TradeTimeAllWasted

1-2年

Have you experienced any drawbacks with MBKET's customer support or noticed issues with the stability of their platform?

Speaking as a cautious trader who takes regulatory oversight seriously, I have reservations based on my experience with MBKET. One of my immediate concerns is that MBKET operates without any valid regulatory licenses, a reality reflected in its very low regulatory index score and the high-risk warnings I observed. This lack of oversight always puts me on alert, particularly when it comes to safeguarding client funds and ensuring the reliability of customer support.

When I sought assistance from MBKET’s customer support, I found their response times to be inconsistent. While they do offer both phone and email contacts and maintain a presence on platforms like YouTube and Facebook, I did not always receive timely or comprehensive answers to my queries, especially for more nuanced trading or account-related issues. In my book, responsive and well-informed customer support is non-negotiable, and MBKET fell short of my expectations in this regard.

As for platform stability, the broker operates its own KE World system for online trading. During my use, I experienced occasional lag, particularly during volatile market periods. For me, platform reliability is essential in managing risk, and even minor instability can lead to slippage or missed opportunities.

Given the absence of regulation and these operational drawbacks, I approach MBKET with extra caution. I believe it is especially prudent for traders to weigh these trust and service gaps very carefully.

Allan777

1-2年

Are there any payment methods with MBKET that allow for immediate withdrawals?

Based on my thorough experience researching brokers and my cautious approach to forex trading, I have found that MBKET, or Maybank Securities (Thailand) Public Company Limited, does not publicly detail its specific payment or withdrawal methods on available resources. Their focus appears to be on a broad suite of financial services, such as institutional broking, investment management, derivatives, and advisory, but explicit information on immediate withdrawal methods remains absent. For me, the absence of this critical operational detail is a red flag, particularly since MBKET is currently unregulated, which enhances risk and demands a higher level of scrutiny regarding fund security.

Without transparent information about payment options or the speed of withdrawals, I can’t confidently answer that MBKET offers any mechanism for immediate fund withdrawal. In my experience, the lack of regulatory oversight and this lack of clarity with payment processing is a combination that warrants significant caution. When dealing with any financial intermediary, but especially one with high potential risk and no verified regulatory backing, I require explicit, published withdrawal policies before considering any involvement. For anyone prioritizing immediate access to their funds, it’s prudent to look for brokers who are not only regulated but also fully transparent about their withdrawal procedures.

Broker Issues

Deposit

Withdrawal

J Forex Trader

1-2年

Is there a commission per lot on MBKET's ECN or raw spread accounts?

In my experience as a forex trader evaluating MBKET, I found it difficult to gain the transparent fee information I would normally expect from more internationally recognized brokers. According to the details available, MBKET does offer derivatives trading—such as futures, options, and other structured products—and references different commissions for various derivative transactions. However, it does not clearly specify standard ECN or raw spread forex accounts, nor does it provide explicit details about commissions charged per lot for these account types.

This lack of detail is concerning for me, especially since transparent pricing is a fundamental part of assessing a broker’s suitability and fairness. It’s worth noting that MBKET is currently unregulated according to the data provided and has been flagged as having a suspicious regulatory license, which already puts me on guard and makes me especially wary about cost structures and potential hidden fees. Without published commission tables or independently verifiable information about spreads and per-lot costs, it's challenging to have full confidence in the trading conditions.

For my own trading, one of my core requirements is to know—before opening an account—exactly how much I would pay per lot traded, especially with ECN or raw spread setups which typically offer lower spreads with a fixed commission per lot. The absence of this clarity on MBKET’s offering means I cannot confirm there is a standardized commission per lot as seen with most reputable ECN providers. For anyone considering MBKET, I would recommend seeking clear, written confirmation from the broker on all trading costs before proceeding, and considering the regulatory status very carefully.

Broker Issues

Fees and Spreads

Abu00saeed

1-2年

Can you tell me if MBKET is under regulation, and which financial authorities oversee it?

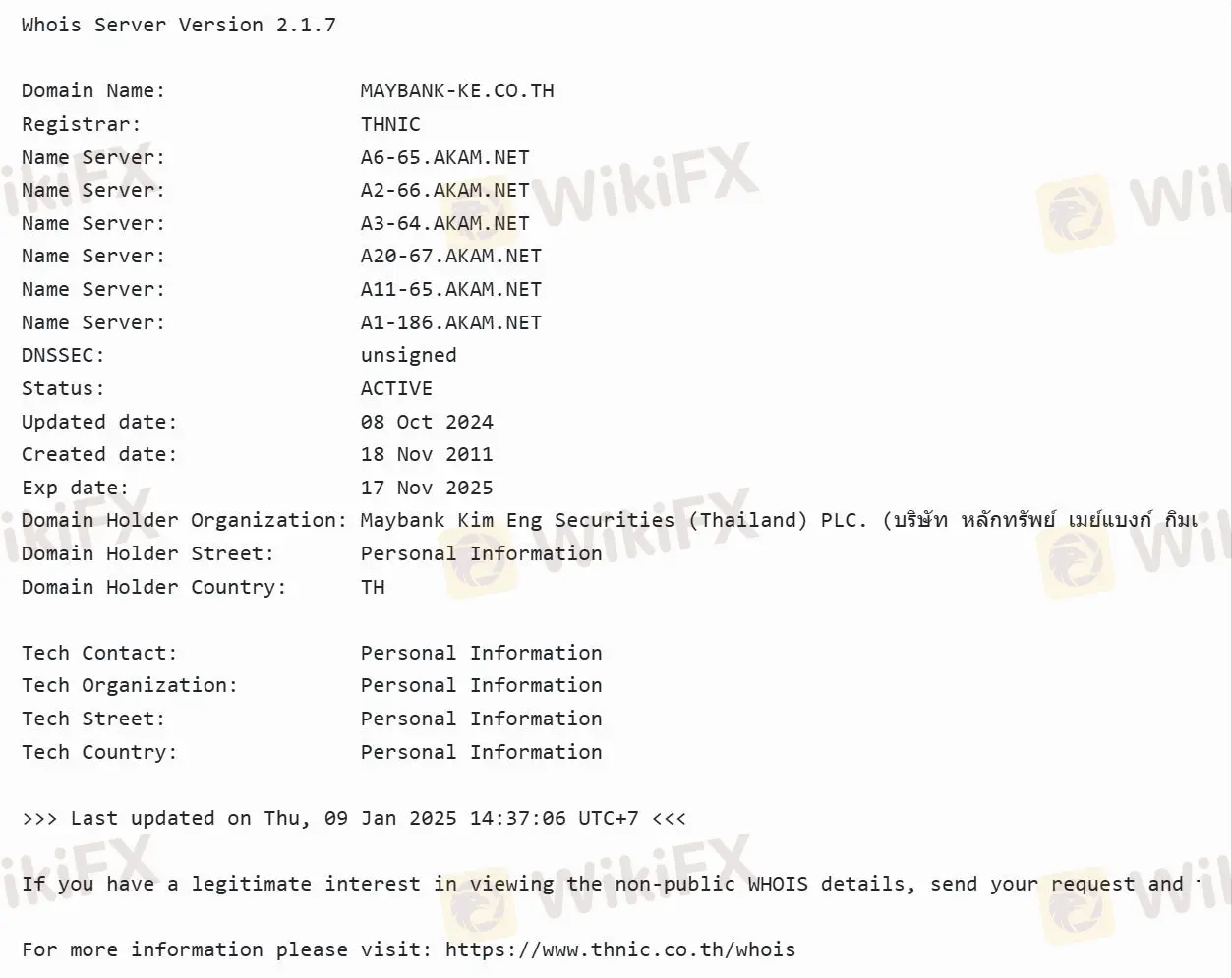

Drawing from my thorough research and as someone who has always prioritized the security of my trading capital, I need to be very clear about MBKET’s situation: MBKET, or Maybank Kim Eng (Thailand), does not currently hold valid regulatory status with any recognized financial authority. Although the company has been in operation for 5-10 years and is active in Thailand, available information consistently underscores its lack of formal regulation. This is a crucial factor I weigh before engaging with any broker because regulation not only adds a layer of financial and operational oversight, but also provides potential avenues for customer recourse in case of disputes or misconduct.

MBKET is associated with a “suspicious regulatory license” and has been flagged as presenting a high potential risk. There are no confirmations of oversight by major regional or international financial authorities, which inherently makes it less secure than brokers who are regulated in jurisdictions such as Australia or the United Kingdom. This unregulated status means MBKET is not subject to the rigorous standards regarding client fund protection, transparency, and auditing that I expect for my own trading practices. In my view, this lack of recognized regulatory supervision is a significant red flag, and I would personally exercise considerable caution before considering any trading activities with MBKET.