose the critical points raised in the complaints and explain, in a practical way, how to recognize and avoid the pitfalls of unreliable brokers.

Introduction: the mask of a “global giant”

MultiBank Group presents itself as a global powerhouse in derivatives, CFDs, and Forex , with a presence in several countries, thousands of instruments, and “up to 16 regulatory licenses .” The showcase is impeccable: polished websites, social media campaigns, influencers, and promotional prizes.

But the experience of those who actually traded with the group tells a different story. The document analyzed gathers hundreds of complaints from customers in different countries, culminating in 728 complaints —most involving withdrawal issues , account blocking , bonuses that block withdrawals , and regulatory opacity . These elements, combined, pose a high risk for Forex investors seeking a reliable broker.

Throughout this article, we expose the critical points raised in the complaints and explain, in a practical way, how to recognize and avoid the traps of untrustworthy brokers .

How MultiBank Group Earns Trust (and Where Risks Begin)

MultiBank Group 's commercial strategy follows a script known among high-risk brokers :

· Aggressive marketing with emphasis on “global” reputation, supposed awards and partnerships .

· Offering high leverage (often 1:500 or more), attracting less experienced profiles.

· Deposit bonuses and “exclusive benefits” that seem irresistible, but impose clauses that, in the end, make withdrawals difficult .

· Regional campaigns (LatAm and Asia) with local agents, creating a sense of proximity and trust.

The problem arises when the user experience doesn't match the hype. Reports of platform crashes , endless document requests during withdrawals, changes to terms without notice, and diffuse responsibilities among sister companies (or companies with very similar names) in offshore jurisdictions are multiplying . All of this increases the information asymmetry against the customer and creates a maze of recovering funds .

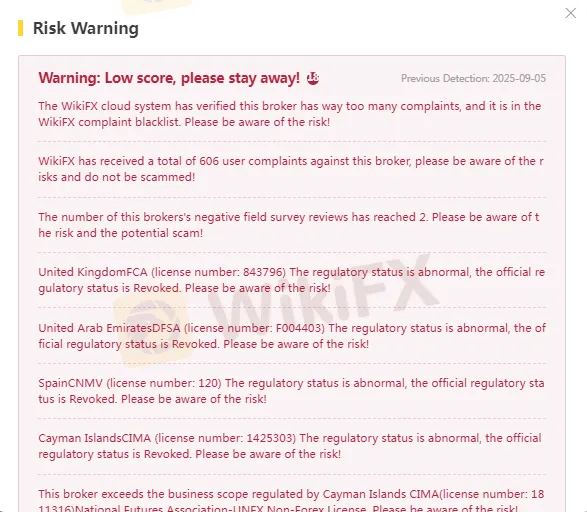

“Strong Regulation”? The Myth Debunked in Practice

MultiBank Group 's recurring promise is that it holds “multiple licenses from top-tier regulators.” In practice, what we find is:

· Licenses that do not cover all activities claimed in marketing.

· Old registrations that have already been revoked , suspended or limited .

· Intensive use of offshore jurisdictions (e.g. Vanuatu, BVI ) that do not offer clients robust compensation mechanisms or effective oversight .

· Fragmented corporate structure : multiple companies, similar names, different headquarters — which makes it difficult to hold accountable in disputes.

For traders, this means legal uncertainty . If there's a dispute, where and against whom will you sue? The local broker that served you is rarely the same entity listed in the main contract. And when a regulator exists, it often doesn't cover Forex/CFDs for clients outside the jurisdiction.

Revoked licenses, offshore entities, and corporate confusion

The most frequently repeated warning signs in the dossier include:

· Licenses revoked by major regulators (landmark cases in respected jurisdictions).

· Public alerts from market authorities in European countries against domains and entities linked to the group.

· Frequent changes of “registered” domains, brands and addresses .

· Dependence on offshore entities to serve international clients.

This combination creates a high operational risk scenario . Even if an entity X in the group appears to have an active license , it 's not guaranteed to be responsible for holding your balance . In many situations, the operation is redirected to a sister company with less oversight—and it's precisely in this regulatory vacuum that withdrawal freezes and unilateral rule changes occur .

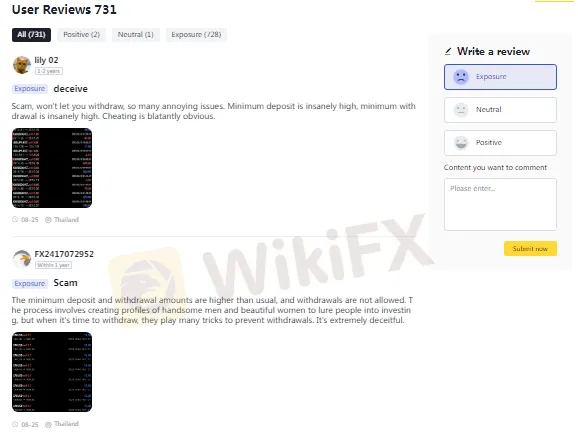

Recurring complaints: blocked withdrawals, abusive demands and missing history

Customer complaints, repeated across different countries, follow a pattern :

· Withdrawals blocked or “under analysis” for weeks/months , without reasonable justification.

· Documentary requirements that are renewed with each attempt (proof of residence, source of funds, selfies with documents, etc.).

· “Generous” bonuses that hide minimum volume and restrictive conditions , blocking withdrawals.

· Disappearance of history or retroactive change of operation reports .

· Evasive service : generic responses, constant changes of attendant and absence of SLA .

None of these elements, taken alone, proves fraud. Together , however, they paint a picture of a typical problematic brokerage , especially when the regulatory framework is weak and unclear —as in the case of MultiBank Group .

Cases and patterns: what the complaints have in common

When comparing reports, clear patterns emerge :

1. Aggressive communication when collecting, bureaucratic when withdrawing.

2. Promise of “institutional” spreads and execution , but slippage and requotes at critical moments.

3. Transfer of responsibility between group units.

4. 24/5 support is only in words; in practice, gaps that delay or make solutions unfeasible.

These patterns are classic red flags for high-risk brokers . For those who trade Forex with disciplined risk management , operational unpredictability is as dangerous as market volatility.

Regulatory Landscape: Why the Risk Score is so Low

The document compiles regulatory alerts and documentary inconsistencies that help explain the group's poor reliability rating from independent evaluators. The decisive factors:

· History of revocations/suspensions in key jurisdictions.

· Conflicts between what is advertising and what is, in fact, authorized .

· Corporate structure that dilutes responsibilities.

· High volume of withdrawal and service complaints .

For investors, the message is unequivocal: without a solid and transparent regulatory framework, there is no security — especially when operations are cross-border (client in one country, entity in another, server in a third).

Latin America and Brazil on the radar: why you are being targeted

MultiBank Group has a clear commercial priority in Latin America . The reasons are well known:

· Expanding market , with many new traders .

· Low average financial education , which increases the effectiveness of marketing.

· Less oversight for cross-border digital offerings .

In Brazil , the lack of local registration to offer derivatives/Forex to retailers is already a warning sign . If something goes wrong, the CVM and the Central Bank won't be able to compensate you —and you'll have to file lawsuits abroad, facing high costs , language barriers , and jurisdictional uncertainty . In other words, legal risk skyrockets .

Real risks to your capital: what's at stake

When operating with MultiBank Group , you may be exposed to:

· Total loss of capital due to blocked withdrawals .

· High counterparty risk , without clear segregation of funds or netting schemes .

· Bonus practices that trap the customer.

· Abnormal slippage and requotes that distort your risk management strategy .

· Dependence on offshore entities , outside the effective reach of first-line regulators .

For a disciplined trader , all these points dismantle the basic premise of professional Forex : risk control + operational predictability .

How to protect yourself: step-by-step anti-fraud checklist

Before depositing any amount :

1. Check the actual license

· Look for the license number on the broker's website.

· Check the license directly on the regulator 's website ( FCA , ASIC , BaFin , CySEC , NFA /CFTC).

· Confirm that the entity that will hold your balance is exactly the licensed one.

2. Avoid offshore entities for primary accounts

· If there's an “offshore vs. top-tier” option, go with the top-tier — even if the spread is a little higher.

3. Withdrawal test

· Deposit a small amount , operate, request withdrawal . If it gets stuck, abandon it .

4. Avoid bonuses

Bonuses block withdrawals . Refuse them. It's a trap to increase retention time and volume .

5. Read reviews and complaints

· Consult independent platforms (like WikiFX ) to see recent complaints and risk scores .

6. Document everything

· Save screenshots , emails , terms and receipts . In a dispute, proof is your best weapon .

7. Risk management first

If the broker adds operational risk to your strategy, it is useless — no matter how good the spread is.

What to do if you already have an account (or money stuck)

If you are already exposed to MultiBank Group :

1. Stop depositing immediately.

2. Request a partial test withdrawal.

3. If there is a blockage , request a written justification and deadline .

4. Submit a formal complaint to the company's Customer Service Department and keep the protocol .

5. File a complaint on independent platforms (WikiFX) and, if applicable, with the regulator of the entity responsible for your contract .

6. Evaluate legal action with a lawyer specializing in international disputes and digital assets/CFDs .

7. Never give in to “additional deposits” required to “unlock withdrawals.” This is a pressure technique to increase your losses .

Conclusion: is it worth taking this risk?

MultiBank Group has built a discourse of authority that doesn't hold up in the face of mounting complaints , regulatory inconsistencies , and documented operational opacity . In Forex , where every pip matters, predictability and compliance aren't “extras”: they're survival conditions .

For Brazilian investors , the assessment is straightforward: the risks far outweigh any promise of return . There are sufficient regulated brokers in top -tier jurisdictions to avoid the legal hassles of fragmented , offshore corporate structures with a history of complaints .

WikiFX Recommendation: Before opening an account, check the broker on WikiFX , confirm licenses on the regulators' website , refuse bonuses , and test withdrawals with a low amount. Trust is proven in withdrawals , not in promises.

Strategic keywords for SEO

MultiBank Group , Forex fraud , MultiBank complaints , blocked withdrawals , unregulated broker , revoked licenses , offshore entities , 1:500 leverage , bonuses that block withdrawals , low risk score , check WikiFX broker , high-risk CFDs , Forex investor protection , FCA ASIC BaFin CySEC regulation , Forex Brazil , how to avoid Forex scams , broker due diligence , requotes and slippage , regulatory conflicts , investor alert .

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

WikiFX Wishes You a Happy International Women's Day

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Oil prices jump above $100 for first time in four years

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Currency Calculator