Elio Matacena

1-2年

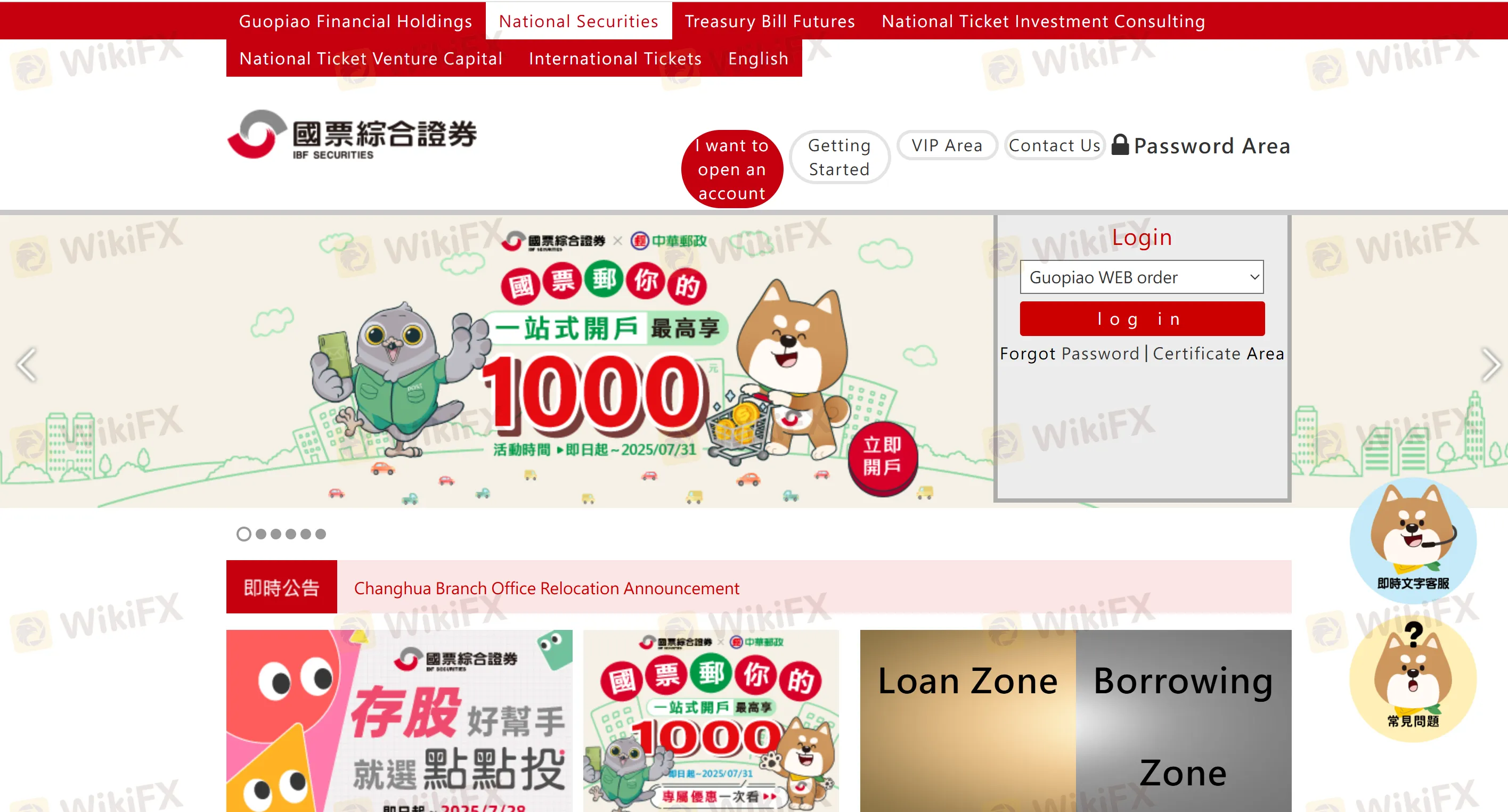

What are the pros and cons of IBF Securities from my perspective?

From my perspective, IBF Securities offers some clear advantages, such as its regulation by TPEx and its diverse selection of trading instruments. The ability to trade stocks, futures, ETFs, and ETNs provides flexibility and the potential for a well-rounded investment strategy. Furthermore, the promotional offers and commission discounts are beneficial for traders looking to maximize their value. However, the lack of transparency regarding fees and the absence of multilingual support are key issues. As a trader, I would want clear and upfront information about fees, as unexpected costs can quickly eat into profits. Additionally, for non-Chinese speakers, the lack of support in other languages could be a significant hurdle. Overall, while IBF Securities offers potential, it could improve in terms of transparency and accessibility for international users.

qirhost

1-2年

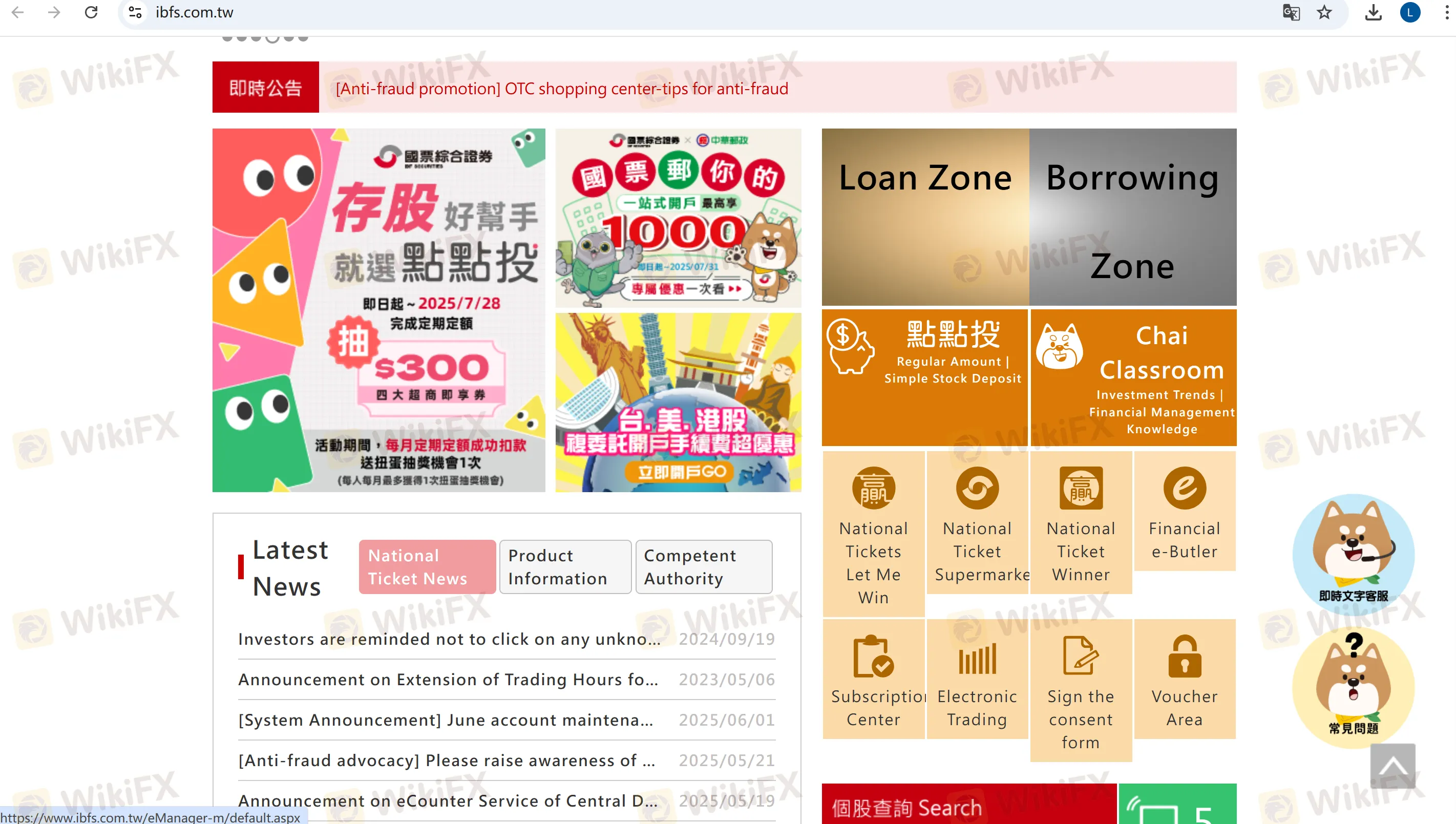

Is IBF Securities regulated?

IBF Securities is regulated by the Taipei Exchange (TPEx) in Taiwan. It holds a legitimate securities business license under the supervision of the Financial Supervisory Commission (FSC) of Taiwan. This regulation offers a degree of investor protection, as the platform is held accountable by a recognized authority in Taiwan. Being a member of the Taiwan Stock Exchange (TWSE) and the Over-The-Counter (OTC) Market adds to the credibility, as it ensures that IBF Securities operates in accordance with Taiwanese financial laws. However, the full license number and specific details about the regulation are not readily available, which can leave some uncertainty for potential investors. Given the available information, IBF Securities can be considered a regulated entity in Taiwan, but more transparency in the licensing details would enhance confidence for international traders.

Tom Nalichowski

1-2年

Is IBF Securities a regulated broker?

IBF Securities is regulated by the Taipei Exchange (TPEx) in Taiwan, under the supervision of the Financial Supervisory Commission (FSC). This regulatory oversight provides a level of safety for traders, ensuring that the platform operates in accordance with Taiwanese financial laws. However, the company has not disclosed the specific license number, which could raise concerns for traders seeking full transparency. Nonetheless, the regulation by TPEx does offer a basic layer of protection for investors.