Perfil de la compañía

| Oriental Securities Corporation Resumen de la revisión | |

| Establecido | 1979 |

| País/Región Registrada | Taiwán |

| Regulación | Bolsa de Taipéi |

| Instrumentos de Mercado | Valores, Futuros, Bonos |

| Plataforma de Trading | Oriental Securities Corporation-亞東e指賺 |

| Soporte al Cliente | Tel: 02-7753-1899;0800-088-567;02-405-0218 |

| Email: service@osc.com.tw | |

Información sobre Oriental Securities Corporation

Oriental Securities Corporation, establecido en Taiwán en 1979 y regulado por la Bolsa de Taipéi, es una plataforma de trading en línea que ofrece operaciones con diversos activos financieros y proporciona una plataforma de trading móvil.

Pros y Contras

| Pros | Contras |

|

|

| |

|

¿Es Oriental Securities Corporation Legítimo?

Oriental Securities Corporation tiene una licencia de "Operaciones con valores" regulada por la Bolsa de Taipéi en Taiwán.

¿Qué Puedo Operar en Oriental Securities Corporation?

La plataforma de Oriental Securities Corporation ofrece activos financieros para operar, incluyendo valores, futuros y bonos.

| Instrumentos Operables | Soportados |

| Valores | ✔ |

| Futuros | ✔ |

| Bonos | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

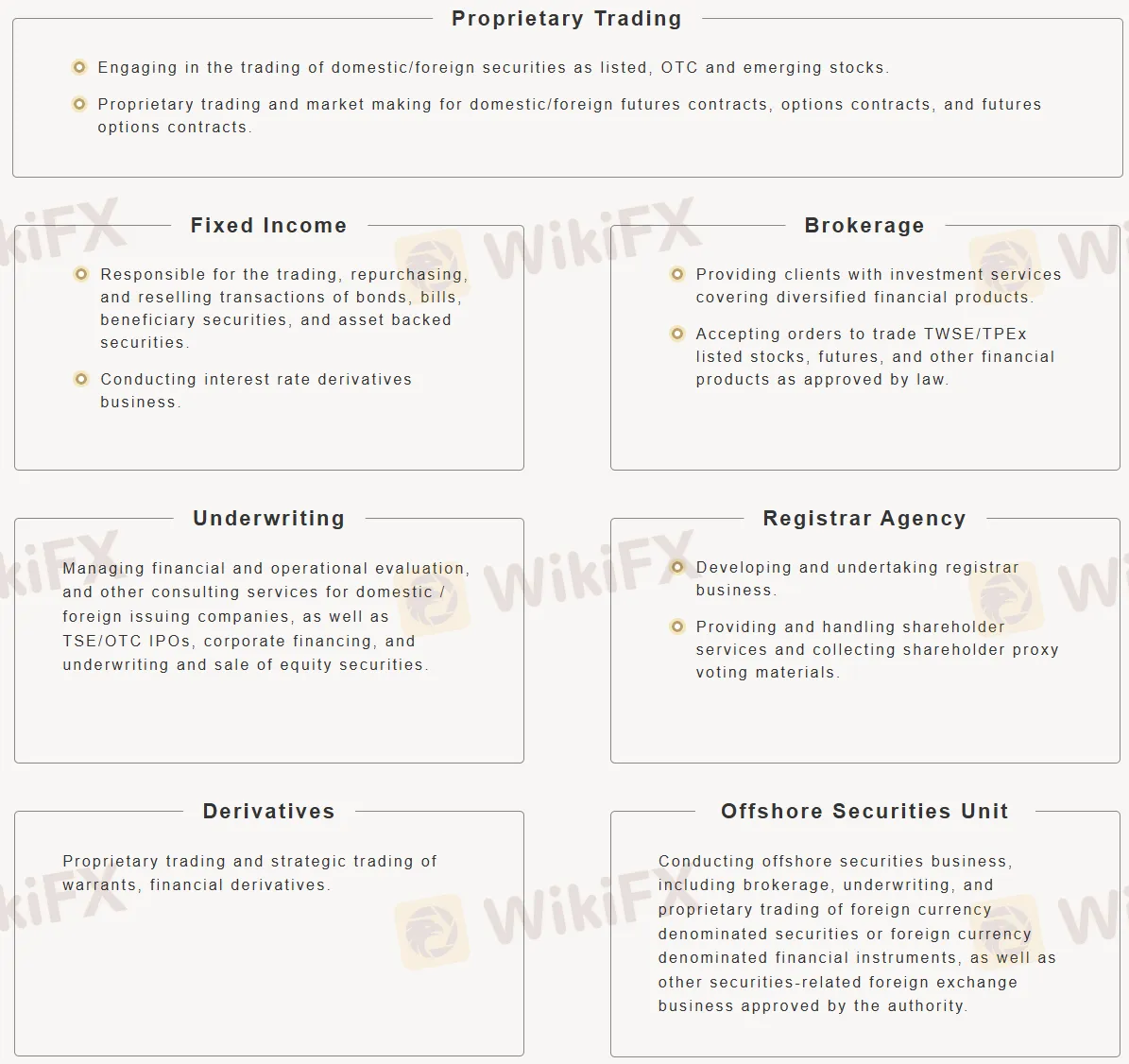

Principales Negocios

Aquí se presentan los principales negocios de Oriental Securities Corporation:

- Operaciones Propietarias: Opera acciones y varios futuros/opciones.

- Renta Fija: Se ocupa de bonos y derivados de tasas de interés.

- Corretaje: Ofrece servicios de inversión y ejecuta operaciones para clientes (acciones, futuros, etc.).

- Colocación: Gestiona OPVs, financiamiento corporativo y ventas de acciones.

- Agencia de Registro: Maneja servicios para accionistas y votaciones por poder.

- Derivados: Opera warrants y derivados financieros.

- Unidad de Valores Offshore: Realiza negocios internacionales de valores (corretaje, colocación, operaciones propietarias en monedas extranjeras).

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |