Şirket özeti

| Oriental Securities Corporation İnceleme Özeti | |

| Kuruluş Yılı | 1979 |

| Kayıtlı Ülke/Bölge | Tayvan |

| Düzenleme | Taipei Borsası |

| Piyasa Enstrümanları | Menkul Kıymetler, Vadeli İşlemler, Tahviller |

| İşlem Platformu | Oriental Securities Corporation-亞東e指賺 |

| Müşteri Desteği | Tel: 02-7753-1899;0800-088-567;02-405-0218 |

| E-posta: service@osc.com.tw | |

Oriental Securities Corporation Bilgileri

Oriental Securities Corporation, 1979 yılında Tayvan'da kurulmuş olup Taipei Borsası tarafından düzenlenen çeşitli finansal varlıklarda işlem yapma imkanı sunan ve mobil işlem platformu sağlayan bir çevrimiçi işlem platformudur.

Artıları ve Eksileri

| Artılar | Eksiler |

|

|

| |

|

Oriental Securities Corporation Güvenilir mi?

Oriental Securities Corporation, Tayvan'da Taipei Borsası tarafından düzenlenen "Menkul Kıymetlerle işlem yapma" lisansına sahiptir.

Oriental Securities Corporation Üzerinde Ne İşlem Yapabilirim?

Oriental Securities Corporation platformu, menkul kıymetler, vadeli işlemler ve tahviller de dahil olmak üzere finansal varlıklarda işlem yapma imkanı sunar.

| İşlem Yapılabilir Enstrümanlar | Desteklenen |

| Menkul Kıymetler | ✔ |

| Vadeli İşlemler | ✔ |

| Tahviller | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Hisse Senetleri | ❌ |

| Kripto Paralar | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

Ana İşletmeler

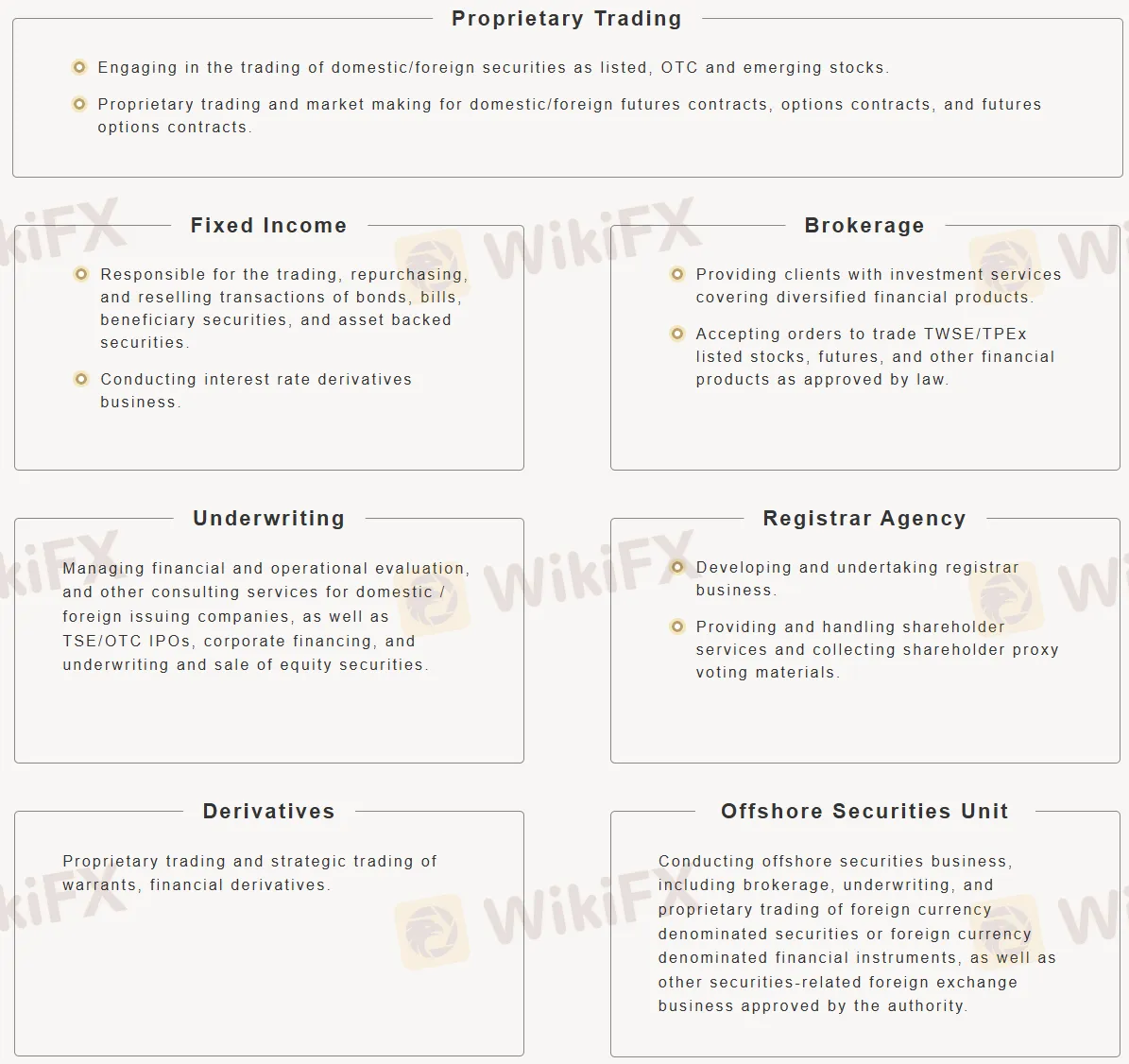

Oriental Securities Corporation 'ün ana işletmeleri şunlardır:

- Özsermaye Ticareti: Hisse senetleri ve çeşitli vadeli işlemler/opsiyonlar yapar.

- Sabit Gelir: Tahviller ve faiz türevleri ile ilgilenir.

- Aracılık: Yatırım hizmetleri sunar ve müşteriler için işlemleri gerçekleştirir (hisse senetleri, vadeli işlemler, vb.).

- Teminat: Halka arzları, kurumsal finansmanı ve öz sermaye satışlarını yönetir.

- Kayıt Ajansı: Hissedar hizmetlerini ve vekalet oy kullanımını yönetir.

- Türevler: Detaylı ve finansal türevler işlemleri yapar.

- Offshore Menkul Kıymetler Birimi: Uluslararası menkul kıymetler işi yapar (aracılık, teminat, yabancı para cinsinden özsermaye ticareti).

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |