简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Axi Review: A Data-Driven Analysis for Experienced Traders

Abstract:In the competitive landscape of forex and CFD brokerage, Axi has carved out a significant presence over its 15+ years of operation. Established in 2007, the Australian-born broker has expanded globally, attracting traders with promises of tight spreads, fast execution, and a robust regulatory umbrella. But for the discerning trader, the decision to commit to a broker for the long term goes beyond marketing claims. It requires a deep dive into the company's operational integrity, trading environment, and the real-world experiences of its clients.

In the competitive landscape of forex and CFD brokerage, Axi has carved out a significant presence over its 15+ years of operation. Established in 2007, the Australian-born broker has expanded globally, attracting traders with promises of tight spreads, fast execution, and a robust regulatory umbrella. But for the discerning trader, the decision to commit to a broker for the long term goes beyond marketing claims. It requires a deep dive into the company's operational integrity, trading environment, and the real-world experiences of its clients.

This comprehensive Axi review is designed for experienced traders evaluating whether this broker meets the high standards required for sustained trading. Drawing primarily on verified data from the global broker inquiry platform WikiFX, supplemented by public information, we will dissect Axis regulatory standing, execution quality, cost structure, and the critical user feedback that paints a complete picture of its strengths and weaknesses.

Axi at a Glance: Company Background and Market Standing

Axi, formerly known as AxiTrader, began its journey in Australia and has since grown into a multinational firm with a client base reportedly exceeding 60,000 traders across more than 100 countries. Its longevity, with an operational history spanning between 15 and 20 years according to WikiFX data, is a testament to its ability to navigate the evolving financial markets.

WikiFX assigns Axi a strong overall score of 8.27 out of 10. This score is a composite measure reflecting the broker's regulatory licensing, business practices, risk management, software quality, and influence. A score in this range places Axi in the upper echelon of brokers, suggesting a generally reliable and well-regarded operation. The broker's “Influence” index is rated AA, even reaching the number one spot in Spain, indicating a powerful brand presence and significant market penetration in specific regions.

However, a high score doesn't tell the whole story. A crucial alert from WikiFX notes that the score has been reduced due to a significant number of user complaints, a critical point we will explore in detail later in this review.

Regulatory Framework and Trader Safety

For any serious trader, a broker's regulatory credentials are non-negotiable. Axi operates through several corporate entities, each licensed in a different jurisdiction. This multi-jurisdictional approach offers traders choices but also necessitates a clear understanding of the protections afforded by each regulator.

Axis regulatory portfolio includes licenses from some of the world's most respected financial authorities:

• Australian Securities & Investments Commission (ASIC): As an Australian-founded broker, Axi is regulated by ASIC (AFSL no. 318232). ASIC is a top-tier regulator known for its stringent oversight and focus on client protection.

• Financial Conduct Authority (FCA): In the United Kingdom, Axi is authorized and regulated by the FCA (FRN 509746). The FCA is another world-leading regulator, providing a high degree of security. Clients under the FCA-regulated entity are typically protected by the Financial Services Compensation Scheme (FSCS), which can cover deposits up to £85,000 in the event of broker insolvency.

• Other Regulated Entities: Public sources indicate Axi also holds licenses from the Cyprus Securities and Exchange Commission (CySEC) for its European operations and the Dubai Financial Services Authority (DFSA) for its presence in the Middle East.

While these top-tier licenses provide a strong foundation of trust, it is crucial to note that Axi's international operations are handled by AxiTrader LLC, a company registered in St. Vincent and the Grenadines (SVG). The Financial Services Authority (FSA) of SVG does not regulate forex brokers in the same stringent manner as ASIC or the FCA. This entity typically offers higher leverage and more flexible account terms but comes with significantly lower regulatory protection and no access to investor compensation funds. Traders must be aware of which entity they are signing up with, as their legal protections will vary dramatically.

WikiFX has not only verified Axi's primary licenses but has also conducted successful on-site surveys of its offices in Australia and Hong Kong, lending physical verification to its operational claims. Traders seeking to verify Axis current regulatory status across its different entities can consult the global broker inquiry app, WikiFX, for detailed license information and operational history.

The Duality of User Experience: Complaints vs. Praise

Perhaps the most complex aspect of this Axi broker review for traders is reconciling its strong regulatory profile with the volume of user complaints. WikiFX issues a clear risk alert: “WikiFX has received a total of 16 user complaints against this broker, please be aware of the risks and do not be scammed!” This warning is prominently displayed and indicates a recurring pattern of negative client experiences.

An analysis of the “Exposure” section on WikiFX reveals several concerning themes in the negative feedback:

• Fund and Account Issues: One user from Brazil claims a deposit was not credited to their MT4 account after they had been profitable and made a withdrawal, leading to a negative balance. They label the broker a “scam” for profitable traders.

• Security Vulnerabilities: A trader from the Philippines reports their funds were “stolen” twice. After a three-month investigation, Axi allegedly refused to refund the amount, raising questions about account security protocols.

• Bonus and Rebate Disputes: A Japanese trader describes an issue where a negative balance resulting from a bonus-related trade was not zeroed out correctly, causing their auto-rebate to be nullified.

These are not trivial complaints about spread widening or platform glitches; they touch upon the core functions of fund safety, deposit integrity, and fair dealing.

Conversely, the same platform features a significant number of positive reviews that praise Axi for its core trading services:

• Execution and Reliability: Multiple users highlight the “lightning-fast execution,” “clean execution during news,” and absence of platform freezes. This aligns with the broker's technical data.

• Transparency and Costs: A trader notes the clarity of Axi's fee structure, stating that spreads, commissions, and swaps are clear upfront, a stark contrast to previous experiences with hidden fees.

• Withdrawal Process: A user commends the “fast withdrawals, no unnecessary questions,” which is a hallmark of a well-run brokerage.

This stark contrast suggests two possibilities: either a minority of users are experiencing severe issues that are not representative of the majority, or the quality of service and problem resolution is inconsistent. For a prospective client, this duality is a significant risk factor that must be weighed against the broker's other strengths.

Trading Environment and Execution Quality

For active traders, execution quality is paramount. This is an area where Axi demonstrably excels, according to technical data collected by WikiFX. The broker's trading environment receives an excellent “AA” rating, supported by impressive underlying metrics:

• Transaction Speed: Rated “AAA,” with an average transaction speed of just 256.3 milliseconds. This rapid execution is crucial for minimizing slippage and ensuring orders are filled at or near the expected price, especially for scalpers and algorithmic traders.

• Stability and Costs: The environment also scores highly on other key factors, with an “A” rating for Slippage and Cost, and an “AA” for Disconnected time. This indicates a stable platform with competitive execution costs and minimal downtime.

These performance metrics are likely the result of a sophisticated infrastructure. Public information suggests Axi utilizes co-located servers in key financial data centers (like New York) and aggregates liquidity from over 20 top-tier providers. This setup is designed to deliver deep liquidity and fast, accurate pricing.

It is important to note that WikiFX classifies Axi as a Market Maker (MM). While the term can have negative connotations, many well-regulated brokers operate on this model. It means Axi may act as the counterparty to its clients' trades. While their pricing engine is fed by liquidity providers, the potential for a conflict of interest exists, which is a key difference from a pure ECN/STP model that some experienced traders prefer.

Account Types and Trading Costs: A Detailed Breakdown

Axi offers a tiered account structure designed to cater to different trader profiles, from novices to high-volume institutions. The cost structure is a primary differentiator between the accounts.

Standard Account

• Best for: New or lower-volume traders who prefer simplicity.

• Cost Structure: Commission-free trading. Costs are built into the spread, which is naturally wider. For example, third-party sites report an average spread of around 1.2 pips on EUR/USD.

• Minimum Deposit: Reportedly as low as $0 or $5, depending on the entity, making it highly accessible.

Pro Account

• Best for: Experienced and active traders who prioritize low spreads.

• Cost Structure: Access to raw spreads from liquidity providers (e.g., as low as 0.2 pips on EUR/USD), combined with a fixed commission. The commission is typically $7 per round-turn lot ($3.50 per side), which is competitive within the industry.

• Minimum Deposit: Also very low, often starting from $0 or $5.

Elite Account

• Best for: High-volume professional and institutional traders.

• Cost Structure: Offers the most competitive pricing with an even lower commission structure, reportedly $3.50 per round-turn lot.

• Minimum Deposit: Requires a substantial commitment, typically $25,000 or more.

Beyond spreads and commissions, Axi maintains a trader-friendly fee policy:

• Deposits and Withdrawals: The broker charges no internal fees for deposits or withdrawals, though third-party banking fees may apply.

• Inactivity Fee: An inactivity fee of $10 per month is charged, but only after a full year of account dormancy, which is a generous policy compared to many competitors.

• Islamic Account: A swap-free account is available for clients of the Muslim faith, adhering to Sharia law by eliminating interest-based charges on overnight positions.

Platforms, Tools, and Tradable Instruments

Axi has built its platform offering around the globally recognized MetaTrader suite, ensuring a familiar and powerful environment for most traders.

• MetaTrader 4 (MT4): Axi holds a Full License for MT4, the industry-standard platform known for its reliability, extensive charting capabilities, and vast ecosystem of Expert Advisors (EAs) and custom indicators.

• MetaTrader 5 (MT5): As noted in user feedback, Axi also offers MT5. This platform is a significant upgrade for algorithmic traders, offering multi-threaded backtesting, more technical indicators, and additional order types.

• VPS Service: For traders running automated strategies 24/7, WikiFX data confirms Axi offers a Virtual Private Server (VPS) service. This ensures EAs can run continuously without relying on the trader's personal computer.

• Tradable Instruments: Axi provides access to a solid range of over 290 CFD instruments across multiple asset classes, including Forex, major Indices, Commodities (like oil and metals), and individual Shares. The availability of certain assets, such as cryptocurrency CFDs, may be restricted based on the client's regulatory jurisdiction.

Conclusion: Is Axi a Broker Worth Trusting?

This in-depth Axi review reveals a broker of two distinct characters. On one hand, Axi is a well-established, highly regulated firm with a demonstrably superior trading environment. On the other, it is a broker shadowed by serious user complaints regarding fundamental aspects of fund security and account management.

Key Strengths:

• Strong Regulation: Top-tier licenses from ASIC and the FCA provide a high level of trust and client protection for those registered under these entities.

• Exceptional Execution: Data-backed evidence of fast execution speeds and a stable trading environment makes it ideal for performance-focused traders.

• Competitive Pricing: The Pro and Elite accounts offer raw spreads and competitive commissions, while the absence of deposit/withdrawal fees is a major advantage.

• Longevity: Over 15 years in the business demonstrates resilience and experience.

Key Weaknesses and Risks:

• **User Complaints

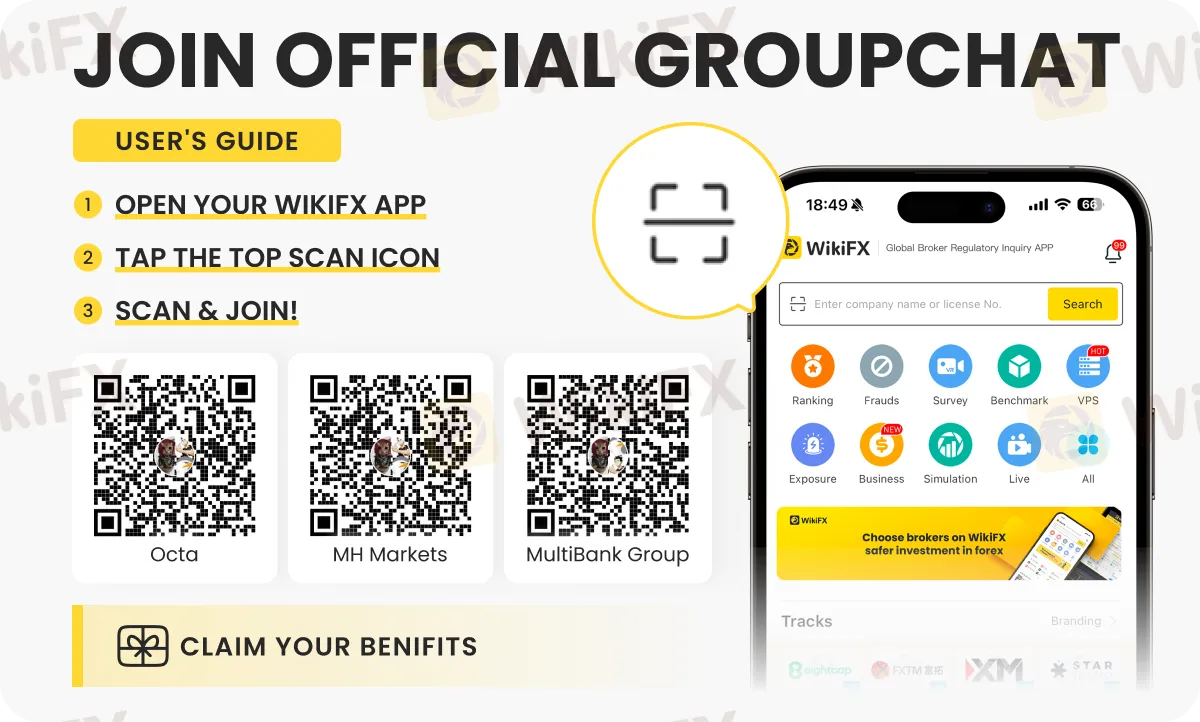

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Why Southeast Asia Can’t Stop Online Scams

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is GMG Safe or a Scam? A 2026 Deep Dive

Pocket Broker Review: Why Traders Should Avoid It

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Currency Calculator