公司简介

| Securities Japan评论摘要 | |

| 成立时间 | 1944 |

| 注册国家 | 日本 |

| 监管 | FSA |

| 产品和服务 | 国内和国外股票、投资信托、债券、期货、期权、保险 |

| 模拟账户 | / |

| 交易平台 | 在线交易 |

| 最低存款 | / |

| 客户支持 | 电话:03-3668-3446 |

| 电子邮件:online@secjp.co.jp | |

Securities Japan信息

日本金融厅监管并授权Securities Japan,该机构成立于1944年。该机构销售各种金融产品,如股票、债券、投资信托、期货、期权和保险。然而,根据交易类型,其手续费可能相对较高。

优缺点

| 优点 | 缺点 |

| 历史悠久(自1944年起) | 某些交易类型的手续费略高 |

| 受FSA监管 | 无MT4/5 |

| 产品范围广泛,包括保险 | 有关存款和提款的信息有限 |

Securities Japan是否合法?

是的,Securities Japan是受监管的。它持有由日本金融厅颁发的零售外汇许可证,许可证号为关东财务局长(金商)第170号。

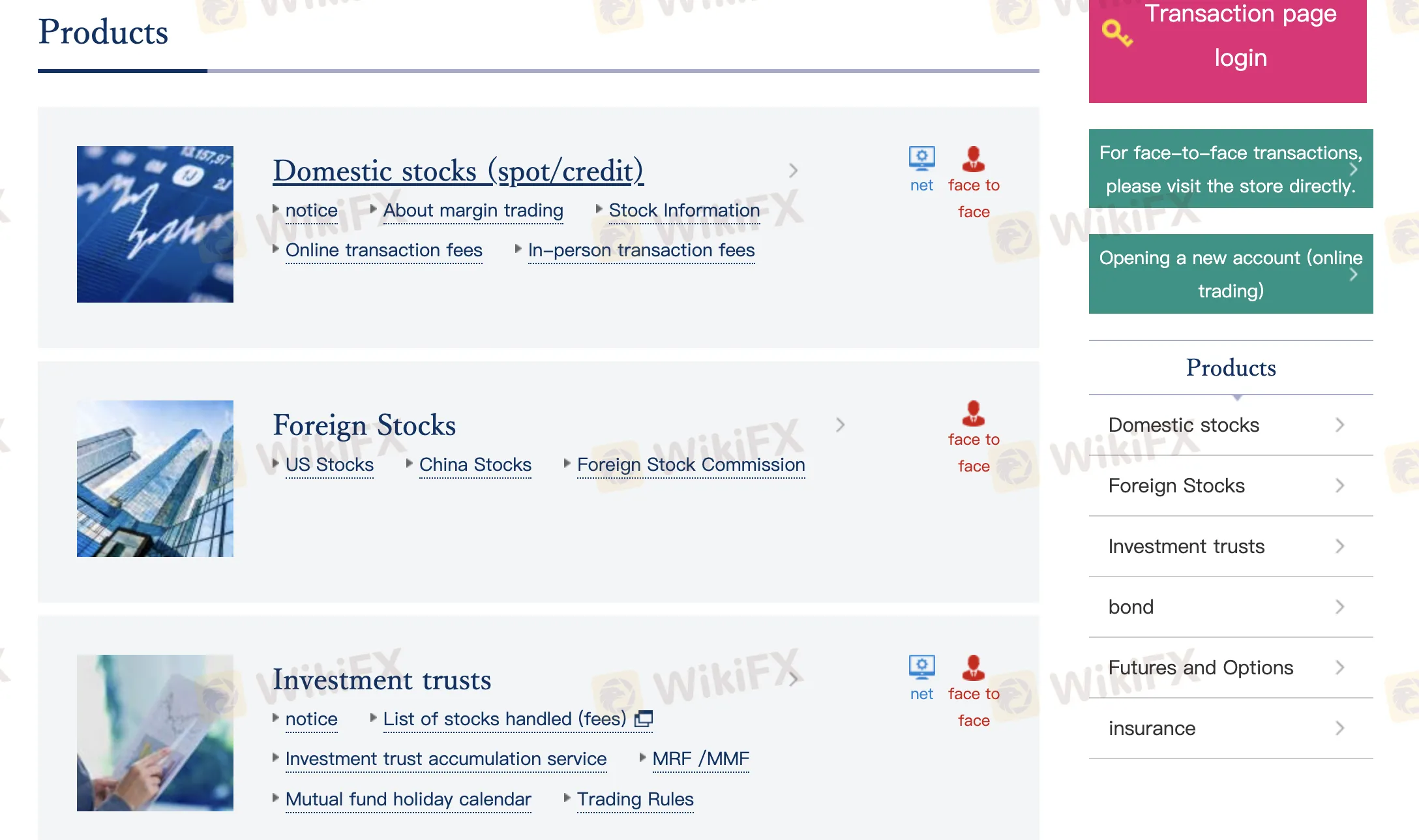

我可以在Securities Japan上交易什么?

Securities Japan提供广泛的金融产品和服务,涵盖国内和国际市场。其服务包括股票、投资信托、债券、期货、期权和保险。

| 交易产品 | 支持 |

| 股票 | ✔ |

| 投资信托 | ✔ |

| 债券 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

| 保险 | ✔ |

| 外汇 | × |

| 大宗商品 | × |

| 指数 | × |

| 加密货币 | × |

| 交易所交易基金 | × |

Securities Japan费用

Securities Japan的交易费用通常与行业标准相比属于中等偏上,尤其取决于您是在线交易、面对面交易还是电话交易。

| 交易费用 | 金额 |

| 在线现货交易(<1百万日元) | 每笔1100日元 |

| 在线现货交易(>1百万日元) | 每笔1650日元 |

| 在线保证金交易 | 每笔1100日元 |

| 在线每日固定费率 | 每3百万日元日交易量2200日元(如果每天交易超过30次,则加收22000日元) |

| 电话交易(<500,000日元) | 2750日元 |

| 电话交易(500k–1百万日元) | 6050日元 |

| 电话交易(1–5百万日元) | 19800日元 |

| 电话交易(5–10百万日元) | 42900日元 |

| 电话交易(10–30百万日元) | 69300日元 |

| 电话交易(>30百万日元) | 132000日元 |

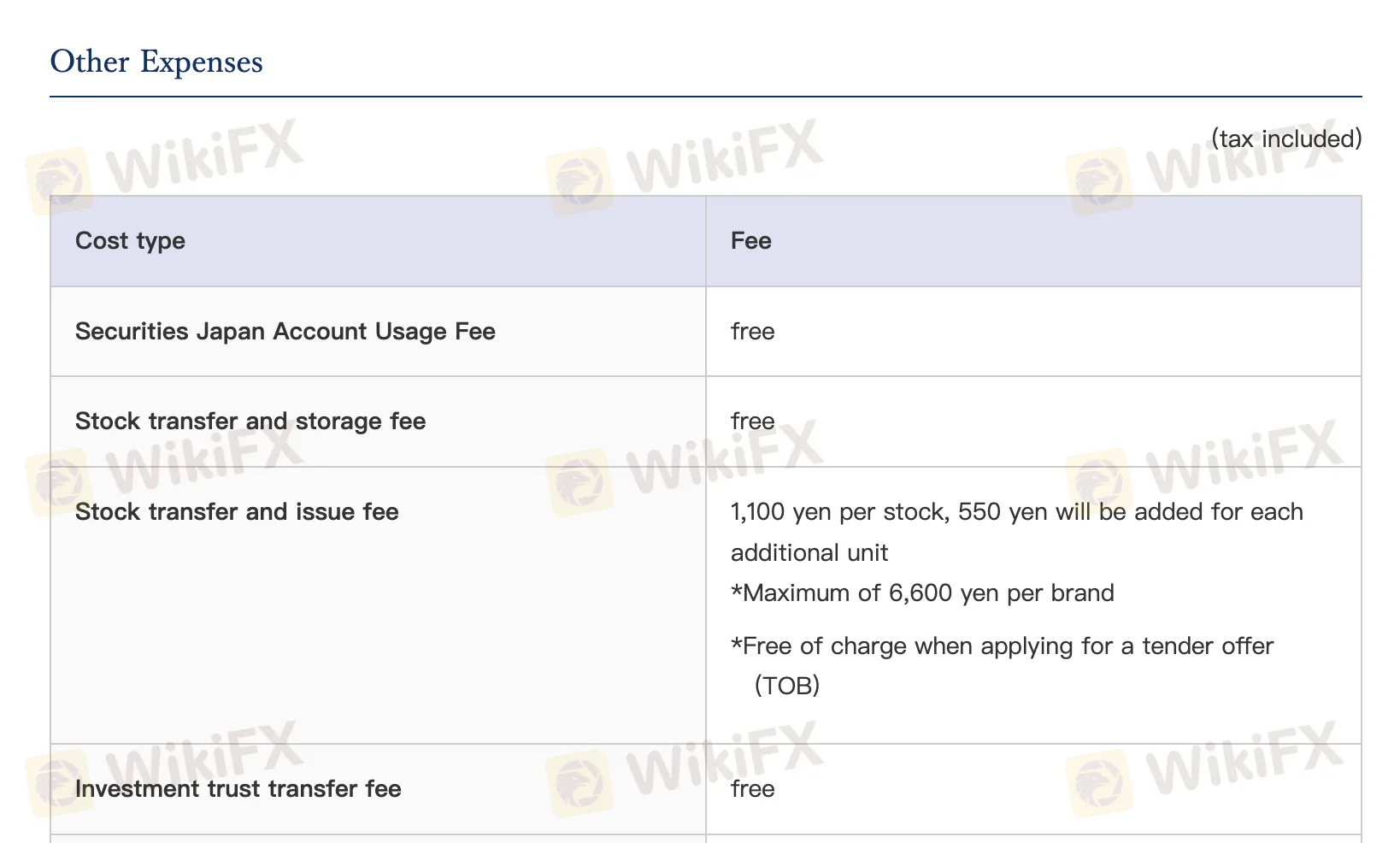

非交易费用

| 非交易费用 | 金额 |

| 账户使用费 | 0 |

| 股票转移/存储费 | 0 |

| 股票转移/发行费 | 1100日元 + 每额外单位550日元(最高6600日元) |

| 投资信托转移费 | 0 |

| 投资信托转移/提取 | 每股3300日元 |

| 政府债券转移/提取 | |

| 零股购买佣金 | 合同价格 × 1.5% + 税 |

| 零股购买经纪费 | 0 |

| 存款转移费 | 客户支付(即时存款免费) |

| 提款转移费 | 0 |

| 客户分类帐副本 | 每次3300日元 |

| 余额证明书发行 | 每次1100日元 |

| 年度交易报告补发 | 每次1100日元 |

| 书面材料请求费 | 每个品牌550日元 |

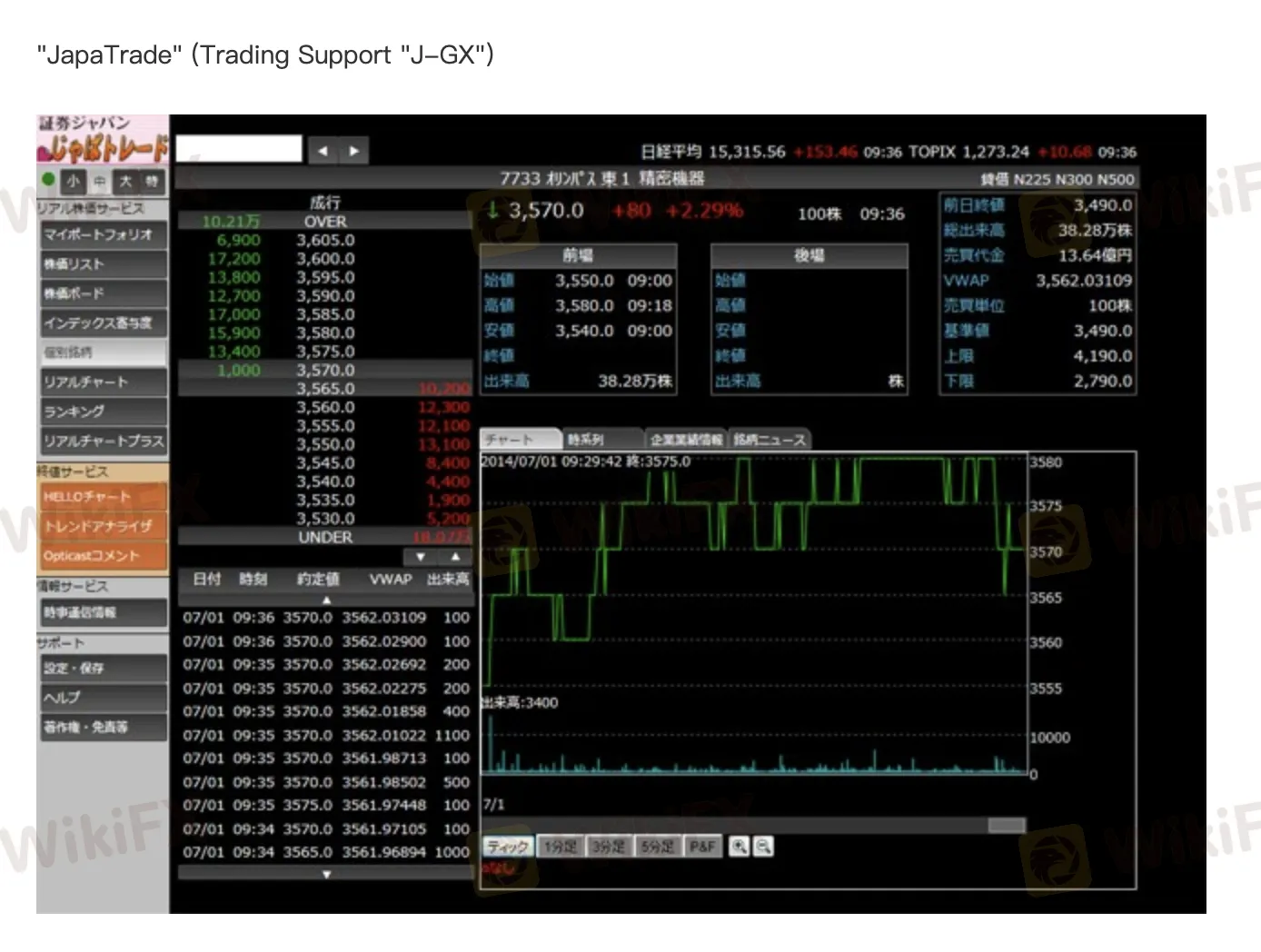

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 在线交易 | ✔ | PC,智能手机,平板电脑 | / |

| MetaTrader 4 | ✔ | / | 初学者 |

| MetaTrader 5 | ✔ | / | 经验丰富的交易者 |