회사 소개

| Oriental Securities Corporation 리뷰 요약 | |

| 설립 연도 | 1979 |

| 등록 국가/지역 | 대만 |

| 규제 | 타이베이 거래소 |

| 시장 상품 | 증권, 선물, 채권 |

| 거래 플랫폼 | Oriental Securities Corporation-亞東e指賺 |

| 고객 지원 | 전화: 02-7753-1899;0800-088-567;02-405-0218 |

| 이메일: service@osc.com.tw | |

Oriental Securities Corporation 정보

Oriental Securities Corporation는 1979년 대만에서 설립되었으며 타이베이 거래소에서 규제를 받는 온라인 거래 플랫폼으로 다양한 금융 자산 거래와 모바일 거래 플랫폼을 제공합니다.

장단점

| 장점 | 단점 |

|

|

| |

|

Oriental Securities Corporation 합법적인가요?

Oriental Securities Corporation은 대만의 타이베이 거래소에서 규제 받는 "증권 거래" 라이센스를 보유하고 있습니다.

Oriental Securities Corporation에서 무엇을 거래할 수 있나요?

Oriental Securities Corporation 플랫폼은 증권, 선물 및 채권을 포함한 금융 자산 거래를 제공합니다.

| 거래 가능한 상품 | 지원 |

| 증권 | ✔ |

| 선물 | ✔ |

| 채권 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

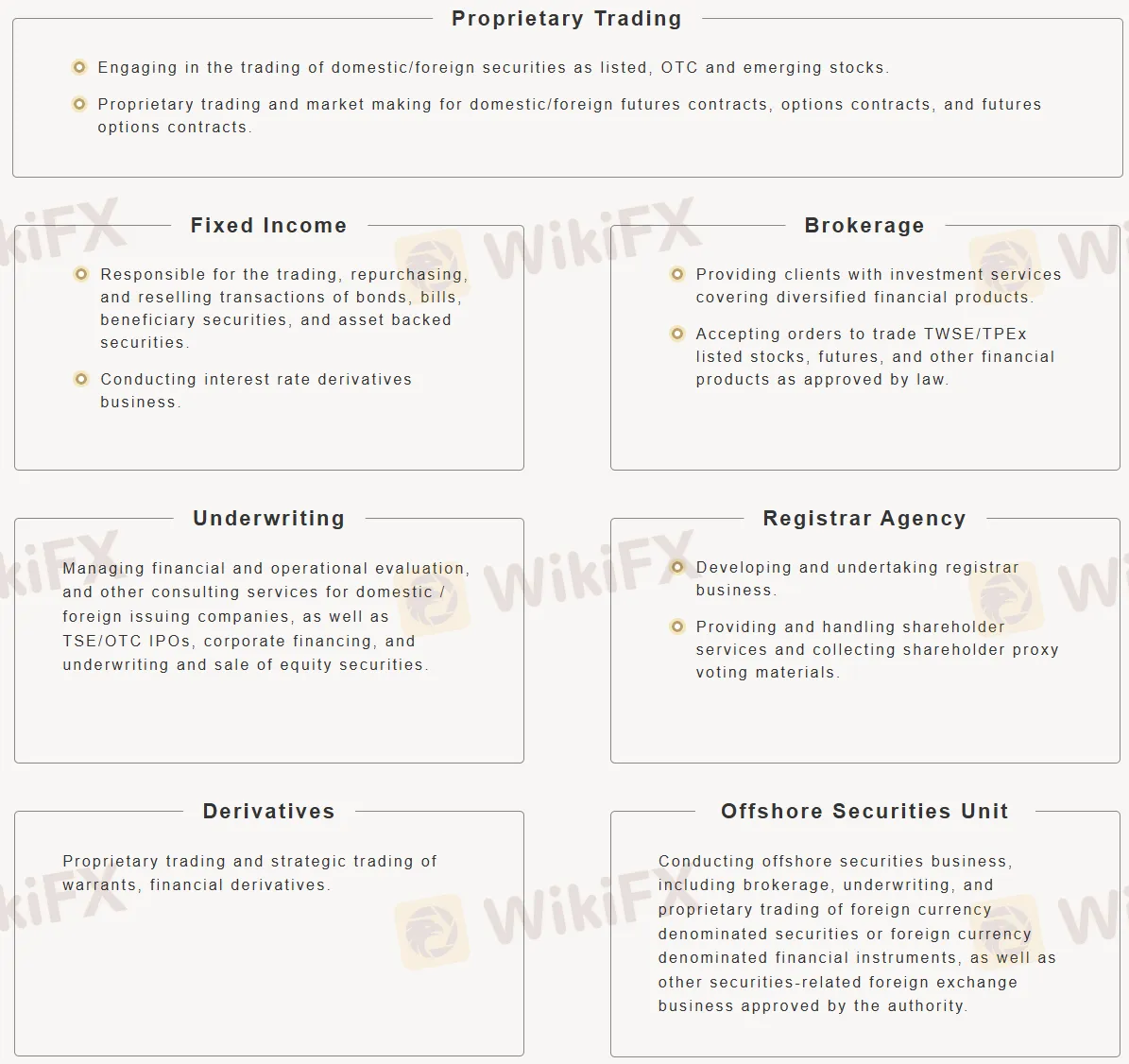

주요 사업

Oriental Securities Corporation의 주요 사업은 다음과 같습니다:

- 자기자본 거래: 주식 및 다양한 선물/옵션 거래.

- 고정 수익: 채권 및 이자 파생상품 거래.

- 중개업무: 투자 서비스 제공 및 고객을 위한 거래 실행 (주식, 선물 등).

- 언더라이팅: IPO, 기업 자금 조달 및 자본 판매 관리.

- 등기대행: 주주 서비스 및 대리 투표 처리.

- 파생상품: 워런트 및 금융 파생상품 거래.

- 해외증권부: 국제 증권 사업 수행 (외화 중개, 언더라이팅, 외화 자기자본 거래).

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |